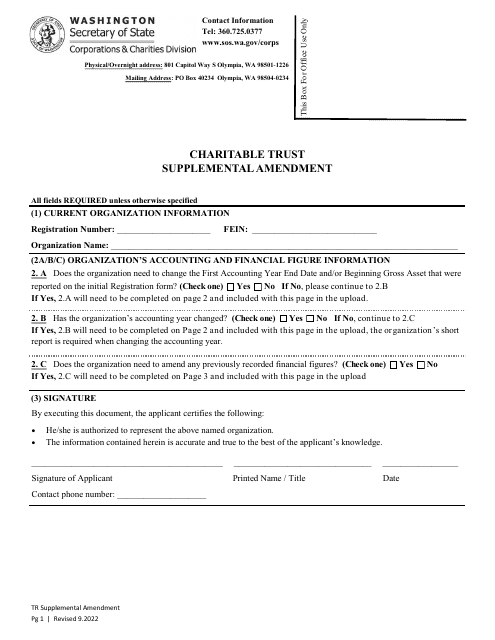

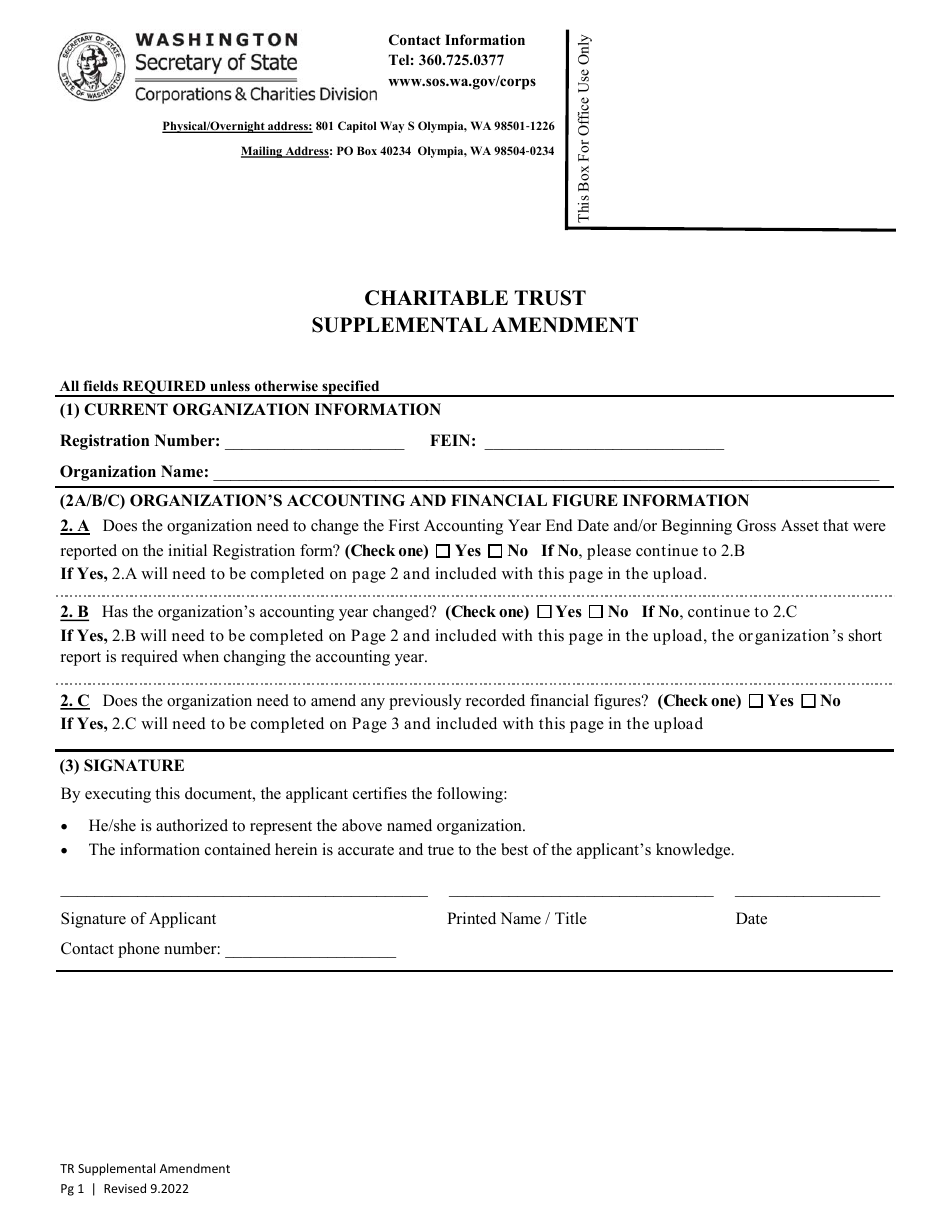

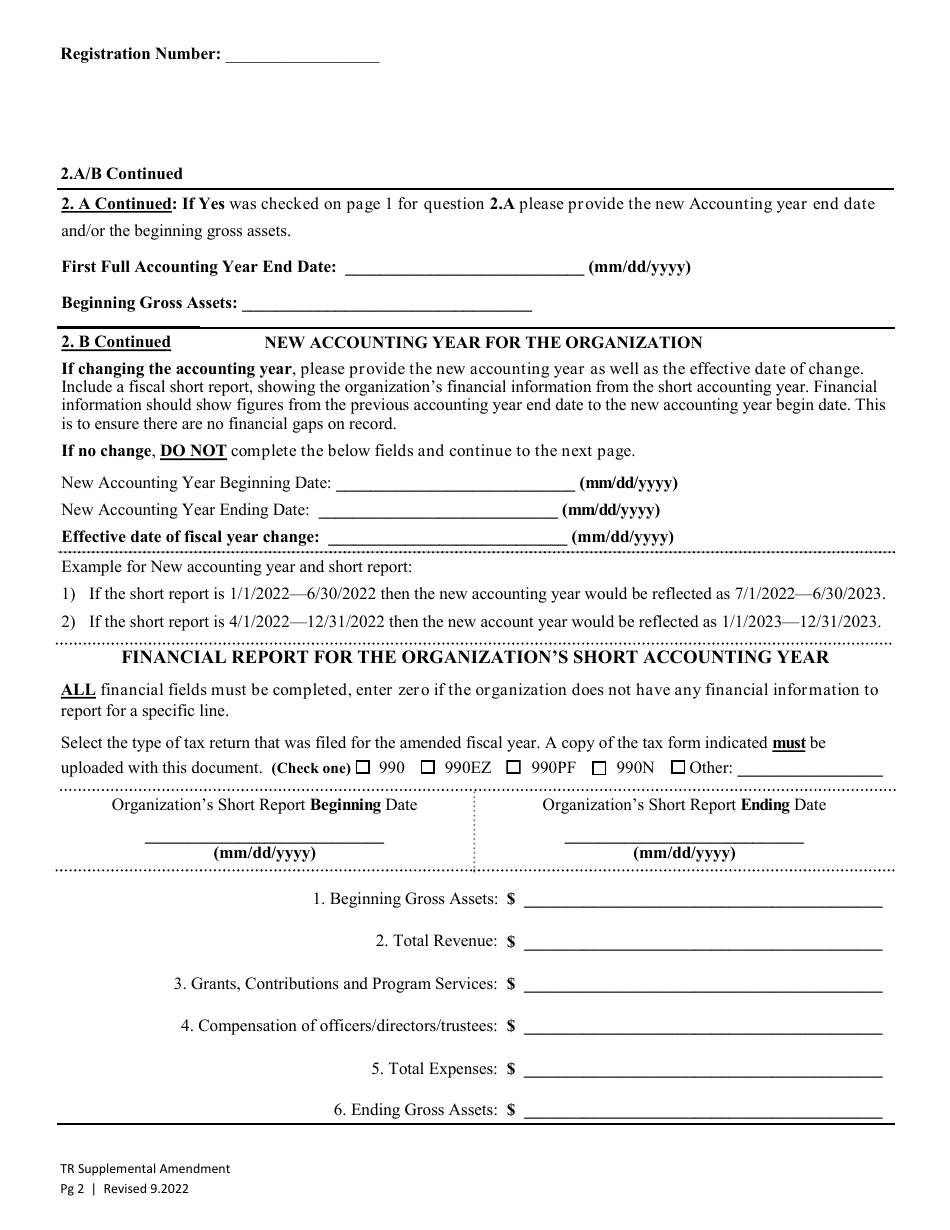

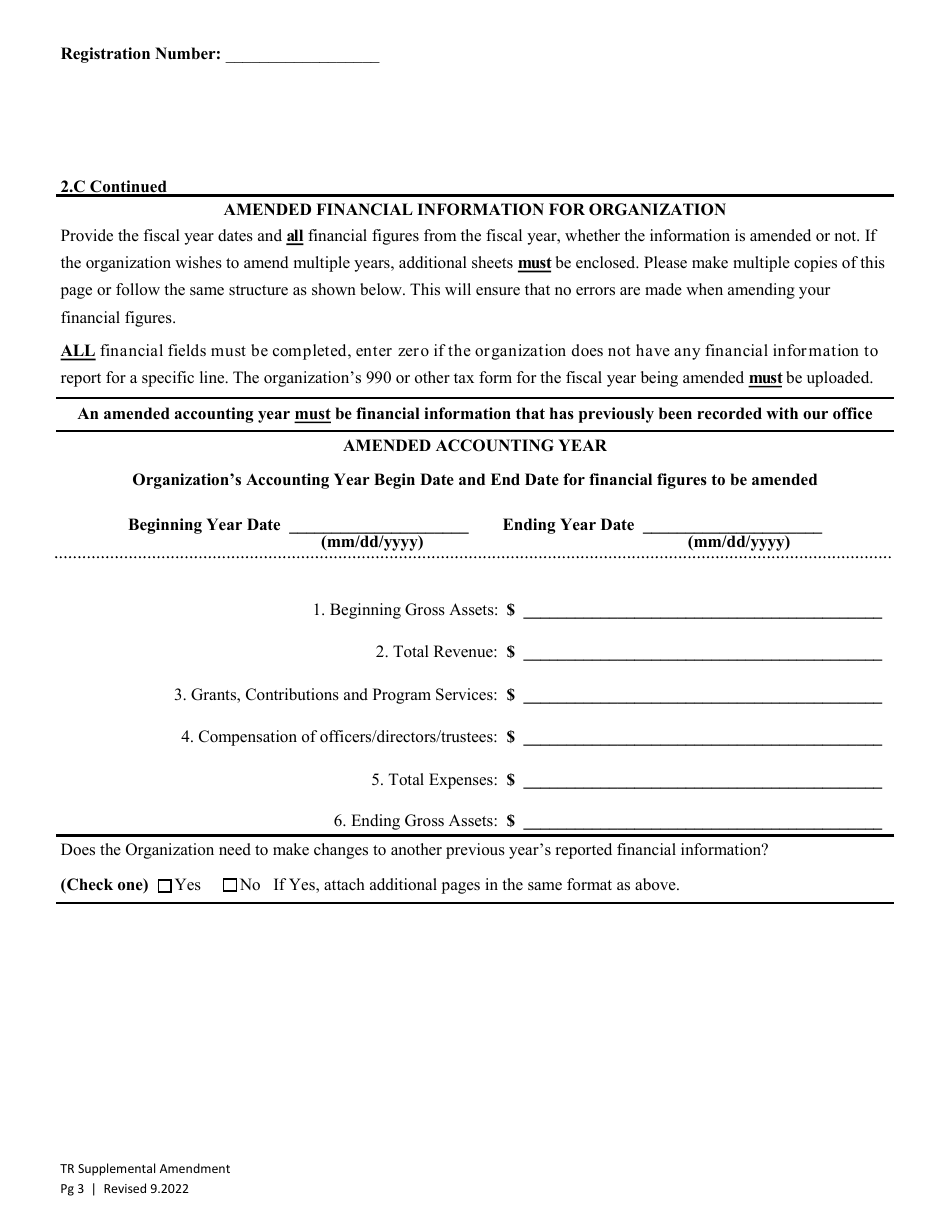

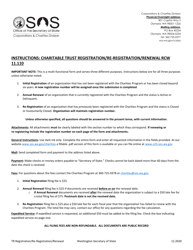

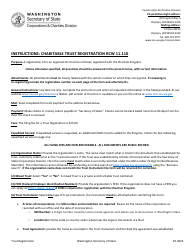

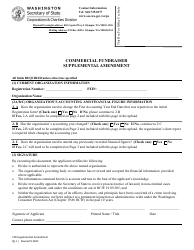

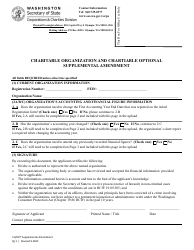

Charitable Trust Supplemental Amendment - Washington

Charitable Trust Supplemental Amendment is a legal document that was released by the Washington Secretary of State - a government authority operating within Washington.

FAQ

Q: What is a charitable trust?

A: A charitable trust is a legal arrangement where assets are set aside to benefit a charity or charitable purpose.

Q: What is a supplemental amendment?

A: A supplemental amendment is a change or addition made to an existing trust document.

Q: Why would someone need to make a supplemental amendment to a charitable trust?

A: A supplemental amendment may be needed to update or modify certain provisions of the trust, such as beneficiaries, charitable purposes, or administrative provisions.

Q: How do I make a supplemental amendment to a charitable trust in Washington?

A: To make a supplemental amendment to a charitable trust in Washington, you will need to consult with an attorney familiar with trust law and follow the legal requirements outlined in the state statutes.

Q: Are there any fees or taxes associated with making a supplemental amendment to a charitable trust in Washington?

A: There may be fees or taxes associated with making a supplemental amendment to a charitable trust in Washington. It is best to consult with an attorney or tax advisor for specific information.

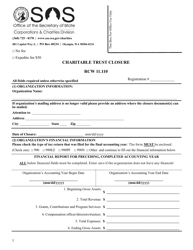

Q: Can a charitable trust be revoked or terminated?

A: In some cases, a charitable trust may be irrevocable, meaning it cannot be revoked or terminated. However, certain circumstances or court actions may allow for the revocation or termination of a charitable trust.

Q: What is the role of the Attorney General in relation to charitable trusts?

A: The Attorney General has a supervisory role in relation to charitable trusts and may have the authority to ensure that charitable assets are used according to their intended charitable purposes.

Form Details:

- Released on September 1, 2022;

- The latest edition currently provided by the Washington Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Washington Secretary of State.