This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

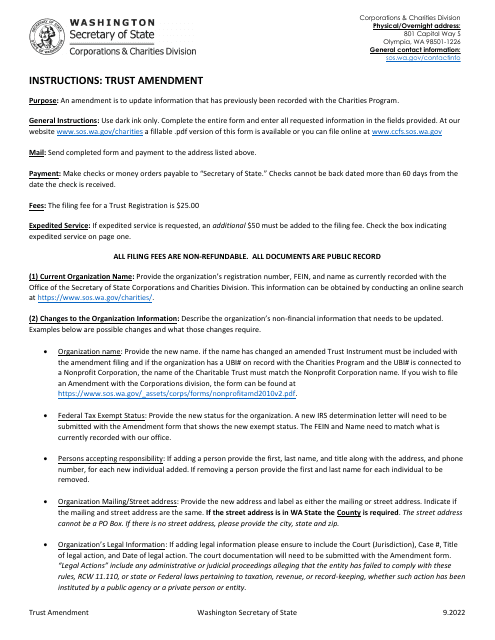

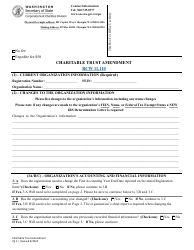

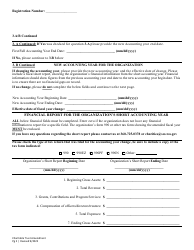

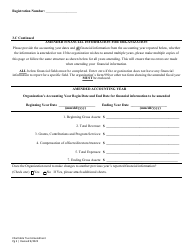

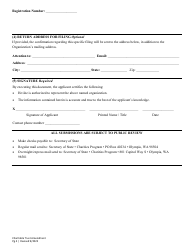

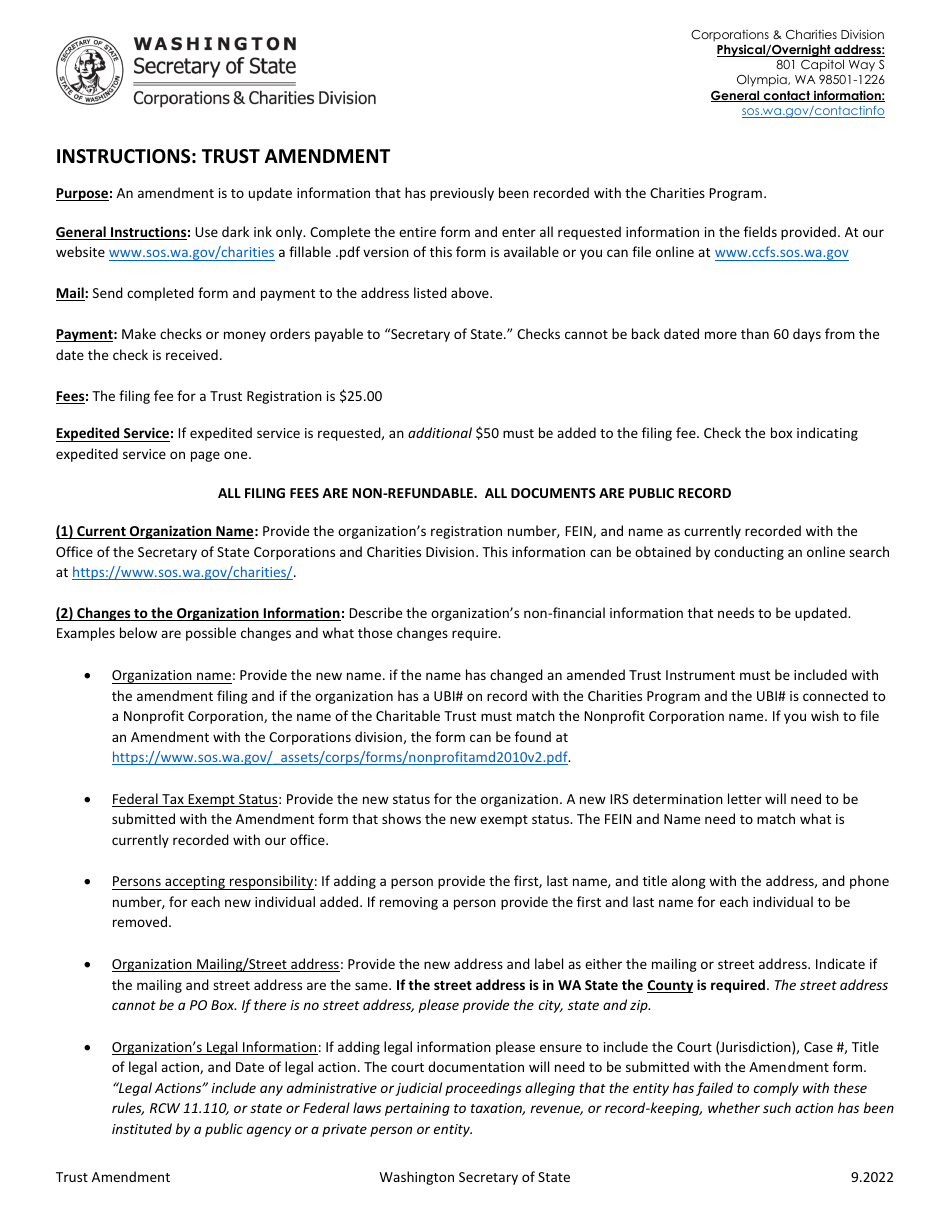

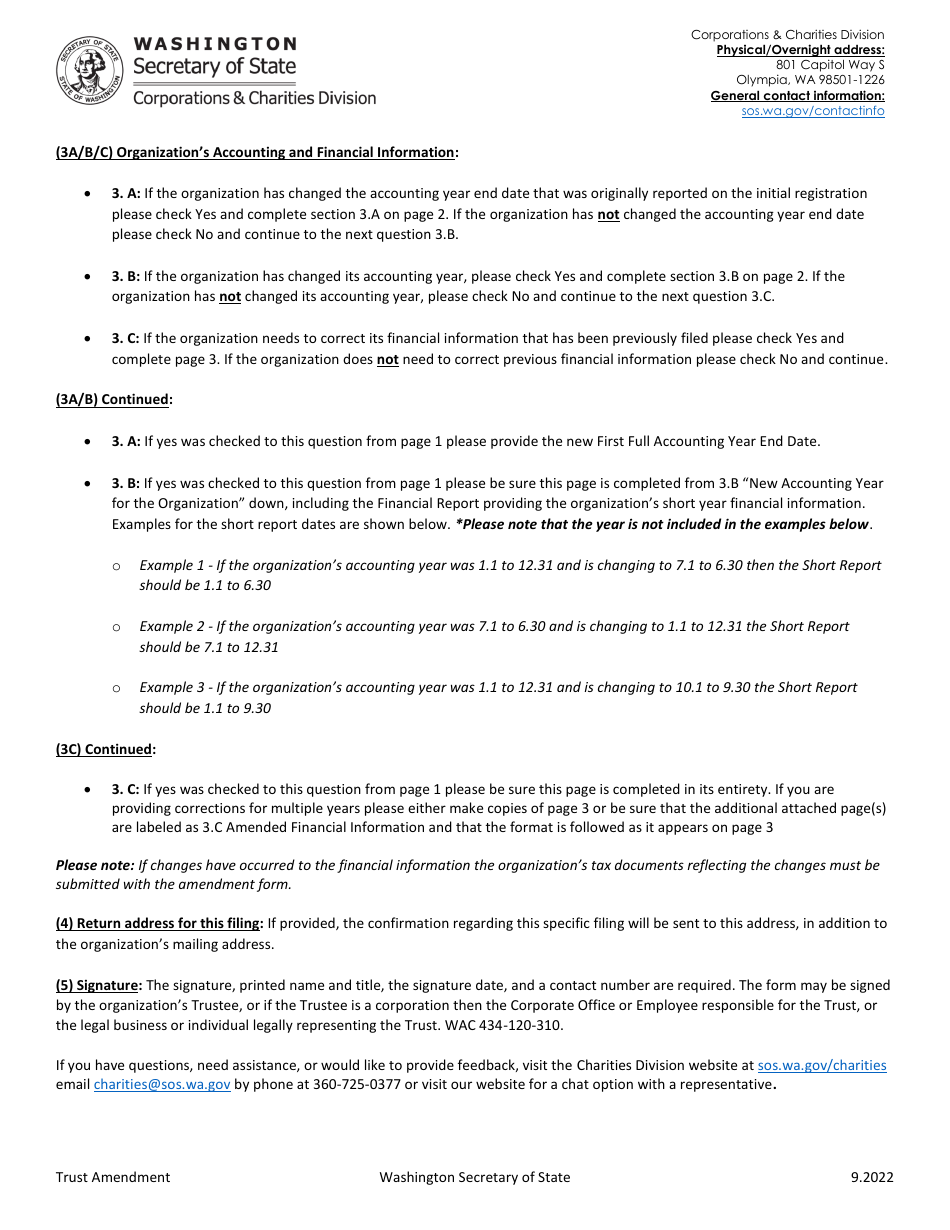

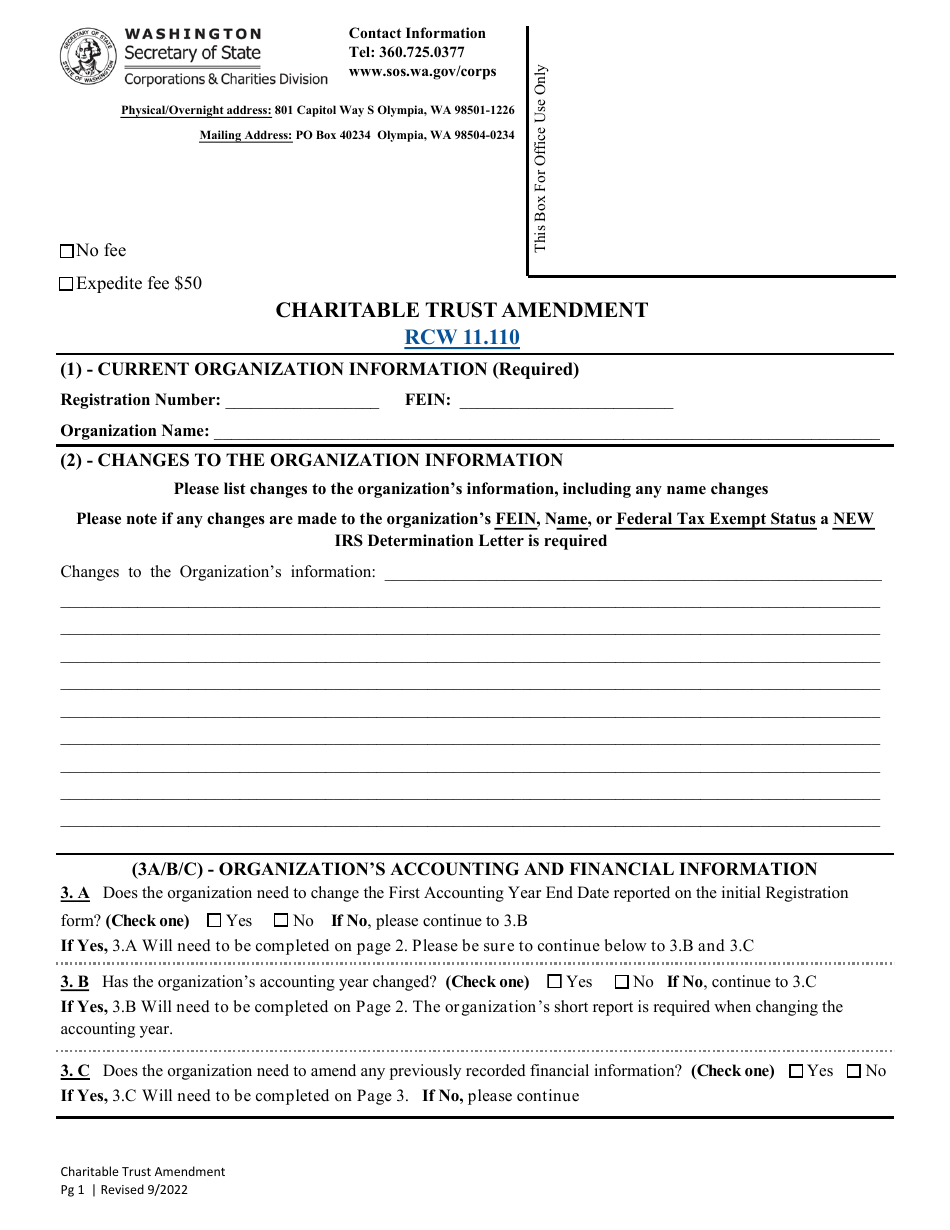

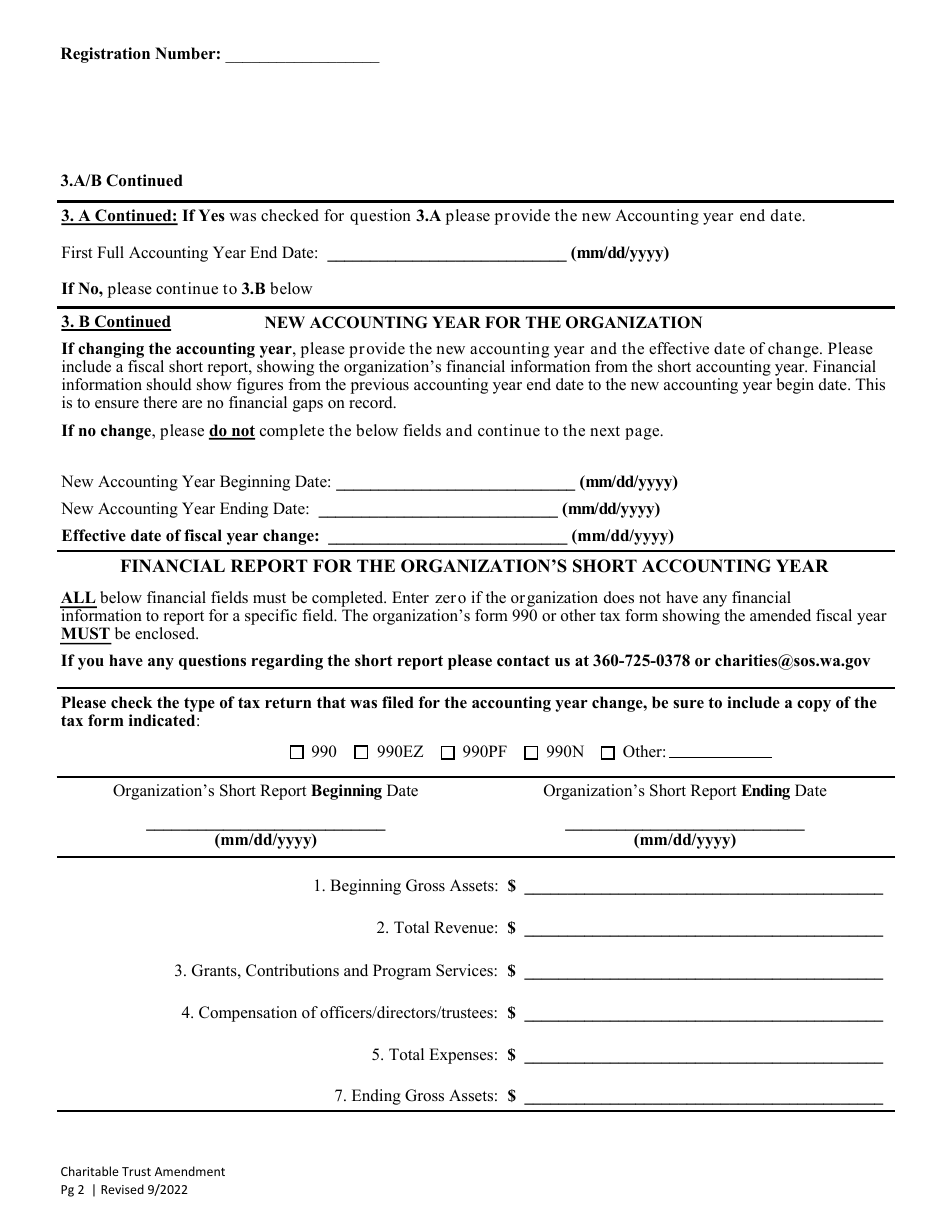

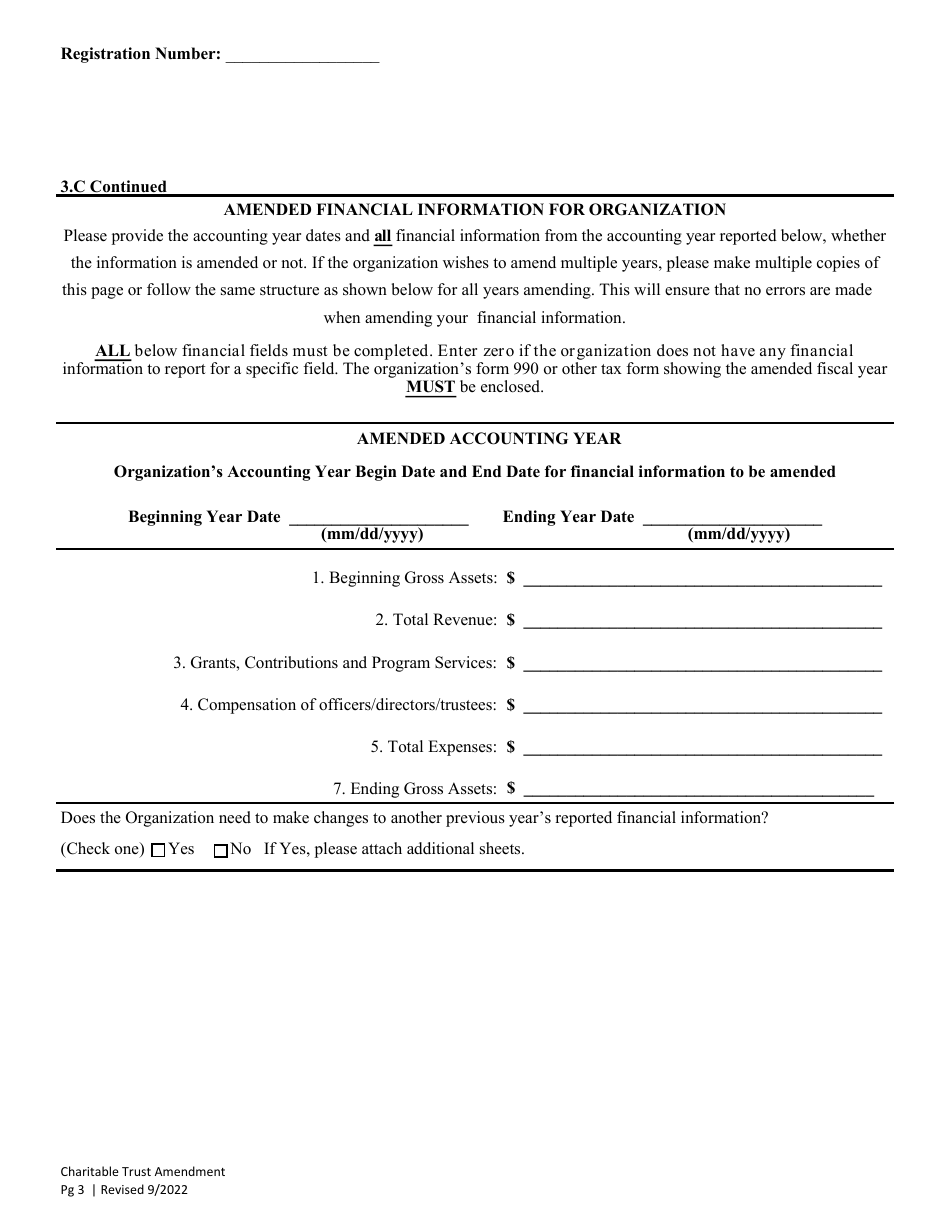

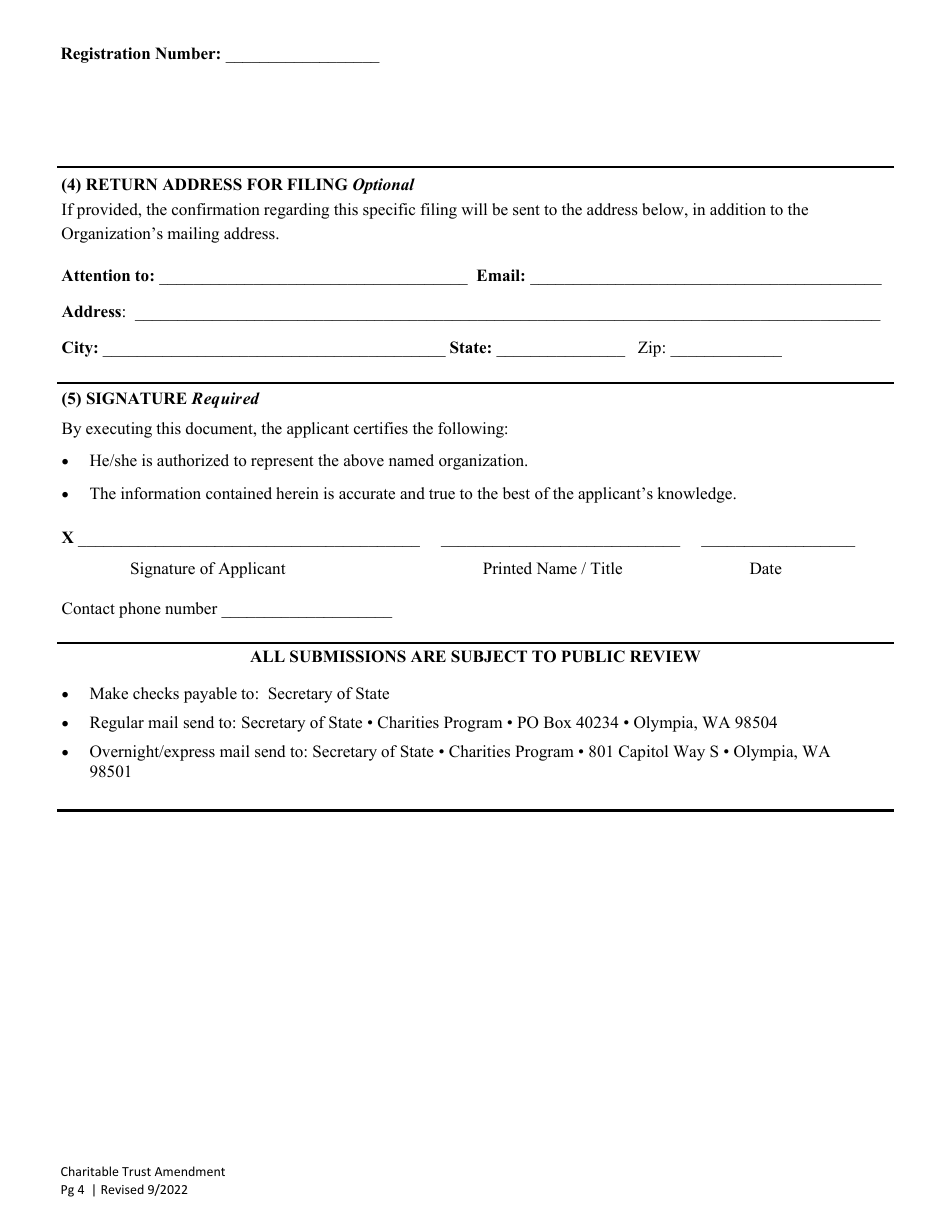

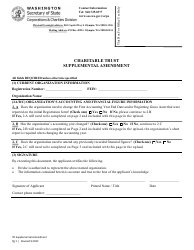

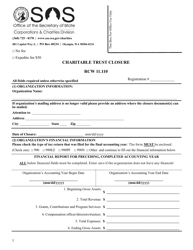

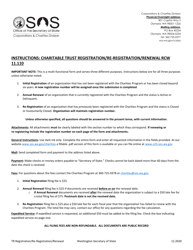

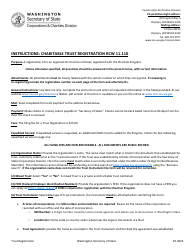

Charitable Trust Amendment - Washington

Charitable Trust Amendment is a legal document that was released by the Washington Secretary of State - a government authority operating within Washington.

FAQ

Q: What is the Charitable Trust Amendment in Washington?

A: The Charitable Trust Amendment in Washington refers to a change or update made to the laws governing charitable trusts in the state of Washington.

Q: What does the Charitable Trust Amendment aim to do?

A: The Charitable Trust Amendment aims to make changes and updates to the regulations and requirements for charitable trusts in Washington.

Q: Who does the Charitable Trust Amendment in Washington apply to?

A: The Charitable Trust Amendment in Washington applies to individuals, organizations, and entities involved in creating, managing, or benefiting from charitable trusts in the state.

Q: What are charitable trusts?

A: Charitable trusts are legal entities created to hold and manage assets for charitable purposes, such as supporting nonprofit organizations or causes.

Q: Why are charitable trusts important?

A: Charitable trusts are important as they provide a means for individuals and organizations to support charitable causes and have their assets managed and distributed in accordance with their charitable intentions.

Q: How can someone create a charitable trust in Washington?

A: To create a charitable trust in Washington, individuals or organizations typically work with an attorney who specializes in trust law to draft the necessary legal documents and ensure compliance with state regulations.

Q: What are the requirements to create a charitable trust in Washington?

A: The specific requirements to create a charitable trust in Washington may vary depending on the nature and purpose of the trust. Generally, the trust agreement must be in writing, signed by the settlor (the person creating the trust), and comply with state laws.

Q: What are the benefits of using a charitable trust?

A: Using a charitable trust can offer benefits such as potential tax advantages, ensuring assets are used for charitable purposes, and providing ongoing support for a chosen cause or organization.

Q: Can a charitable trust be amended?

A: Yes, a charitable trust can be amended, subject to compliance with applicable laws and regulations.

Q: Who oversees charitable trusts in Washington?

A: Charitable trusts in Washington are generally overseen by the Washington State Attorney General's Office, which has jurisdiction over charitable organizations and trusts.

Q: Are there filing or reporting requirements for charitable trusts in Washington?

A: Yes, charitable trusts in Washington are typically required to file certain reports and disclosures with the Attorney General's Office to maintain compliance with state laws.

Form Details:

- Released on September 1, 2022;

- The latest edition currently provided by the Washington Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Washington Secretary of State.