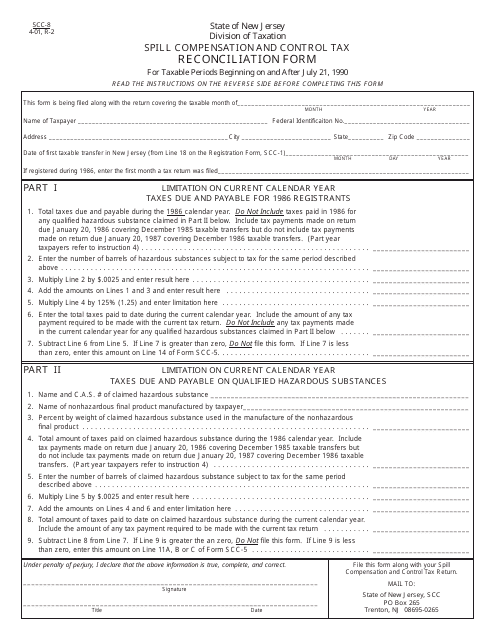

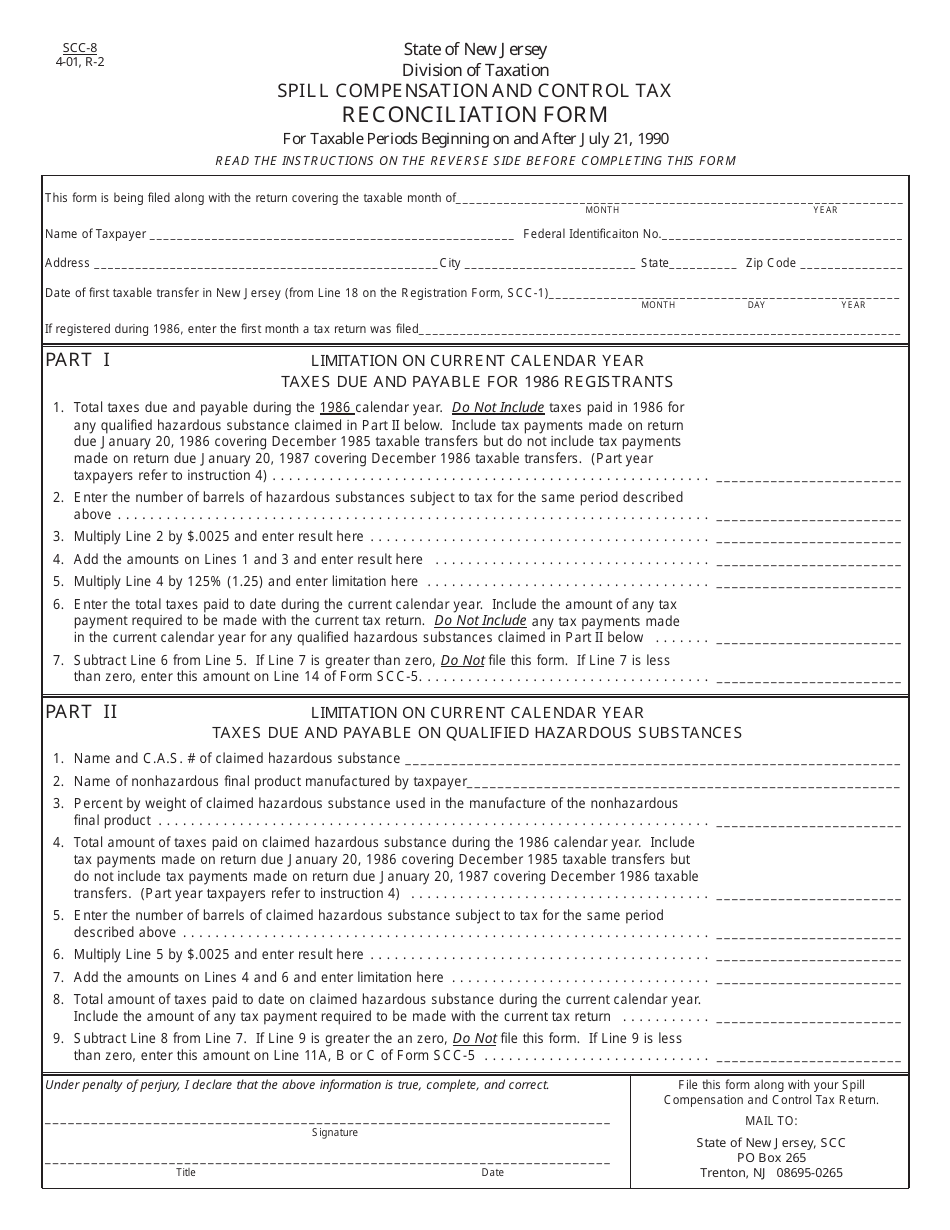

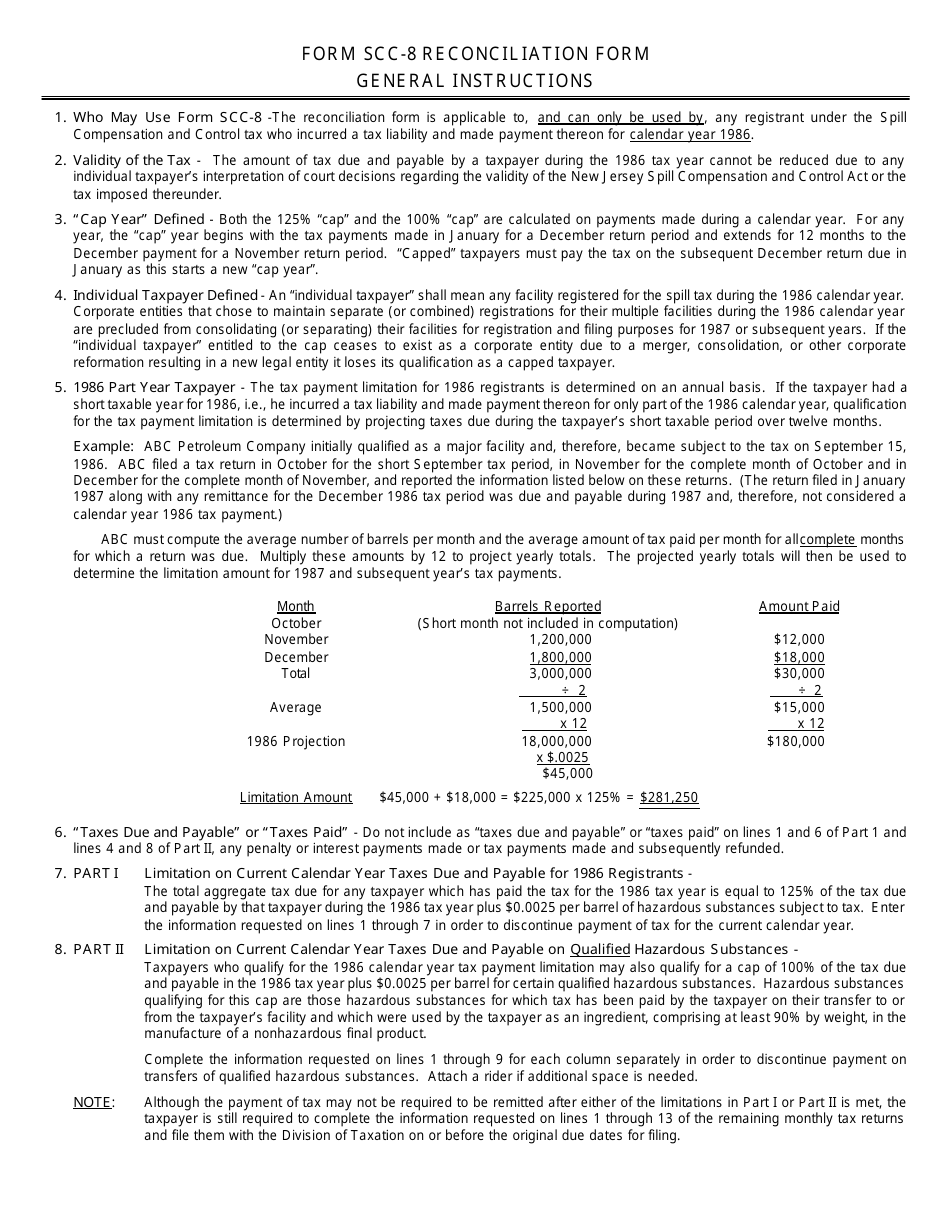

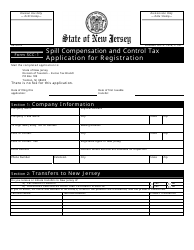

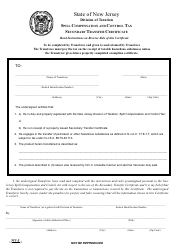

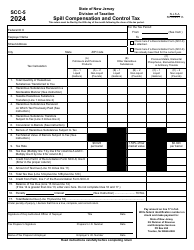

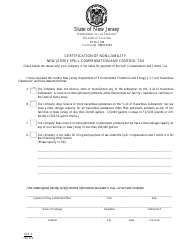

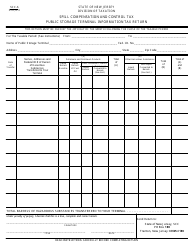

Form SCC-8 Spill Compensation and Control Tax Reconciliation Form - New Jersey

What Is Form SCC-8?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SCC-8?

A: Form SCC-8 is the Spill Compensation and Control Tax Reconciliation Form used in New Jersey.

Q: What is the purpose of Form SCC-8?

A: The purpose of Form SCC-8 is to reconcile the Spill Compensation and Control Tax liabilities and payments.

Q: Who needs to file Form SCC-8?

A: Anyone who is liable for the Spill Compensation and Control Tax in New Jersey needs to file Form SCC-8.

Q: When is the deadline to file Form SCC-8?

A: The deadline to file Form SCC-8 is usually May 1st of each year.

Q: What information is needed to complete Form SCC-8?

A: To complete Form SCC-8, you will need information about your Spill Compensation and Control Tax liabilities and payments for the reporting period.

Q: Are there any penalties for late filing of Form SCC-8?

A: Yes, there are penalties for late filing of Form SCC-8, including interest charges on the unpaid tax liabilities.

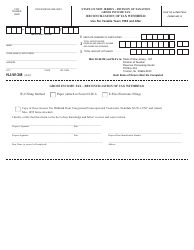

Form Details:

- Released on April 1, 2001;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SCC-8 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.