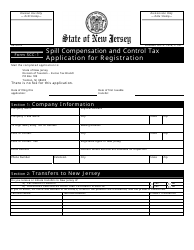

This version of the form is not currently in use and is provided for reference only. Download this version of

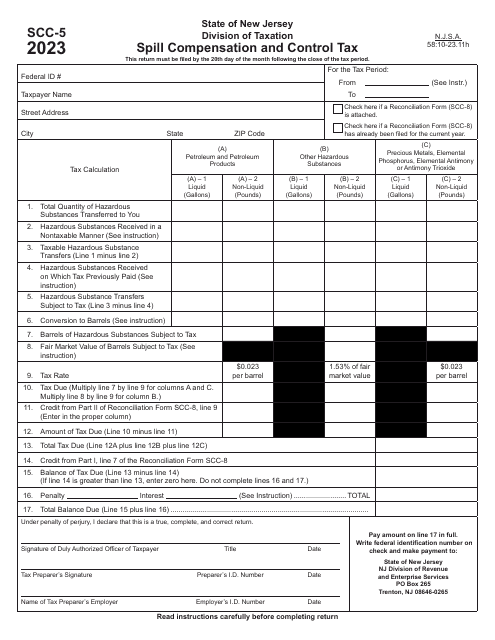

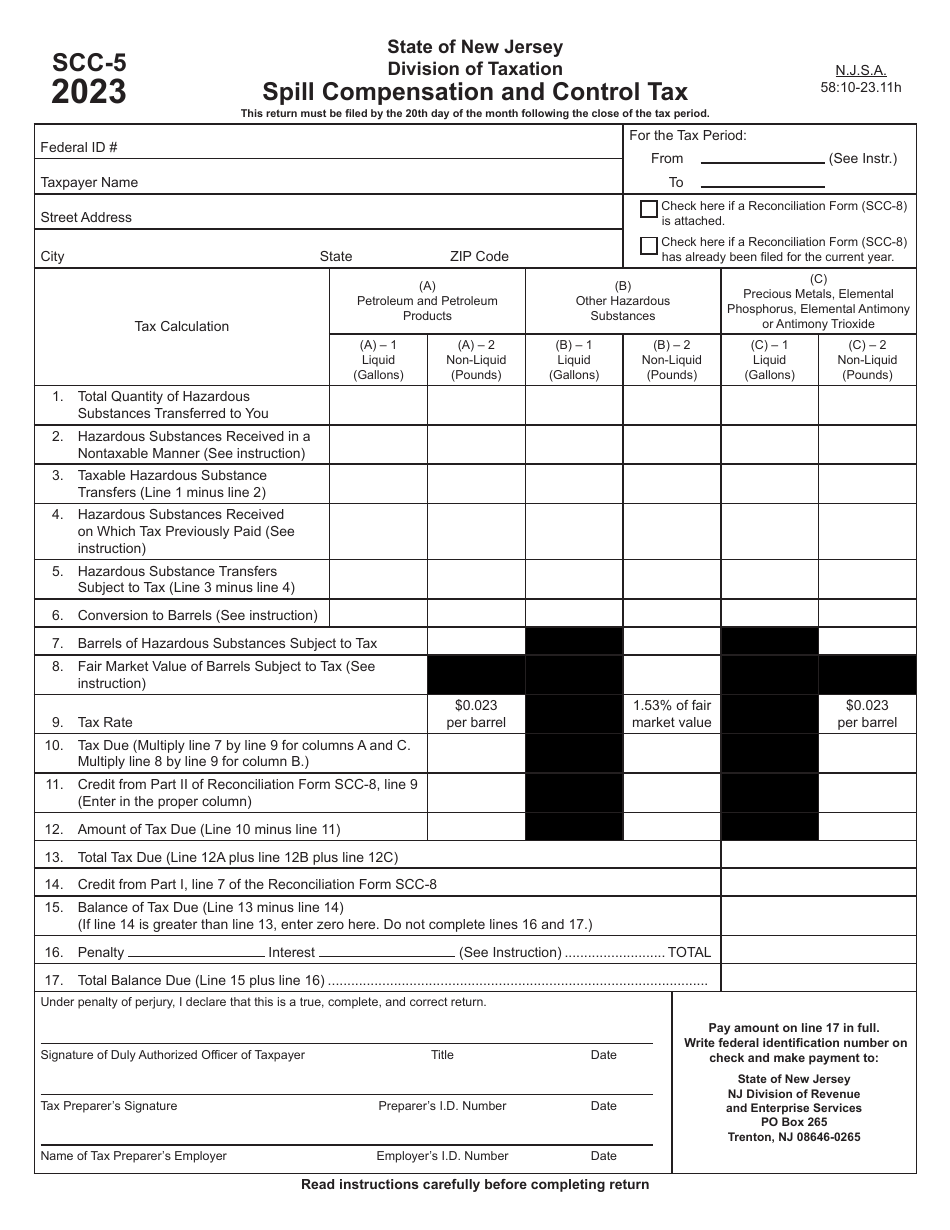

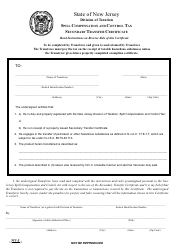

Form SCC-5

for the current year.

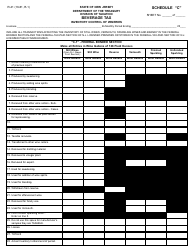

Form SCC-5 Spill Compensation and Control Tax - New Jersey

What Is Form SCC-5?

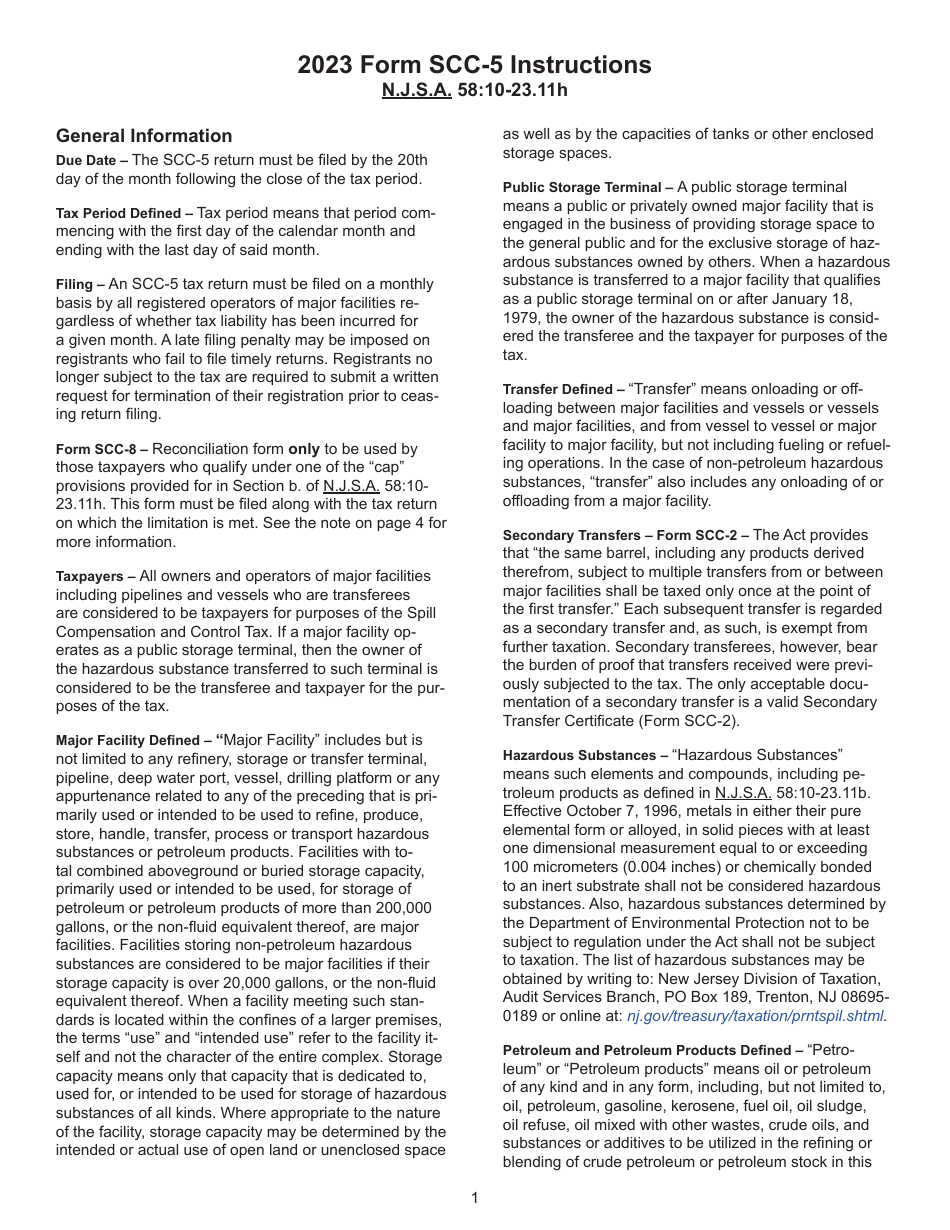

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

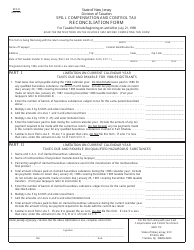

Q: What is Form SCC-5?

A: Form SCC-5 is the Spill Compensation and Control Tax form in the state of New Jersey.

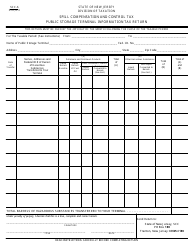

Q: Who needs to file Form SCC-5?

A: Businesses or individuals engaged in certain activities that involve hazardous substances in New Jersey need to file Form SCC-5.

Q: What is the purpose of Form SCC-5?

A: The purpose of Form SCC-5 is to report and pay the Spill Compensation and Control Tax, which is used to fund the cleanup of hazardous substance releases.

Q: What activities trigger the requirement to file Form SCC-5?

A: Activities such as storage, transportation, disposal, or discharge of hazardous substances in New Jersey may trigger the requirement to file Form SCC-5.

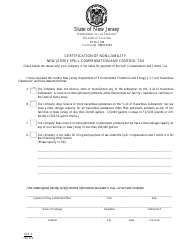

Q: When is Form SCC-5 due?

A: Form SCC-5 is generally due on or before April 30th of each year for the previous calendar year.

Q: Are there any penalties for not filing Form SCC-5?

A: Yes, failure to file Form SCC-5 or pay the Spill Compensation and Control Tax can result in penalties and interest.

Q: Is Form SCC-5 required for individuals who do not have any hazardous substance activity?

A: No, Form SCC-5 is only required for individuals or businesses engaged in activities involving hazardous substances in New Jersey.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SCC-5 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.