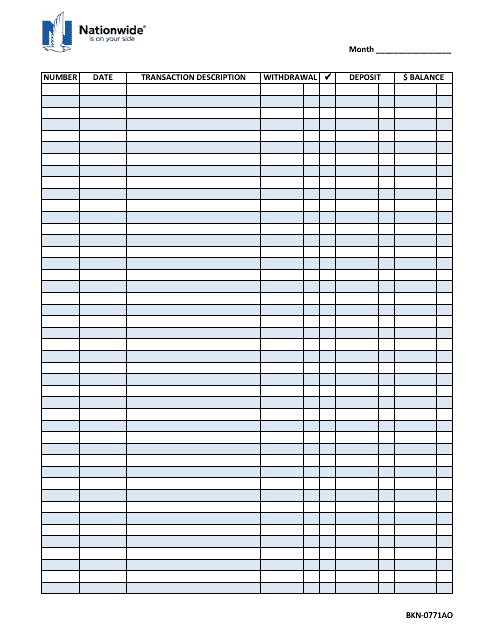

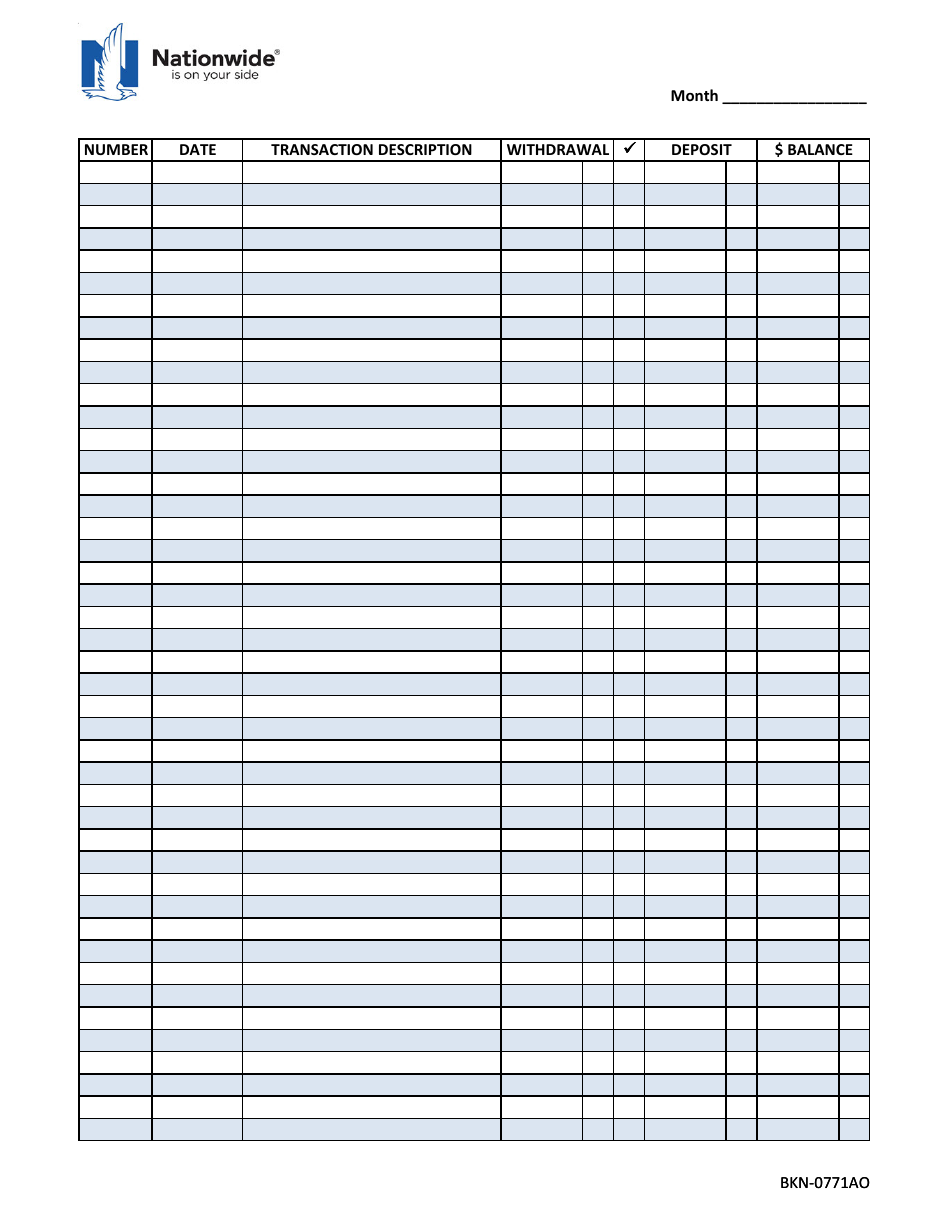

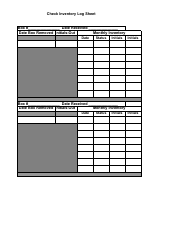

Check Register Template - Nationwide

A check register template is used to record information about the checks you write and the deposits you make in your bank account. It helps you keep track of your spending and manage your finances. Nationwide is an insurance and financial services company, so they may provide a specific check register template as a tool for their customers.

FAQ

Q: What is a check register?

A: A check register is a document used to track and monitor all the transactions made with a checking account.

Q: Why is it important to keep a check register?

A: Keeping a check register helps you keep track of your spending and ensures that you have enough money in your account to cover your expenses.

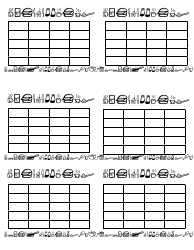

Q: What information should be recorded in a check register?

A: You should record the date, check number (if applicable), description of the transaction, and the amount of money deposited or withdrawn from your checking account.

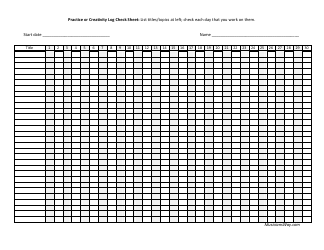

Q: How often should I update my check register?

A: You should update your check register immediately after making a transaction or at least once a day to ensure accuracy.

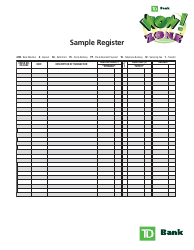

Q: Can I use a check register for other types of accounts?

A: Yes, you can use a similar register for tracking transactions in other types of accounts, such as savings accounts or credit cards.

Q: What are the benefits of using a check register template?

A: Using a check register template can help you organize and categorize your transactions, perform calculations automatically, and print the register for easy reference.