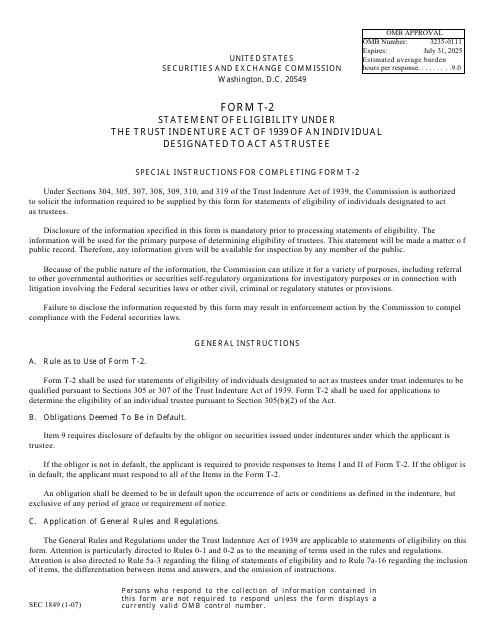

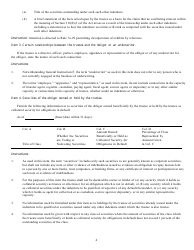

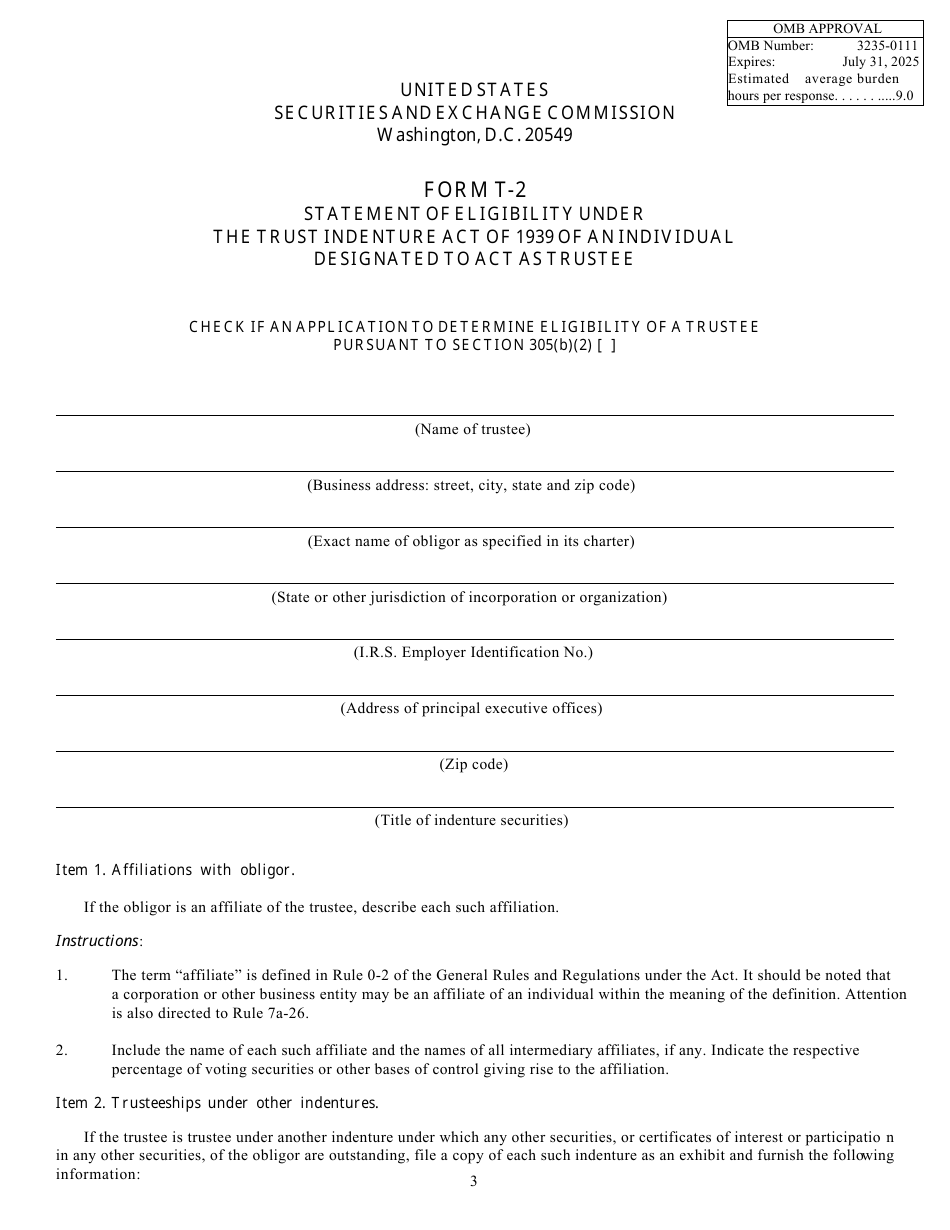

Form T-2 (SEC Form 1849) Statement of Eligibility Under the Trust Indenture Act of 1939 of an Individual Designated to Act as Trustee

What Is Form T-2 (SEC Form 1849)?

This is a legal form that was released by the U.S. Securities and Exchange Commission on January 1, 2007 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form T-2?

A: Form T-2 is also known as SEC Form 1849 and it is the Statement of Eligibility Under the Trust Indenture Act of 1939 of an Individual Designated to Act as Trustee.

Q: What is the Trust Indenture Act of 1939?

A: The Trust Indenture Act of 1939 is a federal law that governs the relationship between issuers of publicly traded debt securities and their trustees.

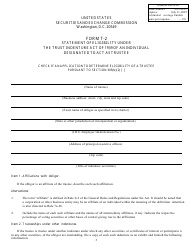

Q: Who needs to file Form T-2?

A: Individual designated to act as a trustee for debt securities offering needs to file Form T-2.

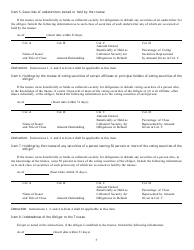

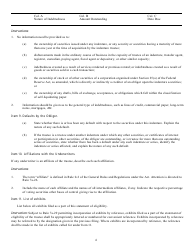

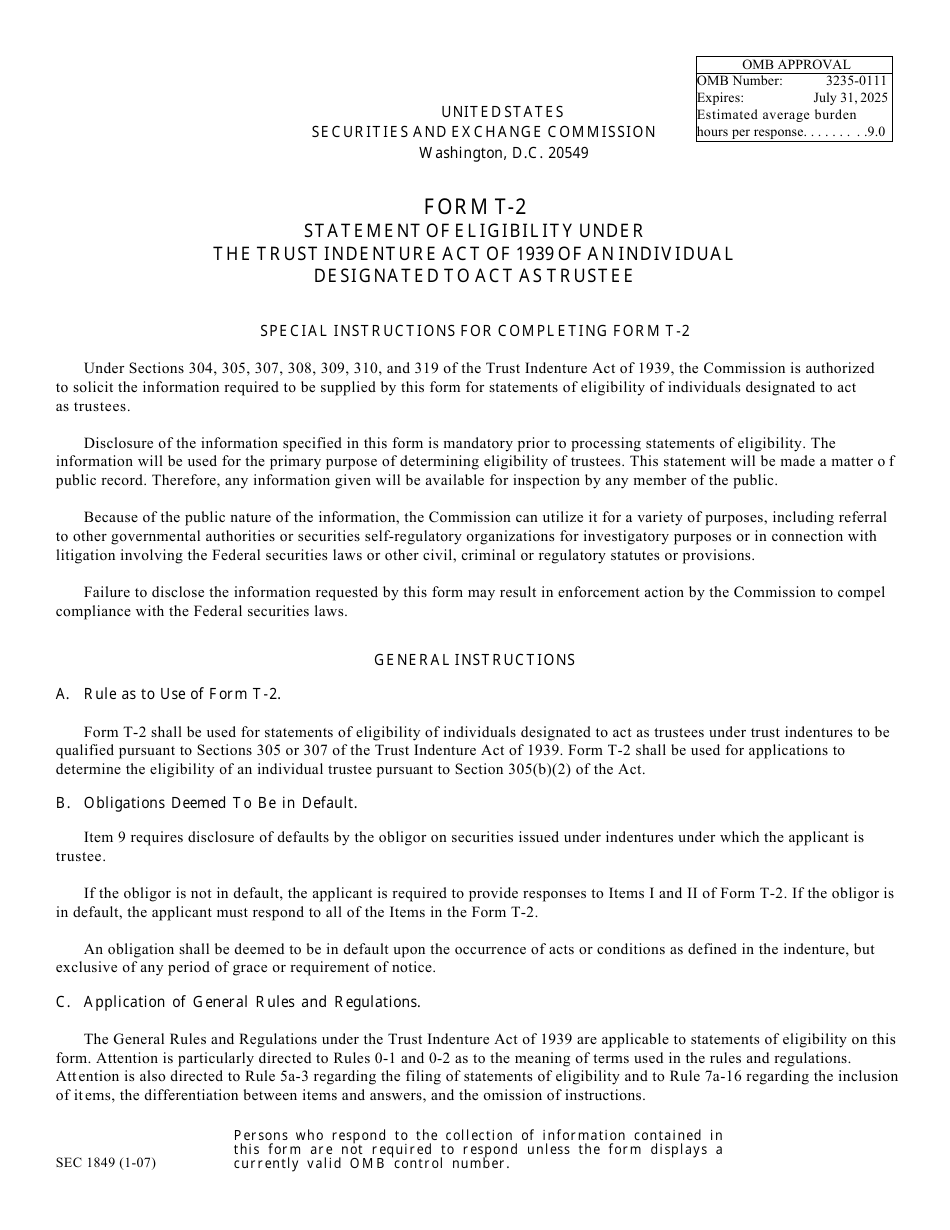

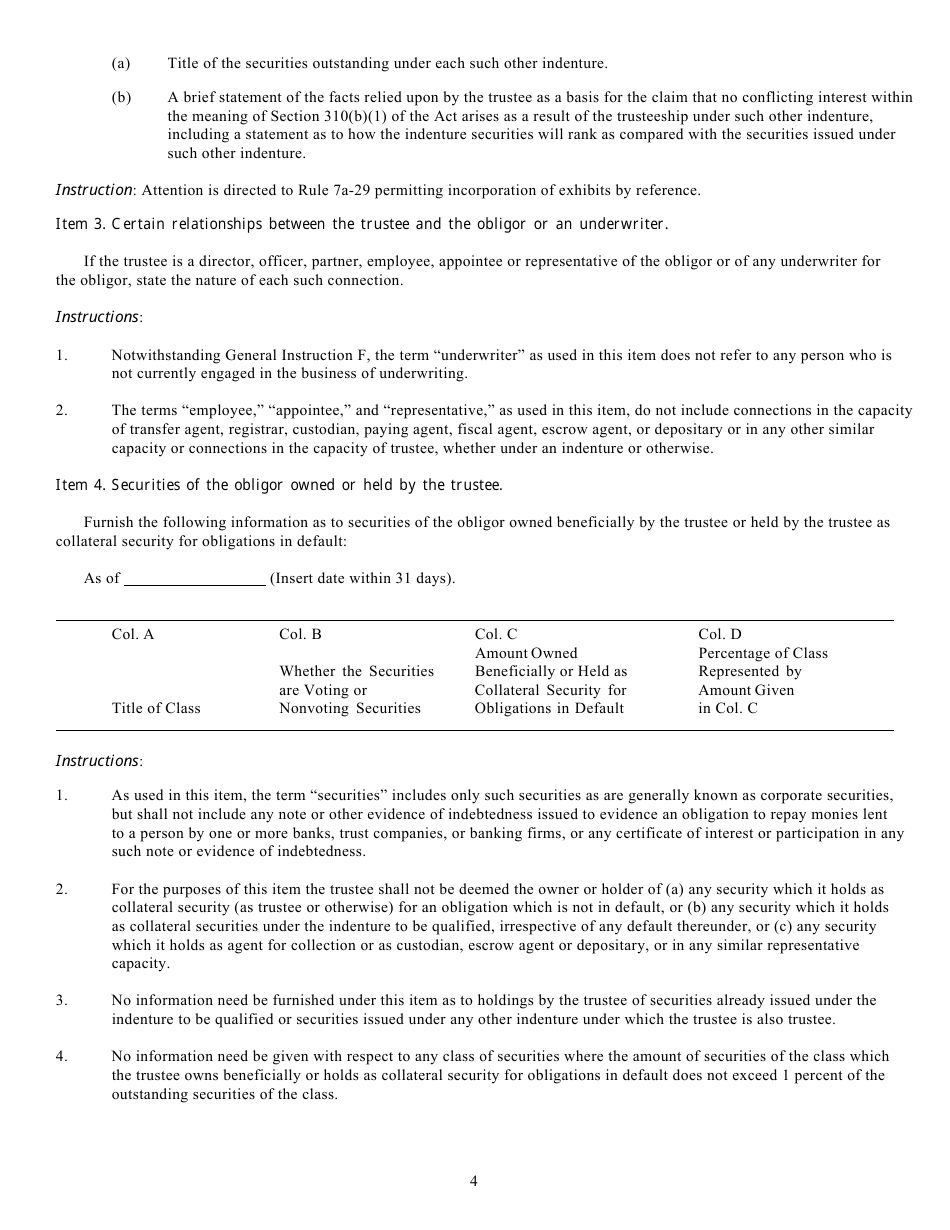

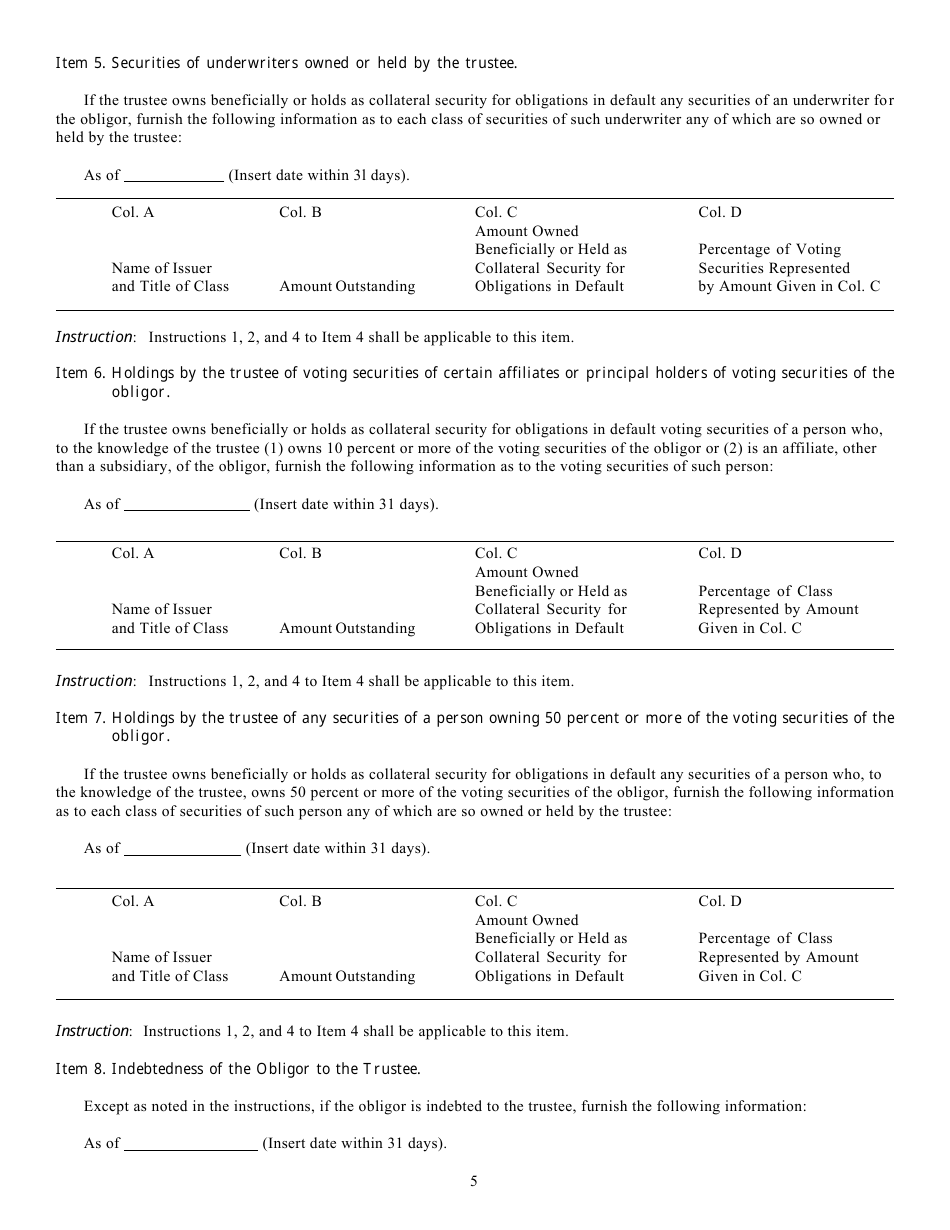

Q: What information is included in Form T-2?

A: Form T-2 includes information about the trustee's eligibility, background, and experience.

Q: Why is Form T-2 important?

A: Form T-2 is important because it helps ensure that individuals acting as trustees for debt securities offerings meet the eligibility requirements under the Trust Indenture Act of 1939.

Q: Are there any fees associated with filing Form T-2?

A: Yes, there are fees associated with filing Form T-2. Please refer to the SEC's fee schedule for the specific amount.

Q: Can I file Form T-2 electronically?

A: Yes, you can file Form T-2 electronically through the SEC's Electronic Data Gathering, Analysis, and Retrieval (EDGAR) system.

Q: Is Form T-2 required for all debt securities offerings?

A: No, Form T-2 is only required for debt securities offerings that are subject to the Trust Indenture Act of 1939.

Q: What are the consequences of not filing Form T-2?

A: Failure to file Form T-2 or providing false information may result in penalties and legal consequences.

Form Details:

- Released on January 1, 2007;

- The latest available edition released by the U.S. Securities and Exchange Commission;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form T-2 (SEC Form 1849) by clicking the link below or browse more documents and templates provided by the U.S. Securities and Exchange Commission.