This version of the form is not currently in use and is provided for reference only. Download this version of

Form HCA50-0704

for the current year.

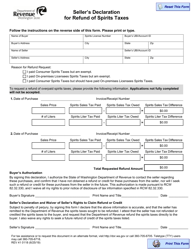

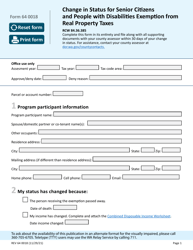

Form HCA50-0704 Pebb Declaration of Tax Status - Washington

What Is Form HCA50-0704?

This is a legal form that was released by the Washington State Health Care Authority - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form HCA50-0704?

A: Form HCA50-0704 is the Pebb Declaration of Tax Status for residents of Washington.

Q: What is the purpose of Form HCA50-0704?

A: The purpose of Form HCA50-0704 is to declare your tax status for healthcare benefits in Washington.

Q: Who needs to fill out Form HCA50-0704?

A: Residents of Washington who are applying for or currently receiving healthcare benefits through the Pebb program need to fill out this form.

Q: Is Form HCA50-0704 specific to Washington residents only?

A: Yes, Form HCA50-0704 is specific to residents of Washington who are enrolled in or applying for healthcare benefits through the Pebb program.

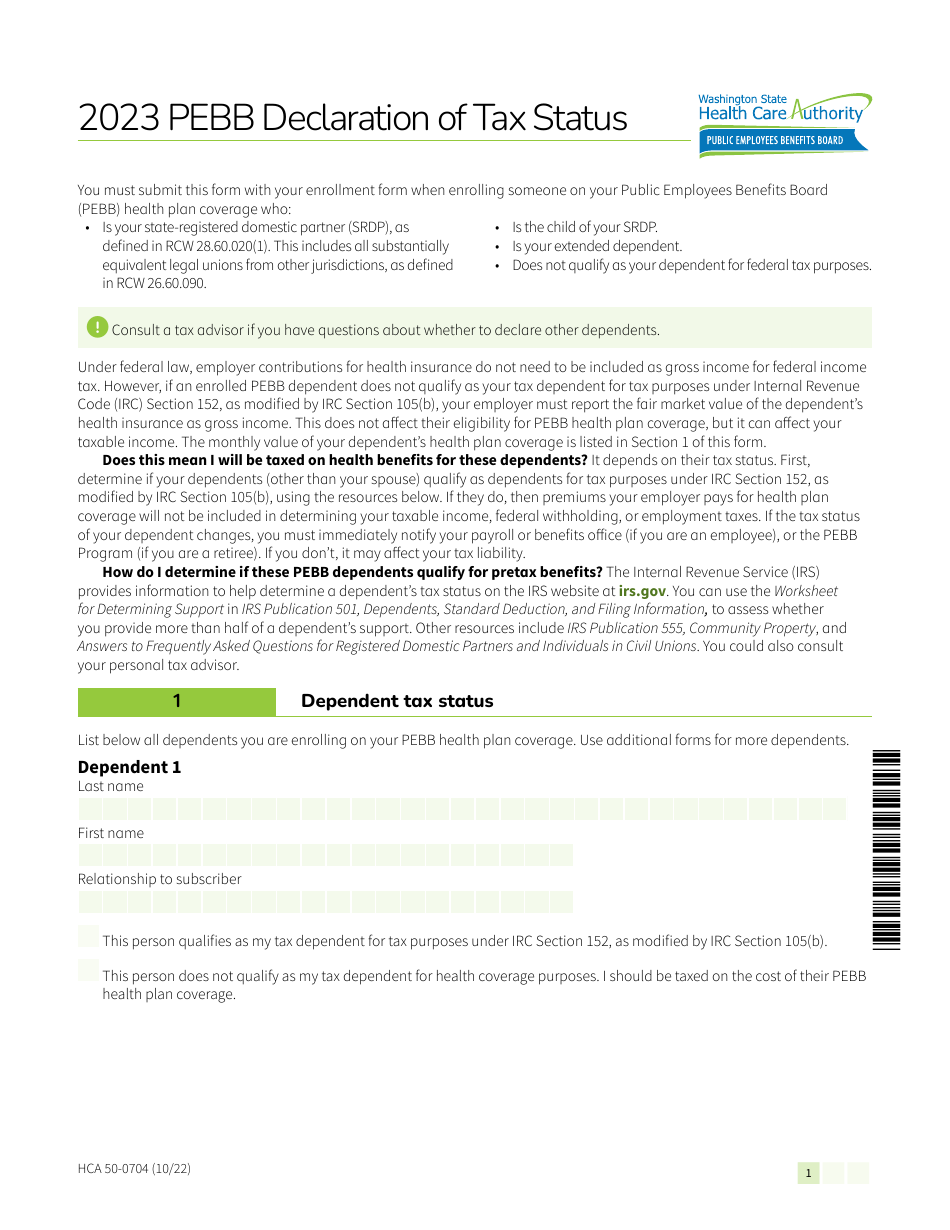

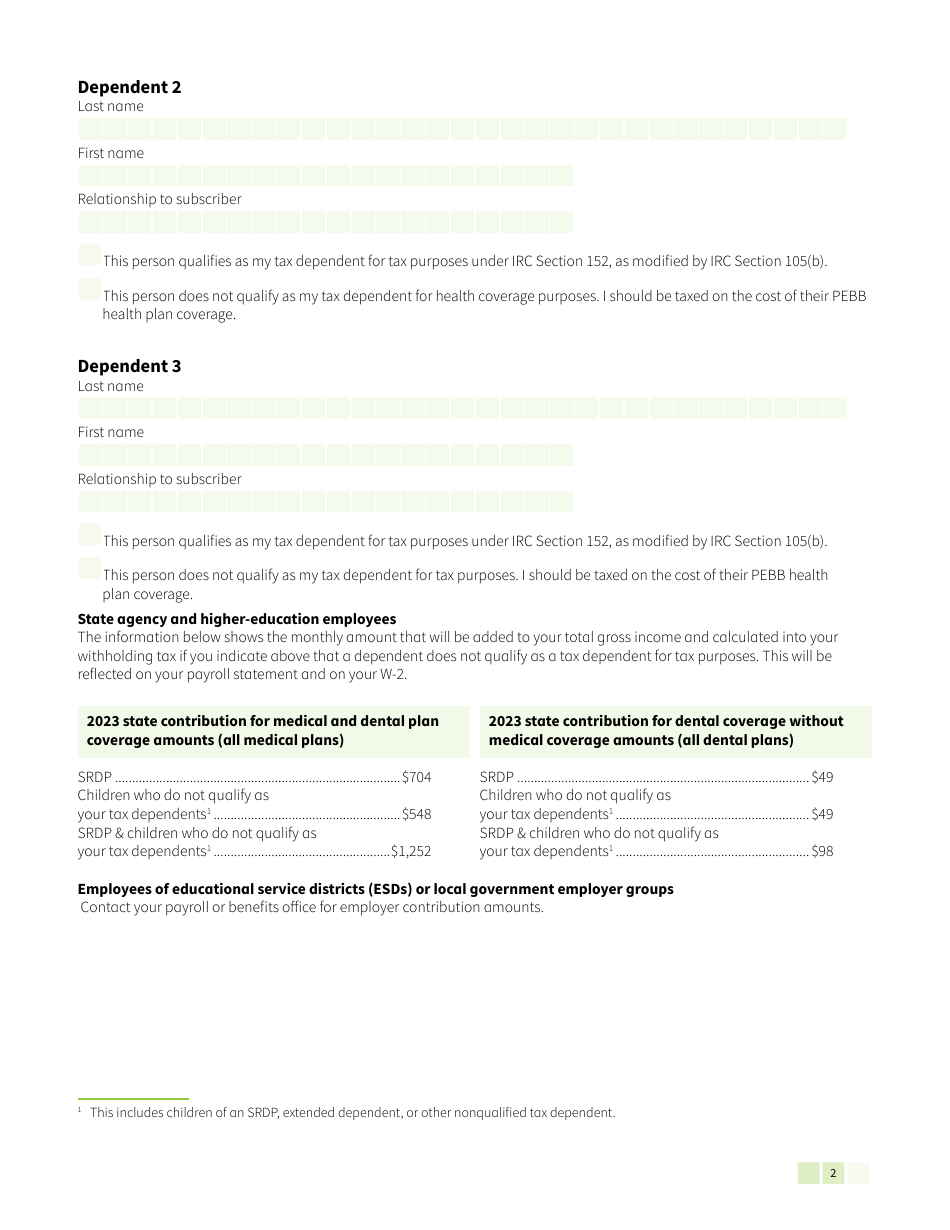

Q: What information do I need to fill out Form HCA50-0704?

A: You will need to provide your personal information, tax filing status, and any dependent information required by the form.

Q: When do I need to submit Form HCA50-0704?

A: You should submit Form HCA50-0704 as soon as you are applying for or have a change in your healthcare benefits status through the Pebb program.

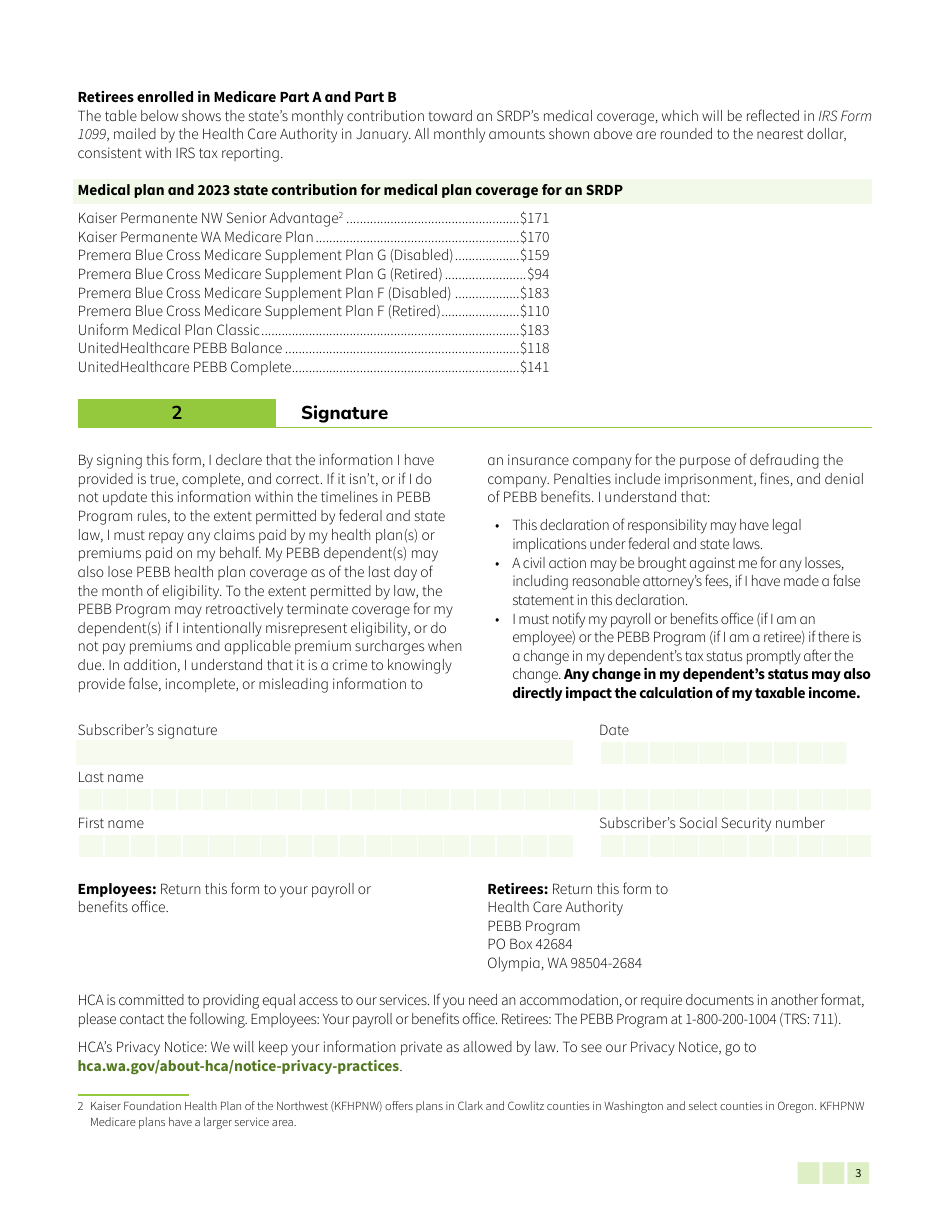

Q: Are there any penalties for not submitting Form HCA50-0704?

A: Failure to submit Form HCA50-0704 may result in a delay or denial of healthcare benefits through the Pebb program.

Q: Can I make changes to my Form HCA50-0704 after submission?

A: If you need to make changes to your Form HCA50-0704, you should contact the appropriate healthcare authority in Washington for instructions on how to do so.

Form Details:

- Released on October 1, 2022;

- The latest edition provided by the Washington State Health Care Authority;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form HCA50-0704 by clicking the link below or browse more documents and templates provided by the Washington State Health Care Authority.