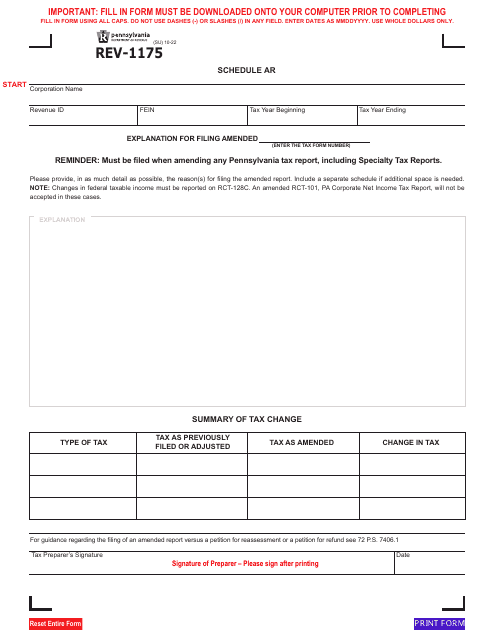

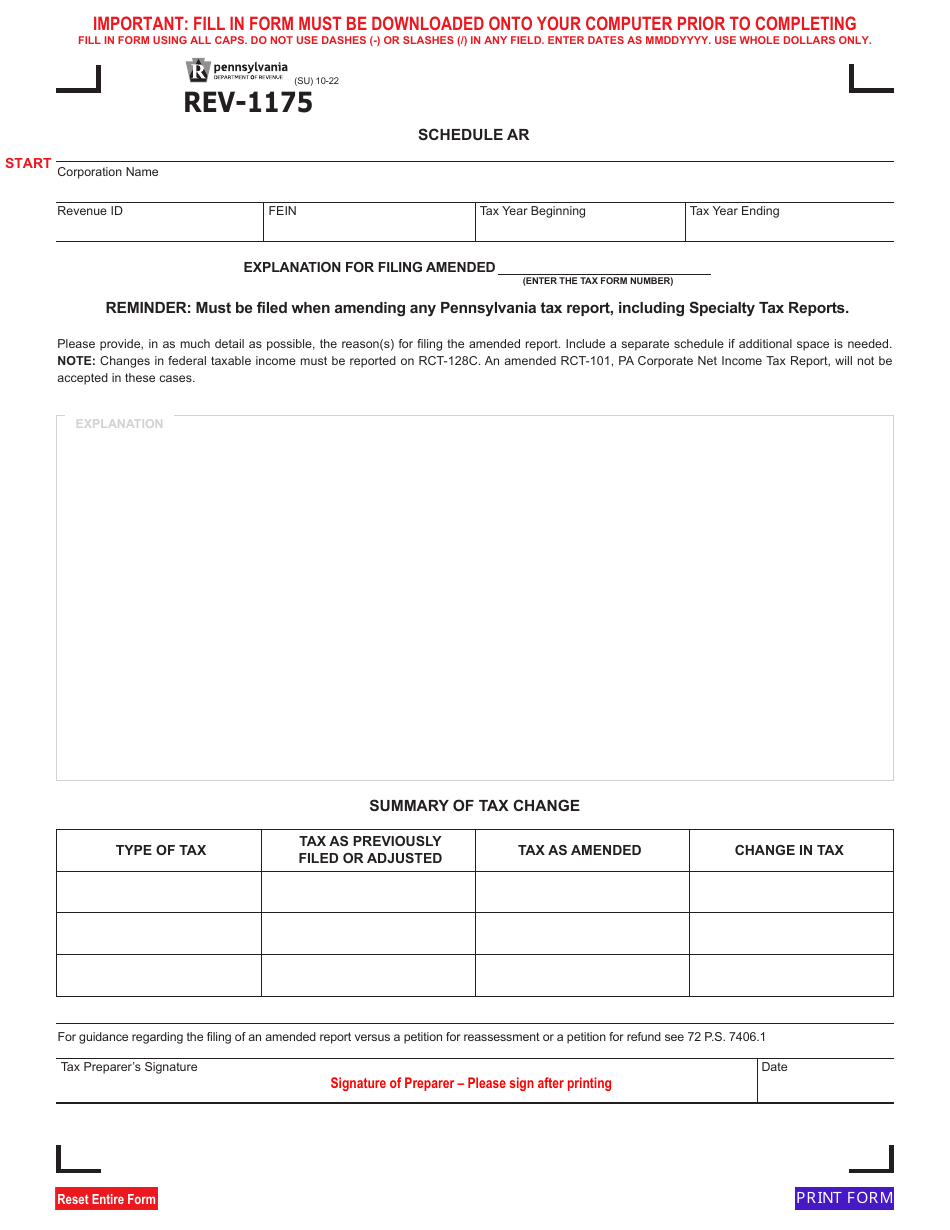

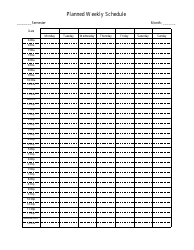

Form REV-1175 Schedule AR - Pennsylvania

What Is Form REV-1175 Schedule AR?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-1175 Schedule AR?

A: Form REV-1175 Schedule AR is a schedule used in Pennsylvania to report income or loss from your business or profession on your state tax return.

Q: Who needs to file Form REV-1175 Schedule AR?

A: You need to file Form REV-1175 Schedule AR if you have income or loss from a business or profession and you are required to file a Pennsylvania state tax return.

Q: What information do I need to complete Form REV-1175 Schedule AR?

A: To complete Form REV-1175 Schedule AR, you will need information about your business or profession, such as your income and expenses.

Q: When is the deadline to file Form REV-1175 Schedule AR?

A: The deadline to file Form REV-1175 Schedule AR is the same as the deadline to file your Pennsylvania state tax return, which is usually April 15th.

Q: Do I need to include Form REV-1175 Schedule AR with my federal tax return?

A: No, Form REV-1175 Schedule AR is specific to Pennsylvania state taxes and should not be included with your federal tax return.

Q: What happens if I don't file Form REV-1175 Schedule AR?

A: If you are required to file Form REV-1175 Schedule AR and you fail to do so, you may face penalties and interest on any tax owed.

Q: Can I e-file Form REV-1175 Schedule AR?

A: Yes, you can e-file Form REV-1175 Schedule AR if you are filing your Pennsylvania state tax return electronically.

Q: Is there a fee to file Form REV-1175 Schedule AR?

A: No, there is no fee to file Form REV-1175 Schedule AR.

Q: What if I made a mistake on Form REV-1175 Schedule AR?

A: If you made a mistake on Form REV-1175 Schedule AR, you can file an amended return using the correct information.

Form Details:

- Released on October 1, 2022;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1175 Schedule AR by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.