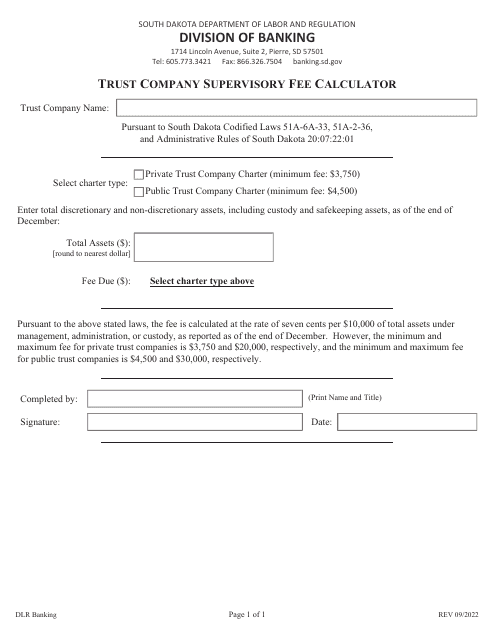

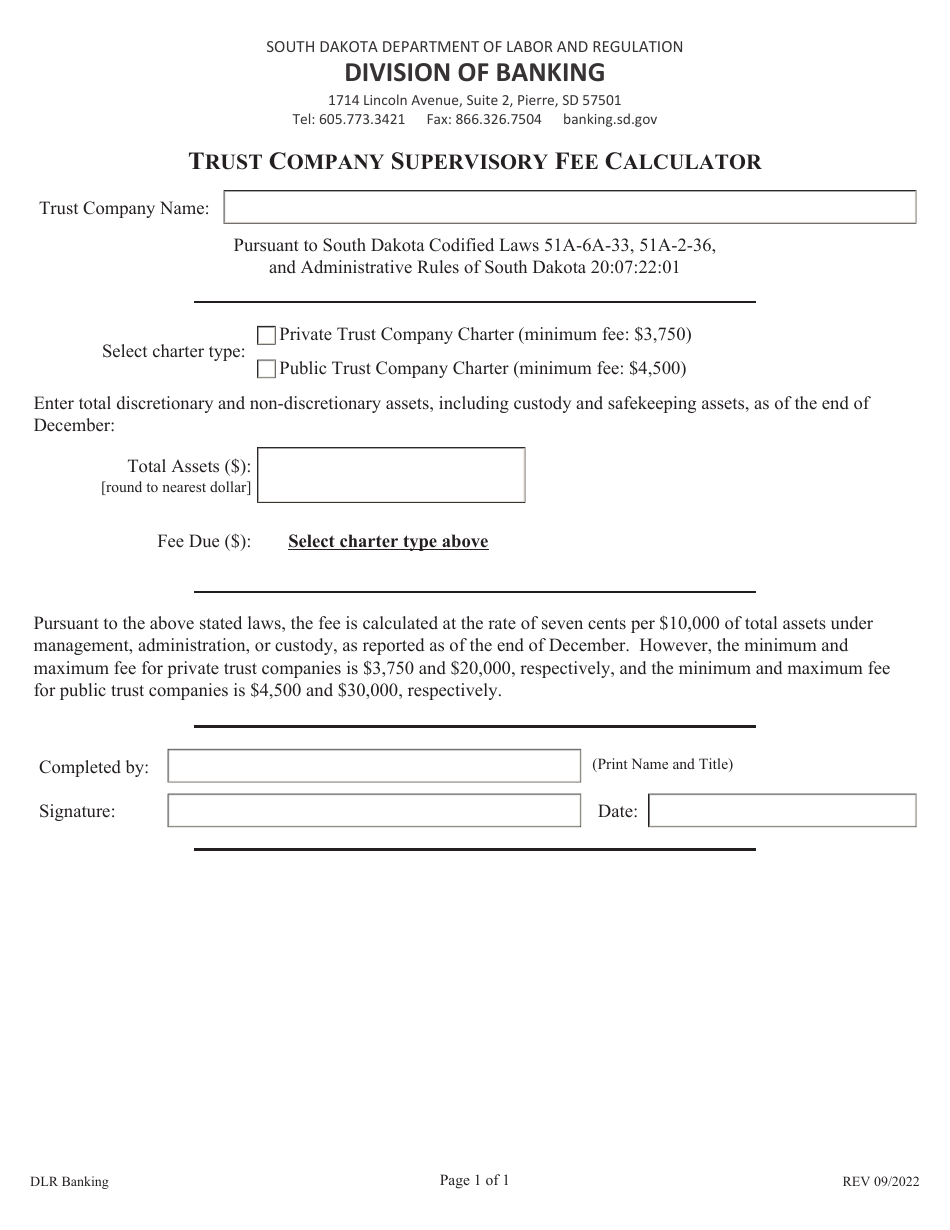

Trust Company Supervisory Fee Calculator - North Dakota

Trust Company Supervisory Fee Calculator is a legal document that was released by the North Dakota Department of Labor and Human Rights - a government authority operating within North Dakota.

FAQ

Q: What is a trust company supervisory fee?

A: A trust company supervisory fee is a fee charged by the state of North Dakota to supervise and regulate trust companies.

Q: Who is responsible for paying the trust company supervisory fee?

A: The trust company is responsible for paying the supervisory fee.

Q: How is the trust company supervisory fee calculated?

A: The fee is calculated based on the total trust assets held by the trust company.

Q: What is the rate of the trust company supervisory fee?

A: The rate varies depending on the total assets under management, with a minimum fee of $500.

Q: When is the trust company supervisory fee due?

A: The fee is due annually on July 31st.

Q: Are there any penalties for late payment of the trust company supervisory fee?

A: Yes, there is a penalty of 2% per month on any unpaid portion of the fee.

Q: Is the trust company supervisory fee tax-deductible?

A: Consult with a tax professional to determine if the fee is tax-deductible for your specific situation.

Form Details:

- Released on September 1, 2022;

- The latest edition currently provided by the North Dakota Department of Labor and Human Rights;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the North Dakota Department of Labor and Human Rights.