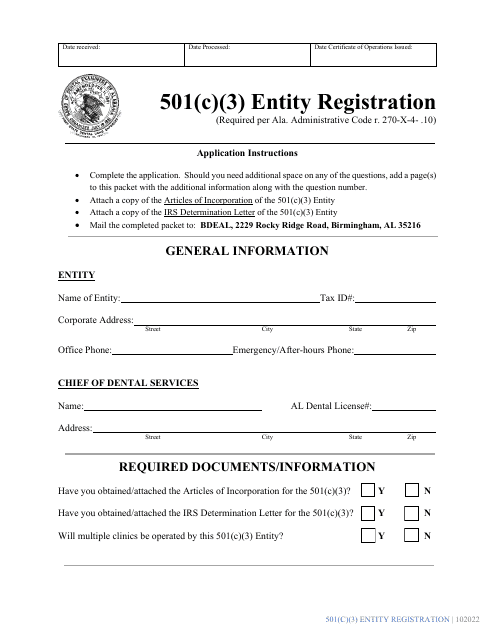

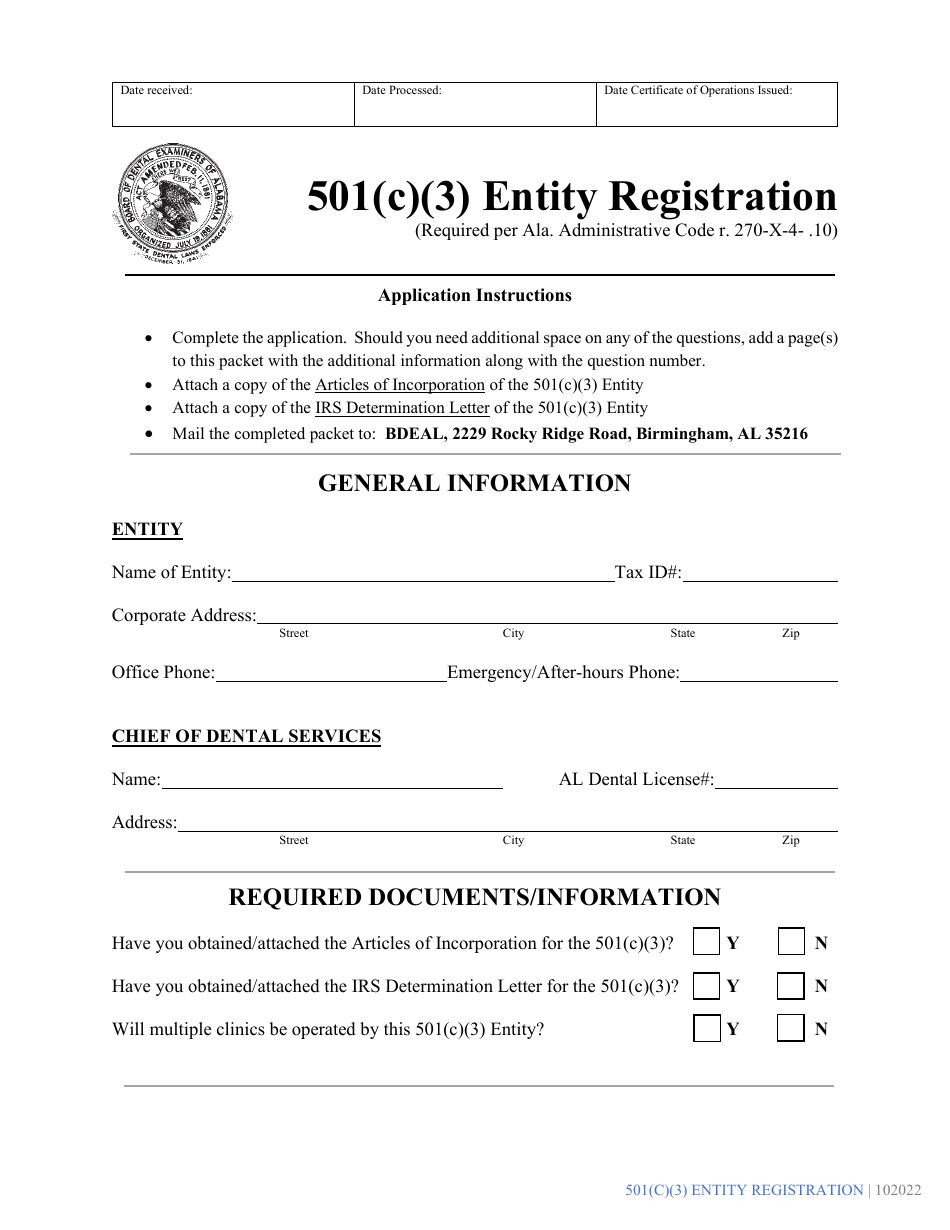

501(C)(3) Entity Registration Form - Alabama

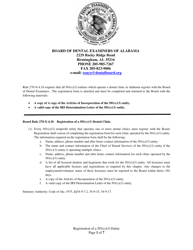

501(C)(3) Entity Registration Form is a legal document that was released by the Board of Dental Examiners of Alabama - a government authority operating within Alabama.

FAQ

Q: What is a 501(c)(3) entity?

A: A 501(c)(3) entity is a nonprofit organization recognized by the Internal Revenue Service (IRS) as tax-exempt.

Q: What is the purpose of the 501(c)(3) Entity Registration Form?

A: The purpose of the 501(c)(3) Entity Registration Form is to apply for state tax-exempt status in Alabama for a nonprofit organization.

Q: Who needs to fill out the 501(c)(3) Entity Registration Form?

A: Nonprofit organizations seeking tax-exempt status in Alabama need to fill out the form.

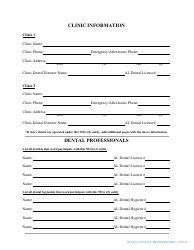

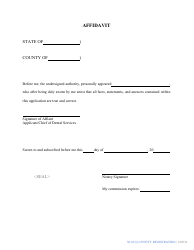

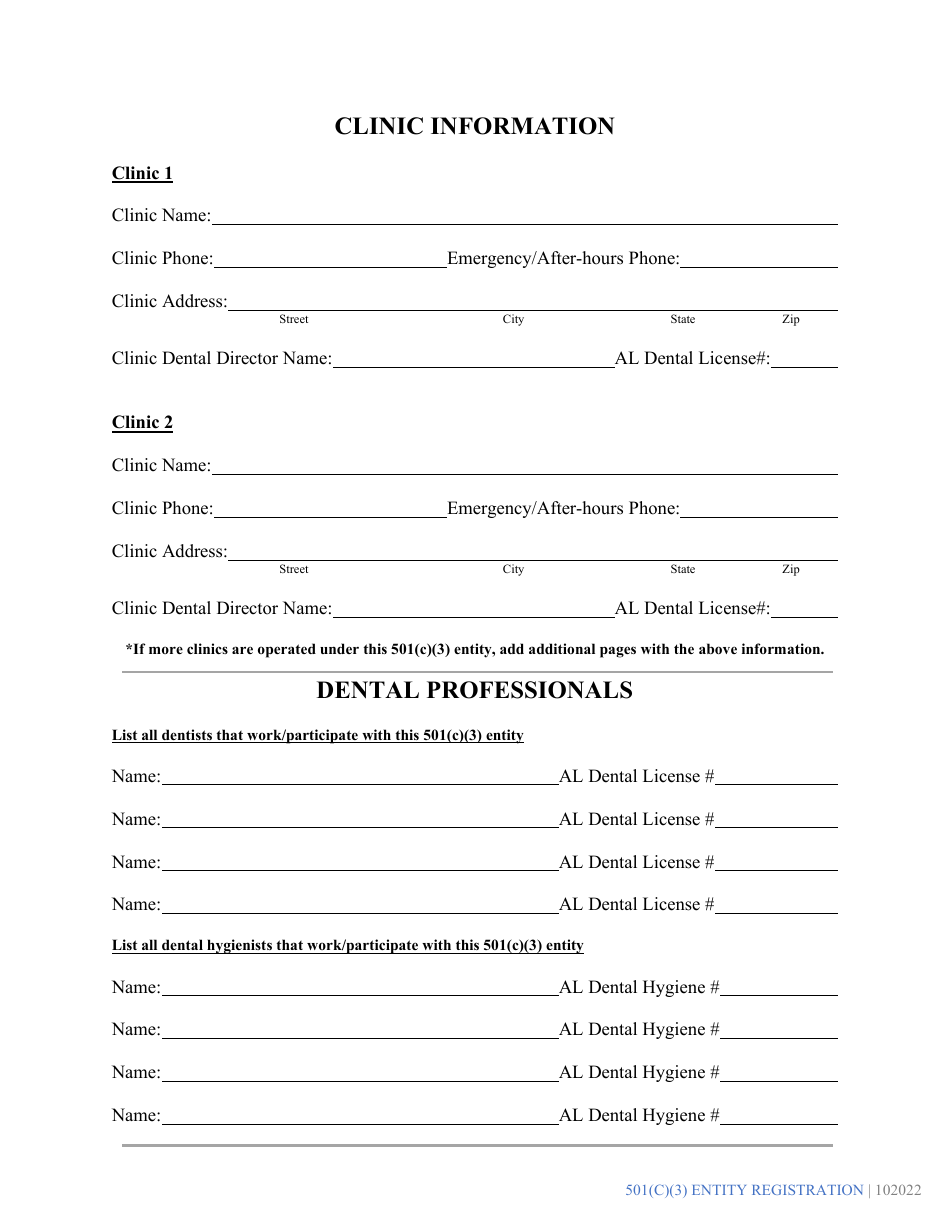

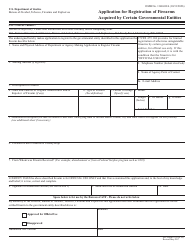

Q: What information is required on the 501(c)(3) Entity Registration Form?

A: The form will require information about the nonprofit organization's purpose, activities, board members, financials, and contact information.

Q: How long does it take to process the 501(c)(3) Entity Registration Form?

A: The processing time varies, but it generally takes several weeks to several months for the Alabama Department of Revenue to review and approve the application.

Q: What happens after the 501(c)(3) Entity Registration Form is approved?

A: Once the form is approved, the nonprofit organization will receive a tax-exempt certificate from the Alabama Department of Revenue.

Q: Can a nonprofit organization operate without tax-exempt status?

A: Yes, but without tax-exempt status, the organization may be required to pay taxes on its income and donations, which could impact its financial resources.

Q: Are there any ongoing requirements after obtaining tax-exempt status?

A: Yes, nonprofit organizations with tax-exempt status are required to file annual reports and maintain compliance with IRS and state regulations.

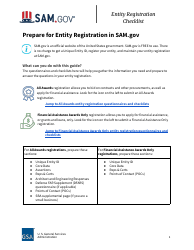

Form Details:

- Released on October 1, 2022;

- The latest edition currently provided by the Board of Dental Examiners of Alabama;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Board of Dental Examiners of Alabama.