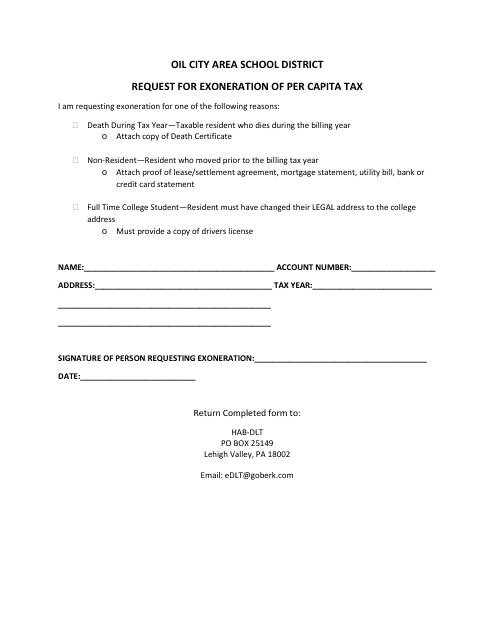

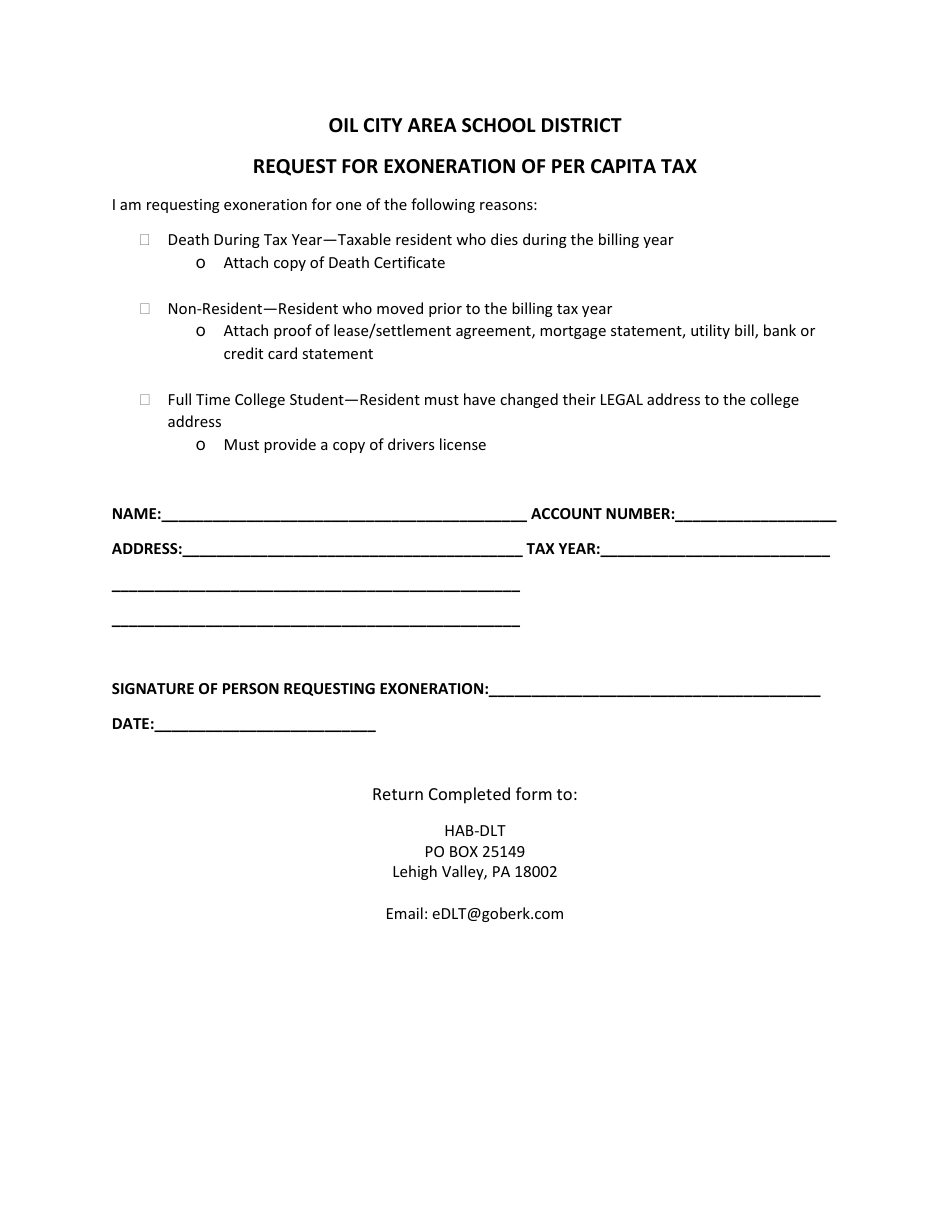

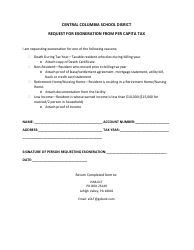

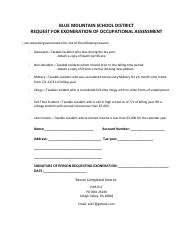

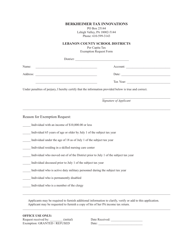

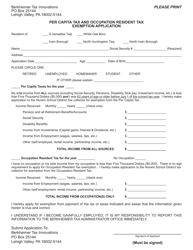

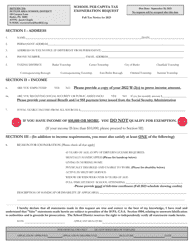

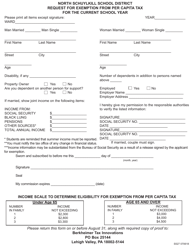

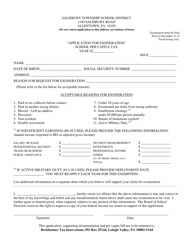

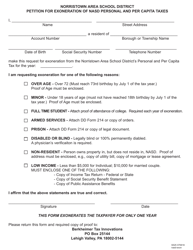

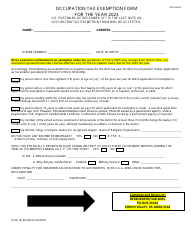

Request for Exoneration of Per Capita Tax - Oil City Area School District - Pennsylvania

Request for Exoneration of Per Capita Tax - Oil City Area School District is a legal document that was released by the Berkheimer Tax Administrator - a government authority operating within Pennsylvania.

FAQ

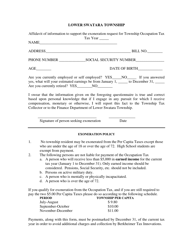

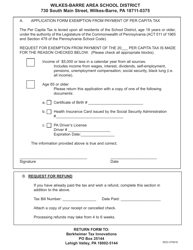

Q: What is the Exoneration of Per Capita Tax?

A: The Exoneration of Per Capita Tax is a request for exemption from paying a specific tax based on a per-person basis.

Q: What is the Per Capita Tax in the Oil City Area School District in Pennsylvania?

A: The Per Capita Tax in the Oil City Area School District in Pennsylvania is a tax assessed on each individual, typically for residents over 18 years old.

Q: How can I request Exoneration of Per Capita Tax in the Oil City Area School District?

A: To request Exoneration of Per Capita Tax in the Oil City Area School District, you need to submit a formal request to the appropriate tax authority or school district office.

Q: Am I eligible for Exoneration of Per Capita Tax?

A: Eligibility for Exoneration of Per Capita Tax varies, and it is best to review the specific requirements set by the Oil City Area School District and Pennsylvania tax laws.

Q: What are some common criteria for Exoneration of Per Capita Tax?

A: Common criteria for Exoneration of Per Capita Tax may include being under a certain age, having a low income, being a certain type of student, or having certain disabilities. Please consult the guidelines set by the Oil City Area School District for more information.

Q: Are there any deadlines for requesting Exoneration of Per Capita Tax?

A: Deadlines for requesting Exoneration of Per Capita Tax may vary, so it is crucial to review the deadlines specified by the Oil City Area School District or the Pennsylvania tax laws.

Q: What happens if my request for Exoneration of Per Capita Tax is approved?

A: If your request for Exoneration of Per Capita Tax is approved, you will be exempted from paying the Per Capita Tax for the specified period.

Q: What happens if my request for Exoneration of Per Capita Tax is denied?

A: If your request for Exoneration of Per Capita Tax is denied, you will be responsible for paying the Per Capita Tax as required by the Oil City Area School District and Pennsylvania tax laws.

Q: Can I appeal a denial of Exoneration of Per Capita Tax?

A: You may be able to appeal a denial of Exoneration of Per Capita Tax. It is recommended to review the guidelines and procedures for appeals set by the Oil City Area School District or the Pennsylvania tax laws.

Form Details:

- The latest edition currently provided by the Berkheimer Tax Administrator;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Berkheimer Tax Administrator.