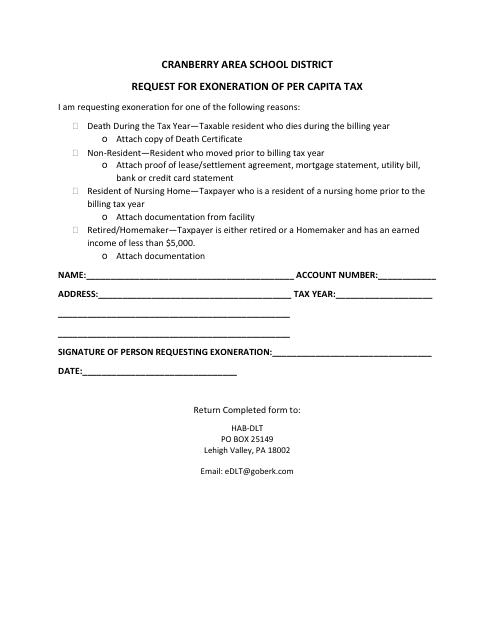

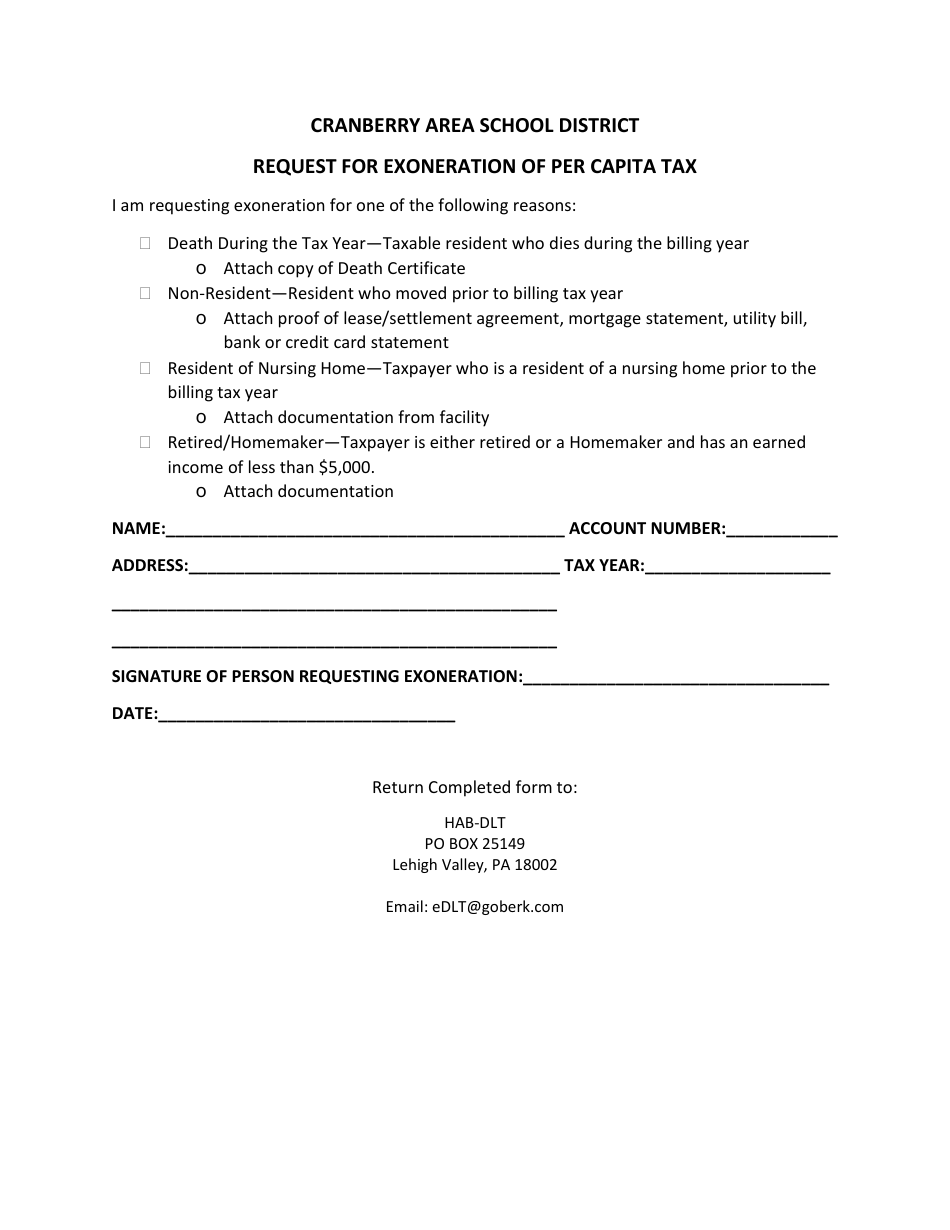

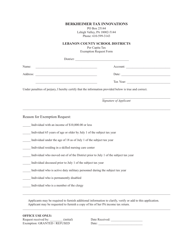

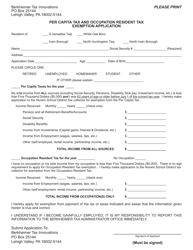

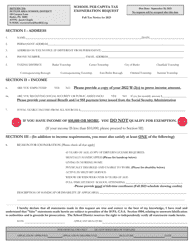

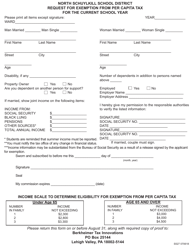

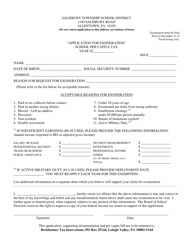

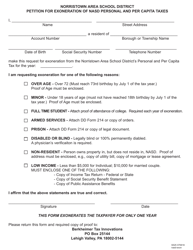

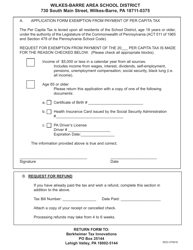

Request for Exoneration of Per Capita Tax - Cranberry Area School District - Pennsylvania

Request for Exoneration of Per Capita Tax - Cranberry Area School District is a legal document that was released by the Berkheimer Tax Administrator - a government authority operating within Pennsylvania.

FAQ

Q: What is the Cranberry Area School District?

A: The Cranberry Area School District is a school district in Pennsylvania.

Q: What is a per capita tax?

A: A per capita tax is a tax imposed on individuals, usually based on their residency or per person.

Q: Why would someone request exoneration of a per capita tax?

A: Someone may request exoneration of a per capita tax if they are exempt from paying it, such as being below a certain income threshold or having a specific tax exemption.

Q: How can someone request exoneration of the per capita tax in the Cranberry Area School District?

A: To request exoneration of the per capita tax in the Cranberry Area School District, you will need to contact the school district directly and follow their instructions and procedures.

Q: Is the per capita tax mandatory for residents of the Cranberry Area School District?

A: Yes, unless otherwise exempted, residents of the Cranberry Area School District are required to pay the per capita tax.

Q: Are there any specific eligibility criteria for exoneration of the per capita tax in the Cranberry Area School District?

A: Yes, the Cranberry Area School District may have specific eligibility criteria for exoneration of the per capita tax. Contact them directly for more information.

Form Details:

- The latest edition currently provided by the Berkheimer Tax Administrator;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Berkheimer Tax Administrator.