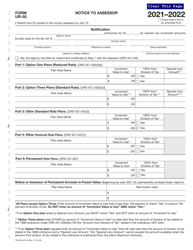

This version of the form is not currently in use and is provided for reference only. Download this version of

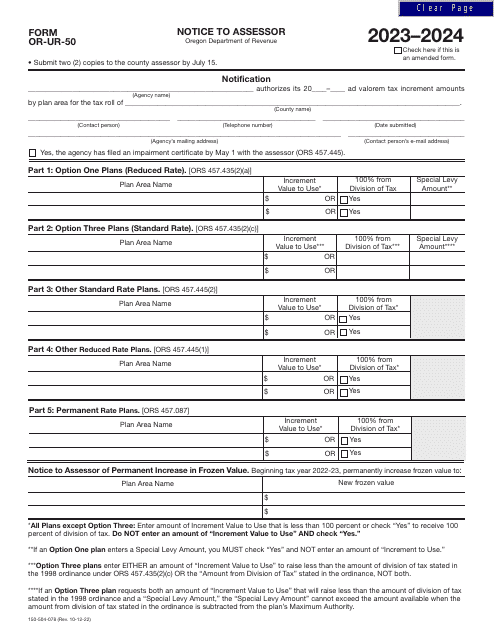

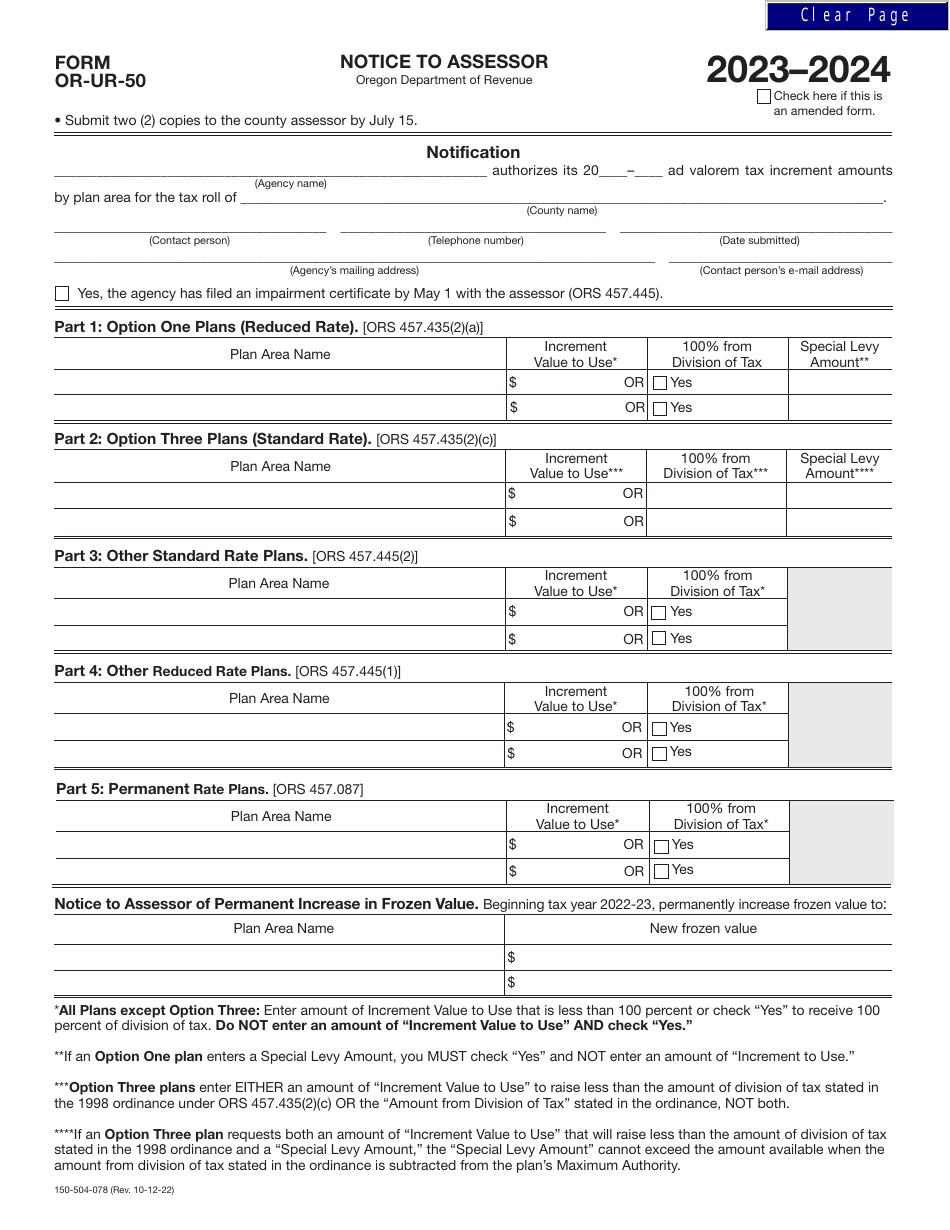

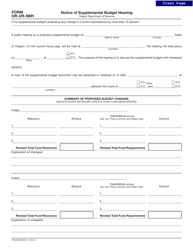

Form OR-UR-50 (150-504-078)

for the current year.

Form OR-UR-50 (150-504-078) Notice to Assessor - Oregon

What Is Form OR-UR-50 (150-504-078)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form OR-UR-50?

A: Form OR-UR-50 is a Notice to Assessor in the state of Oregon.

Q: Who should use Form OR-UR-50?

A: This form should be used by individuals or businesses to notify the assessor of certain changes or updates regarding their property.

Q: What kind of changes or updates can be reported on Form OR-UR-50?

A: Form OR-UR-50 can be used to report changes in ownership, improvements made to the property, changes in use, or corrections to previous assessments.

Q: How should Form OR-UR-50 be filled out?

A: Form OR-UR-50 should be completed with accurate and detailed information regarding the changes or updates being reported. Supporting documents may also be required.

Q: Is there a deadline for submitting Form OR-UR-50?

A: Yes, Form OR-UR-50 must be submitted to the county assessor within 30 days of the change or update being reported.

Q: Are there any fees associated with submitting Form OR-UR-50?

A: There is no fee for submitting Form OR-UR-50.

Q: What happens after submitting Form OR-UR-50?

A: Once Form OR-UR-50 is submitted, the assessor will review the information and make any necessary adjustments to the property's assessment.

Form Details:

- Released on October 12, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-UR-50 (150-504-078) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.