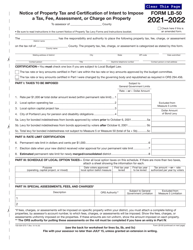

This version of the form is not currently in use and is provided for reference only. Download this version of

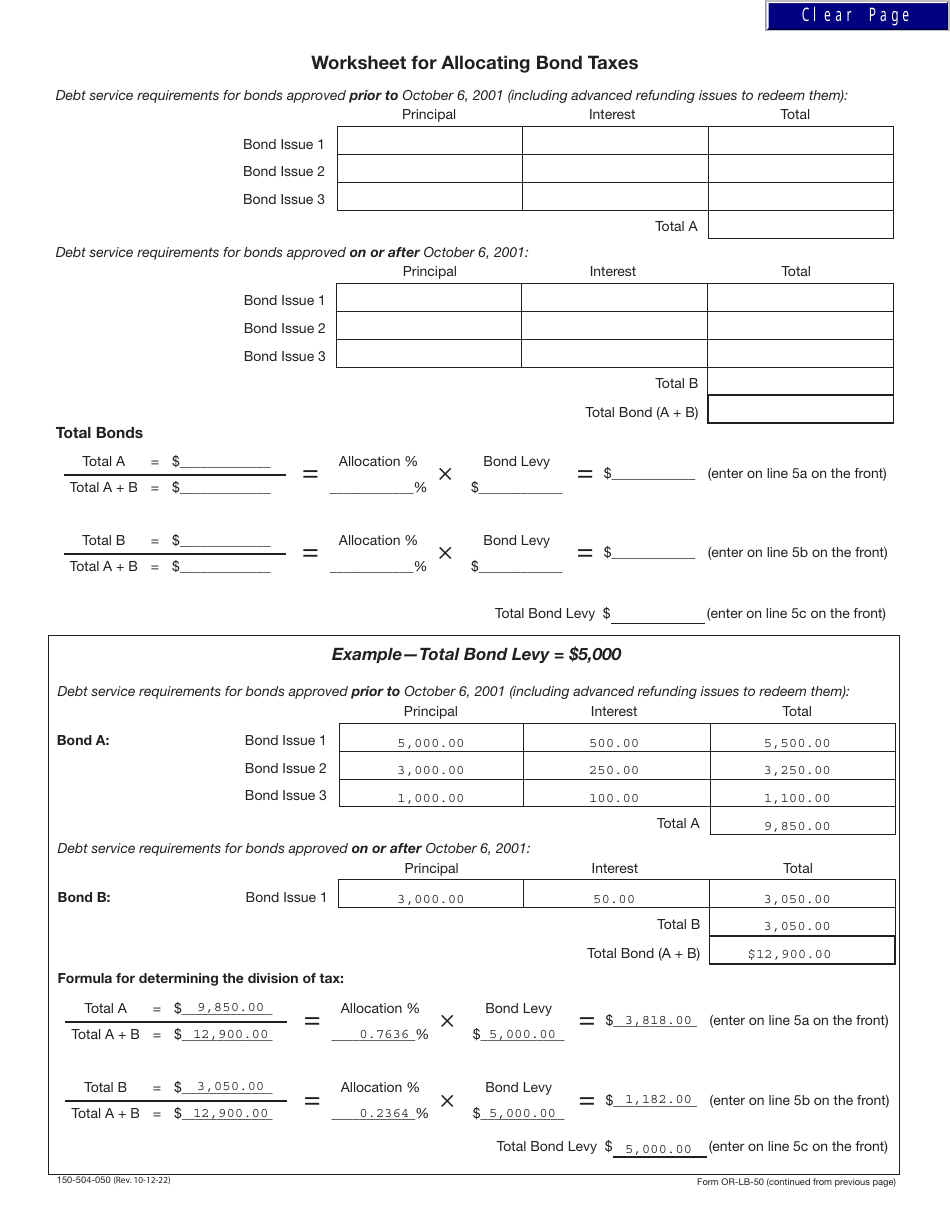

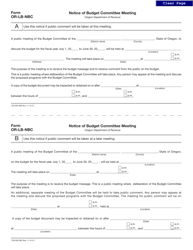

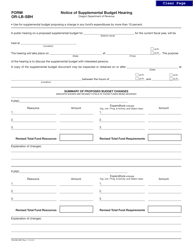

Form OR-LB-50 (150-504-050)

for the current year.

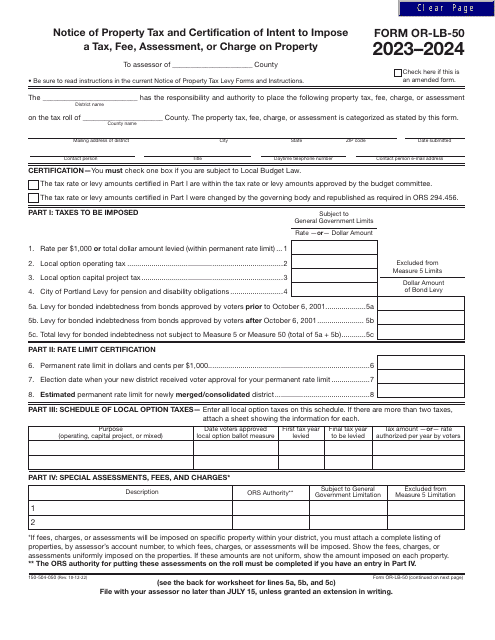

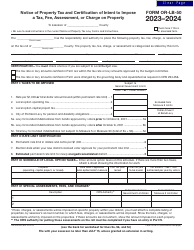

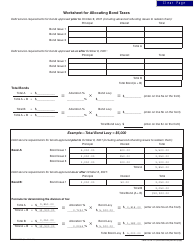

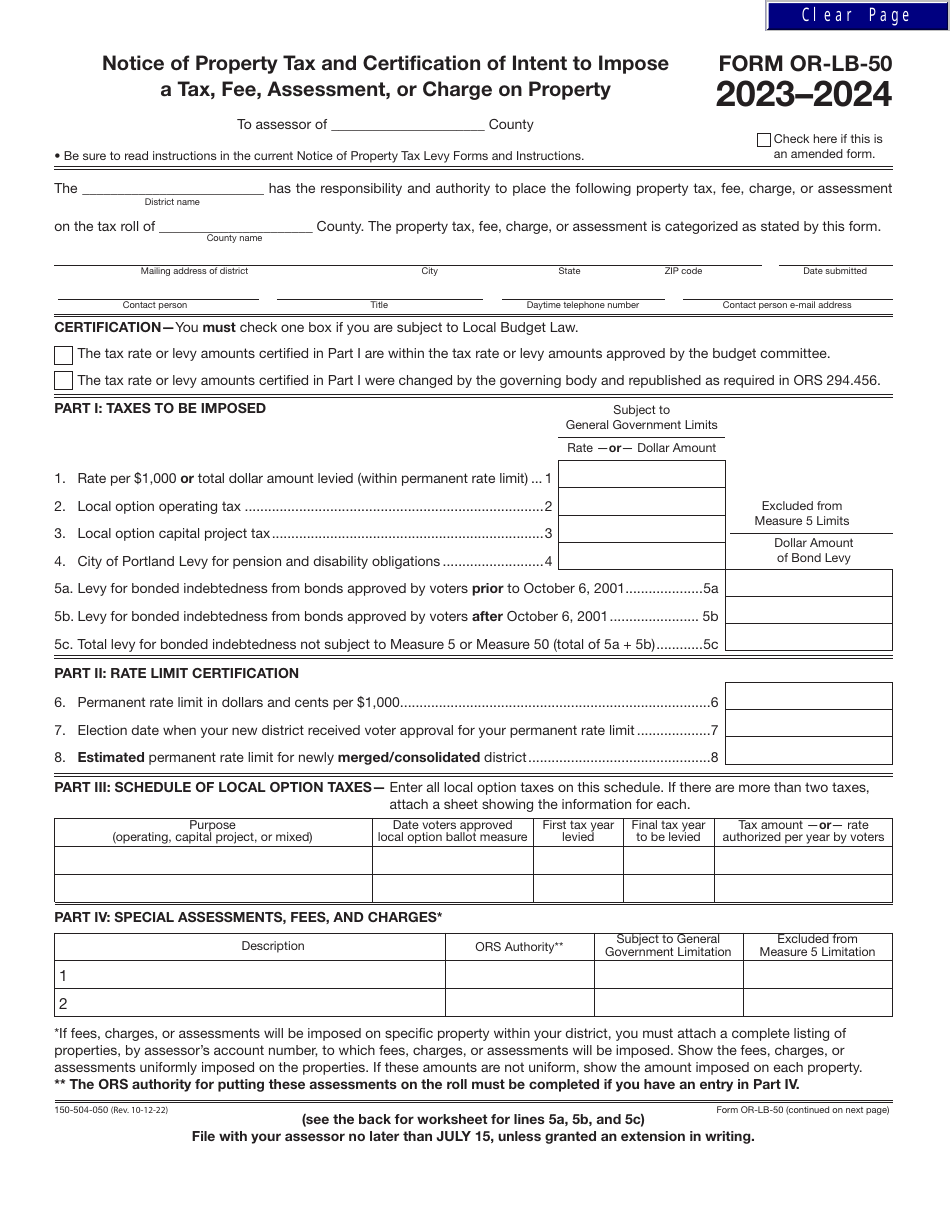

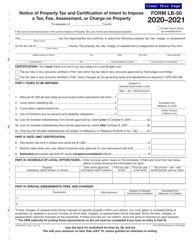

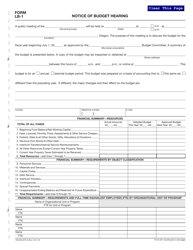

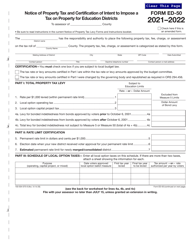

Form OR-LB-50 (150-504-050) Notice of Property Tax and Certification of Intent to Impose a Tax, Fee, Assessment, or Charge on Property - Oregon

What Is Form OR-LB-50 (150-504-050)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is form OR-LB-50?

A: Form OR-LB-50 is the Notice of Property Tax and Certification of Intent to Impose a Tax, Fee, Assessment, or Charge on Property in Oregon.

Q: What is the purpose of form OR-LB-50?

A: The purpose of form OR-LB-50 is to notify property owners of any changes in property taxes or the intent to impose any new taxes, fees, assessments, or charges on their property.

Q: Who needs to fill out form OR-LB-50?

A: Form OR-LB-50 needs to be filled out by the governmental entity or agency that intends to impose the tax, fee, assessment, or charge on the property.

Q: Is there a deadline for submitting form OR-LB-50?

A: Yes, there is a deadline for submitting form OR-LB-50. The form must be filed with the county assessor's office by October 25th of each year.

Q: What happens after I submit form OR-LB-50?

A: After you submit form OR-LB-50, the county assessor will review the information and determine any changes in property taxes or the imposition of new taxes, fees, assessments, or charges on your property.

Q: Is there a fee for filing form OR-LB-50?

A: No, there is no fee for filing form OR-LB-50.

Q: What should I do if I disagree with the changes in property taxes or the new taxes, fees, assessments, or charges imposed on my property?

A: If you disagree with the changes or imposition, you may file an appeal with your local county board of property tax appeals.

Q: Can I request an extension for filing form OR-LB-50?

A: Yes, you may request an extension for filing form OR-LB-50. The request must be submitted to the county assessor's office in writing before the October 25th deadline.

Form Details:

- Released on October 12, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-LB-50 (150-504-050) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.