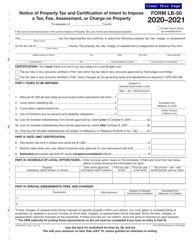

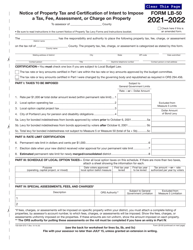

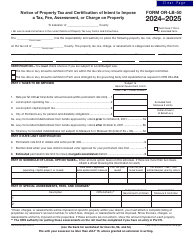

This version of the form is not currently in use and is provided for reference only. Download this version of

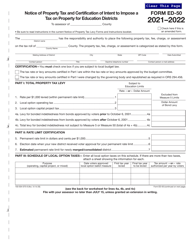

Form OR-ED-50 (150-504-060)

for the current year.

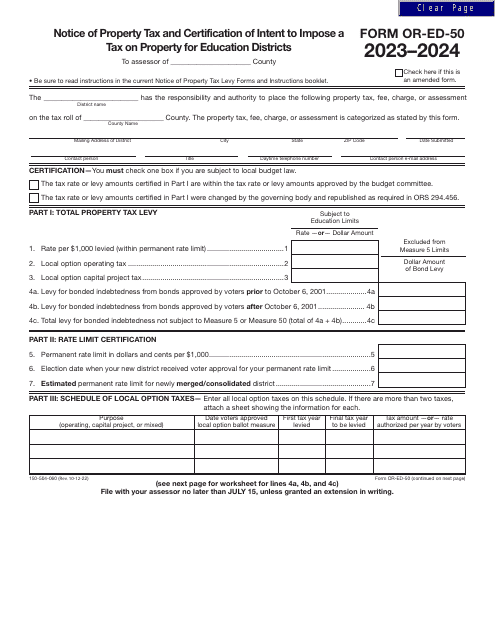

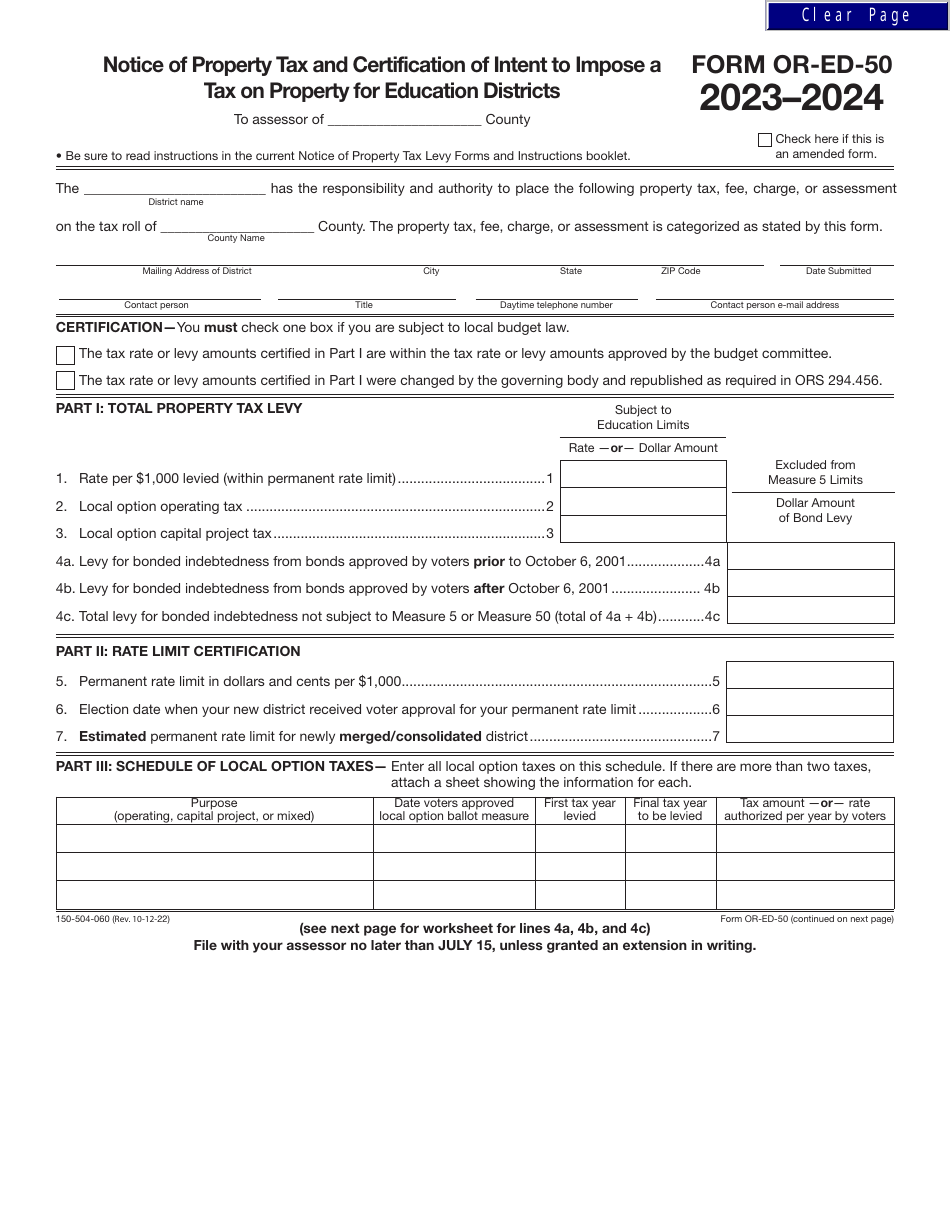

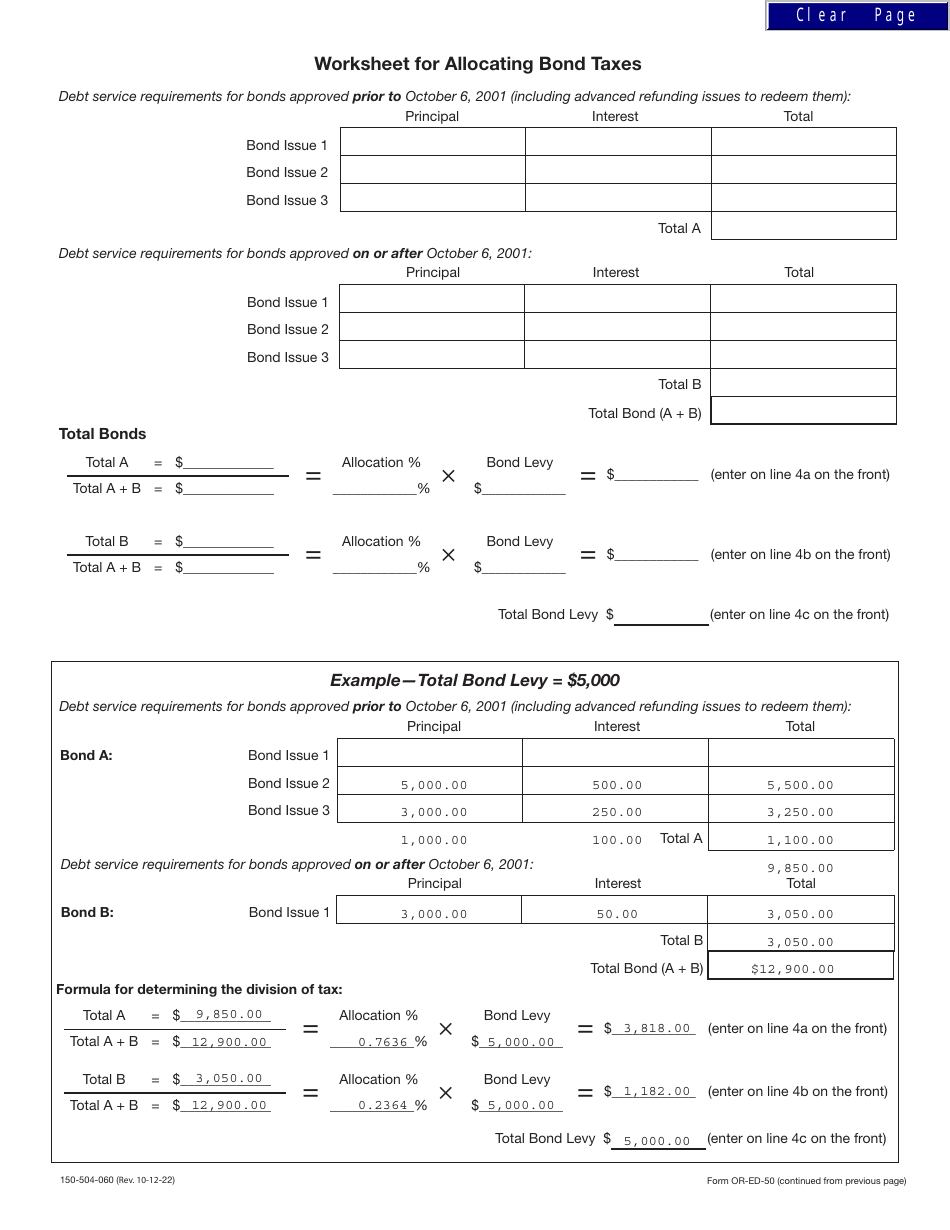

Form OR-ED-50 (150-504-060) Notice of Property Tax and Certification of Intent to Impose a Tax on Property for Education Districts - Oregon

What Is Form OR-ED-50 (150-504-060)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form OR-ED-50?

A: Form OR-ED-50 is the Notice of Property Tax and Certification of Intent to Impose a Tax on Property for Education Districts in Oregon.

Q: What is the purpose of Form OR-ED-50?

A: The purpose of Form OR-ED-50 is to notify property owners about the imposition of a tax on property for education districts in Oregon and to certify the intent to impose this tax.

Q: Who needs to fill out Form OR-ED-50?

A: Property owners in education districts in Oregon need to fill out Form OR-ED-50.

Q: When should Form OR-ED-50 be filed?

A: Form OR-ED-50 should be filed by November 15th of each year.

Q: Is there a fee for filing Form OR-ED-50?

A: No, there is no fee for filing Form OR-ED-50.

Q: What happens if I don't file Form OR-ED-50?

A: If you don't file Form OR-ED-50, you may be subject to penalties or the loss of certain property tax exemptions.

Q: What information is required on Form OR-ED-50?

A: Form OR-ED-50 requires information such as the property owner's name, address, property description, and the assessed value of the property.

Q: Who should I contact if I have questions about Form OR-ED-50?

A: If you have questions about Form OR-ED-50, you should contact your local county assessor's office or the Oregon Department of Revenue.

Form Details:

- Released on October 12, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-ED-50 (150-504-060) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.