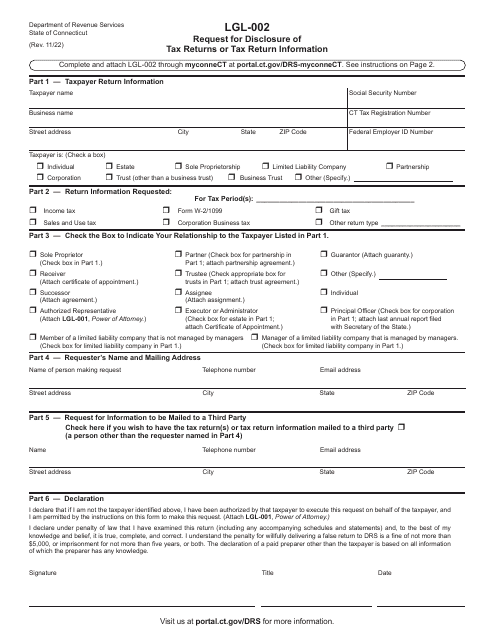

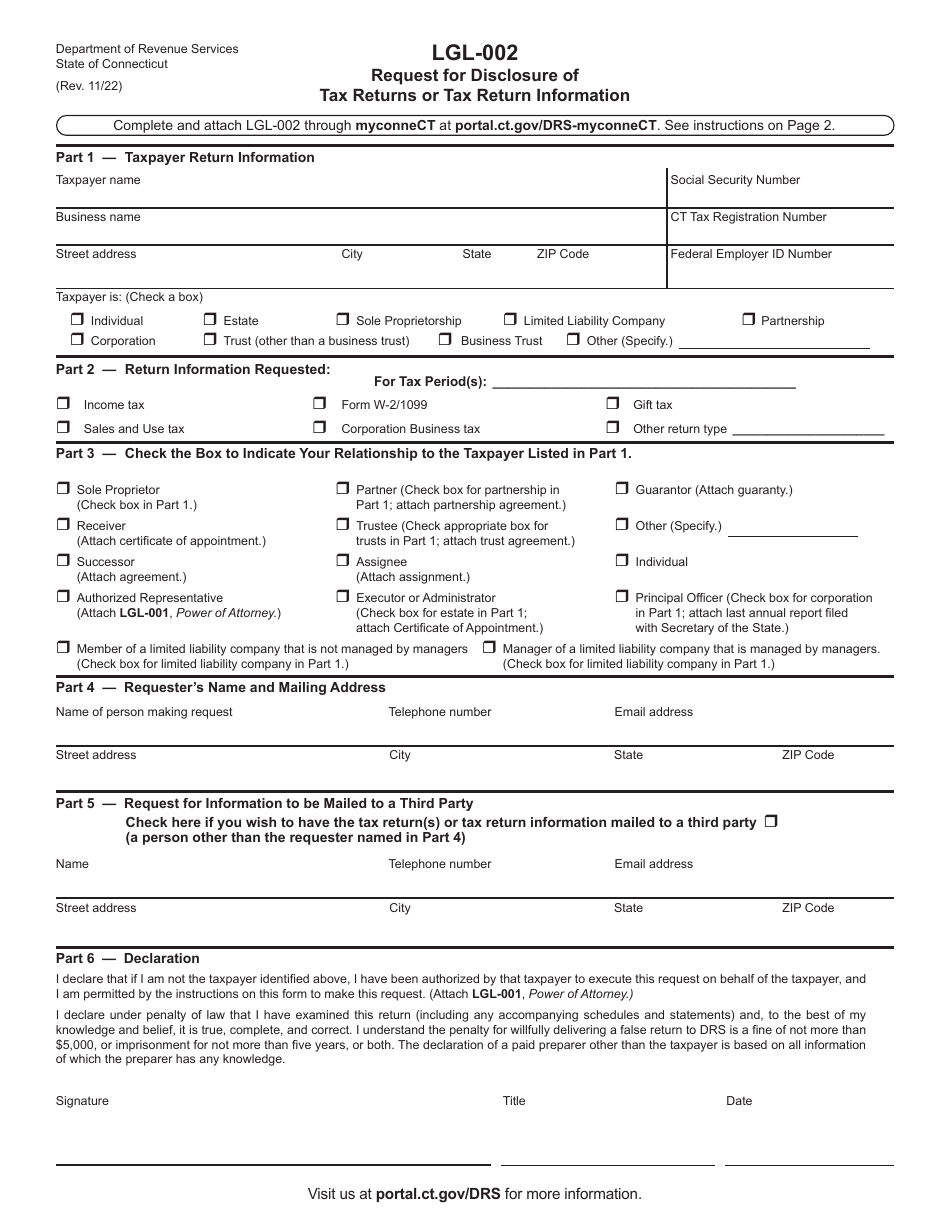

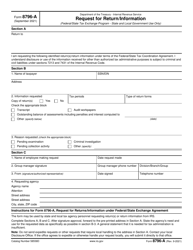

Form LGL-002 Request for Disclosure of Tax Returns or Tax Return Information - Connecticut

What Is Form LGL-002?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form LGL-002?

A: Form LGL-002 is the Request for Disclosure of Tax Returns or Tax Return Information specific to Connecticut.

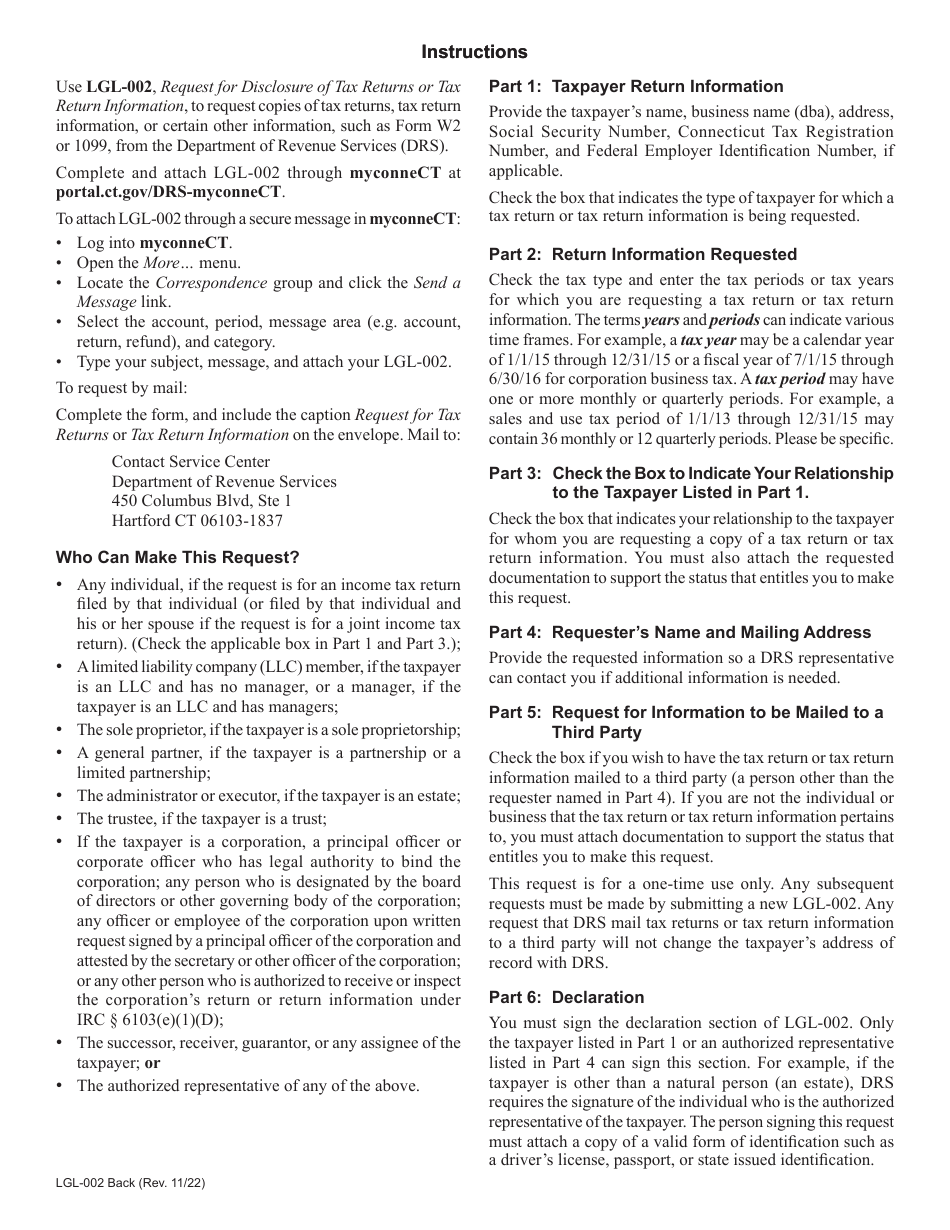

Q: Who can use Form LGL-002?

A: Form LGL-002 can be used by individuals or authorized representatives to request disclosure of tax returns or tax return information.

Q: What information is required on Form LGL-002?

A: The form requires the requester's personal information, the tax period and type of return for which information is being requested, and the reason for the request.

Q: How should I submit Form LGL-002?

A: The completed form should be mailed to the Connecticut Department of Revenue Services at the address provided on the form.

Q: Is there a fee for using Form LGL-002?

A: Yes, there is a fee for requesting disclosure of tax returns or tax return information using Form LGL-002. The fee amount is specified on the form.

Q: How long does it take to receive the requested information?

A: The processing time for requests made using Form LGL-002 can vary. It is recommended to allow sufficient time for processing and delivery of the requested information.

Form Details:

- Released on November 1, 2022;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form LGL-002 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.