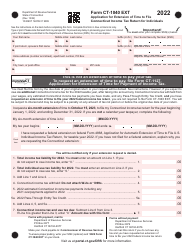

This version of the form is not currently in use and is provided for reference only. Download this version of

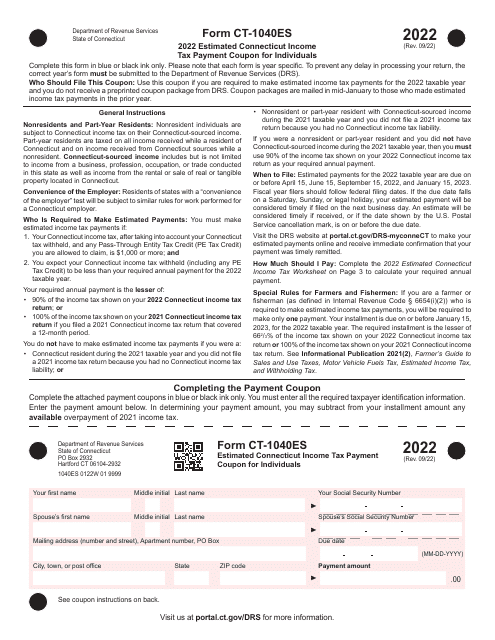

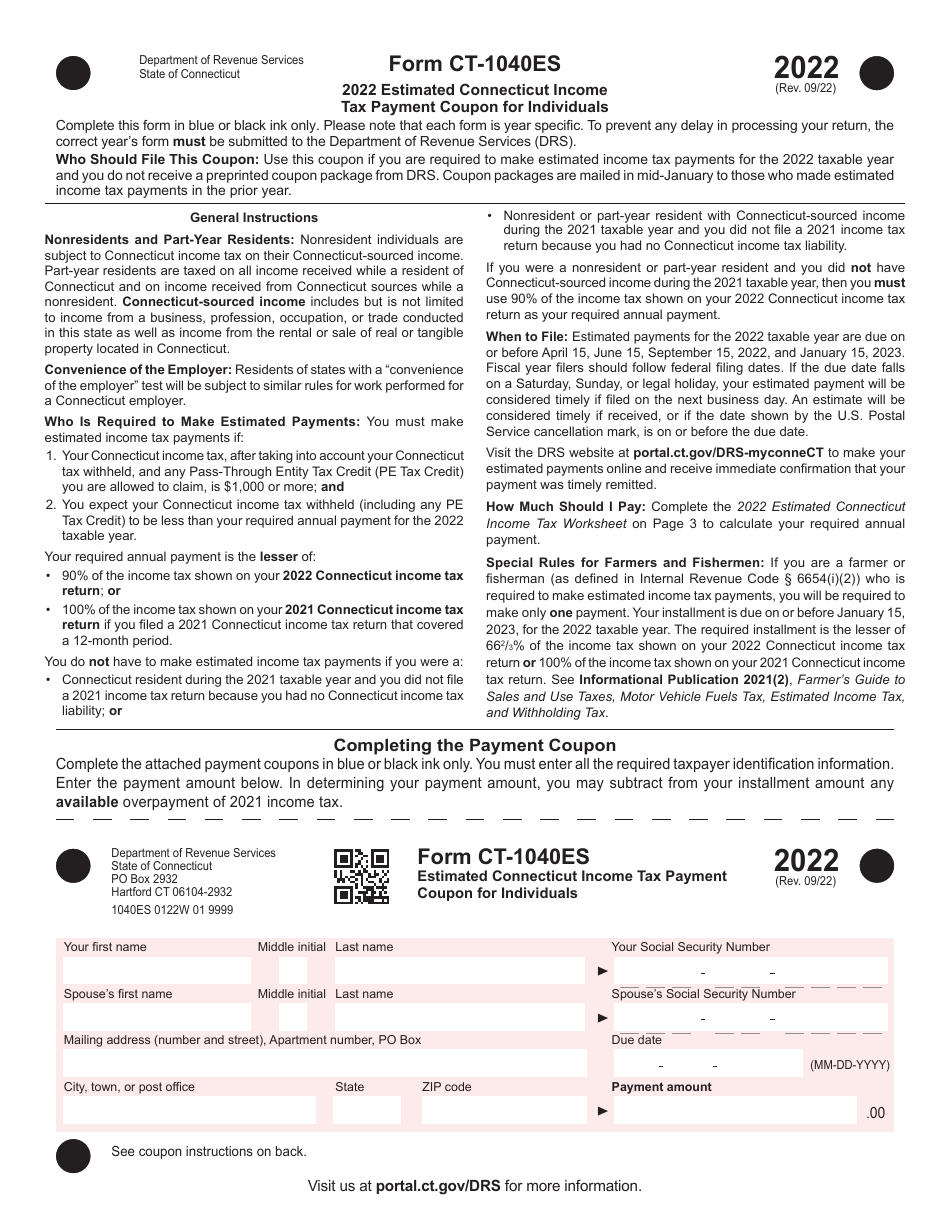

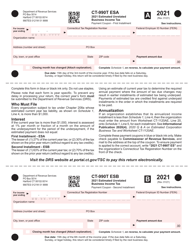

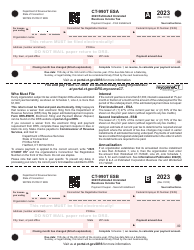

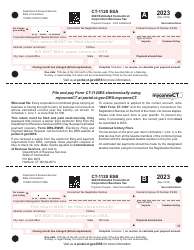

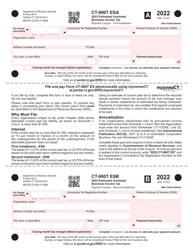

Form CT-1040ES

for the current year.

Form CT-1040ES Estimated Connecticut Income Tax Payment Coupon for Individuals - Connecticut

What Is Form CT-1040ES?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1040ES?

A: Form CT-1040ES is the estimated Connecticut Income Tax payment coupon for individuals.

Q: Who is Form CT-1040ES for?

A: Form CT-1040ES is for individuals who need to make estimated tax payments to the state of Connecticut.

Q: What is the purpose of Form CT-1040ES?

A: The purpose of Form CT-1040ES is to report and pay estimated income tax to the state of Connecticut.

Q: When should I use Form CT-1040ES?

A: You should use Form CT-1040ES if you expect to owe $1,000 or more in Connecticut income tax for the tax year.

Q: How often do I need to make estimated tax payments using Form CT-1040ES?

A: Estimated tax payments using Form CT-1040ES are typically made quarterly.

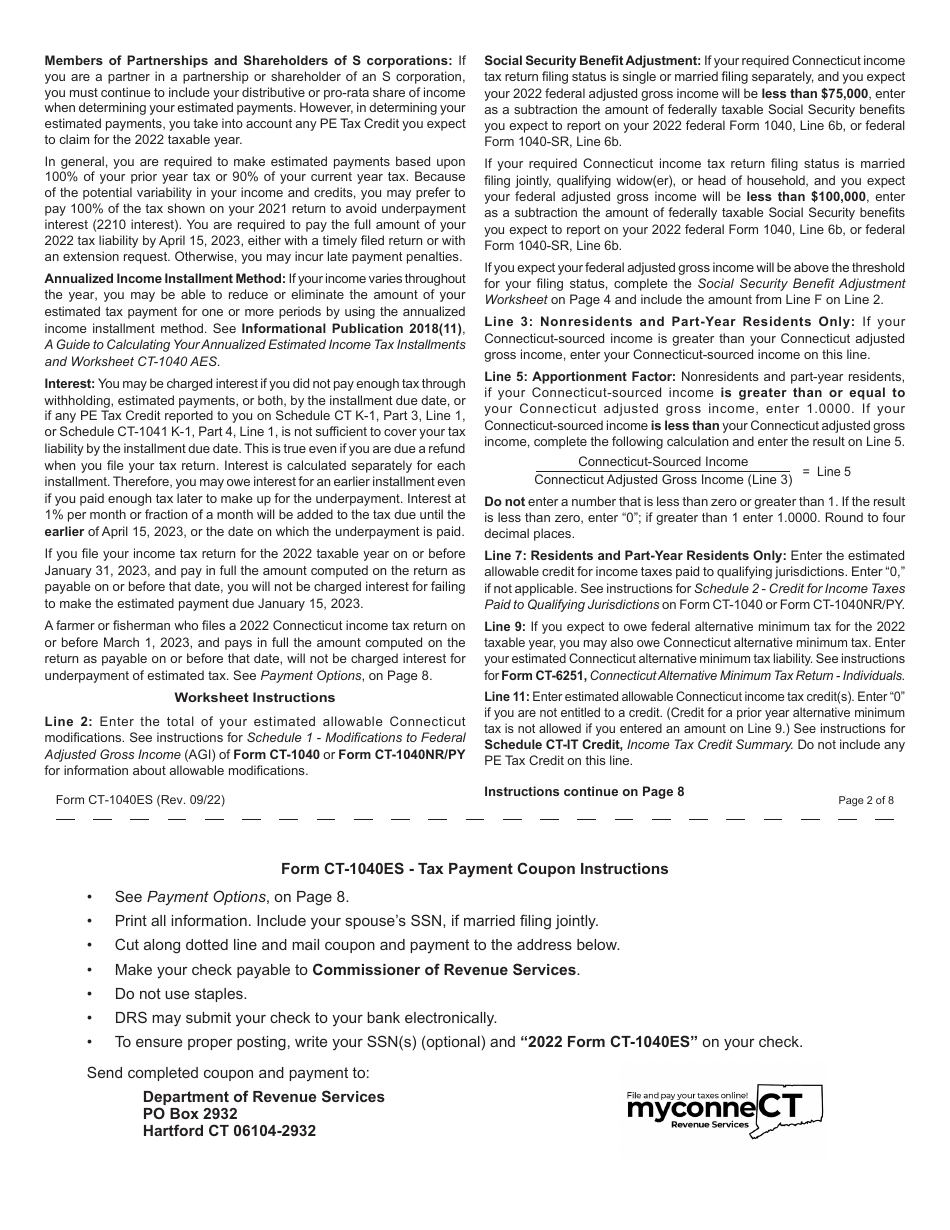

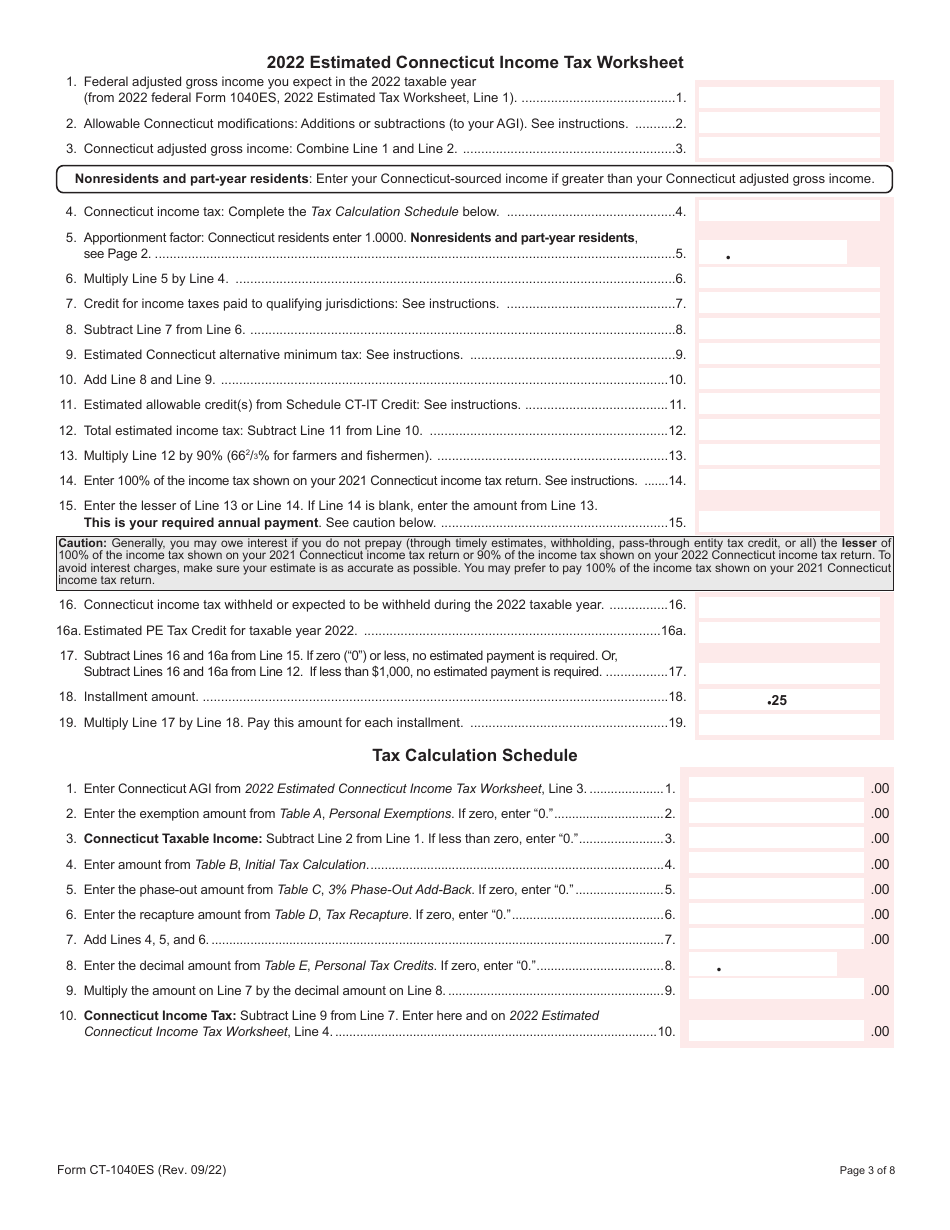

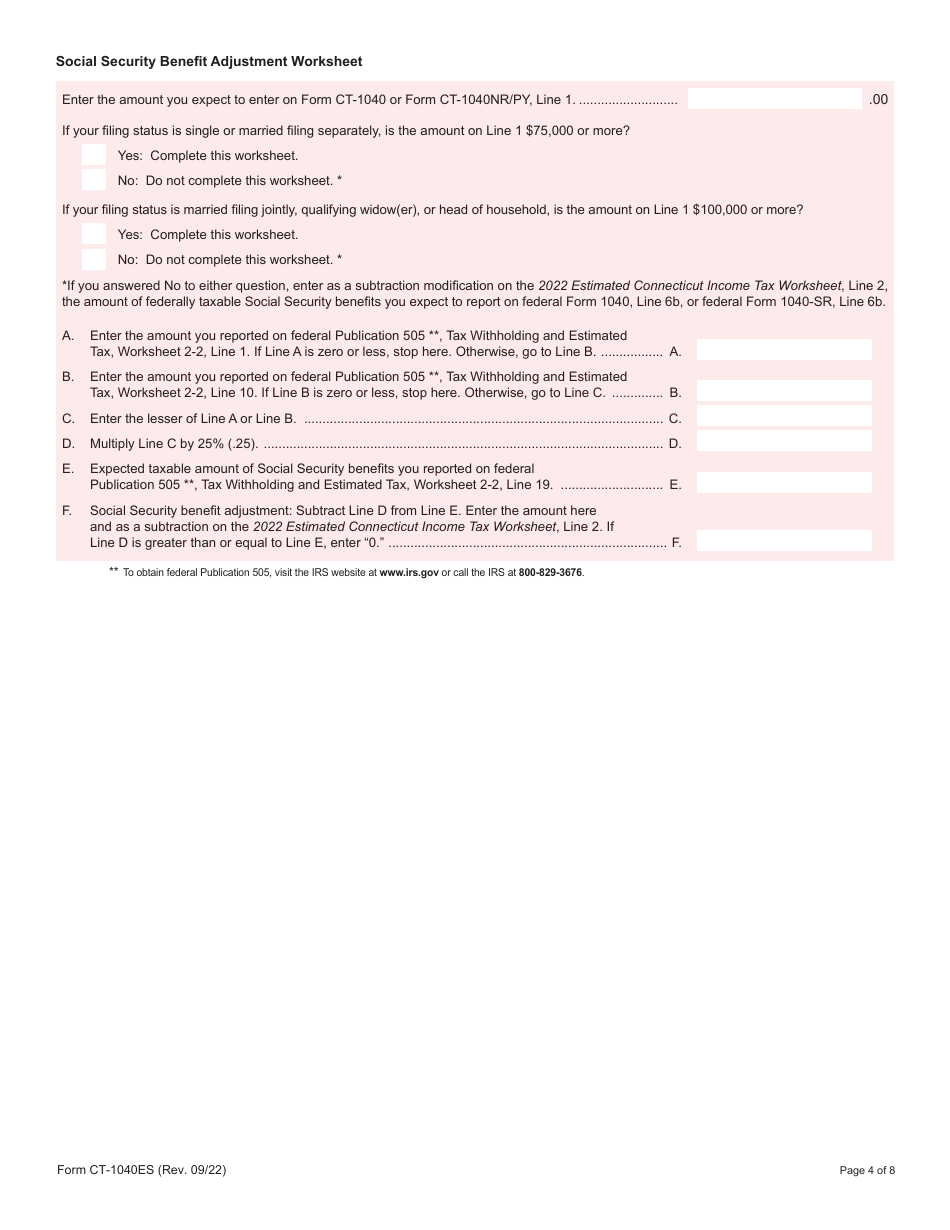

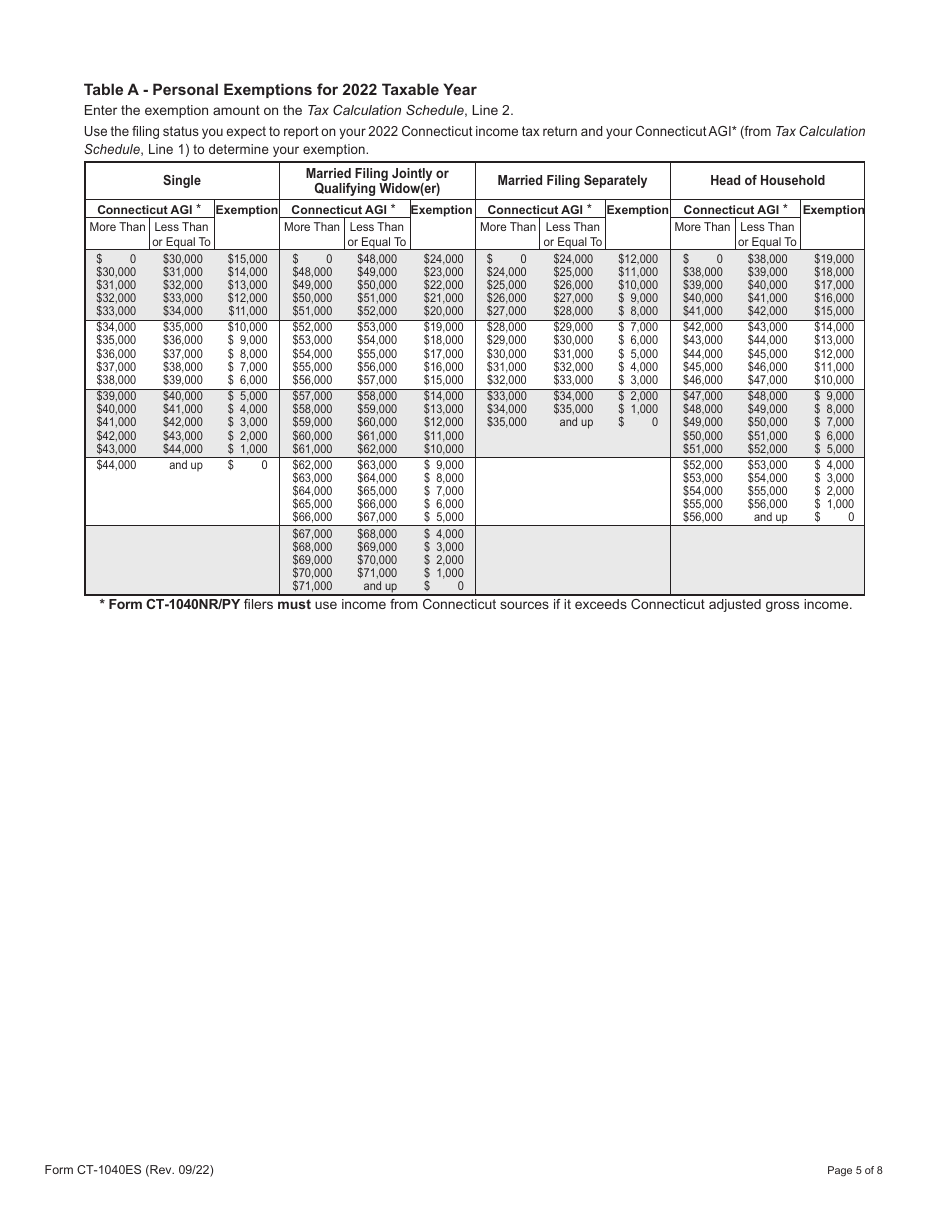

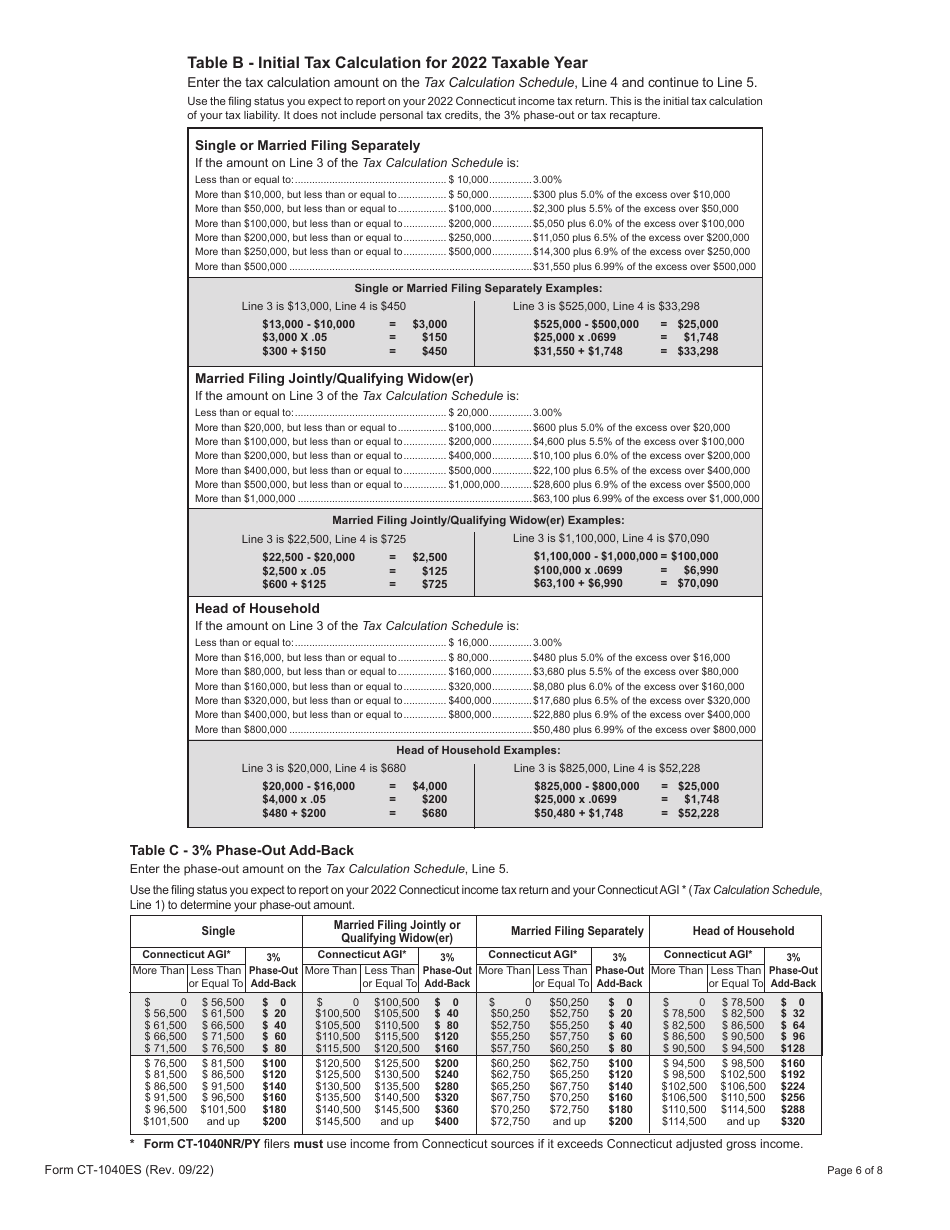

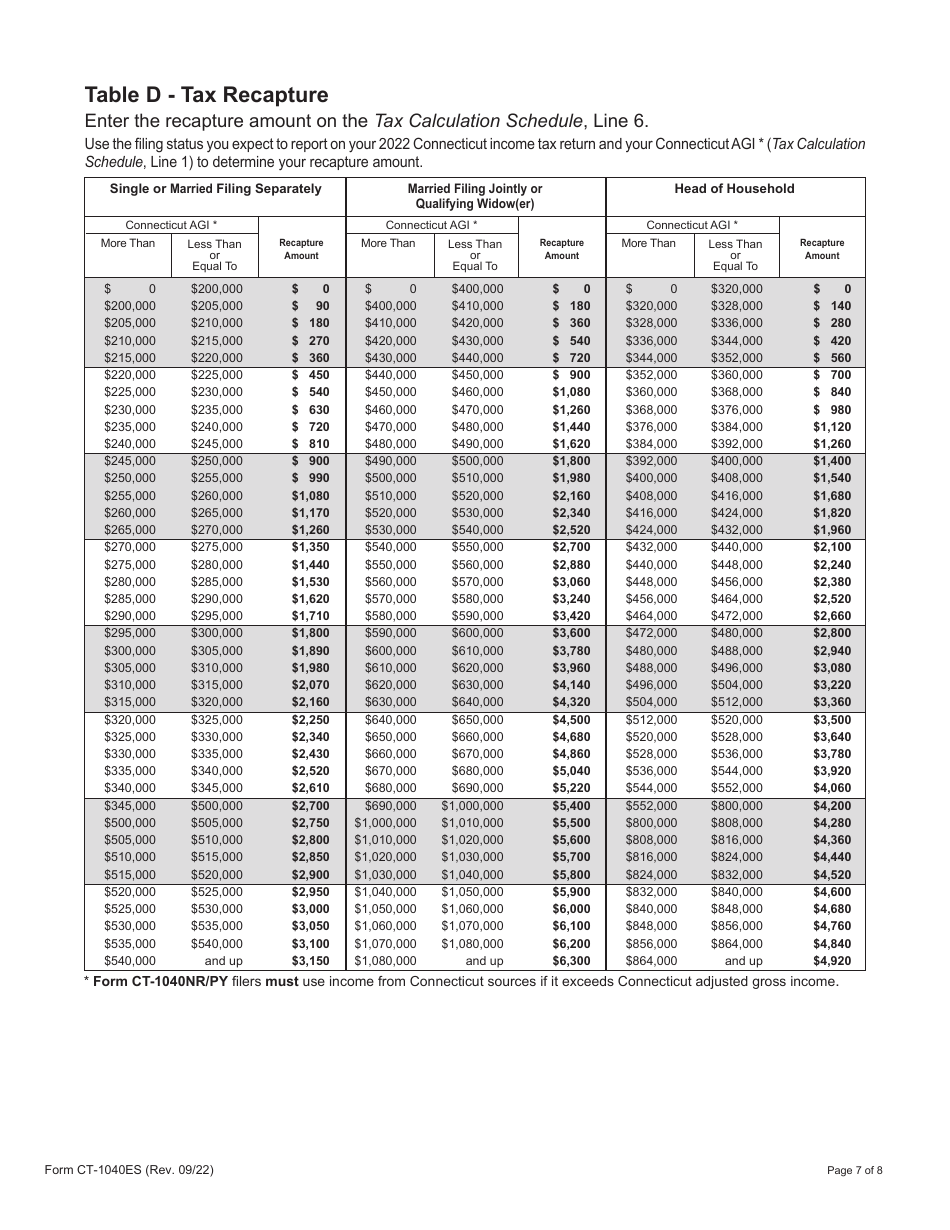

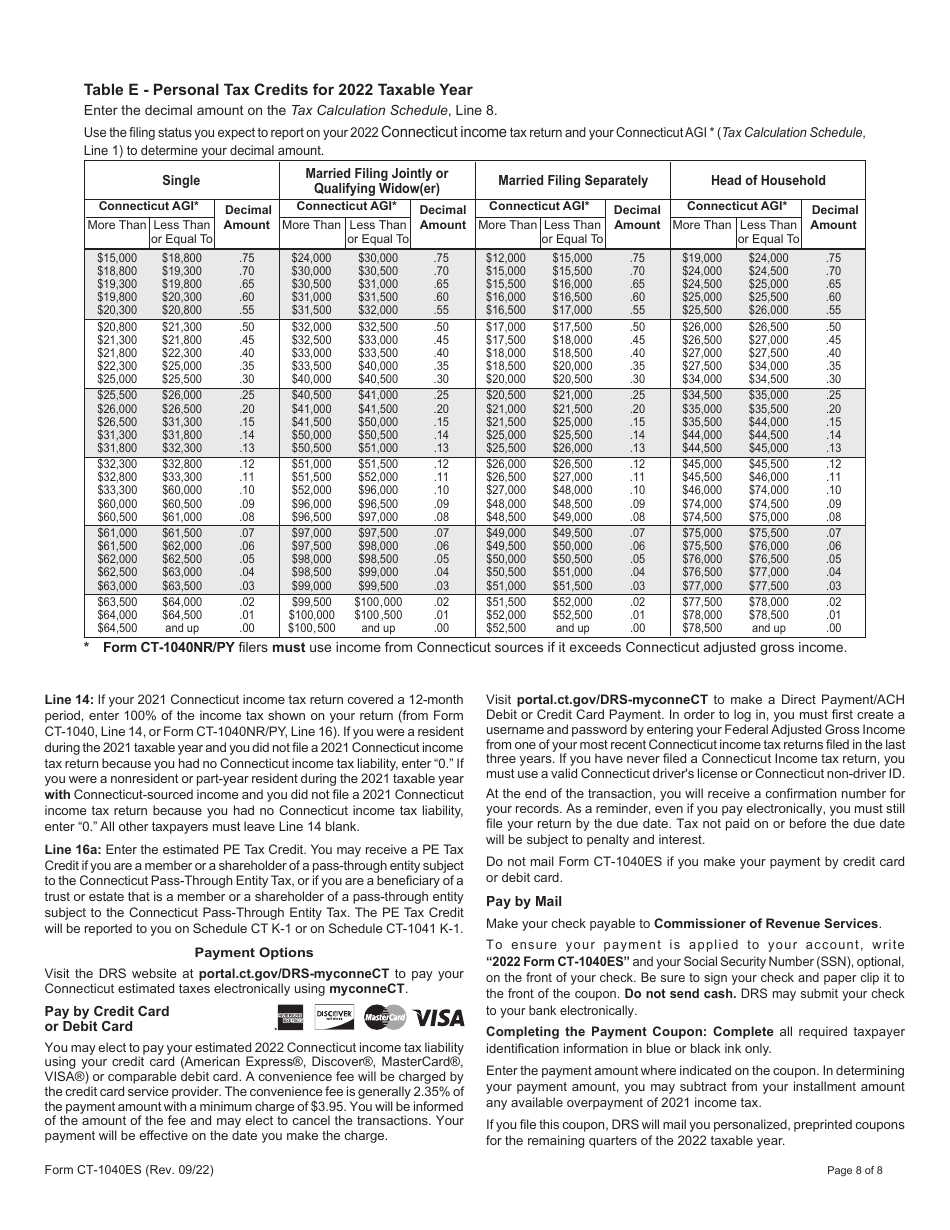

Q: How do I fill out Form CT-1040ES?

A: To complete Form CT-1040ES, you will need to provide your personal information, estimate your income for the year, calculate your estimated tax liability, and make the corresponding payment.

Q: What consequences could I face if I don't file Form CT-1040ES?

A: If you fail to make estimated tax payments using Form CT-1040ES, you may be subject to penalties and interest on any underpayment of Connecticut income tax.

Form Details:

- Released on September 1, 2022;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1040ES by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.