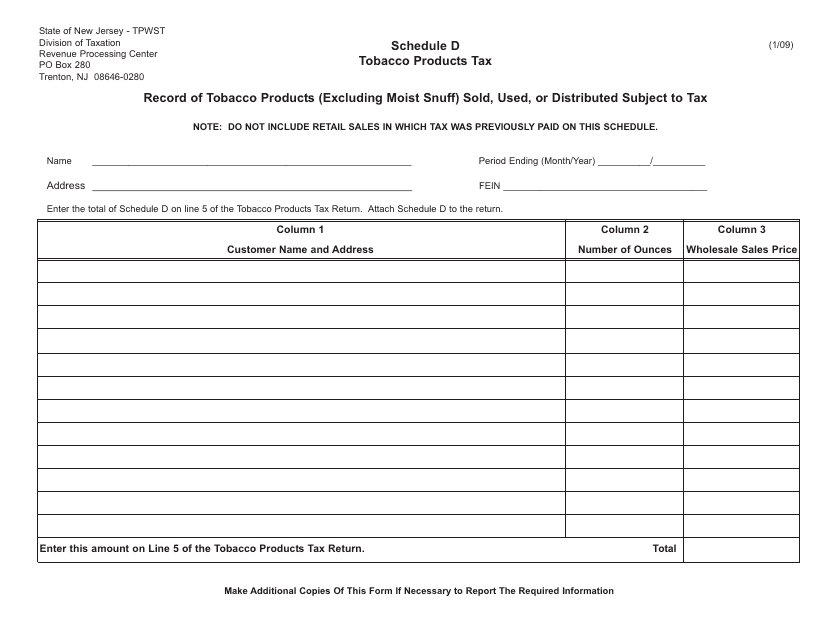

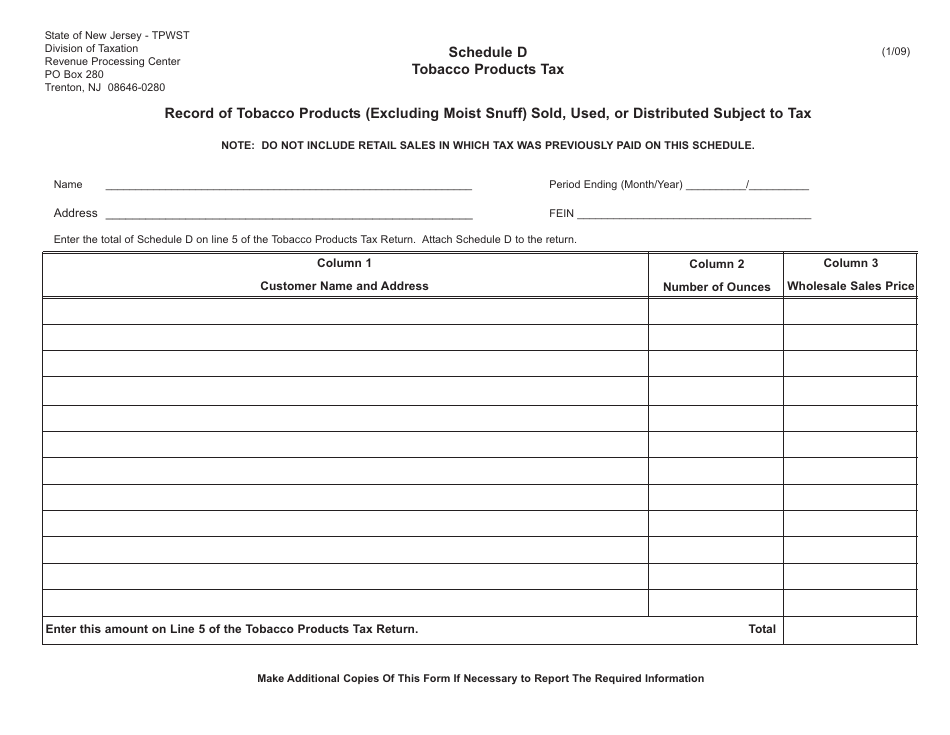

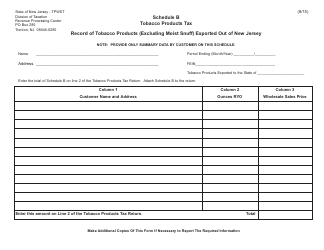

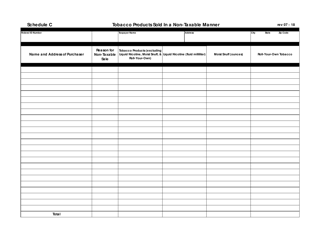

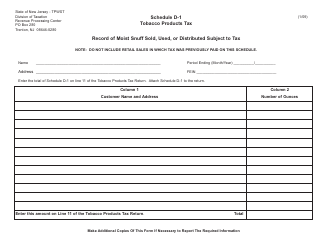

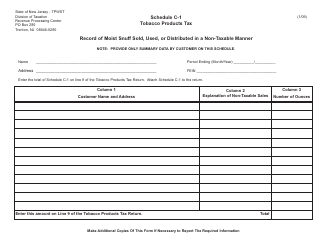

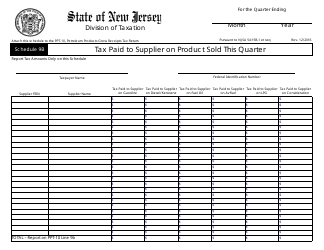

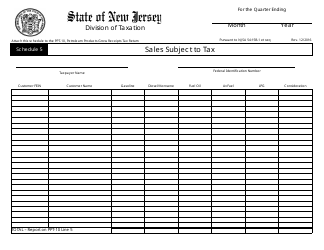

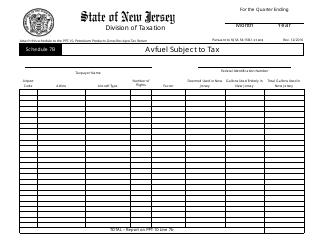

Schedule D Record of Tobacco Products (Excluding Moist Snuff) Sold, Used, or Distributed Subject to Tax - New Jersey

What Is Schedule D?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule D?

A: Schedule D is a record of tobacco products (excluding moist snuff) sold, used, or distributed subject to tax.

Q: Who needs to file Schedule D in New Jersey?

A: Any entity or person engaged in the sale, use, or distribution of tobacco products (excluding moist snuff) subject to tax in New Jersey needs to file Schedule D.

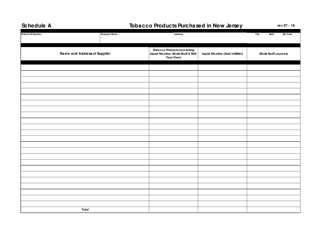

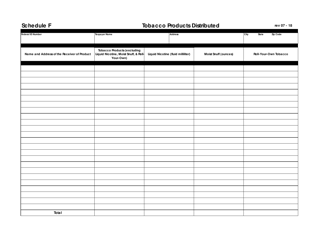

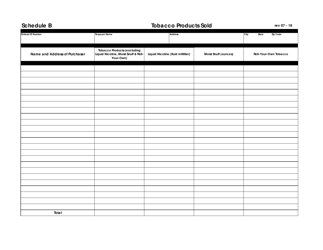

Q: What should be included in Schedule D?

A: Schedule D should include detailed information about the tobacco products sold, used, or distributed, including the quantity, brand name, manufacturer, and other relevant details.

Q: Is Schedule D only for businesses?

A: No, Schedule D is not only for businesses. Individuals and other entities engaged in the sale, use, or distribution of tobacco products subject to tax in New Jersey also need to file this form.

Form Details:

- Released on January 1, 2009;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule D by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.