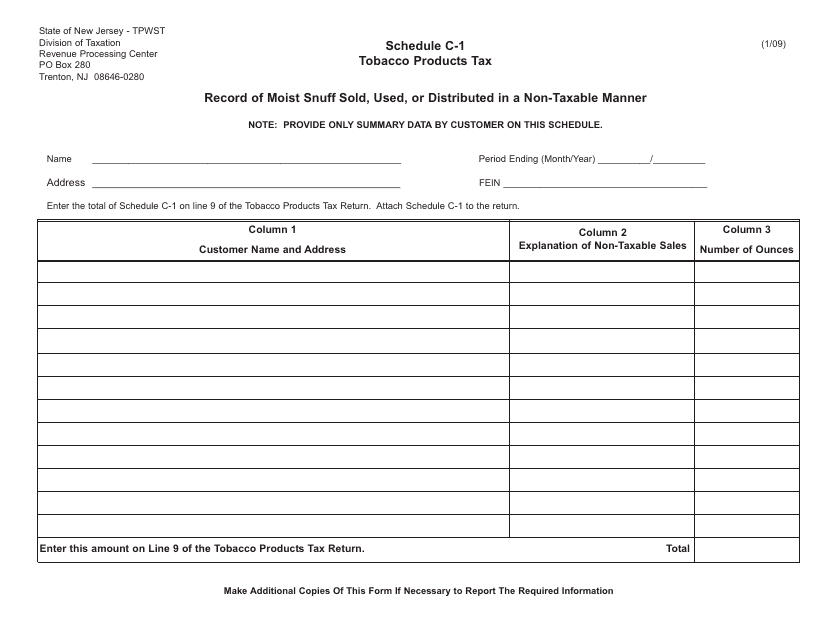

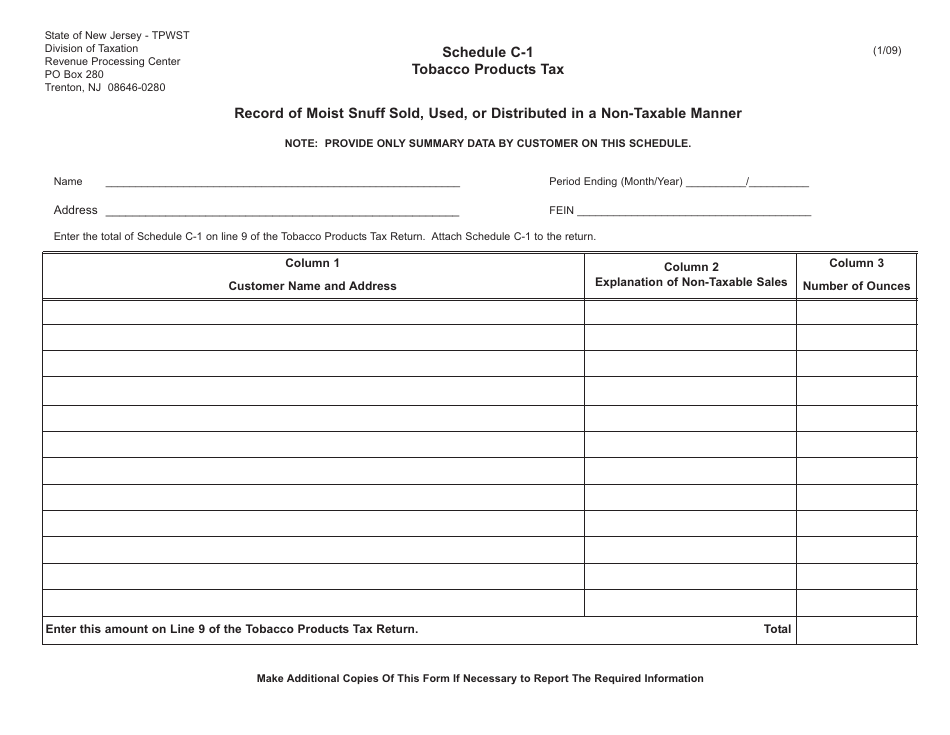

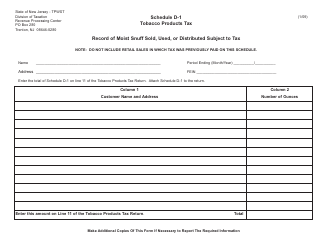

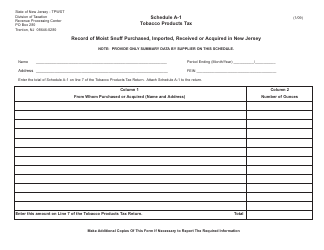

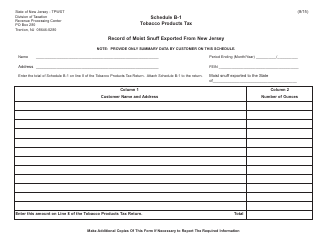

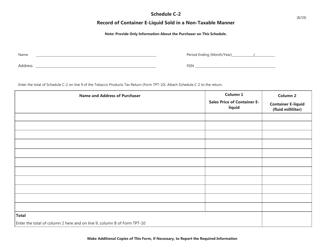

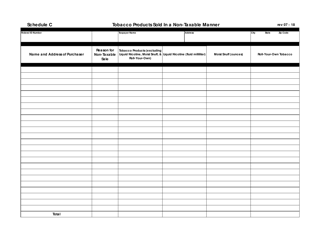

Schedule C-1 Record of Moist Snuff Sold, Used, or Distributed in a Non-taxable Manner - New Jersey

What Is Schedule C-1?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule C-1?

A: Schedule C-1 is a record of moist snuff sold, used, or distributed in a non-taxable manner in New Jersey.

Q: What is moist snuff?

A: Moist snuff is a type of smokeless tobacco that is typically used by placing it between the lower lip and gum.

Q: Who is required to fill out Schedule C-1?

A: Any person or entity that sells or distributes moist snuff in a non-taxable manner in New Jersey is required to fill out Schedule C-1.

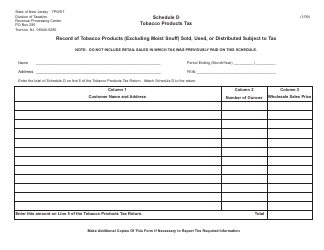

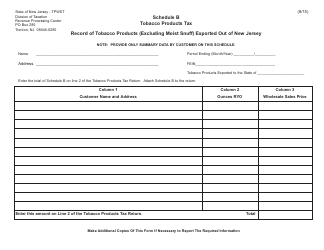

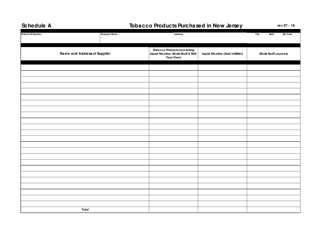

Q: What information does Schedule C-1 require?

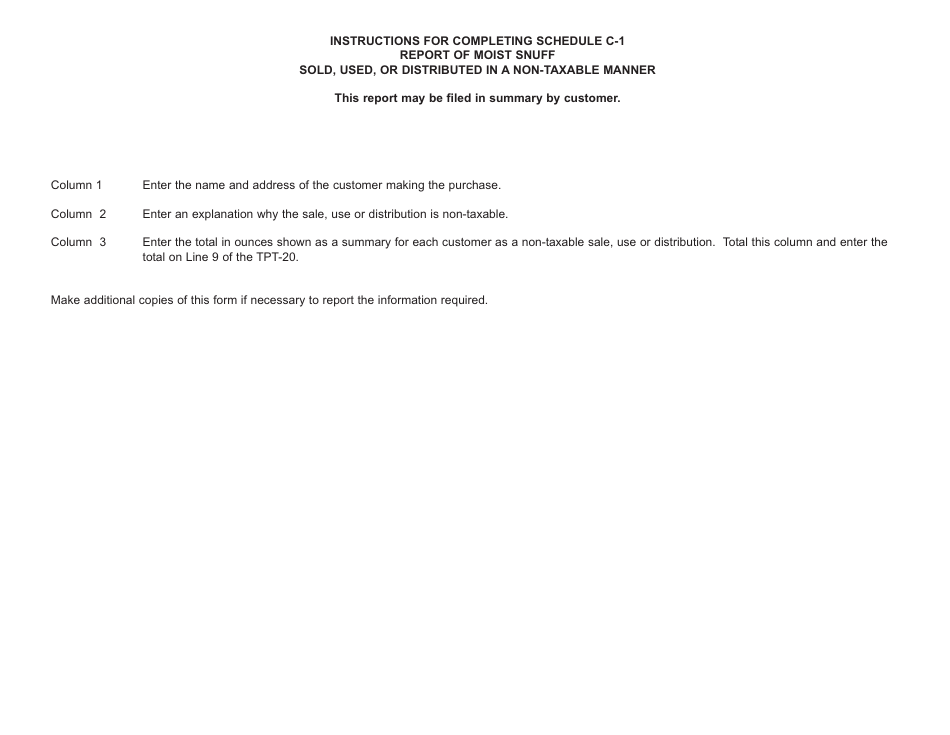

A: Schedule C-1 requires information such as the quantity of moist snuff sold or distributed, the name and address of the purchaser, and the date of sale or distribution.

Q: Why is Schedule C-1 important?

A: Schedule C-1 is important to track the sale and distribution of moist snuff in New Jersey, particularly when it is sold or distributed in a non-taxable manner.

Q: Is there a deadline to file Schedule C-1?

A: Yes, Schedule C-1 must be filed on a monthly basis, and the deadline is the 20th day of the following month.

Q: Are there any penalties for not filing Schedule C-1?

A: Yes, failure to file Schedule C-1 or providing false information may result in penalties and possible legal consequences.

Q: Who can I contact for more information about Schedule C-1?

A: For more information about Schedule C-1, you can contact the New Jersey Division of Taxation directly.

Form Details:

- Released on January 1, 2009;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule C-1 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.