This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form E-500H

for the current year.

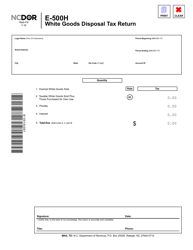

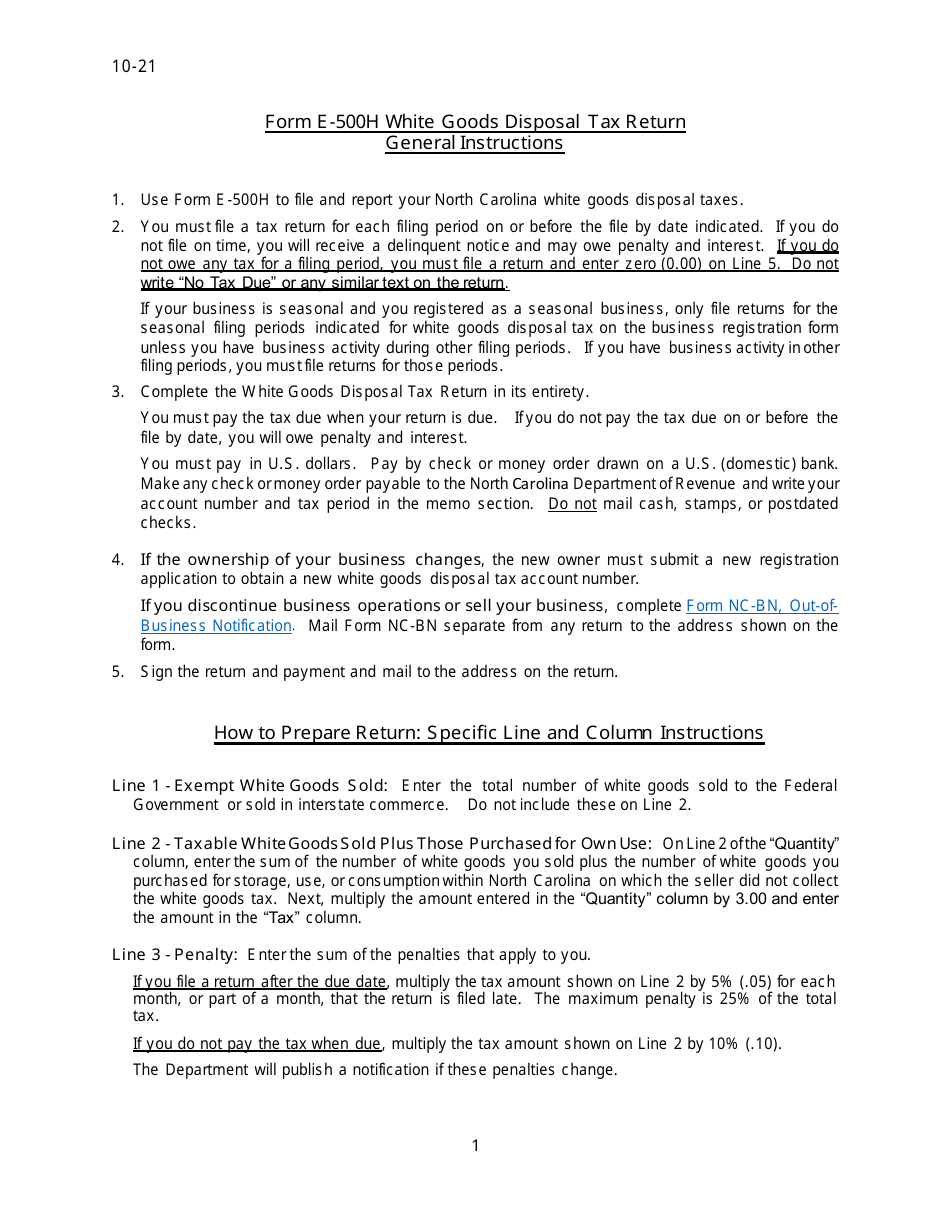

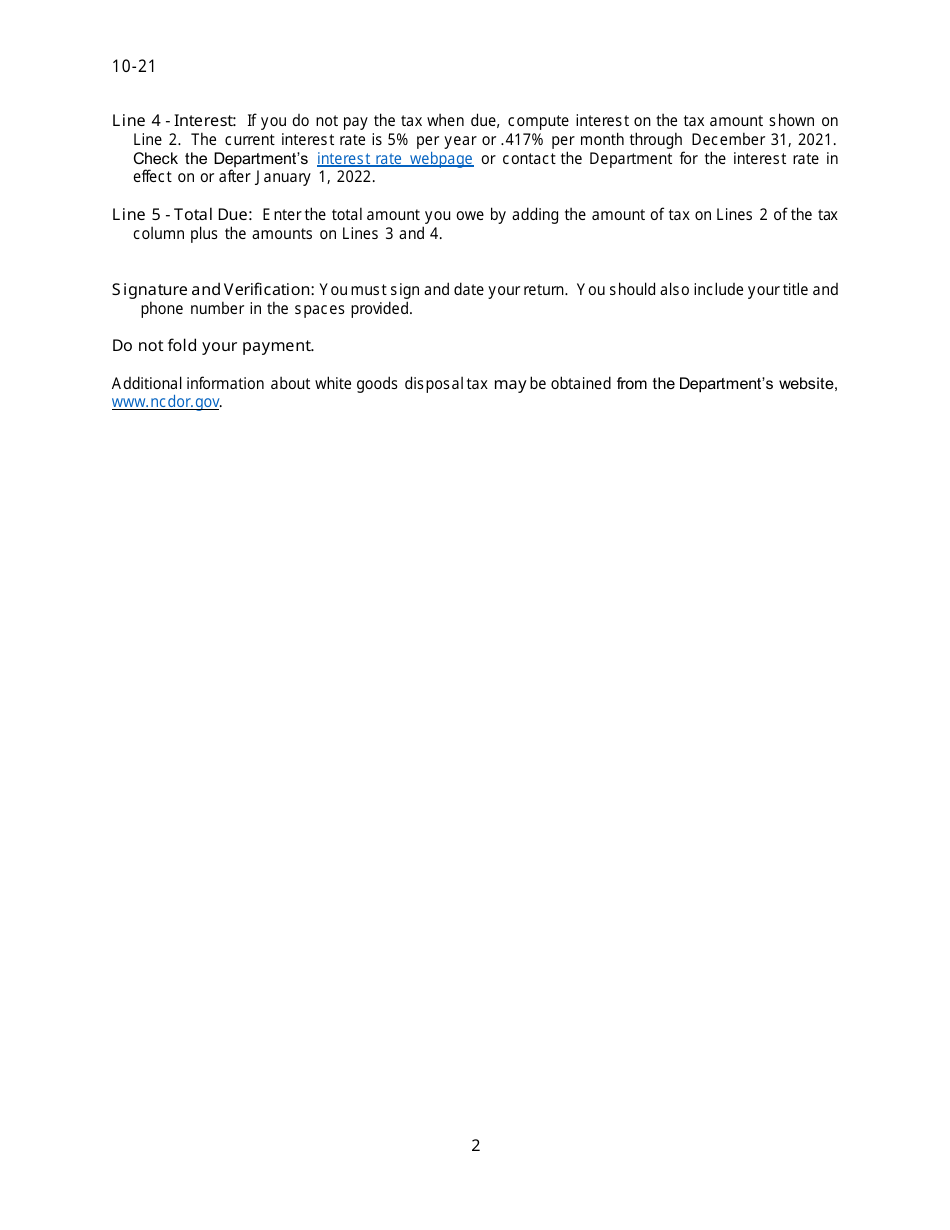

Instructions for Form E-500H White Goods Disposal Tax Return - North Carolina

This document contains official instructions for Form E-500H , White Goods Disposal Tax Return - a form released and collected by the North Carolina Department of Revenue. An up-to-date fillable Form E-500H is available for download through this link.

FAQ

Q: What is Form E-500H?

A: Form E-500H is the White Goods Disposal Tax Return in North Carolina.

Q: What is the purpose of Form E-500H?

A: The purpose of Form E-500H is to report and pay the White Goods Disposal Tax.

Q: Who needs to file Form E-500H?

A: Any person, business, or organization that sells or transfers white goods to consumers in North Carolina needs to file Form E-500H.

Q: What are white goods?

A: White goods refer to appliances like refrigerators, freezers, stoves, washers, dryers, and dishwashers.

Q: How often should Form E-500H be filed?

A: Form E-500H should be filed quarterly, by the last day of the month following the end of each quarter.

Q: Are there any penalties for not filing Form E-500H?

A: Yes, there are penalties for not filing or paying the White Goods Disposal Tax on time, including interest charges and possible assessments.

Q: Is there a minimum threshold for filing Form E-500H?

A: Yes, if your annual White Goods Disposal Tax liability is less than $100, you are not required to file Form E-500H.

Q: Are there any exemptions from the White Goods Disposal Tax?

A: Yes, there are certain exemptions for white goods that are sold for resale, used for agricultural purposes, or sold to the federal government or its agencies.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the North Carolina Department of Revenue.