This version of the form is not currently in use and is provided for reference only. Download this version of

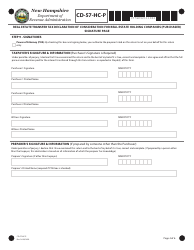

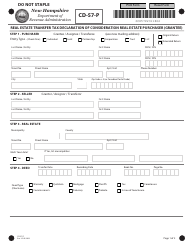

Form CD-57-HC-P

for the current year.

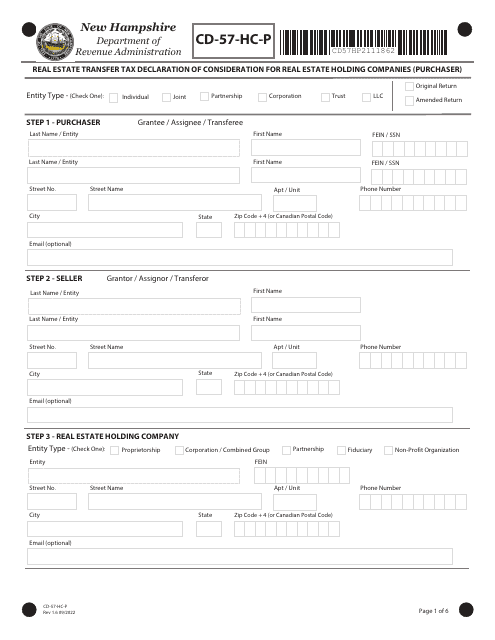

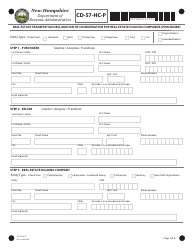

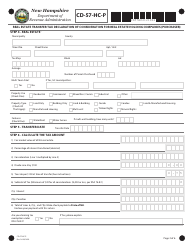

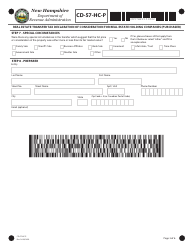

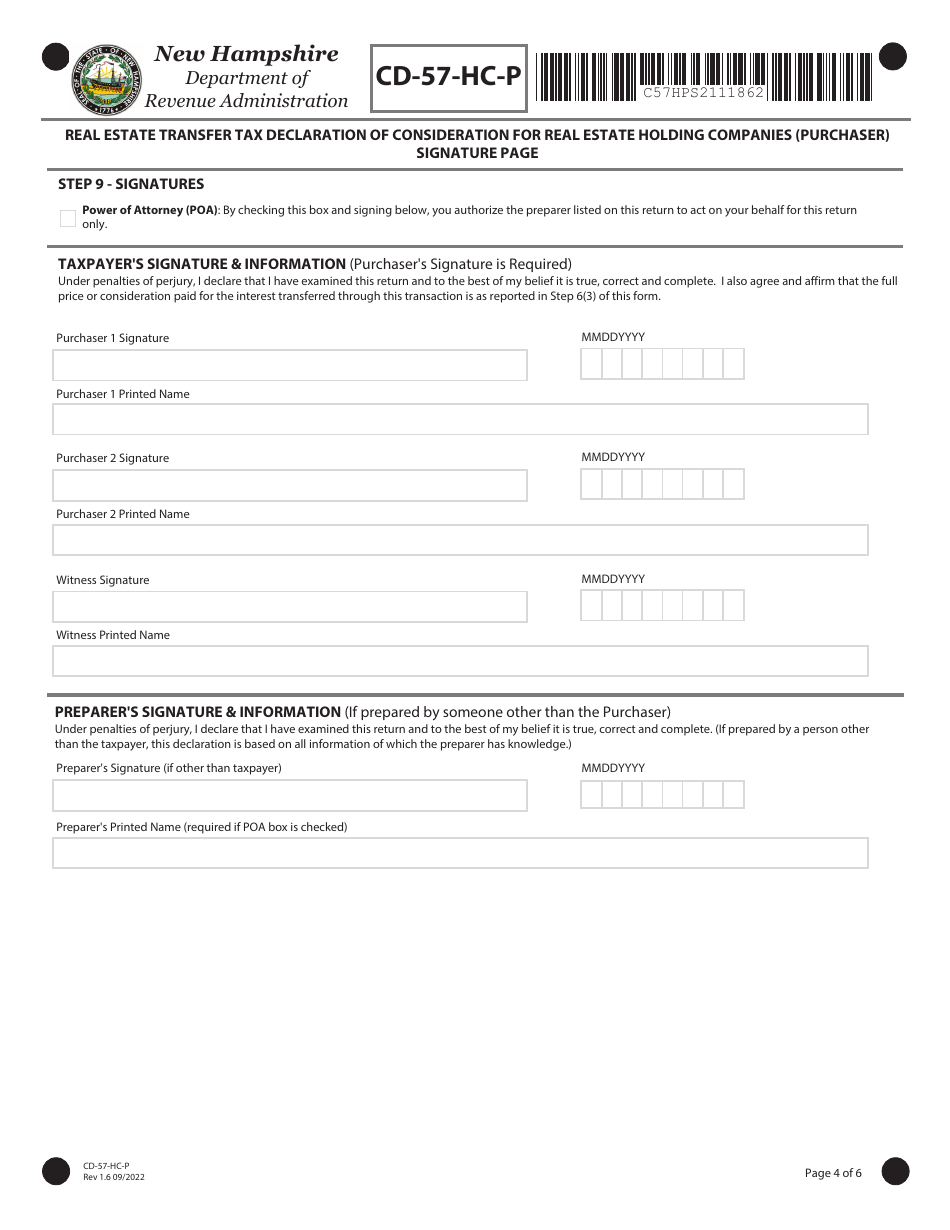

Form CD-57-HC-P Real Estate Transfer Tax Declaration of Consideration for Real Estate Holding Companies (Purchaser) - New Hampshire

What Is Form CD-57-HC-P?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CD-57-HC-P?

A: Form CD-57-HC-P is the Real Estate Transfer Tax Declaration of Consideration form for Real Estate Holding Companies (Purchaser) in New Hampshire.

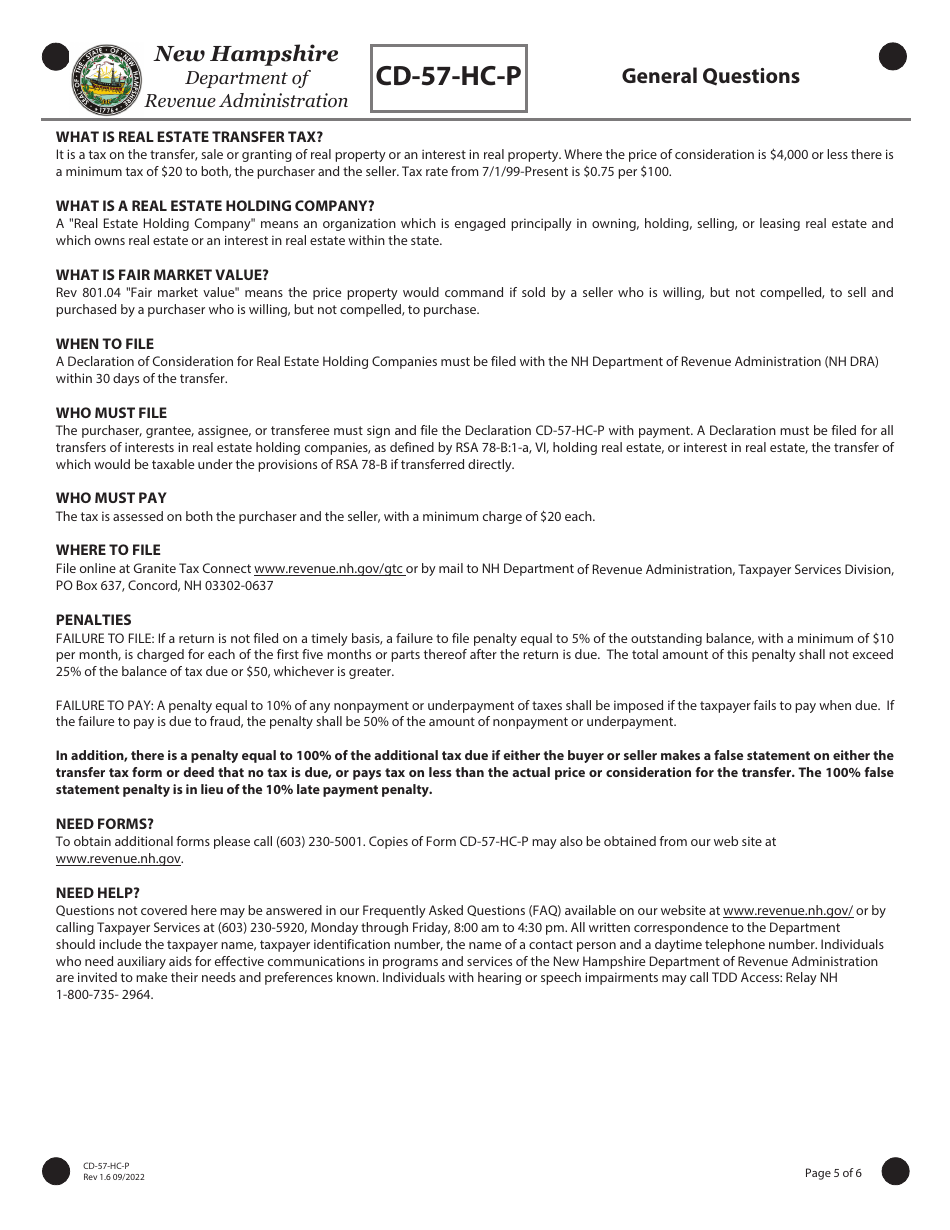

Q: What is the purpose of Form CD-57-HC-P?

A: The purpose of Form CD-57-HC-P is to declare the consideration paid or to be paid for real estate by a real estate holding company in New Hampshire.

Q: Who needs to file Form CD-57-HC-P?

A: Real estate holding companies (purchasers) in New Hampshire need to file Form CD-57-HC-P when purchasing real estate.

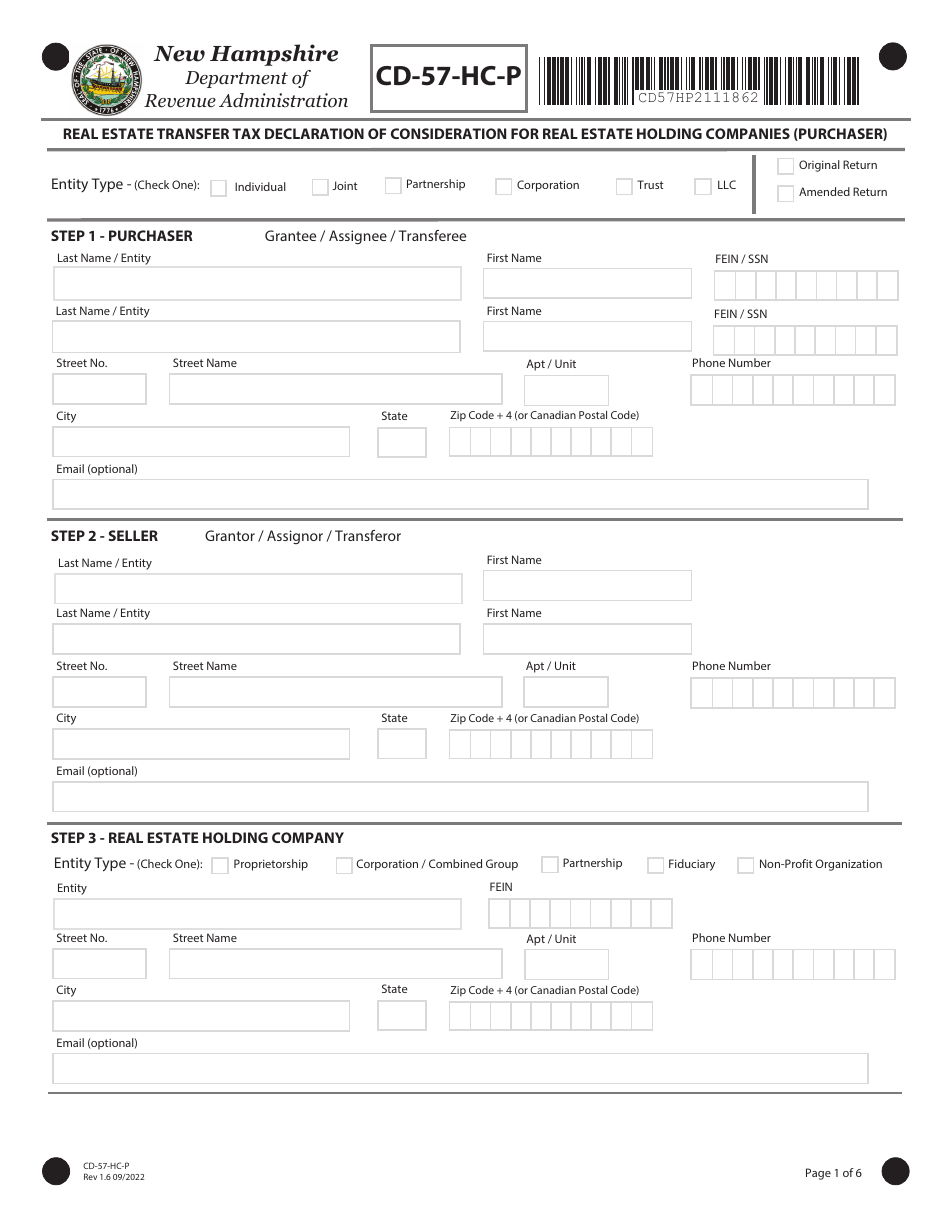

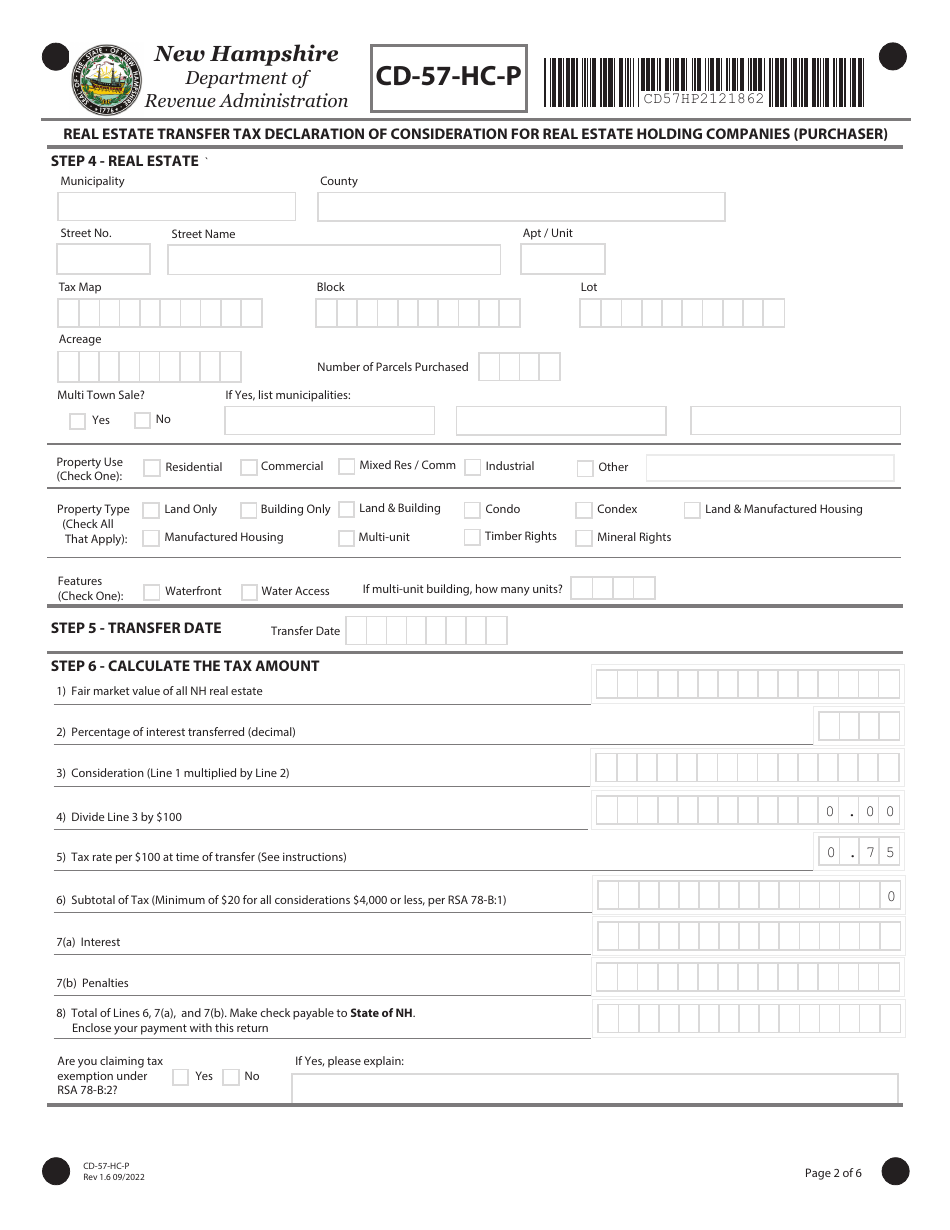

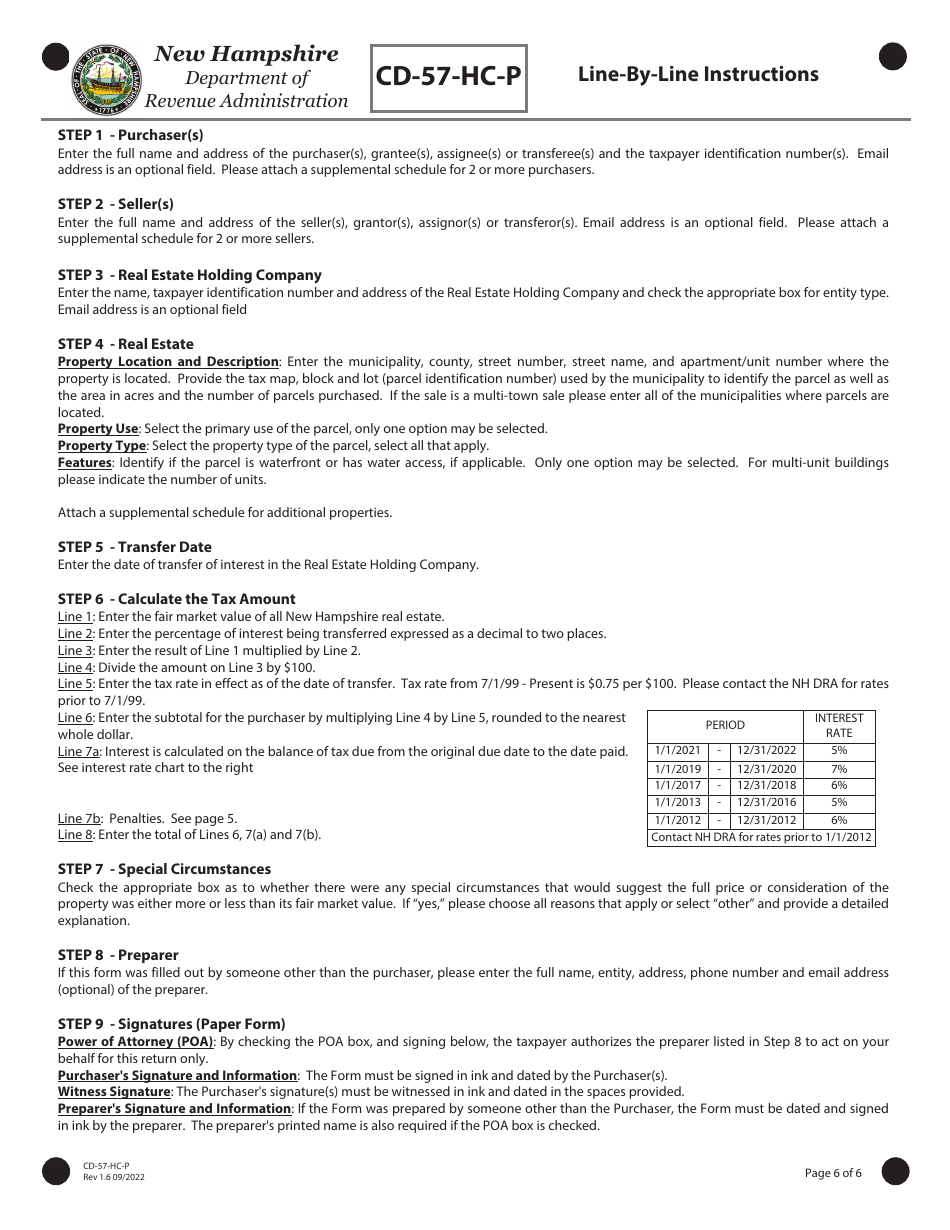

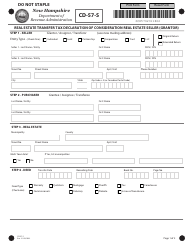

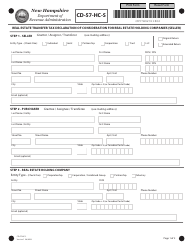

Q: What information is required on Form CD-57-HC-P?

A: Form CD-57-HC-P requires information about the real estate being purchased, the purchase price, and the real estate holding company.

Q: Is there a deadline for filing Form CD-57-HC-P?

A: Yes, Form CD-57-HC-P must be filed within 30 days of the transfer of the real estate.

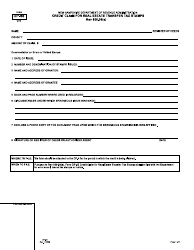

Q: Are there any exemptions to the Real Estate Transfer Tax?

A: Yes, there are exemptions available for certain transfers, such as transfers between spouses or transfers as a result of divorce or inheritance.

Form Details:

- Released on September 1, 2022;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CD-57-HC-P by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.