This version of the form is not currently in use and is provided for reference only. Download this version of

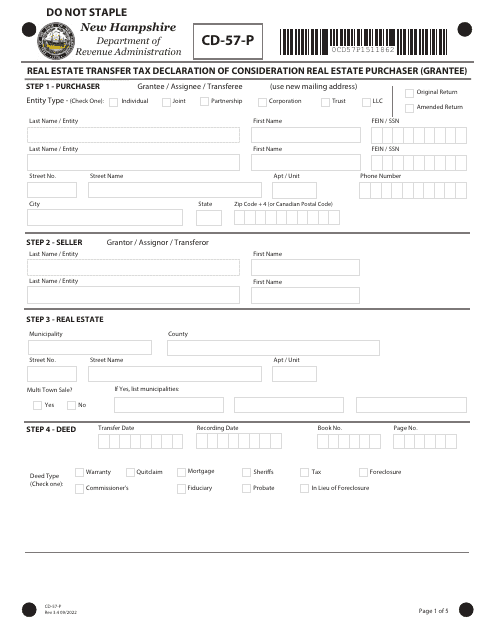

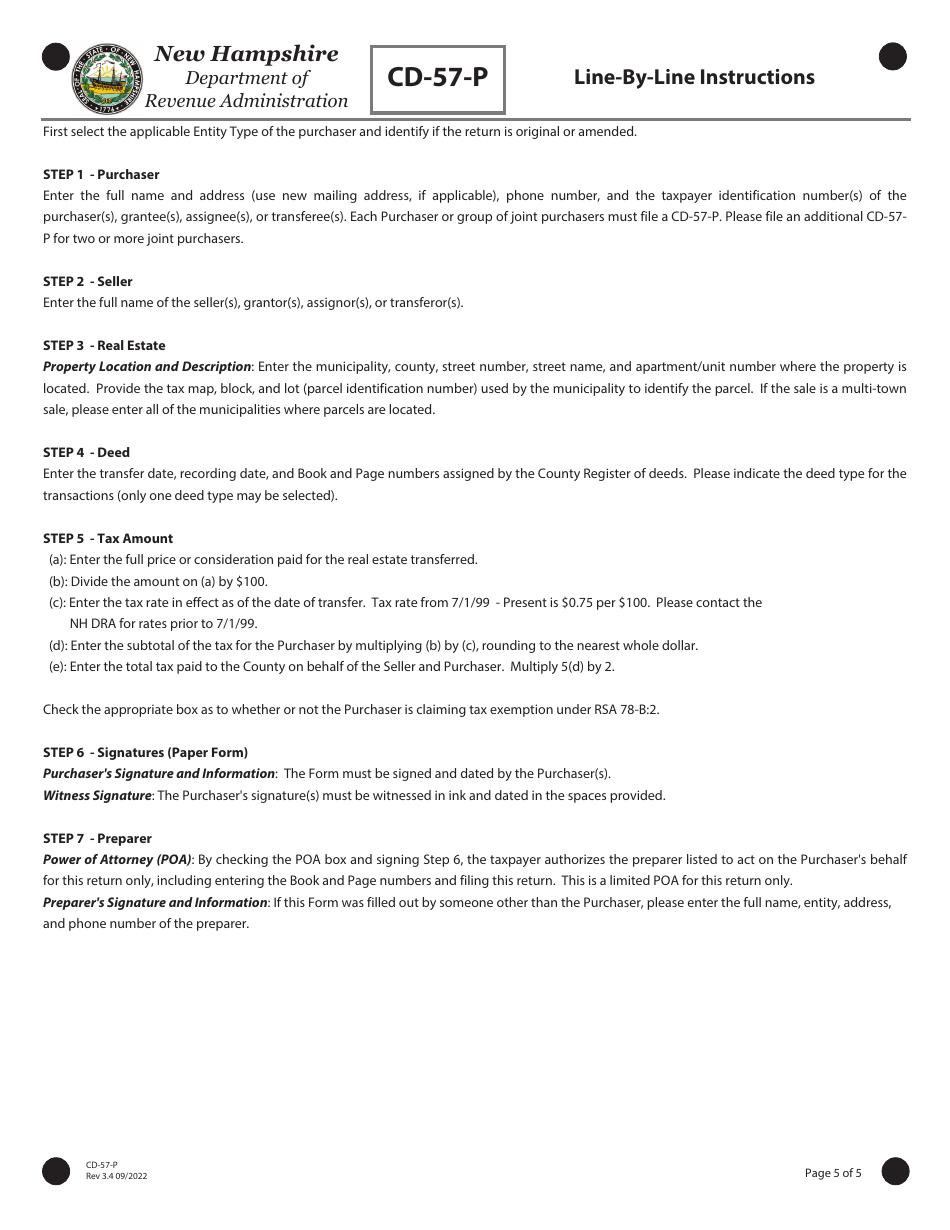

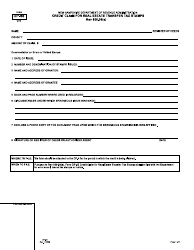

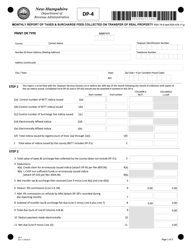

Form CD-57-P

for the current year.

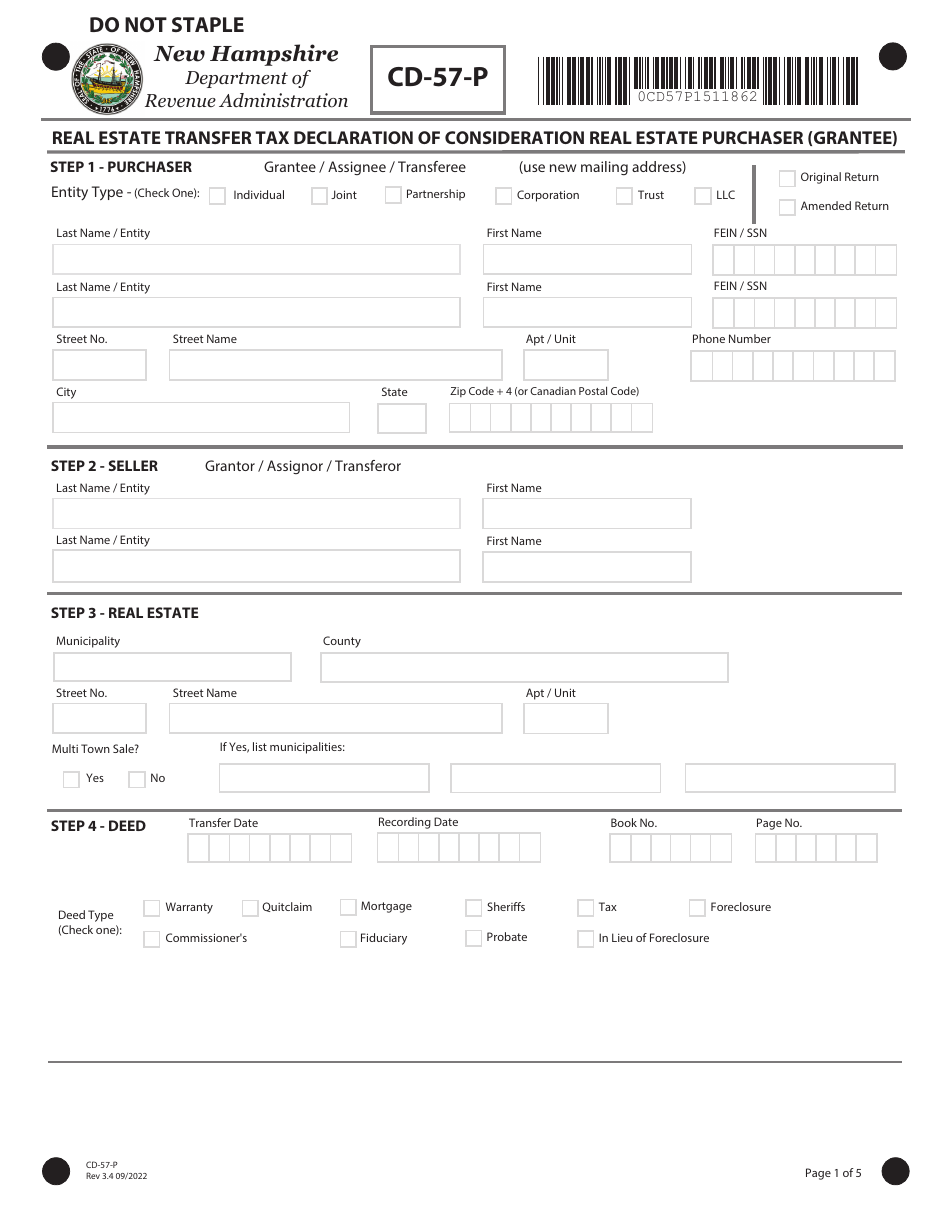

Form CD-57-P Real Estate Transfer Tax Declaration of Consideration Real Estate Purchaser (Grantee) - New Hampshire

What Is Form CD-57-P?

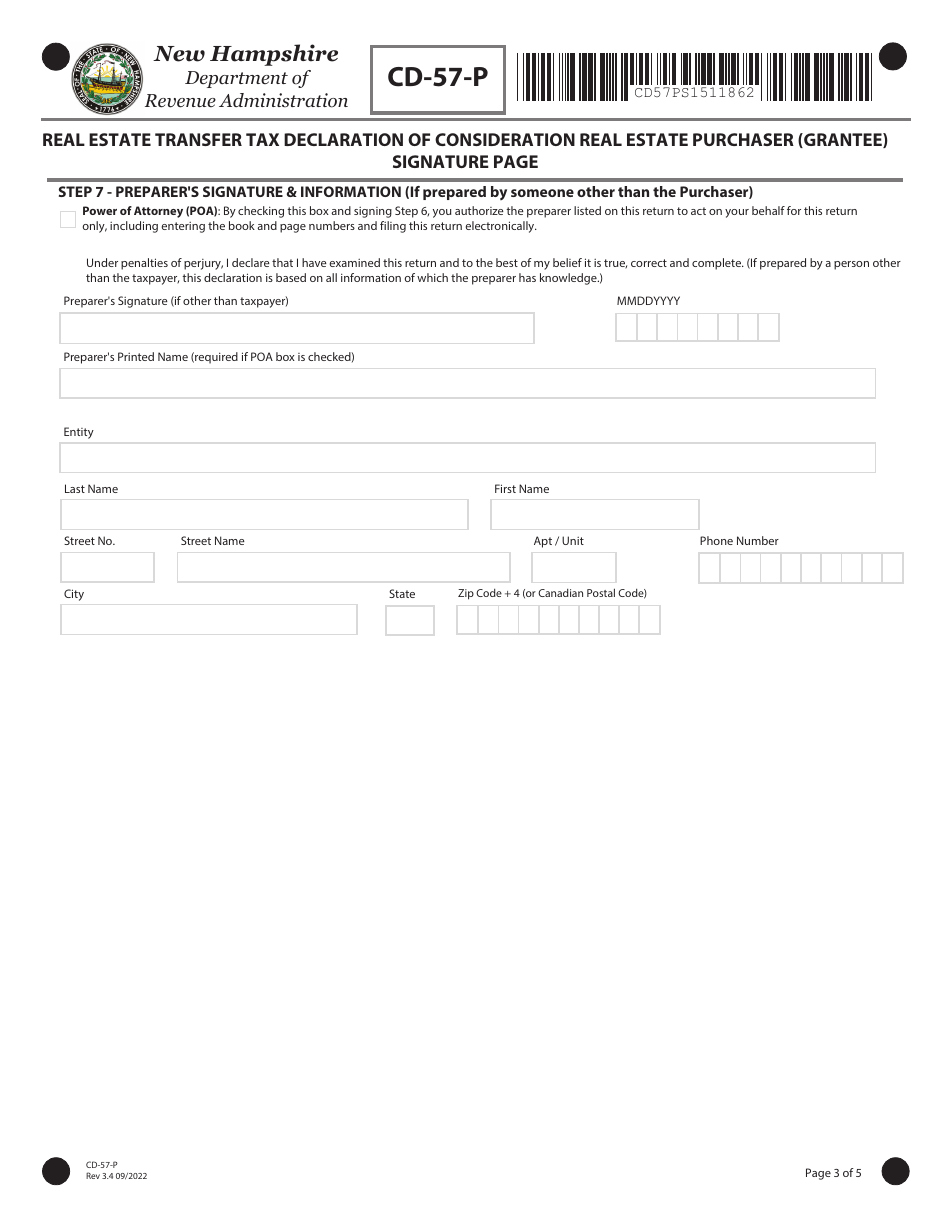

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

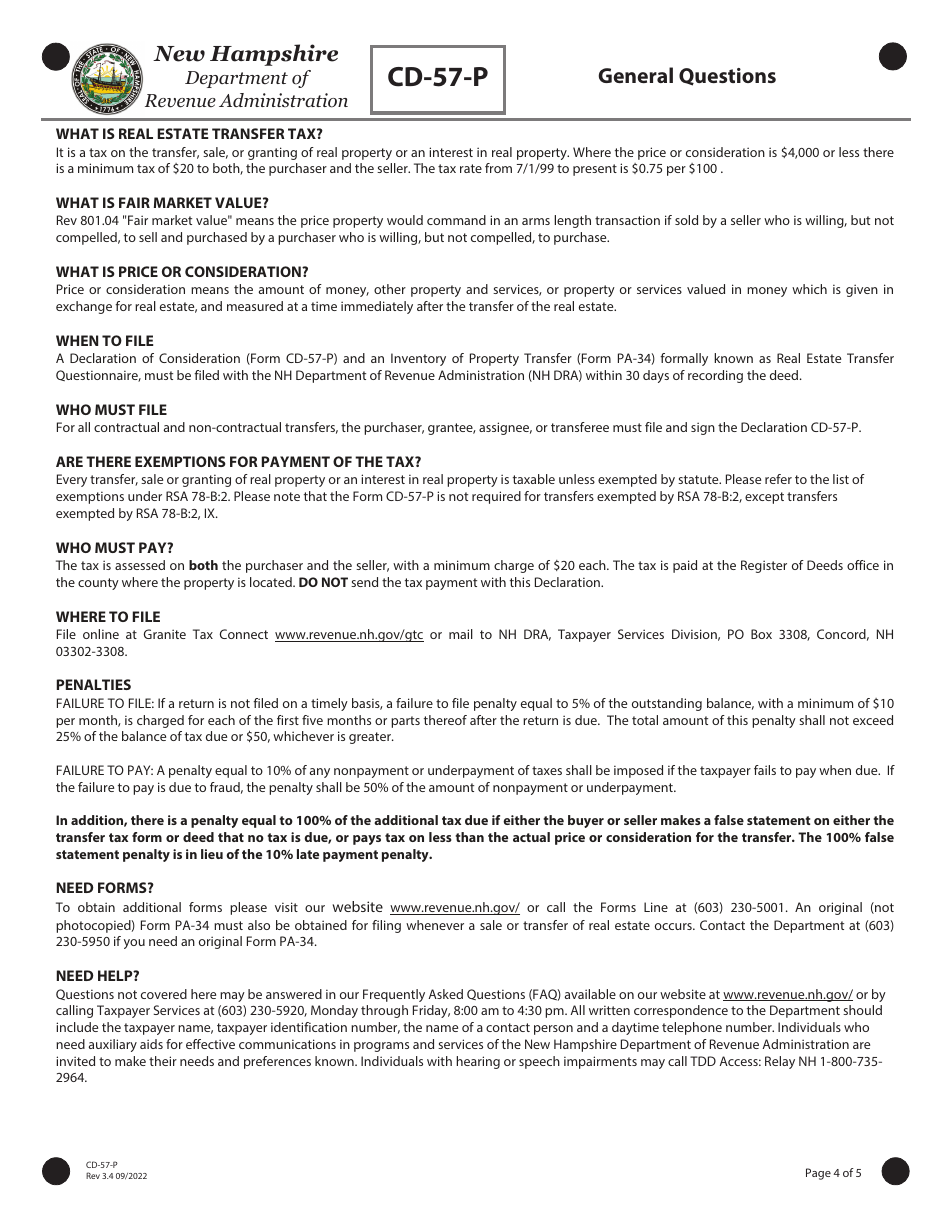

Q: What is Form CD-57-P?

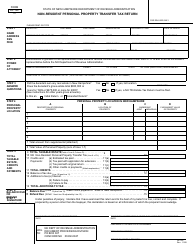

A: Form CD-57-P is the Real Estate Transfer Tax Declaration of Consideration for Real Estate Purchaser (Grantee) in New Hampshire.

Q: Who needs to fill out Form CD-57-P?

A: Real estate purchasers (grantees) in New Hampshire need to fill out Form CD-57-P.

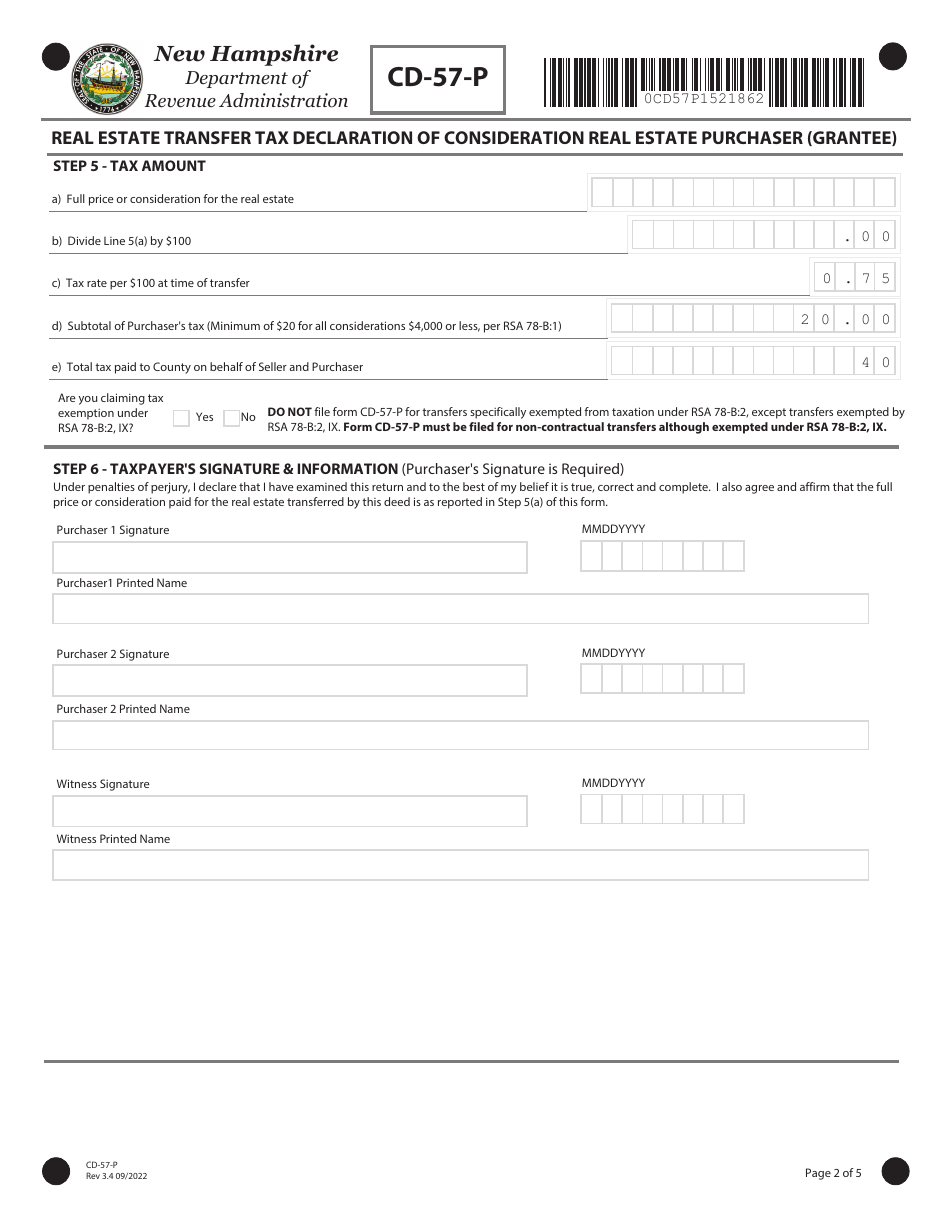

Q: What is the purpose of Form CD-57-P?

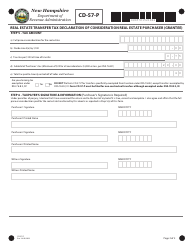

A: The purpose of Form CD-57-P is to declare the consideration amount for the real estate transfer tax.

Q: Is there a fee for filing Form CD-57-P?

A: Yes, there is a fee for filing Form CD-57-P. The fee amount is determined based on the consideration amount.

Q: When should Form CD-57-P be filed?

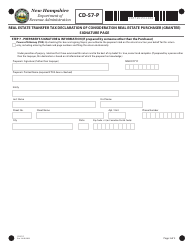

A: Form CD-57-P should be filed within 30 days of the transfer of the property.

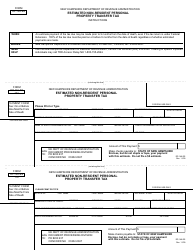

Q: Are there any exemptions to the real estate transfer tax?

A: Yes, there are certain exemptions to the real estate transfer tax. These exemptions are listed in the instructions for Form CD-57-P.

Q: What happens if I don't file Form CD-57-P?

A: Failure to file Form CD-57-P or providing false information may result in penalties and interest.

Q: Is Form CD-57-P specific to New Hampshire?

A: Yes, Form CD-57-P is specific to real estate transactions in New Hampshire.

Form Details:

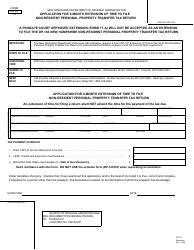

- Released on September 1, 2022;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CD-57-P by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.