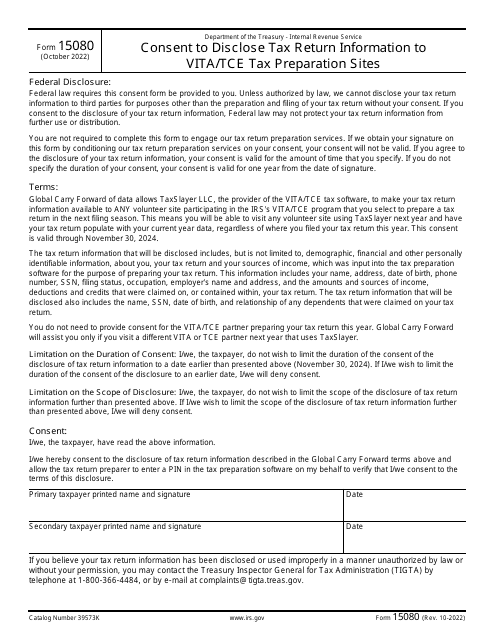

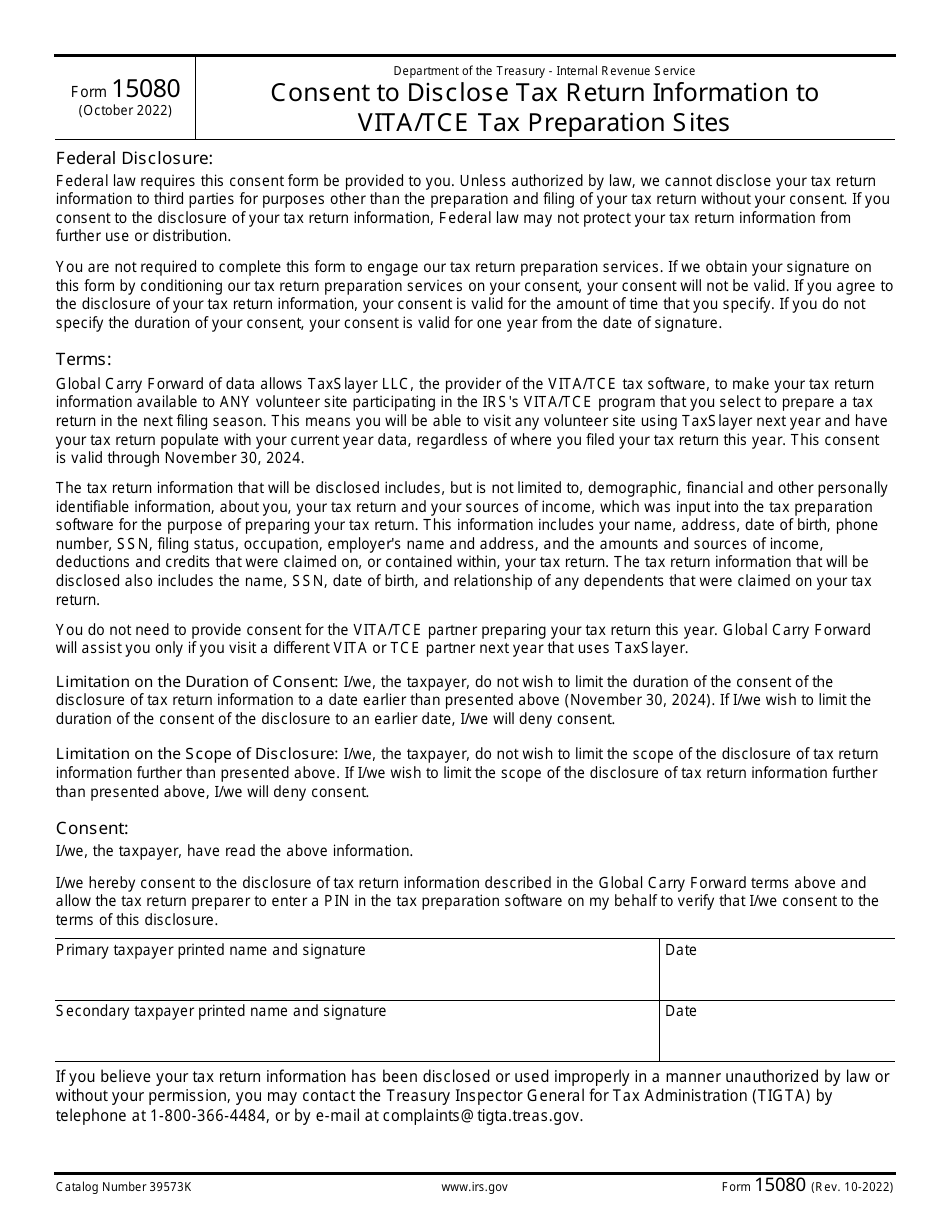

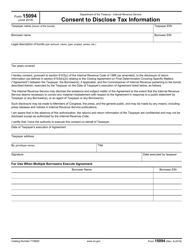

IRS Form 15080 Consent to Disclose Tax Return Information to Vita / Tce Tax Preparation Sites

What Is IRS Form 15080?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on October 1, 2022. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 15080?

A: IRS Form 15080 is a Consent to Disclose Tax Return Information to Vita/Tce Tax Preparation Sites form.

Q: What is the purpose of IRS Form 15080?

A: The purpose of IRS Form 15080 is to authorize the disclosure of your tax return information to Vita/Tce Tax Preparation Sites.

Q: Who needs to fill out IRS Form 15080?

A: Anyone who wants to authorize the disclosure of their tax return information to Vita/Tce Tax Preparation Sites needs to fill out IRS Form 15080.

Q: Do I need to submit IRS Form 15080 every year?

A: No, you only need to submit IRS Form 15080 once unless you want to revoke the authorization.

Q: Can I revoke the authorization given on IRS Form 15080?

A: Yes, you can revoke the authorization given on IRS Form 15080 by submitting a written statement to the IRS.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 15080 through the link below or browse more documents in our library of IRS Forms.