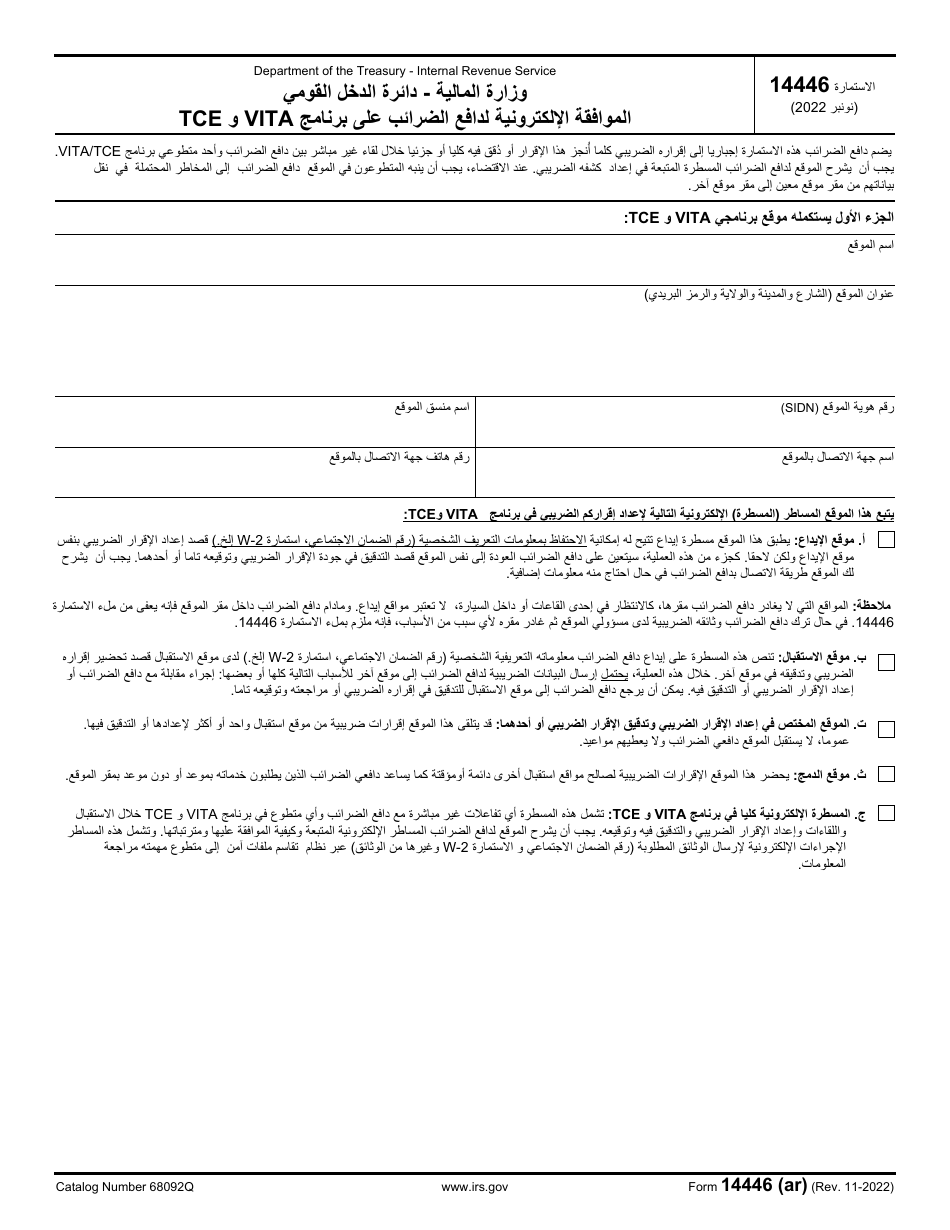

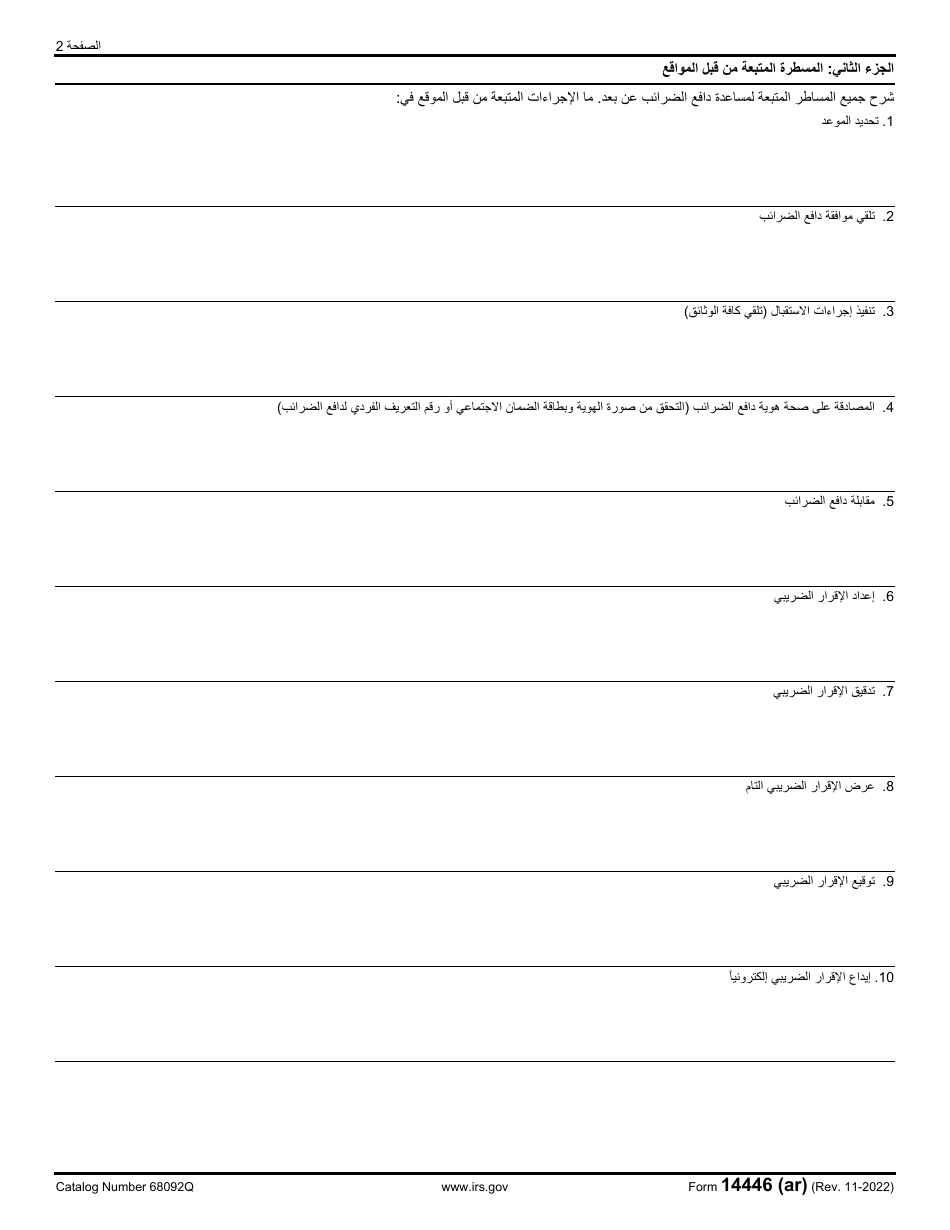

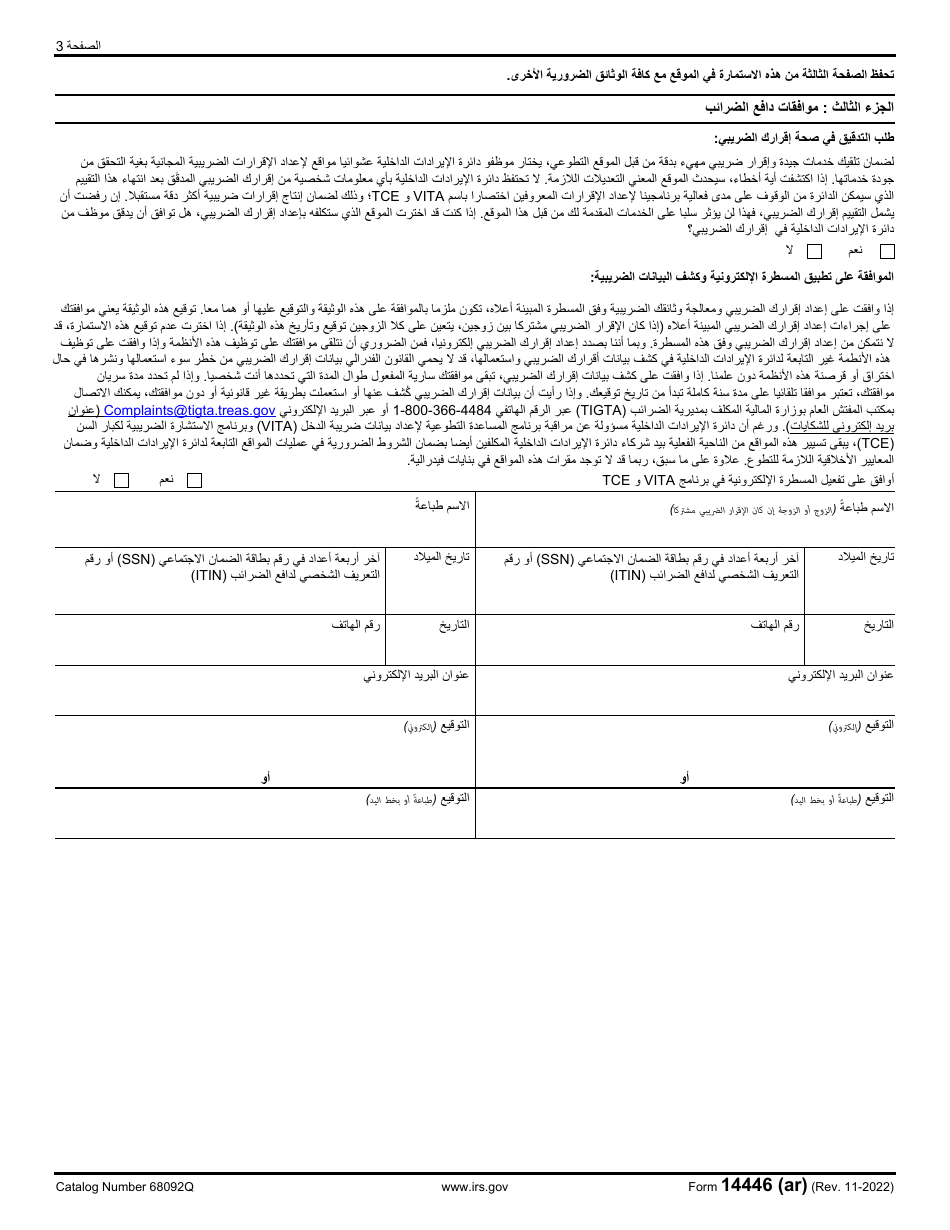

This version of the form is not currently in use and is provided for reference only. Download this version of

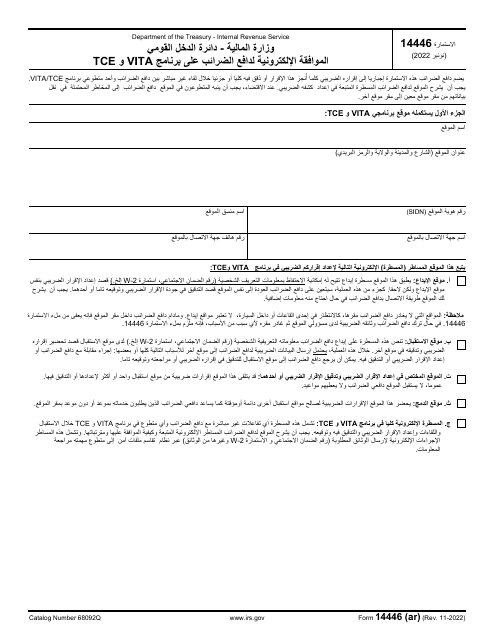

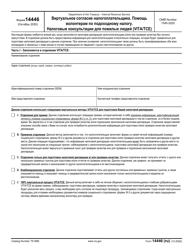

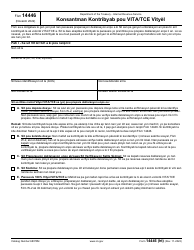

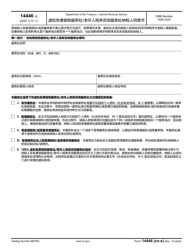

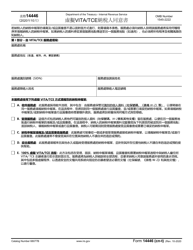

IRS Form 14446 (AR)

for the current year.

IRS Form 14446 (AR) Virtual Vita / Tce Taxpayer Consent (Arabic)

FAQ

Q: What is IRS Form 14446 (AR)?

A: IRS Form 14446 (AR) is a form used for taxpayer consent in the Virtual VITA/TCE program.

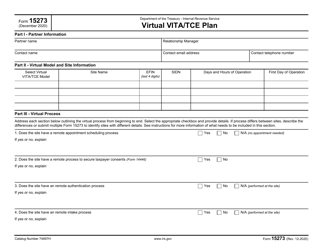

Q: What is the Virtual VITA/TCE program?

A: The Virtual VITA/TCE program is a volunteer-based tax preparation service provided by the IRS.

Q: Why would I need to fill out IRS Form 14446 (AR)?

A: You would need to fill out IRS Form 14446 (AR) to provide your consent for participating in the Virtual VITA/TCE program in Arabic.

Q: Is IRS Form 14446 (AR) available in Arabic only?

A: Yes, IRS Form 14446 (AR) is specifically for Arabic-speaking taxpayers.

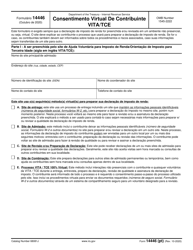

Q: Can I submit IRS Form 14446 (AR) electronically?

A: No, IRS Form 14446 (AR) must be printed, signed, and mailed to the address provided on the form.

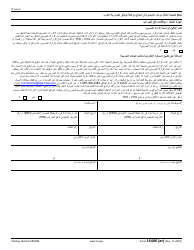

Q: Is participation in the Virtual VITA/TCE program mandatory?

A: Participation in the Virtual VITA/TCE program is voluntary, and you can choose to opt out at any time.

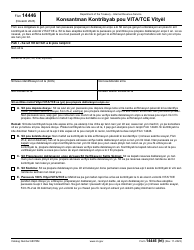

Q: Are there any fees associated with the Virtual VITA/TCE program?

A: No, the Virtual VITA/TCE program is a free tax preparation service.

Q: Can I get help filling out IRS Form 14446 (AR)?

A: Yes, you can get assistance with filling out IRS Form 14446 (AR) from the VITA/TCE program volunteers.

Q: What if I don't understand Arabic? Can I still participate in the Virtual VITA/TCE program?

A: Yes, the Virtual VITA/TCE program also provides assistance in other languages. You can contact the program for language support.