This version of the form is not currently in use and is provided for reference only. Download this version of

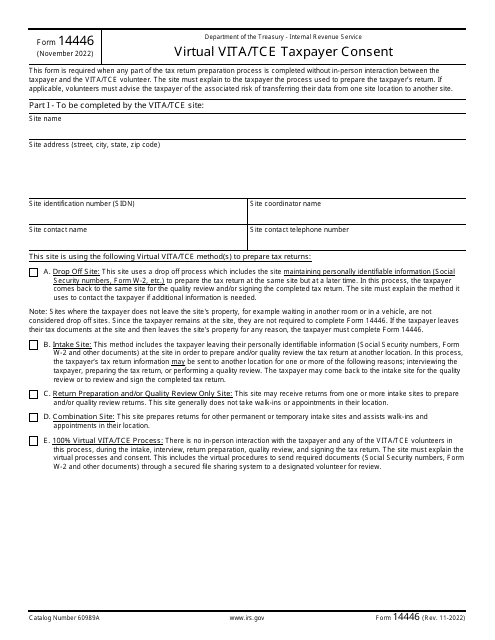

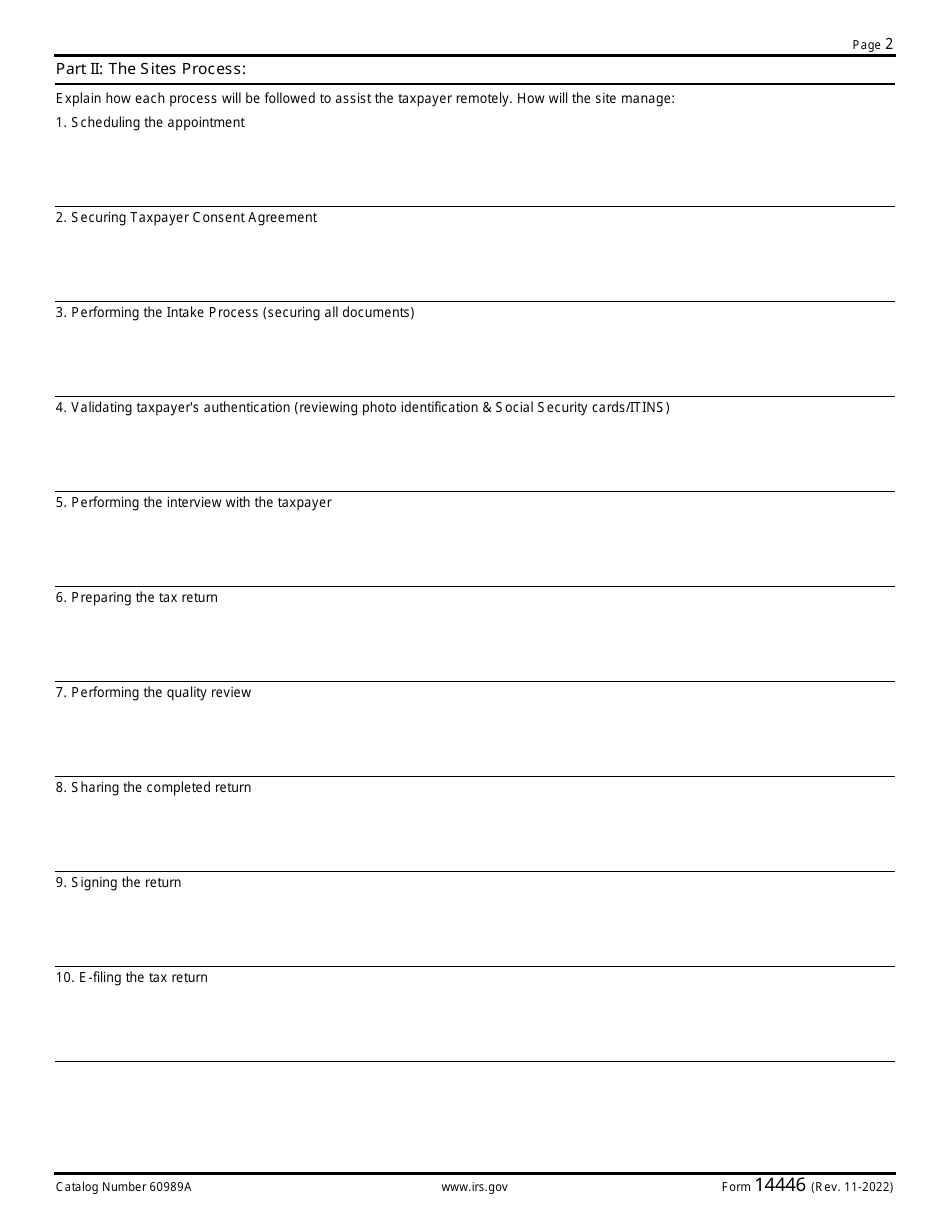

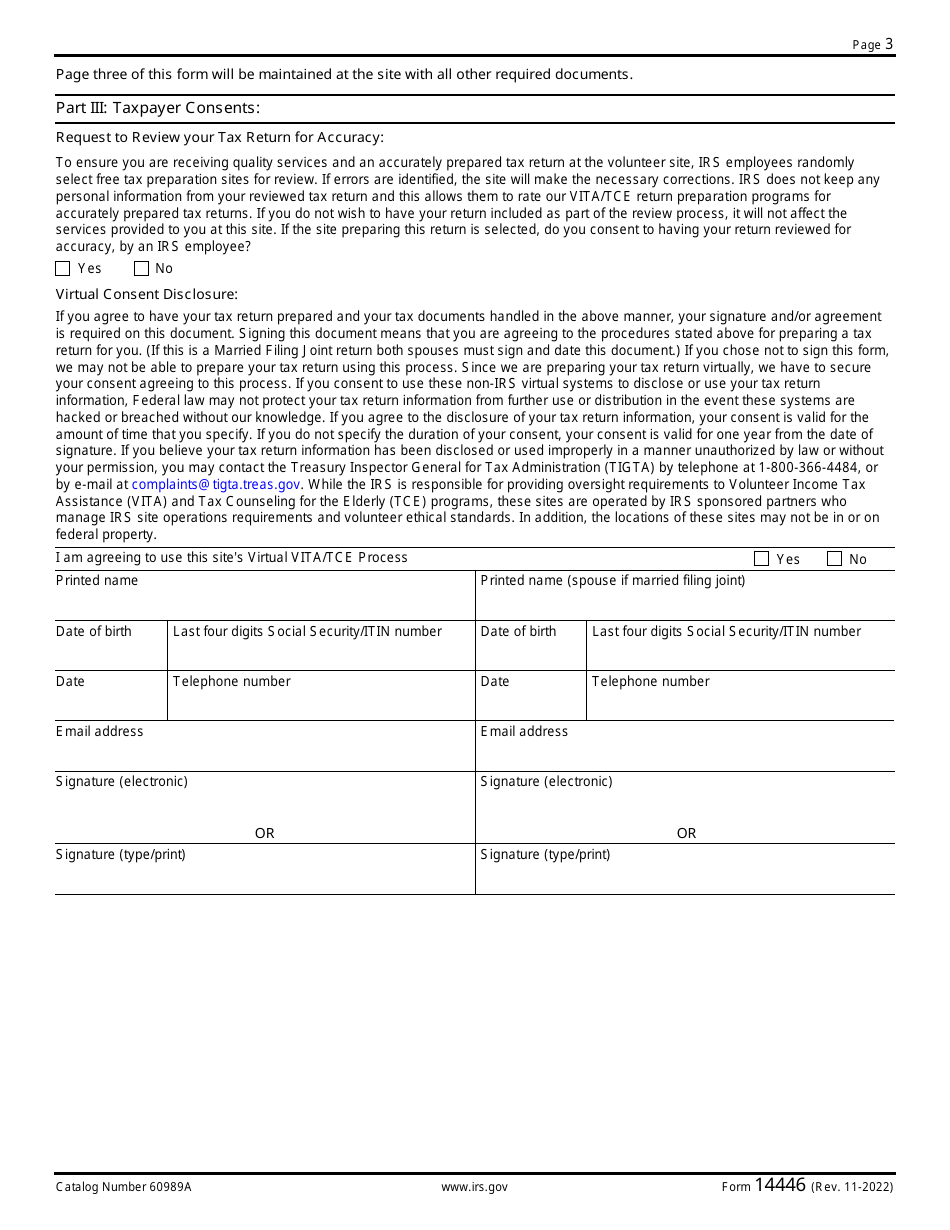

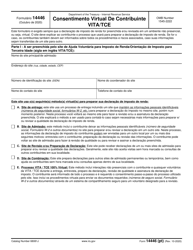

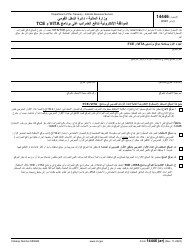

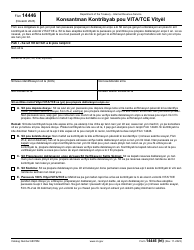

IRS Form 14446

for the current year.

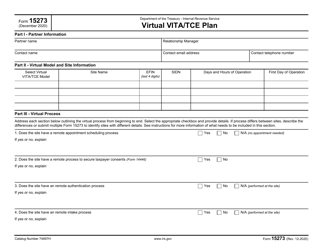

IRS Form 14446 Virtual Vita / Tce Taxpayer Consent

What Is IRS Form 14446?

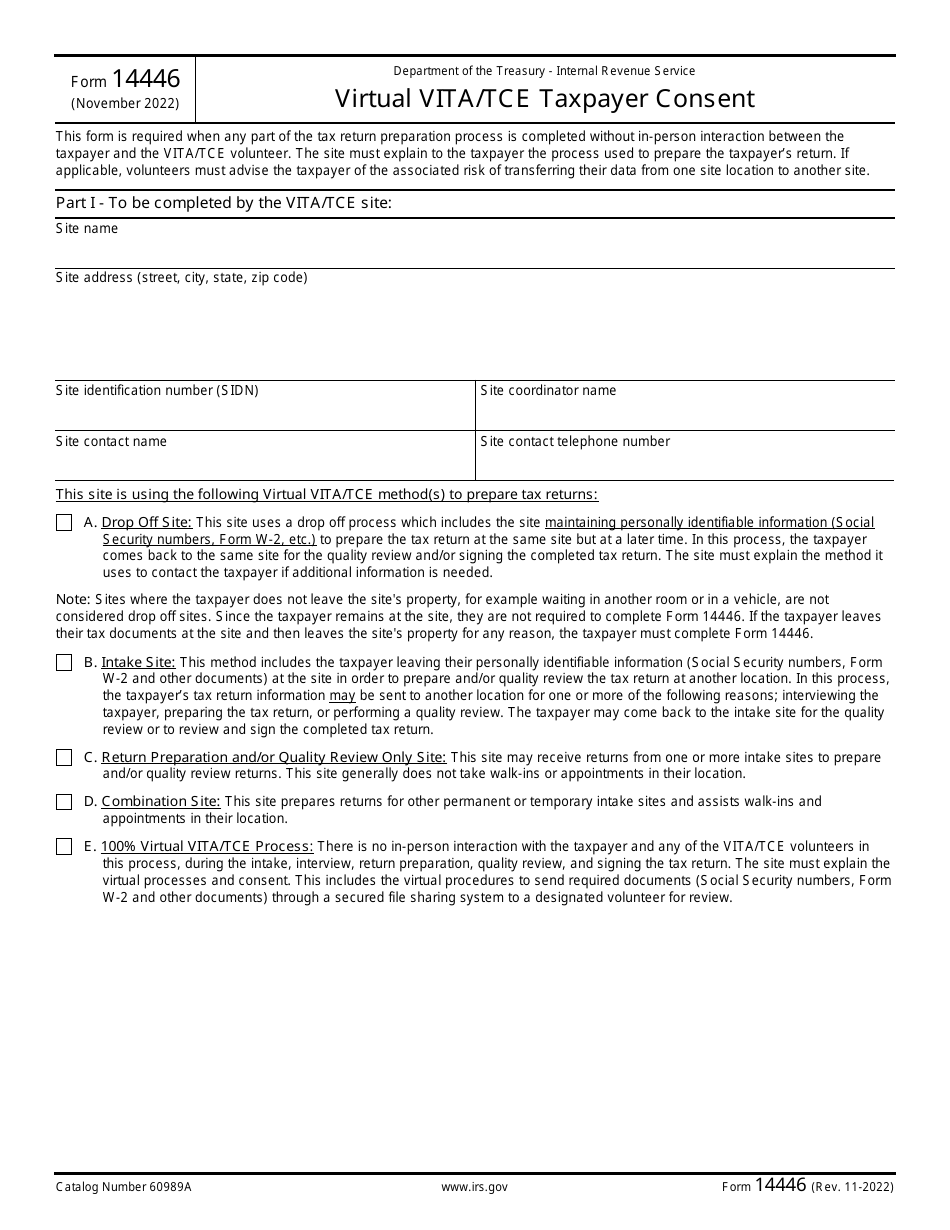

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on November 1, 2022. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 14446?

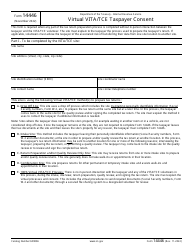

A: IRS Form 14446 is a consent form that taxpayers must complete in order to use the Virtual VITA/TCE program.

Q: Who can use the Virtual VITA/TCE program?

A: The Virtual VITA/TCE program is available to taxpayers who meet certain income eligibility requirements.

Q: Is there a deadline to submit IRS Form 14446?

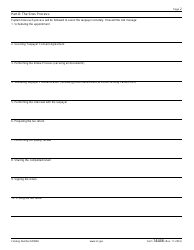

A: There is no specific deadline to submit IRS Form 14446, but it is recommended to complete the form as soon as possible to access the Virtual VITA/TCE program.

Q: Can I change my consent after submitting IRS Form 14446?

A: Yes, you can change your consent by completing a new IRS Form 14446 with the updated information.

Q: What happens after I submit IRS Form 14446?

A: After submitting IRS Form 14446, you will receive instructions on how to access the Virtual VITA/TCE program and receive tax assistance.

Q: Is there a fee for using the Virtual VITA/TCE program?

A: No, the Virtual VITA/TCE program provides free tax assistance and preparation services.

Q: Can I use the Virtual VITA/TCE program if I have complex tax issues?

A: The Virtual VITA/TCE program is designed for individuals with relatively simple tax returns. If you have complex tax issues, it is recommended to seek professional tax advice.

Form Details:

- A 3-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

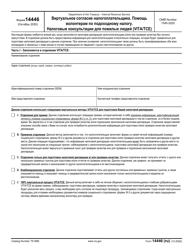

- A Spanish version of IRS Form 14446 is available for spanish-speaking filers;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14446 through the link below or browse more documents in our library of IRS Forms.