This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 8959

for the current year.

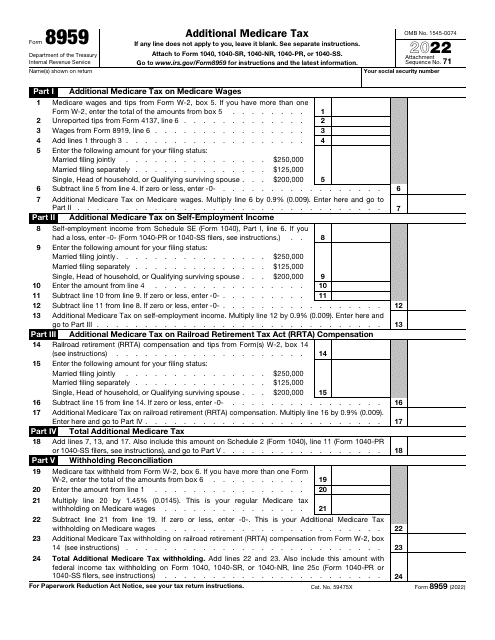

IRS Form 8959 Additional Medicare Tax

What Is IRS Form 8959?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8959?

A: IRS Form 8959 is a tax form used to calculate and report the Additional Medicare Tax.

Q: What is the Additional Medicare Tax?

A: The Additional Medicare Tax is a tax imposed on certain types of income for high-income individuals.

Q: Who is required to file Form 8959?

A: Individuals who have earned income above certain thresholds or who have additional Medicare tax withheld by an employer are required to file Form 8959.

Q: What types of income are subject to the Additional Medicare Tax?

A: Wages, self-employment income, and Railroad RetirementTax Act compensation are examples of income that may be subject to the Additional Medicare Tax.

Q: What is the threshold for the Additional Medicare Tax?

A: For most individuals, the threshold is $200,000 for single filers and $250,000 for married couples filing jointly. However, there are certain exceptions and special rules for specific groups of taxpayers.

Q: How do I calculate the Additional Medicare Tax?

A: To calculate the Additional Medicare Tax, you need to determine your total wages, self-employment income, and other applicable sources of income subject to the tax and use the appropriate tax rate to calculate the tax amount.

Q: When do I need to file Form 8959?

A: Form 8959 is filed with your annual tax return, typically due by April 15th of each year.

Q: What happens if I don't file Form 8959?

A: Failing to file Form 8959 when required could result in penalties and interest being assessed by the IRS.

Q: Can I e-file Form 8959?

A: Yes, you can e-file Form 8959 using IRS-approved tax software or through a tax professional.

Q: Do I need to file Form 8959 if I don't owe any Additional Medicare Tax?

A: If your income is below the threshold or you had the correct amount of Additional Medicare Tax withheld, you may not be required to file Form 8959. However, it is always a good idea to consult with a tax professional or refer to the official IRS guidelines to determine your filing requirements.

Q: Can I claim a refund of Additional Medicare Tax?

A: Yes, if you had excess Additional Medicare Tax withheld or paid, you may be able to claim a refund by filing the appropriate forms with the IRS.

Q: Are there any exemptions from the Additional Medicare Tax?

A: Certain nonresident aliens, dual-status aliens, and Puerto Rican residents are exempt from the Additional Medicare Tax. There are also specific rules and exceptions for certain types of income and situations, so it's important to review the official IRS guidelines or consult a tax professional for more information.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8959 through the link below or browse more documents in our library of IRS Forms.