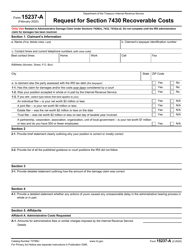

This version of the form is not currently in use and is provided for reference only. Download this version of

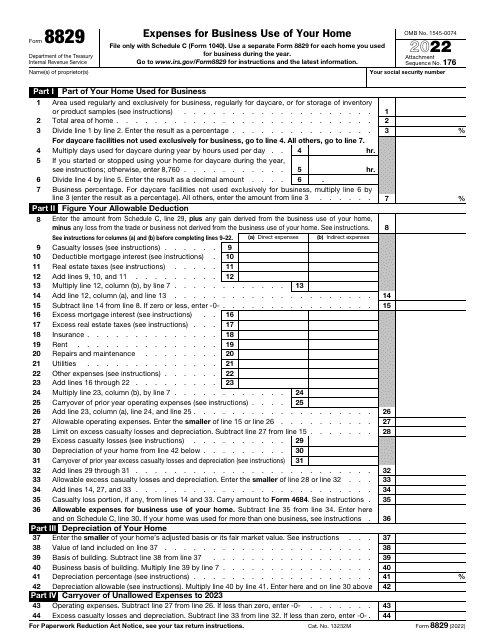

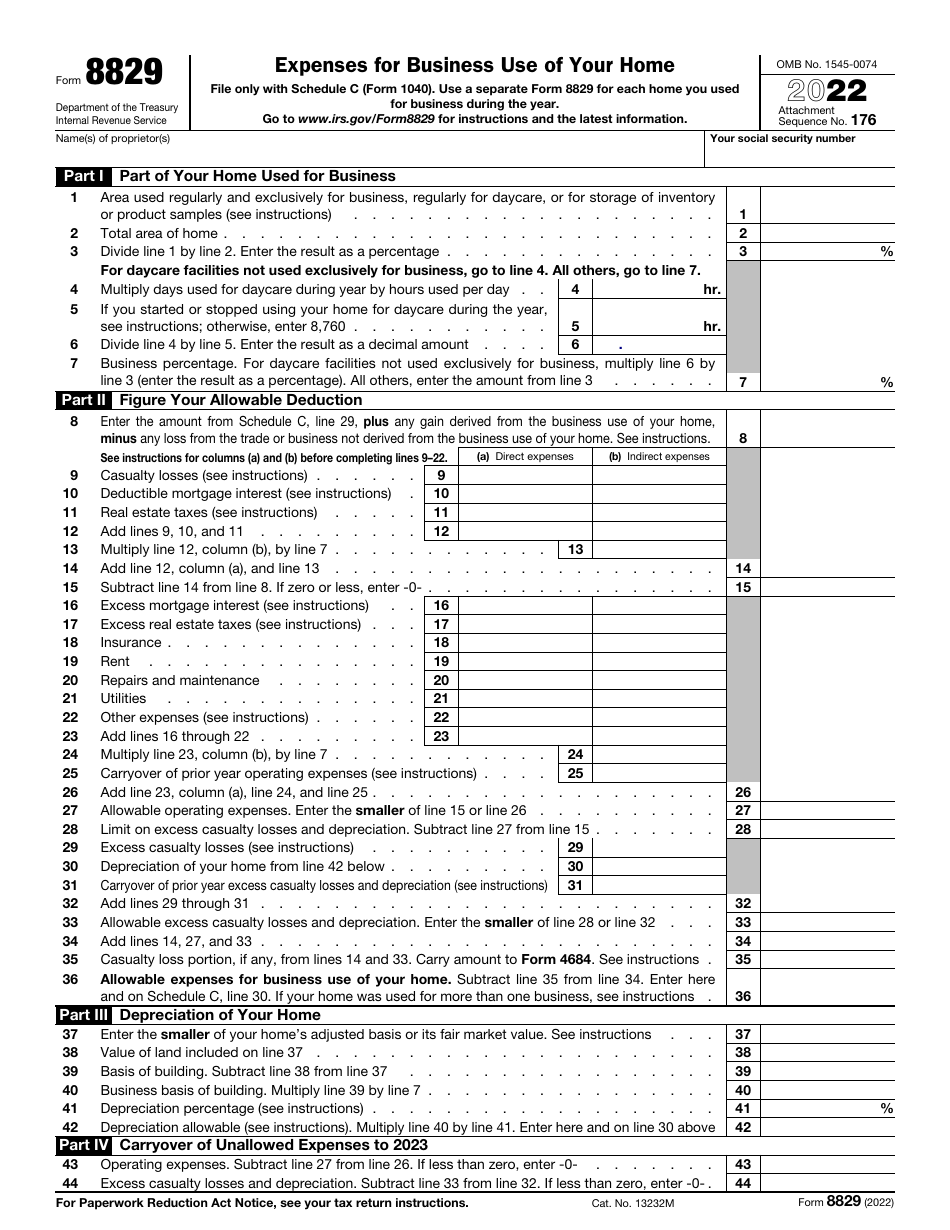

IRS Form 8829

for the current year.

IRS Form 8829 Expenses for Business Use of Your Home

What Is IRS Form 8829?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8829?

A: IRS Form 8829 is a tax form used to claim deductions for business use of your home expenses.

Q: Who can use IRS Form 8829?

A: Self-employed individuals and employees who work from home can use IRS Form 8829.

Q: What expenses can I claim on IRS Form 8829?

A: You can claim expenses such as mortgage interest, insurance, utilities, and repairs directly related to the business use of your home.

Q: How do I calculate the business use of my home?

A: You can calculate the business use of your home by dividing the square footage of your home office by the total square footage of your home.

Q: Can I claim a deduction for my home office if I am an employee?

A: Yes, you can claim a deduction for your home office if you are an employee, but there are additional requirements you must meet.

Q: When is the deadline to file IRS Form 8829?

A: IRS Form 8829 is typically filed as part of your annual income tax return, which is due on April 15th (or the next business day if April 15th falls on a weekend or holiday).

Q: Can I claim a deduction for both a home office and a rented office space?

A: No, you cannot claim deductions for both a home office and a rented office space. You can only claim deductions for one location.

Q: What documentation do I need to support my deductions on IRS Form 8829?

A: You should keep records and receipts that substantiate your claimed expenses, such as mortgage statements, utility bills, and repair invoices.

Q: Can I amend my previously filed tax returns to include a deduction for home office expenses?

A: Yes, you can amend your previously filed tax returns to include a deduction for home office expenses within the applicable statute of limitations.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8829 through the link below or browse more documents in our library of IRS Forms.