This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 8824

for the current year.

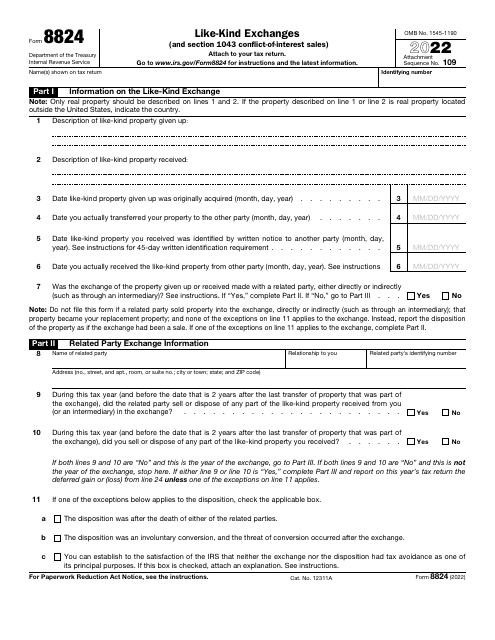

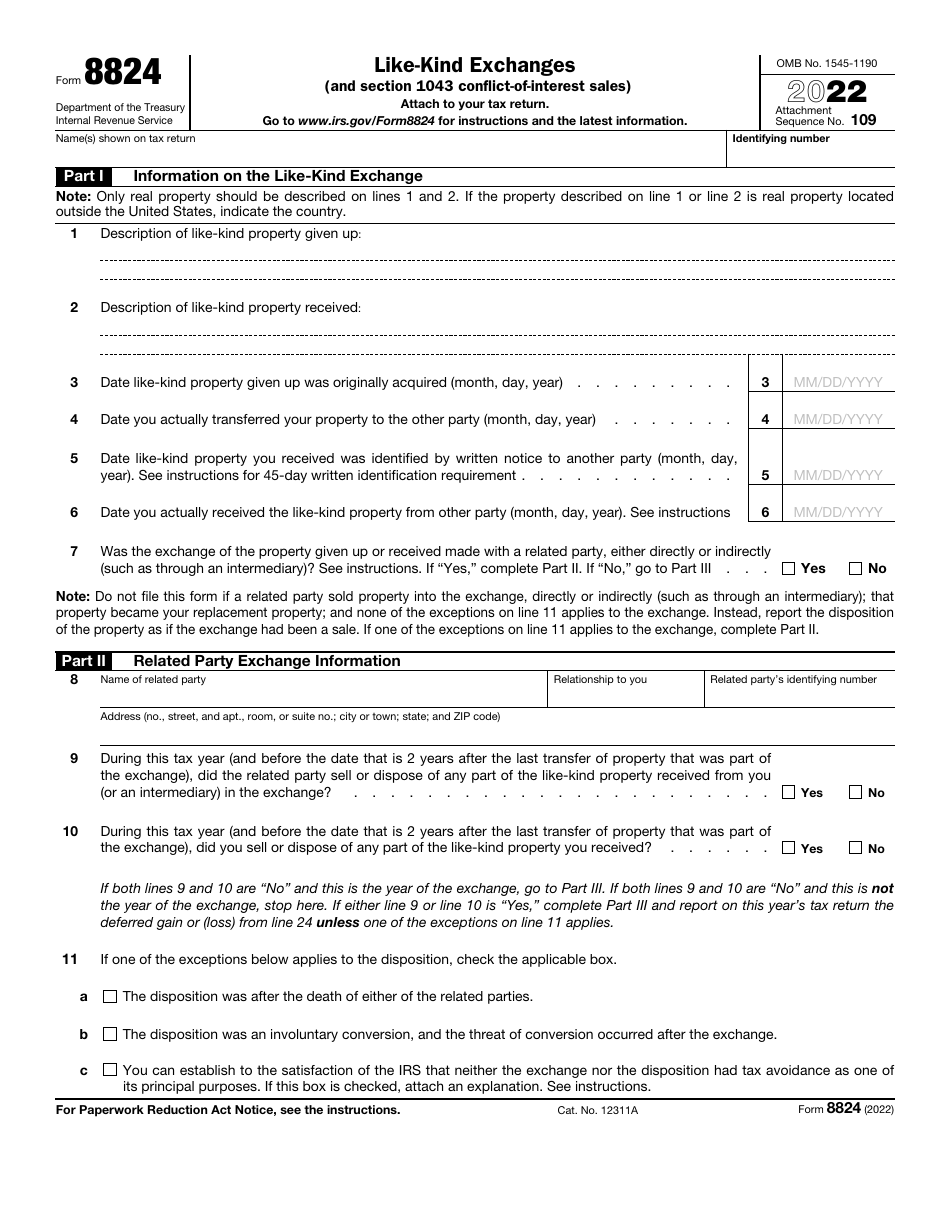

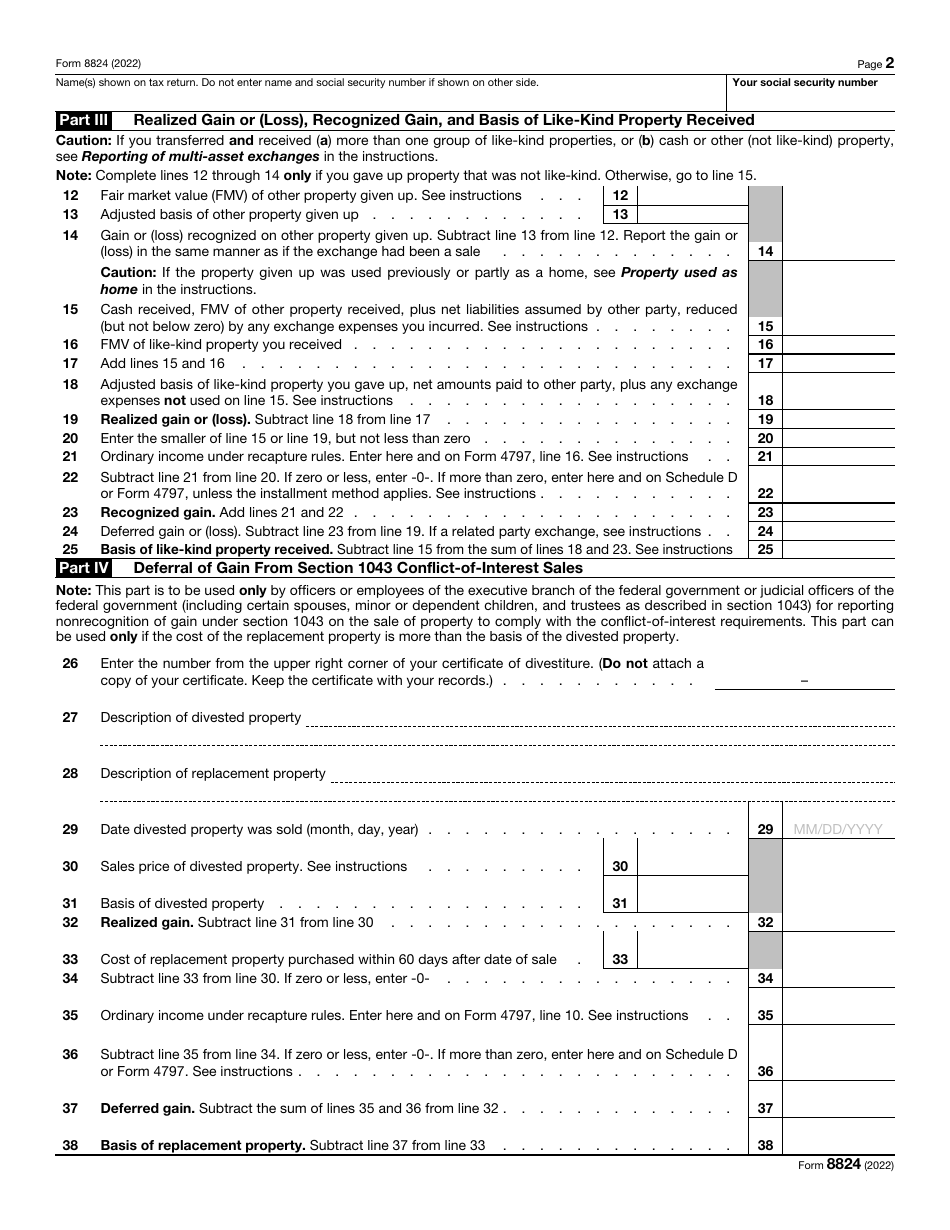

IRS Form 8824 Like-Kind Exchanges (And Section 1043 Conflict-Of-Interest Sales)

What Is IRS Form 8824?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8824?

A: IRS Form 8824 is used to report like-kind exchanges and section 1043 conflict-of-interest sales.

Q: What are like-kind exchanges?

A: Like-kind exchanges refer to the exchange of property held for productive use in a trade or business or for investment, where the properties being exchanged are of a similar nature.

Q: What is a section 1043 conflict-of-interest sale?

A: A section 1043 conflict-of-interest sale refers to the sale of property to comply with conflict-of-interest rules set out in section 1043 of the Internal Revenue Code.

Q: Why is IRS Form 8824 important?

A: IRS Form 8824 is important because it allows individuals or businesses to report and defer any taxable gains or losses from like-kind exchanges or section 1043 conflict-of-interest sales.

Q: What information is required on IRS Form 8824?

A: The form requires information such as the details of the exchanged properties, their adjusted basis, the realized gain or loss, and whether any cash or other non-like-kind property was received.

Q: Are all like-kind exchanges tax-free?

A: Not all like-kind exchanges are fully tax-free. Any taxable gain or loss is deferred until a later taxable transaction takes place.

Q: Is it possible to amend an IRS Form 8824?

A: Yes, it is possible to amend an IRS Form 8824 by filing an amended return using Form 1040X.

Q: What are the consequences of not filing IRS Form 8824 for a like-kind exchange?

A: Failing to report a like-kind exchange on IRS Form 8824 may result in the IRS treating the transaction as a taxable sale and assessing taxes accordingly.

Q: Can the use of IRS Form 8824 be beneficial for tax planning?

A: Yes, utilizing IRS Form 8824 for like-kind exchanges can be beneficial for tax planning as it allows for the deferral of taxable gains or losses.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8824 through the link below or browse more documents in our library of IRS Forms.