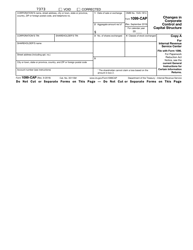

This version of the form is not currently in use and is provided for reference only. Download this version of

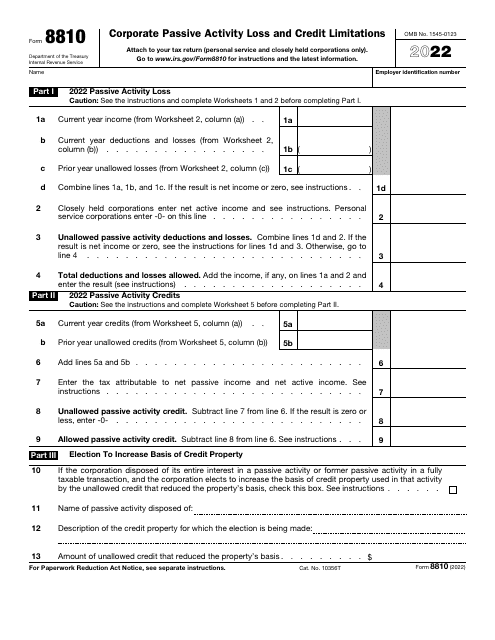

IRS Form 8810

for the current year.

IRS Form 8810 Corporate Passive Activity Loss and Credit Limitations

What Is IRS Form 8810?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8810?

A: IRS Form 8810 is a form used to calculate and report corporate passive activity loss and credit limitations.

Q: Who needs to file IRS Form 8810?

A: Corporate taxpayers who have passive activity losses or credits need to file IRS Form 8810.

Q: What is a passive activity?

A: A passive activity is any trade or business in which the taxpayer does not materially participate.

Q: What are passive activity losses and credits?

A: Passive activity losses are losses incurred from passive activities, while passive activity credits are credits earned from passive activities.

Q: How do I calculate the passive activity loss limitation?

A: The passive activity loss limitation is calculated using a variety of factors, including the taxpayer's adjusted gross income and the amount of passive losses.

Q: What is the purpose of the passive activity loss limitation?

A: The purpose of the passive activity loss limitation is to prevent taxpayers from using passive losses to offset their ordinary income.

Q: Are there any exceptions to the passive activity loss limitation?

A: Yes, there are some exceptions and special rules that may apply in certain situations. It is best to consult the instructions for IRS Form 8810 to determine if any exceptions apply.

Q: When is IRS Form 8810 due?

A: IRS Form 8810 is generally due on the same date as the taxpayer's income tax return, which is typically April 15th of each year.

Q: What should I do if I need help with IRS Form 8810?

A: If you need help with IRS Form 8810, you can contact the IRS directly or consult a tax professional for assistance.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8810 through the link below or browse more documents in our library of IRS Forms.