IRS Form 8804 Section 1446 Annual Return for Partnership Withholding Tax

What Is IRS Form 8804 Section 1446?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on November 1, 2022. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

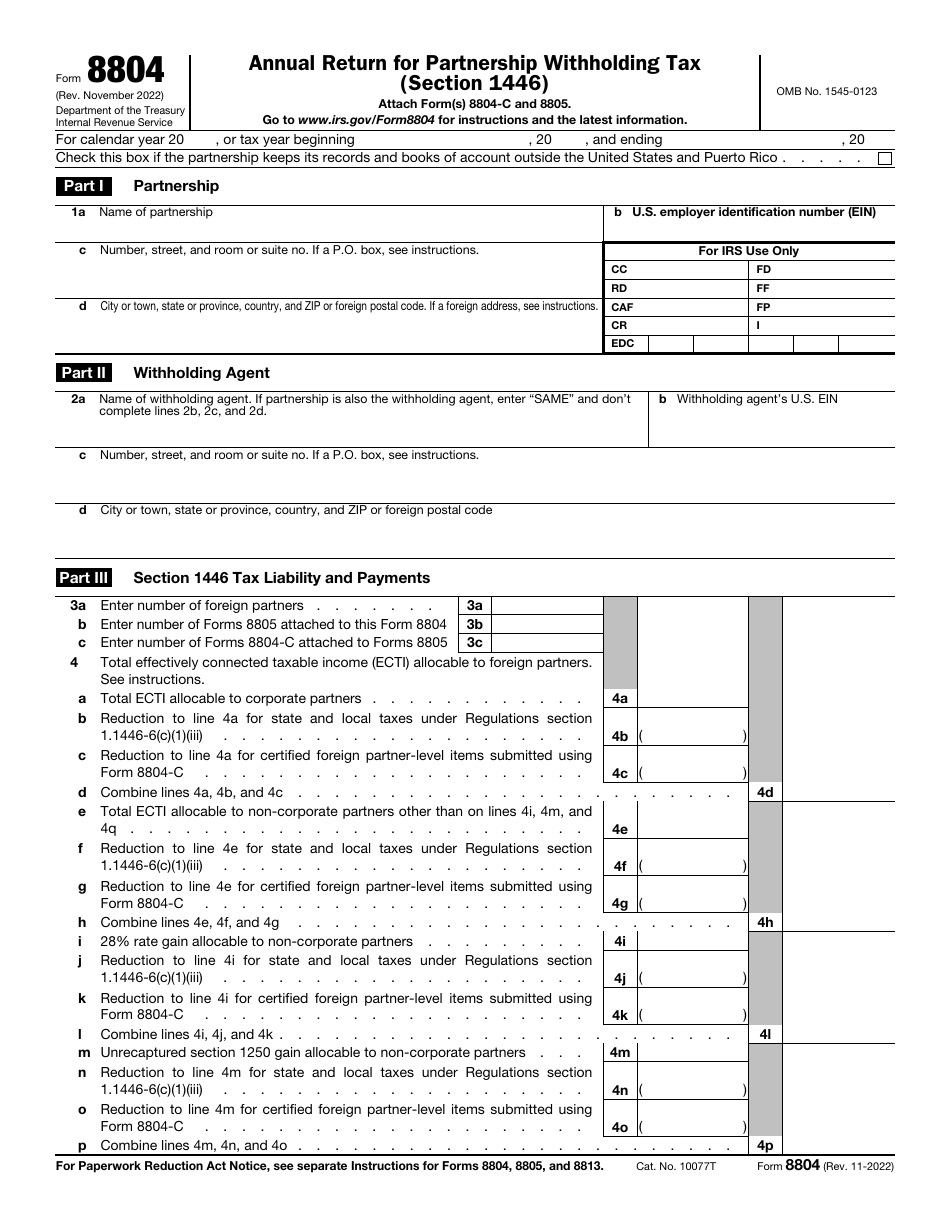

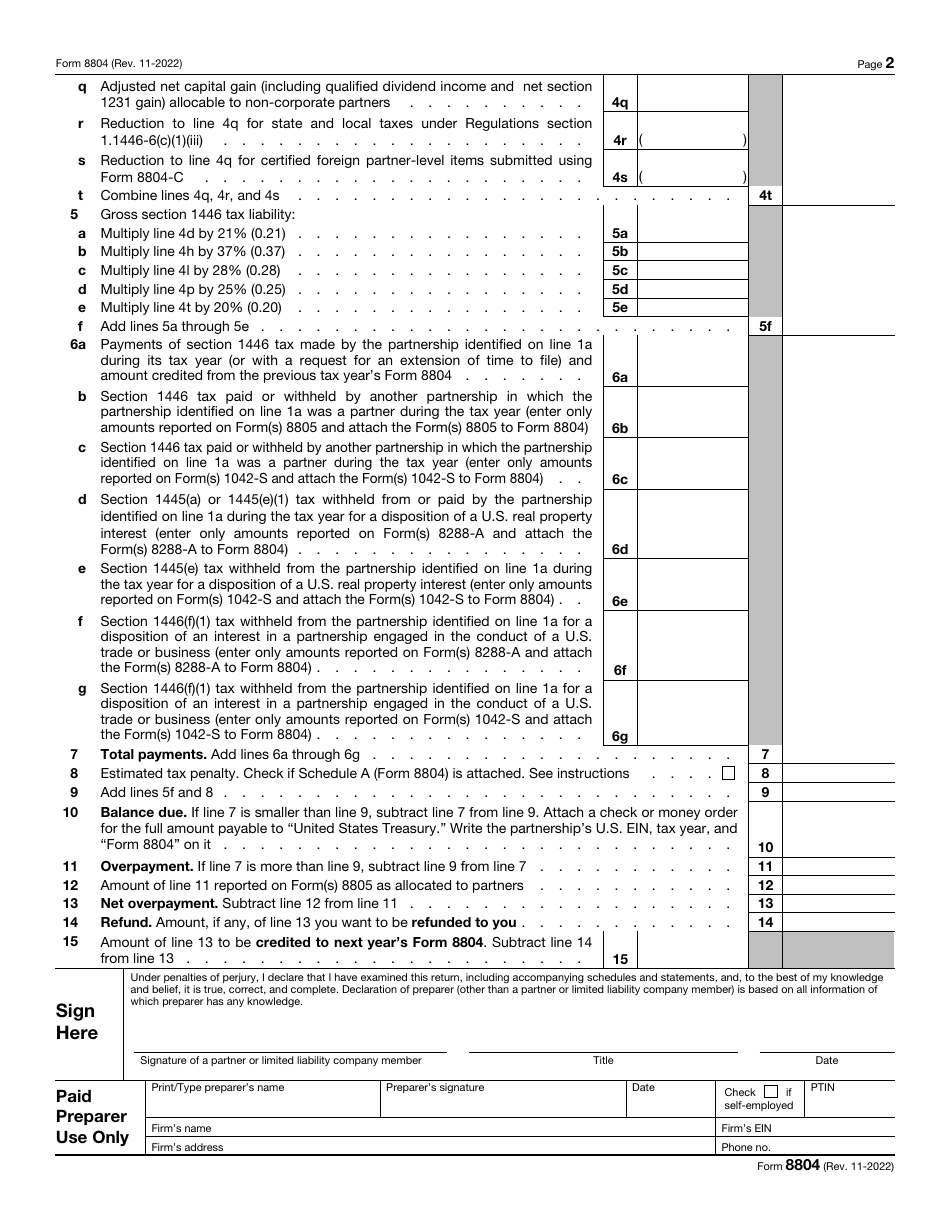

Q: What is IRS Form 8804?

A: IRS Form 8804 is a form used to report and pay annual withholding taxes on behalf of partnerships.

Q: What is Section 1446?

A: Section 1446 of the Internal Revenue Code pertains to the withholding tax requirements for partnerships.

Q: Who needs to file IRS Form 8804?

A: Partnerships that have withholding tax obligations are required to file IRS Form 8804.

Q: What is the purpose of IRS Form 8804?

A: The purpose of IRS Form 8804 is to report and pay withholding taxes on income distributed by partnerships to foreign partners.

Q: When is IRS Form 8804 due?

A: IRS Form 8804 is due on the 15th day of the 4th month following the end of the partnership's tax year.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8804 Section 1446 through the link below or browse more documents in our library of IRS Forms.