This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 8801

for the current year.

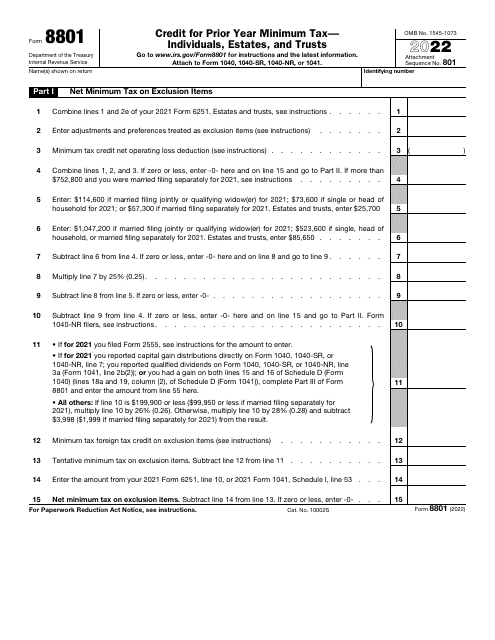

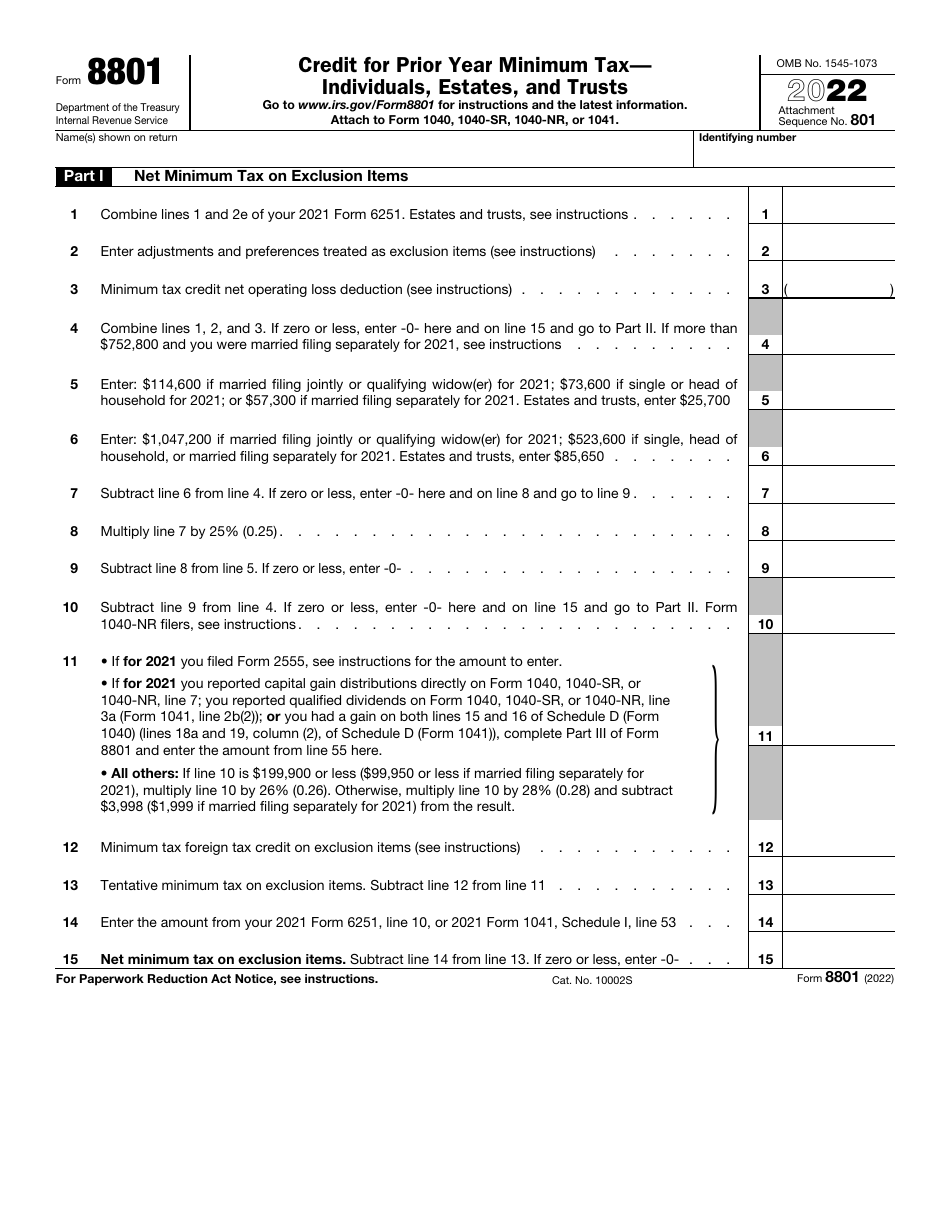

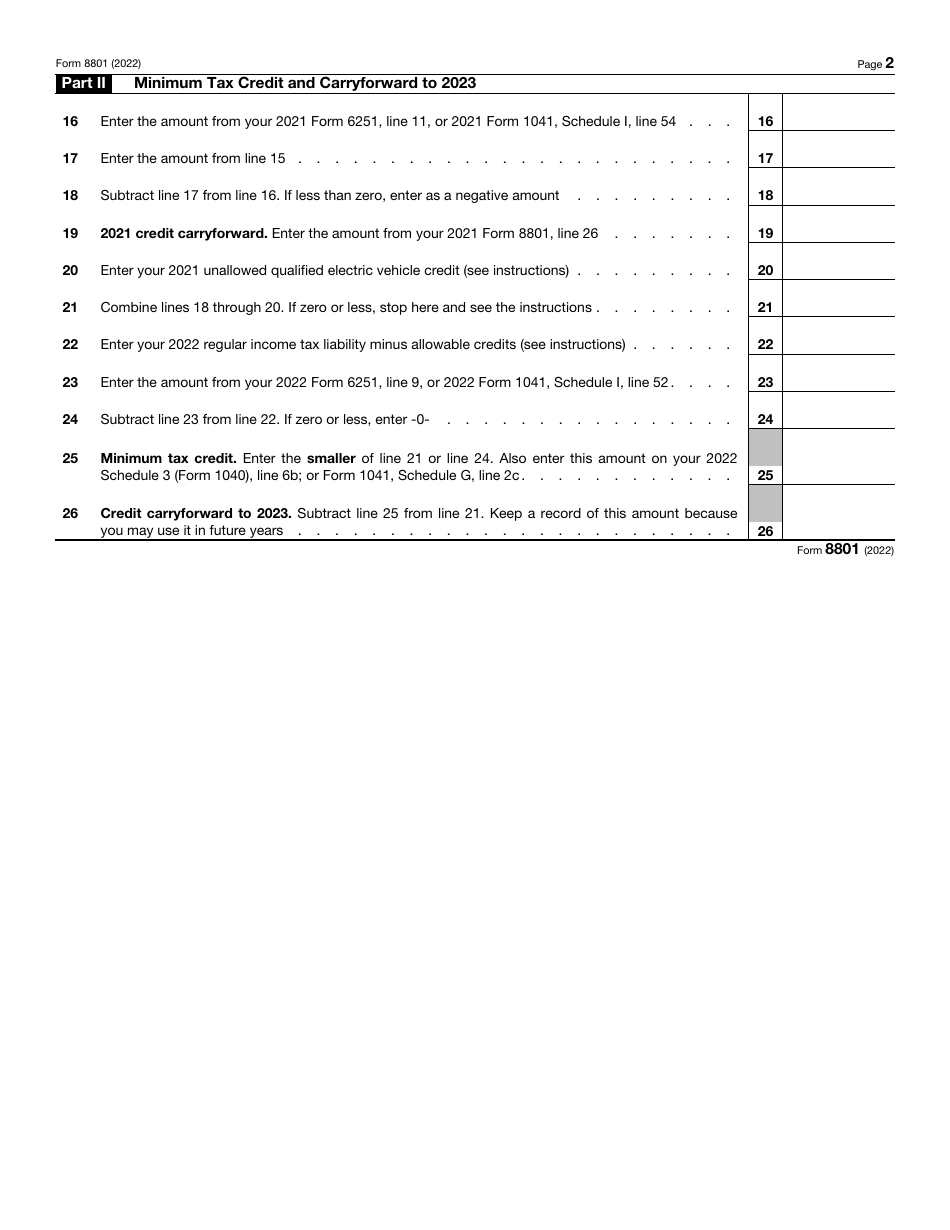

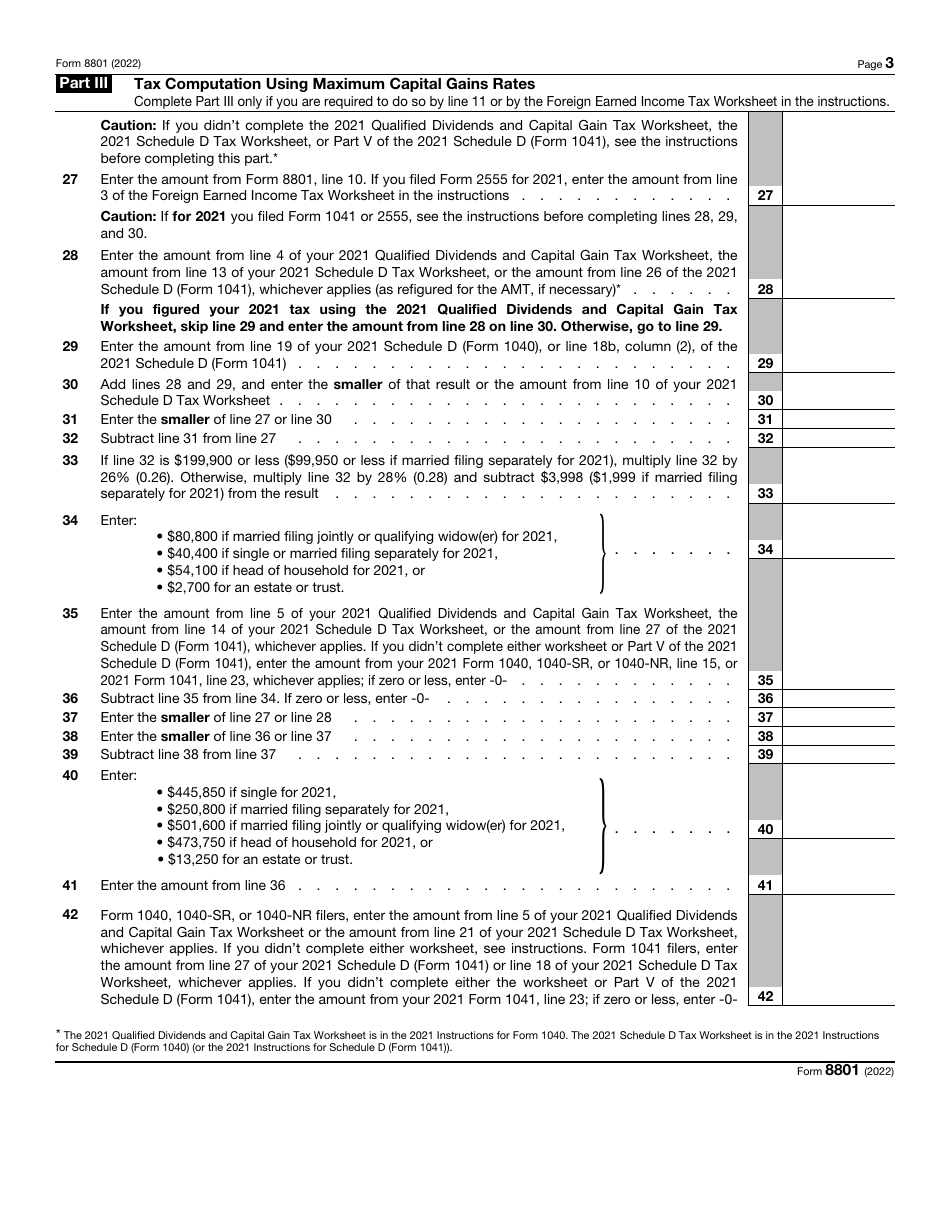

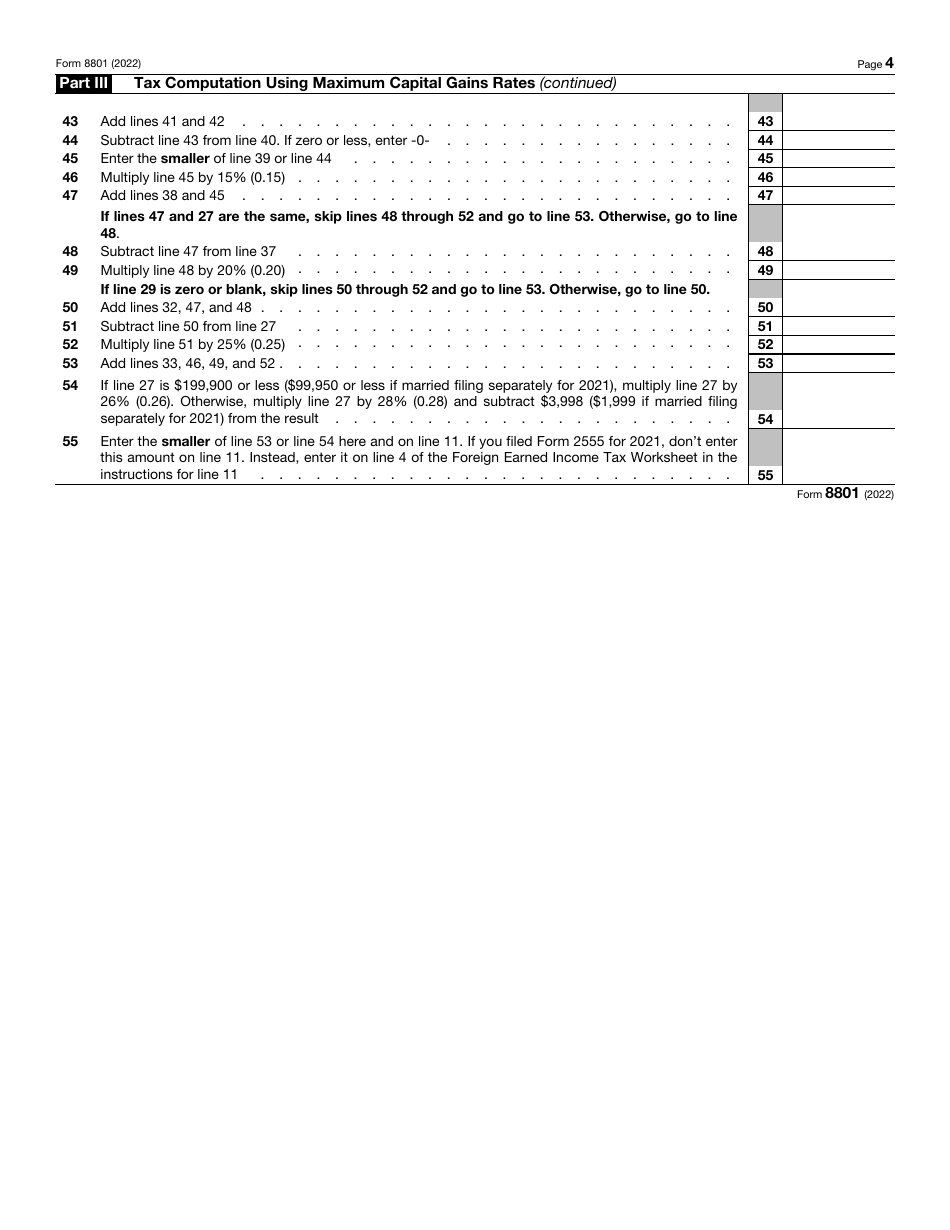

IRS Form 8801 Credit for Prior Year Minimum Tax - Individuals, Estates, and Trusts

What Is IRS Form 8801?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8801?

A: IRS Form 8801 is a form used to claim the credit for prior year minimum tax.

Q: Who can use IRS Form 8801?

A: Individuals, estates, and trusts can use IRS Form 8801.

Q: What is the credit for prior year minimum tax?

A: The credit for prior year minimum tax is a tax credit that can help offset the alternative minimum tax paid in a previous year.

Q: How do I claim the credit for prior year minimum tax?

A: You can claim the credit for prior year minimum tax by filling out and submitting IRS Form 8801 with your tax return.

Q: Can the credit for prior year minimum tax be carried forward?

A: Yes, any unused credit can be carried forward and used in future years.

Form Details:

- A 4-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8801 through the link below or browse more documents in our library of IRS Forms.