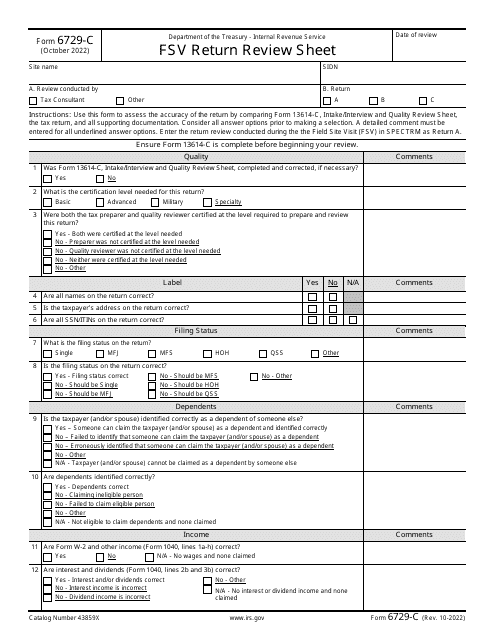

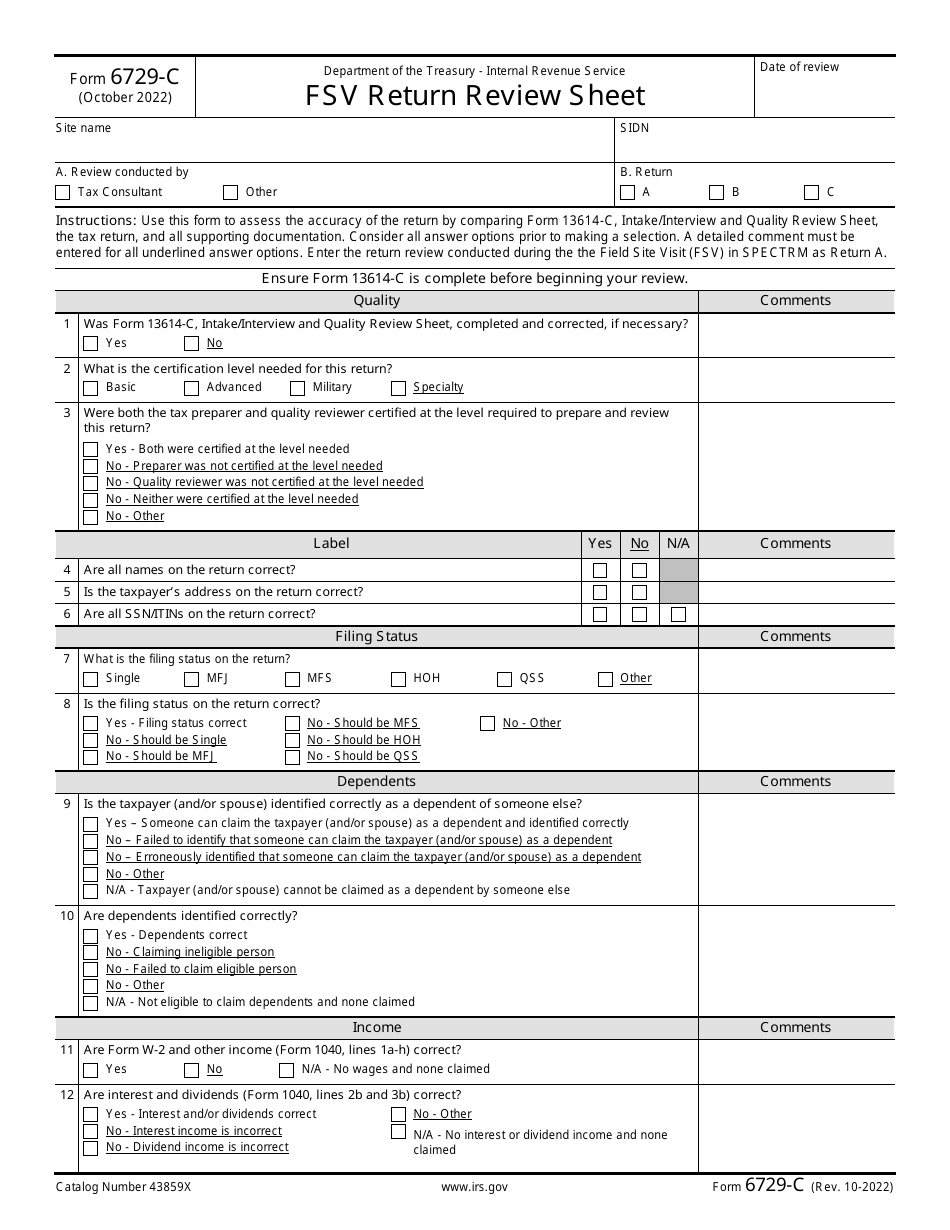

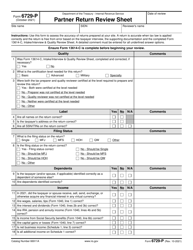

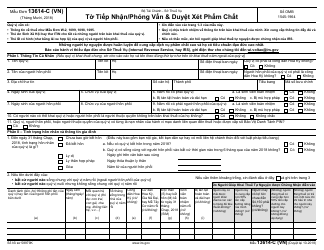

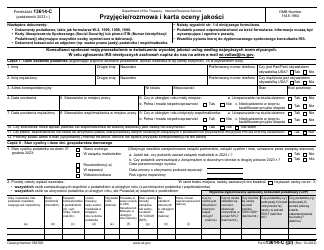

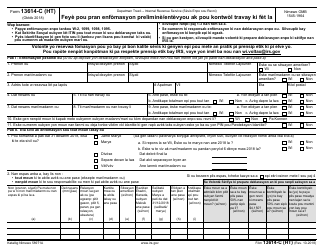

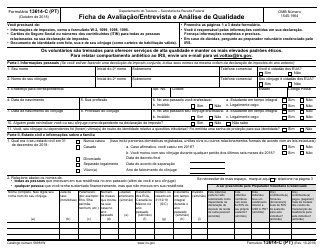

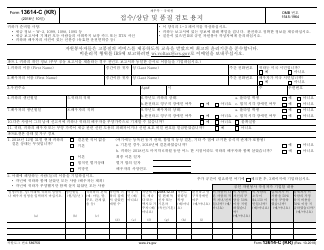

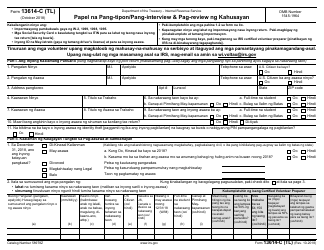

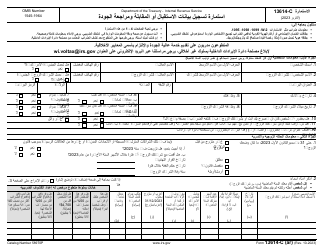

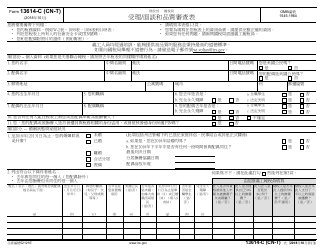

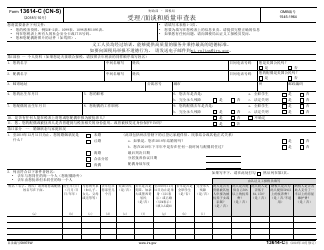

IRS Form 6729-C Fsv Return Review Sheet

What Is IRS Form 6729-C?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on October 1, 2022. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 6729-C?

A: IRS Form 6729-C is the FSV Return Review Sheet.

Q: What is the purpose of IRS Form 6729-C?

A: The purpose of IRS Form 6729-C is to review FSV (Foreign Service Volume) tax returns.

Q: Who needs to file IRS Form 6729-C?

A: IRS Form 6729-C is filed by the Internal Revenue Service (IRS) to review tax returns of individuals in the Foreign Service.

Q: What is the Foreign Service?

A: The Foreign Service refers to the U.S. diplomatic corps, including diplomats, consular officers, and other employees serving in U.S. embassies and consulates around the world.

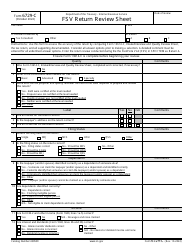

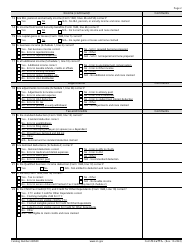

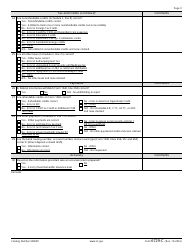

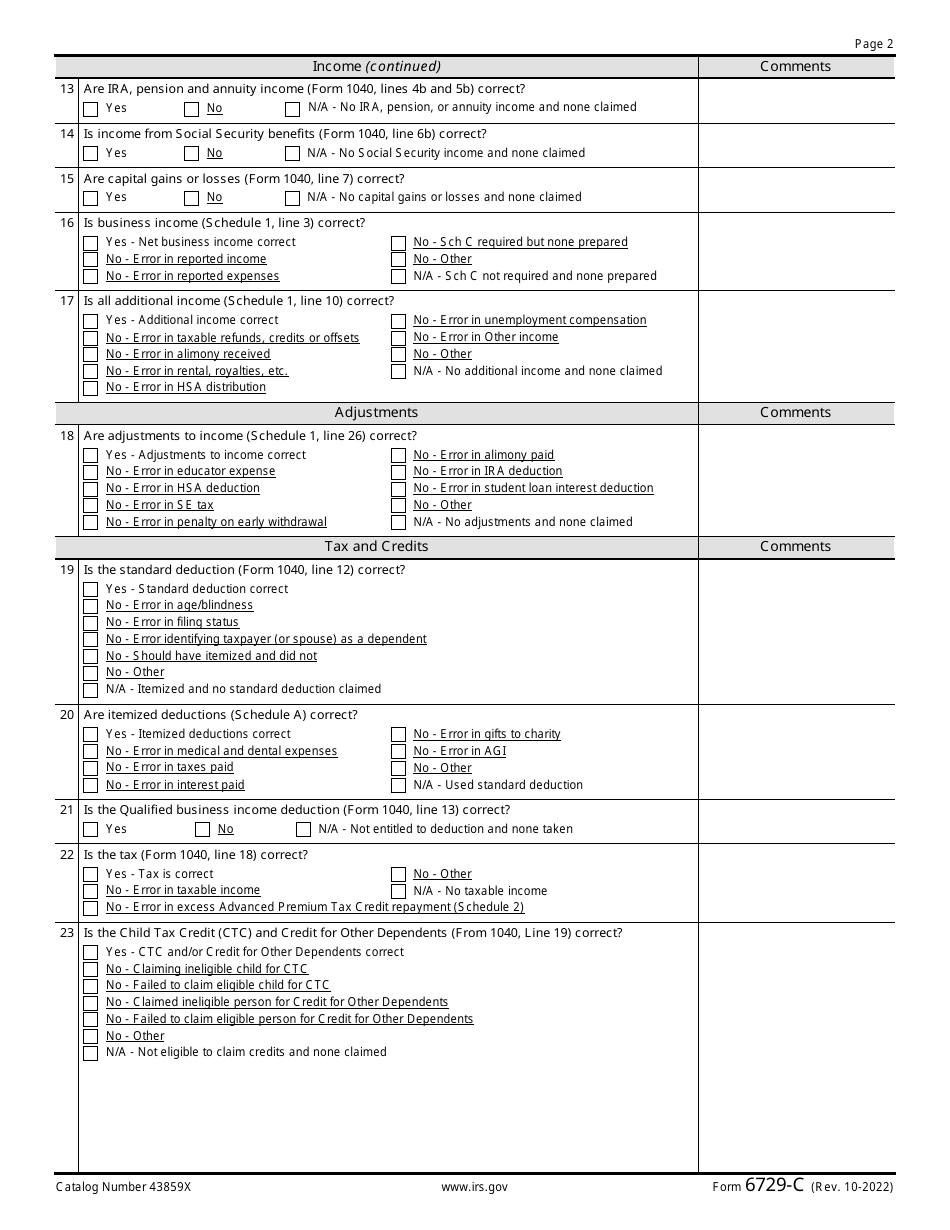

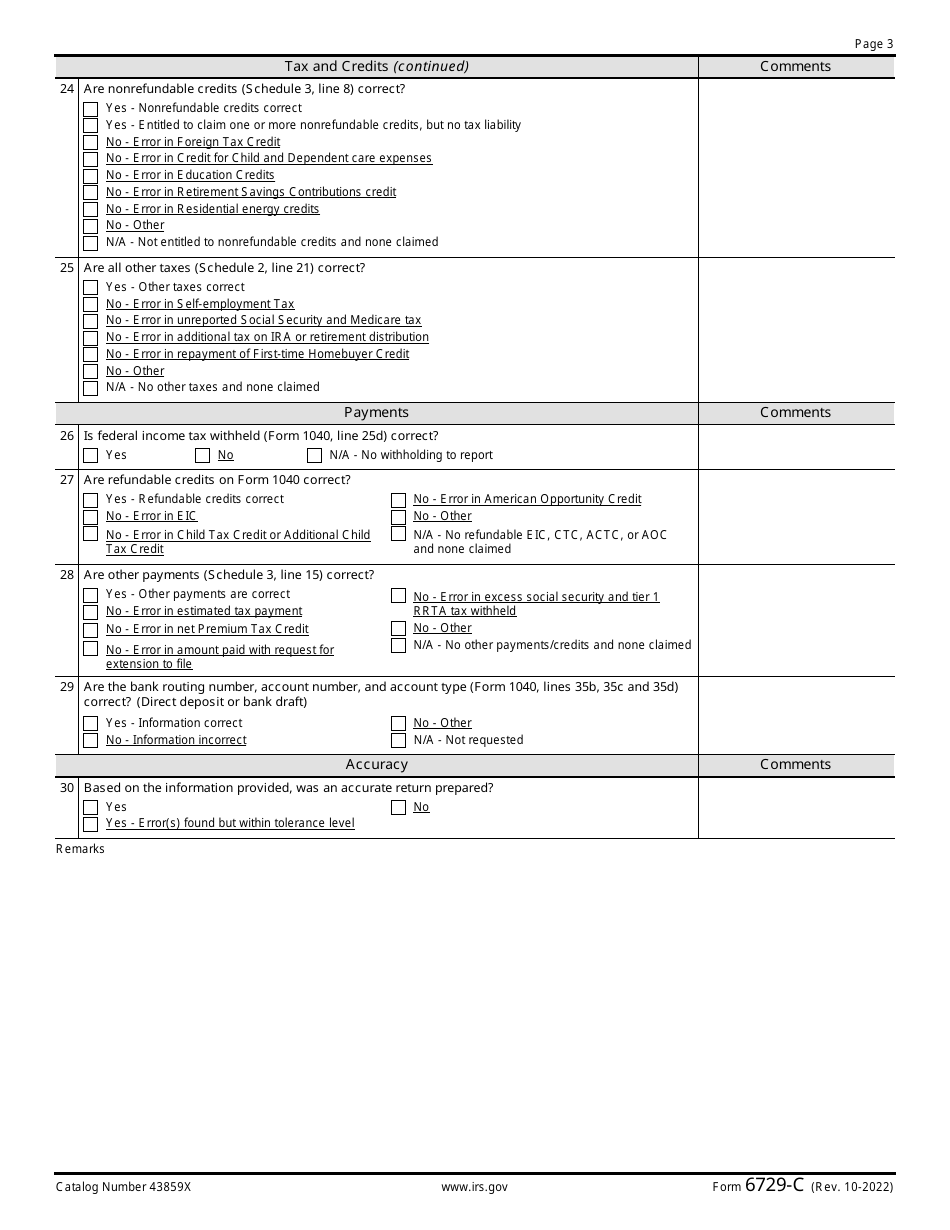

Q: What information is required on IRS Form 6729-C?

A: IRS Form 6729-C requires information related to the taxpayer's Foreign Service status and details of their tax return for review purposes.

Form Details:

- A 3-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 6729-C through the link below or browse more documents in our library of IRS Forms.