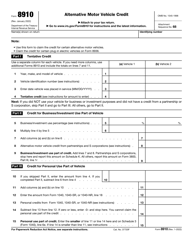

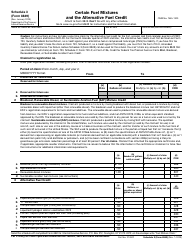

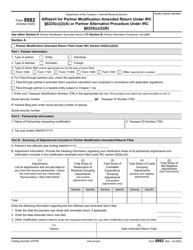

This version of the form is not currently in use and is provided for reference only. Download this version of

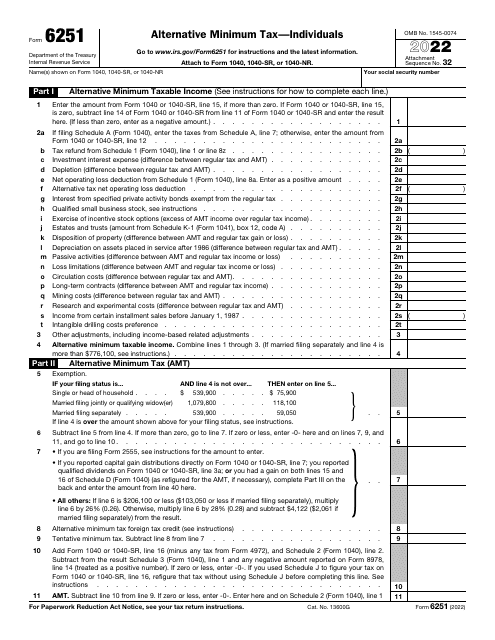

IRS Form 6251

for the current year.

IRS Form 6251 Alternative Minimum Tax - Individuals

What Is IRS Form 6251?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 6251?

A: IRS Form 6251 is the Alternative Minimum Tax form for individuals.

Q: Who needs to file Form 6251?

A: Individuals who meet certain criteria and are subject to the Alternative Minimum Tax (AMT) may need to file Form 6251.

Q: What is the Alternative Minimum Tax (AMT)?

A: The Alternative Minimum Tax is a separate tax calculation that ensures individuals with high incomes and certain deductions still pay a minimum amount of tax.

Q: What does Form 6251 calculate?

A: Form 6251 calculates the amount of Alternative Minimum Tax owed by an individual.

Q: How do I know if I owe Alternative Minimum Tax?

A: You may owe Alternative Minimum Tax if you have certain types of income and deductions, such as significant capital gains or a large number of itemized deductions.

Q: When is the deadline to file Form 6251?

A: The deadline to file Form 6251 is the same as the regular tax filing deadline, which is April 15th of each year (or the next business day if April 15th falls on a weekend or holiday).

Form Details:

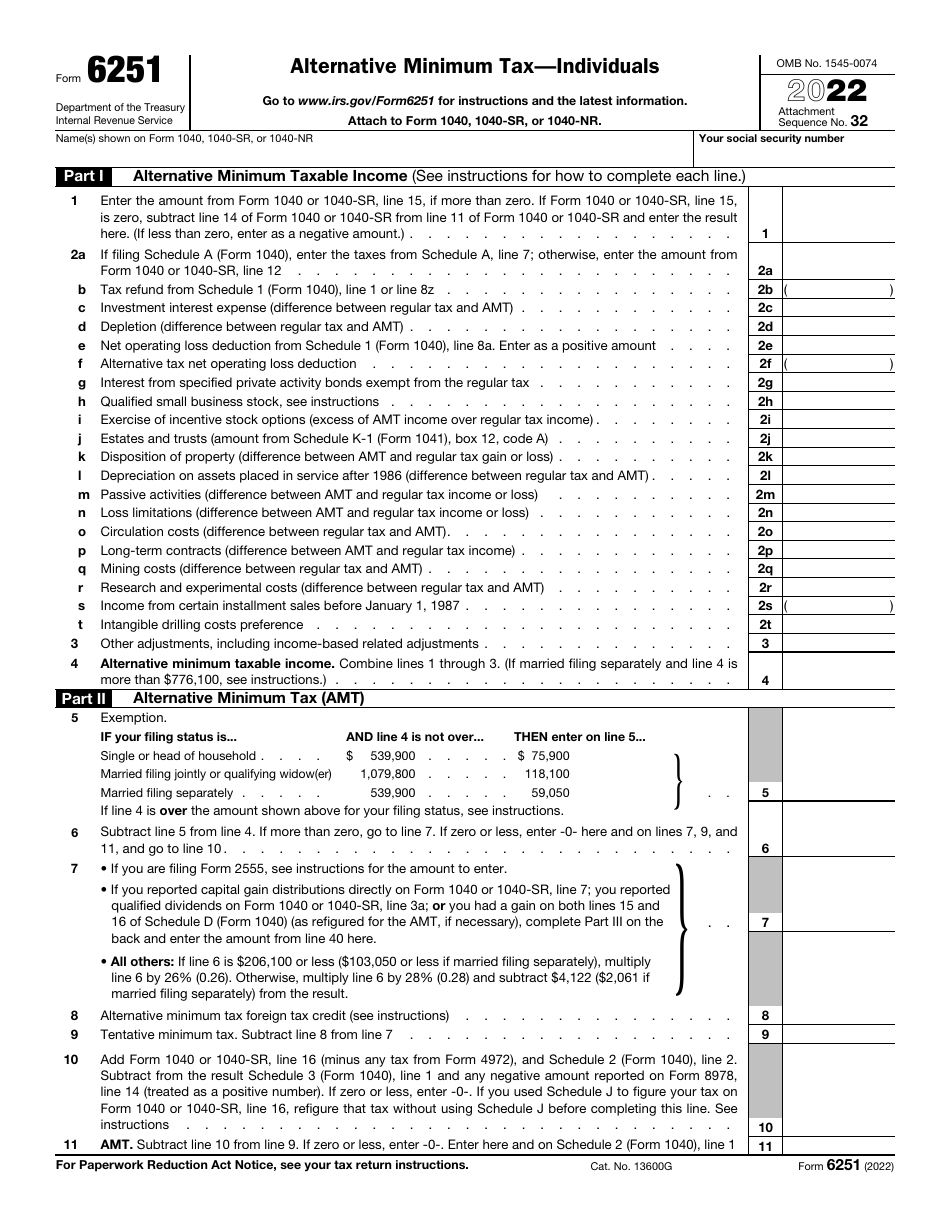

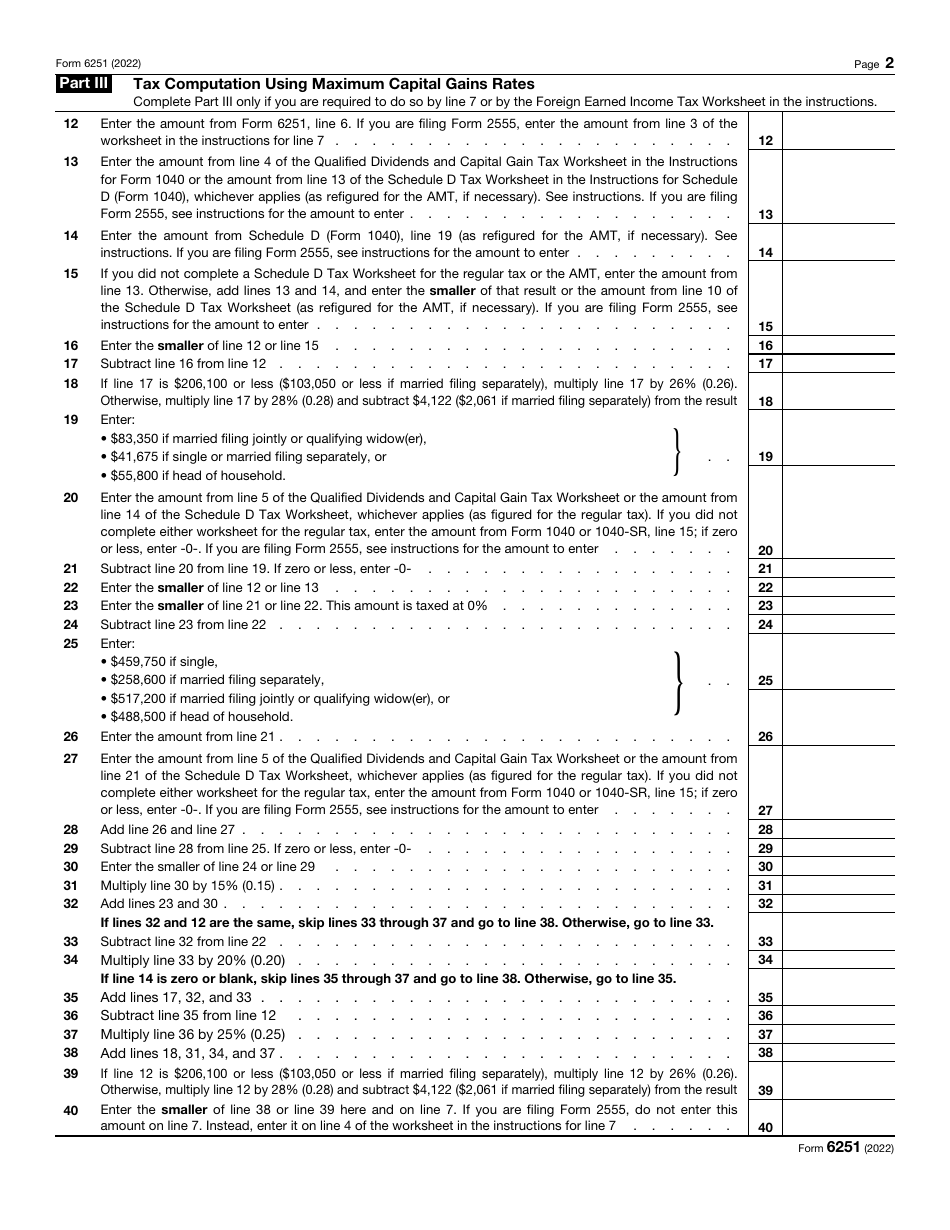

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 6251 through the link below or browse more documents in our library of IRS Forms.