This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 5227

for the current year.

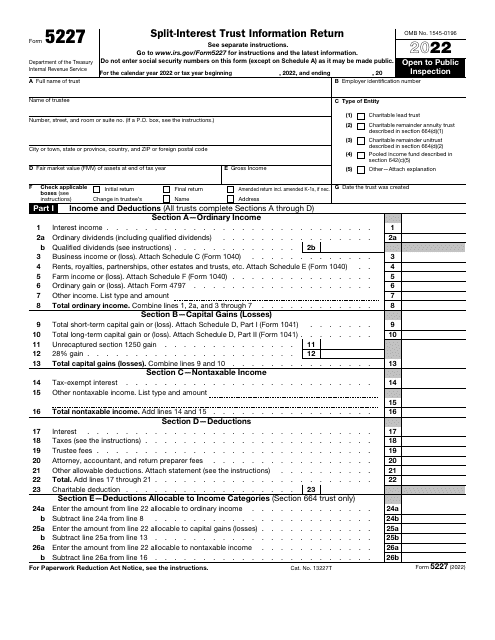

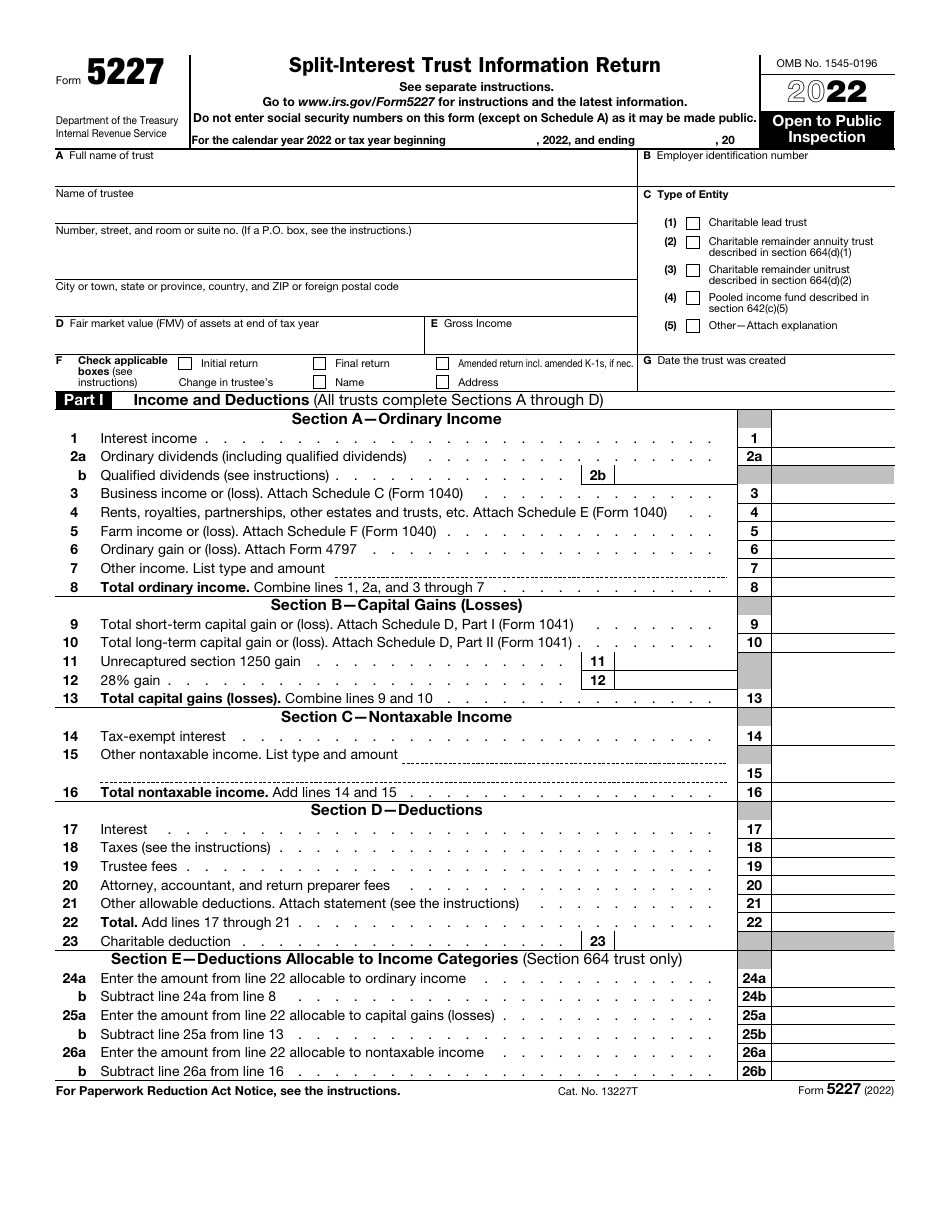

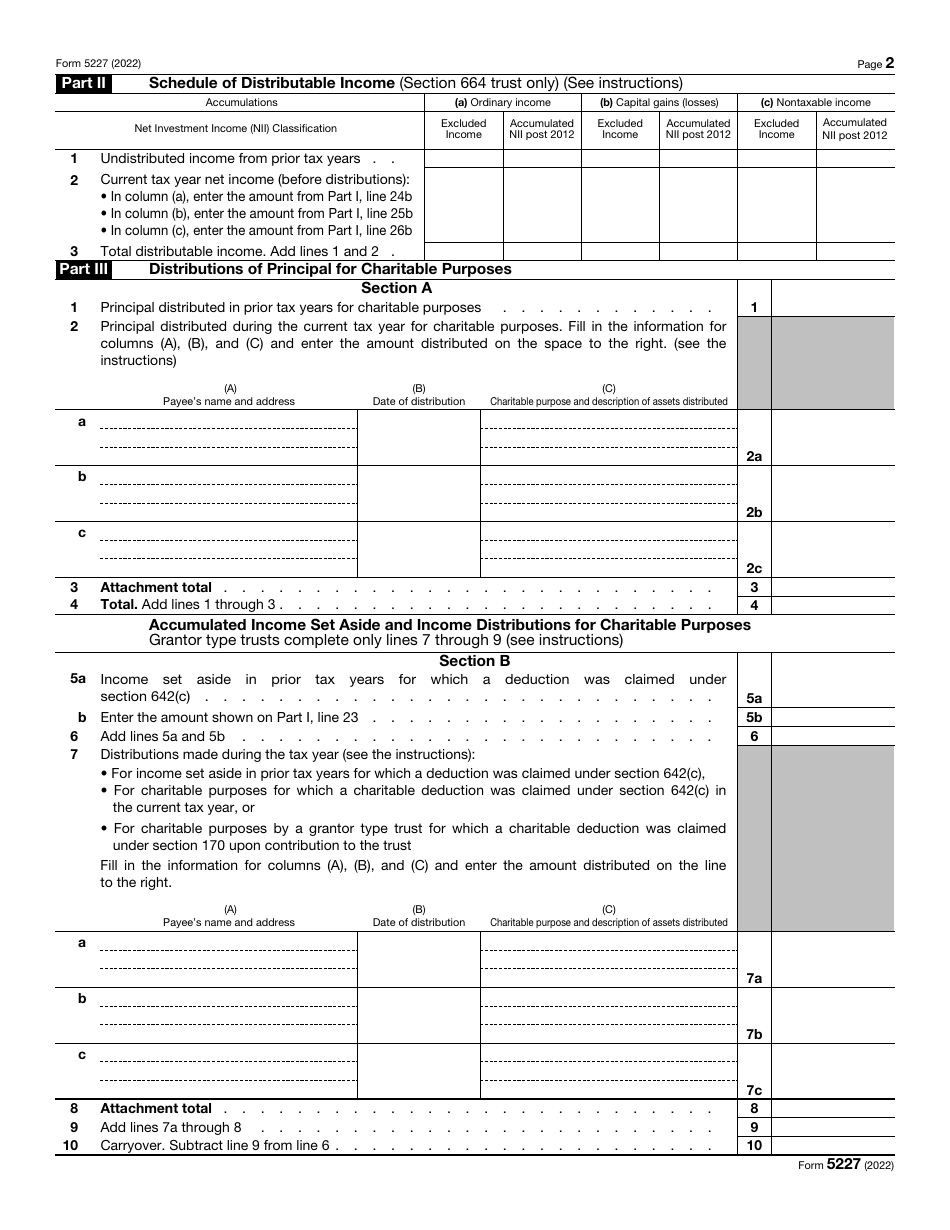

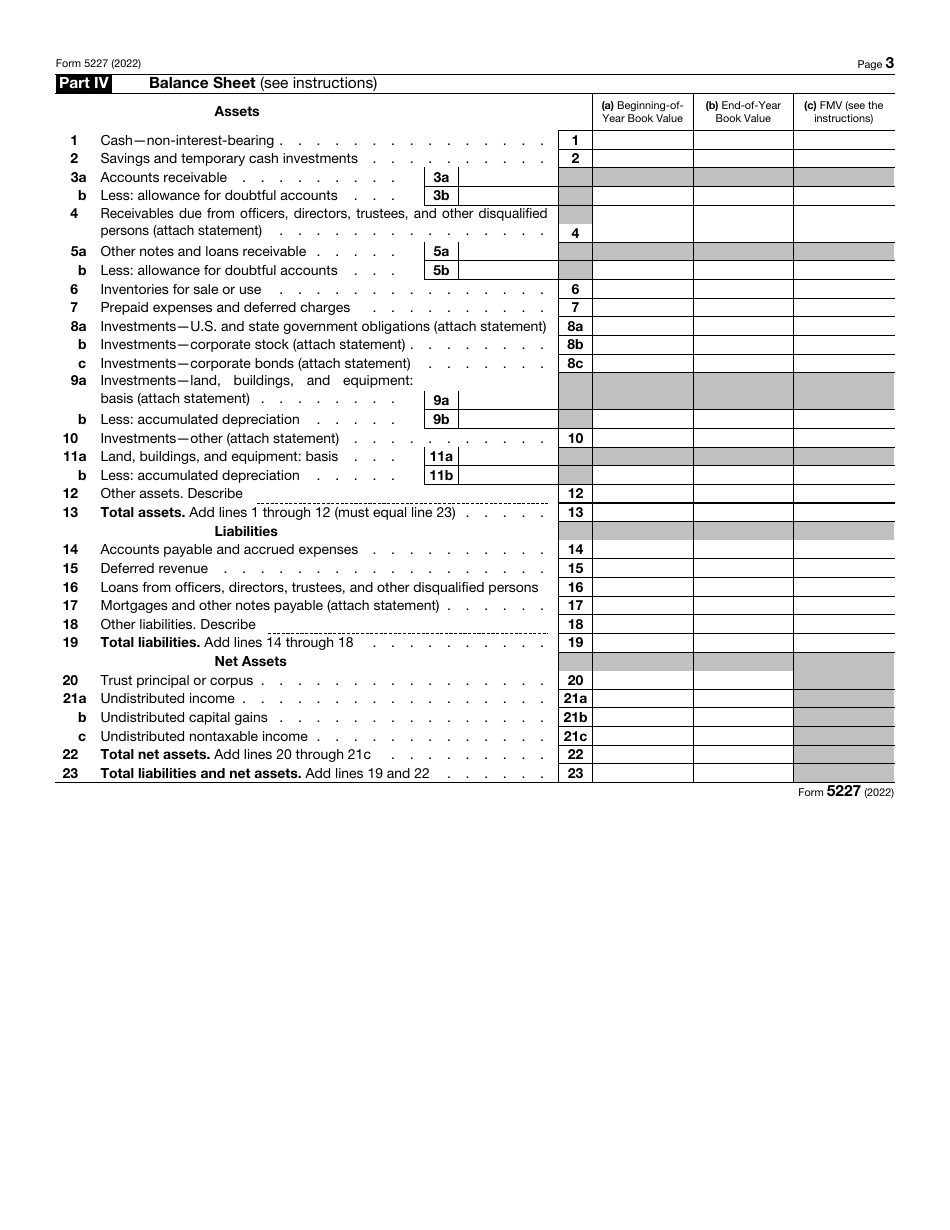

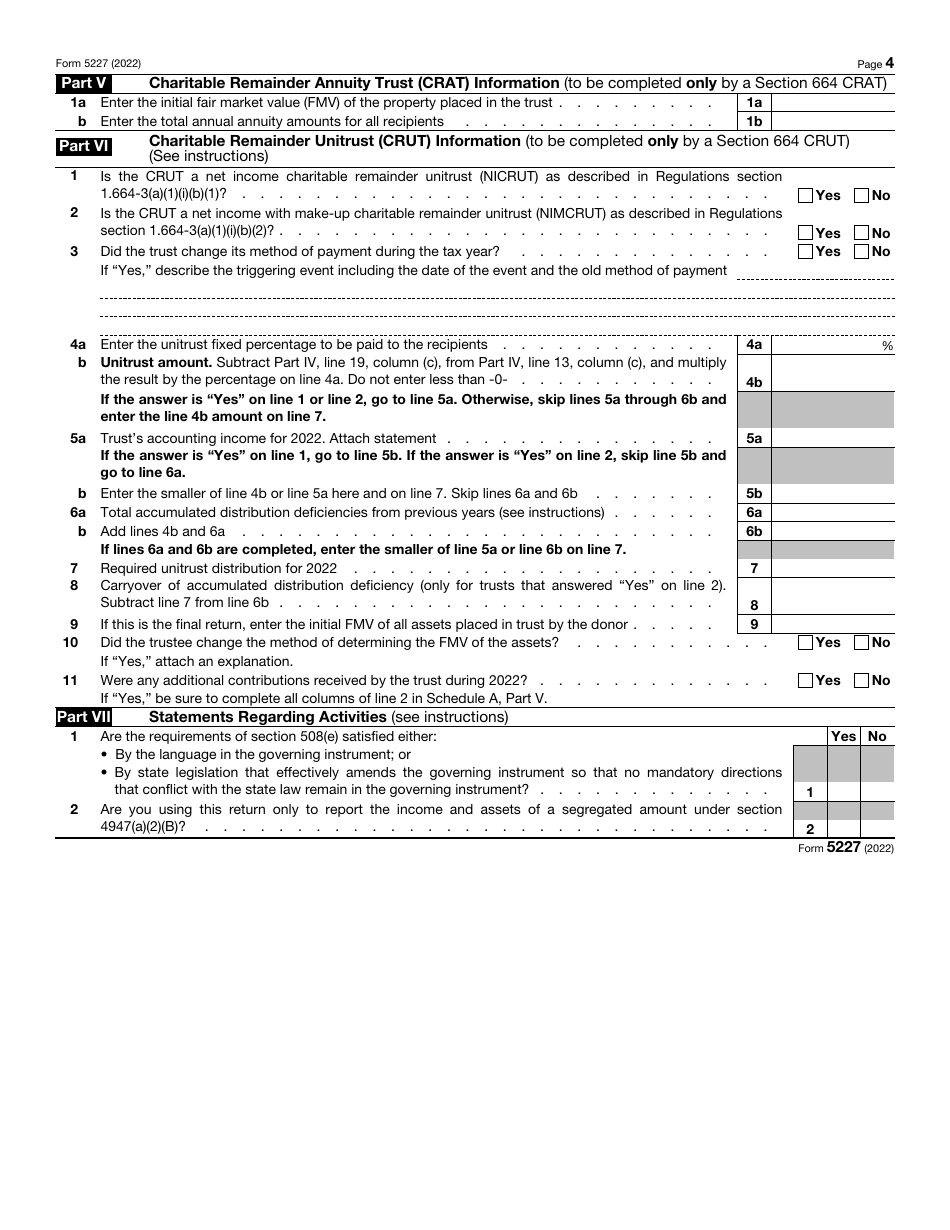

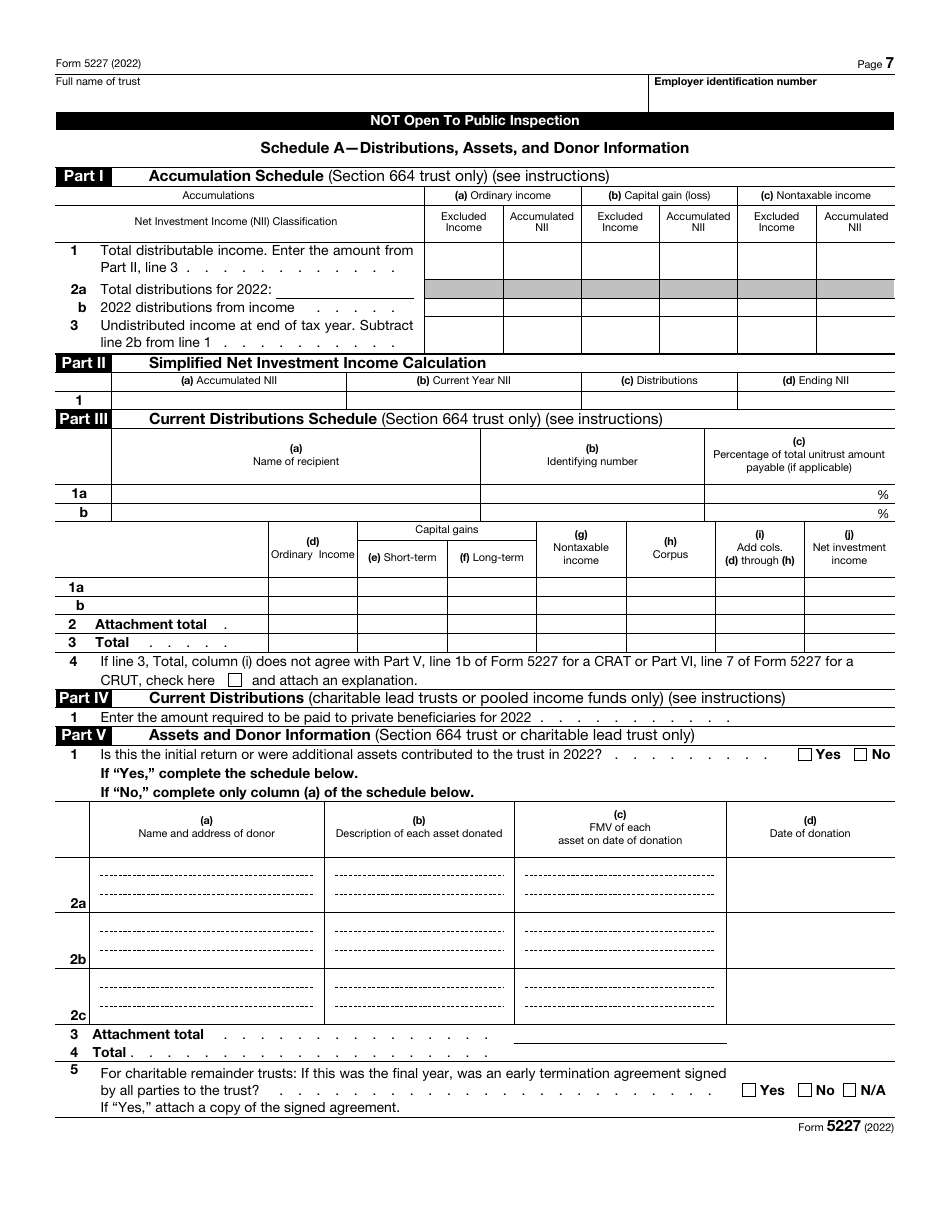

IRS Form 5227 Split-Interest Trust Information Return

What Is IRS Form 5227?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 5227?

A: IRS Form 5227 is the Split-Interest Trust Information Return.

Q: Who needs to file IRS Form 5227?

A: Split-interest trusts, such as charitable remainder trusts and charitable lead trusts, need to file IRS Form 5227.

Q: What information is required on IRS Form 5227?

A: IRS Form 5227 requires information about the trust, its assets, income, and distributions.

Q: When is the deadline to file IRS Form 5227?

A: The deadline to file IRS Form 5227 is typically April 15th, unless an extension has been granted.

Q: What is the purpose of filing IRS Form 5227?

A: The purpose of filing IRS Form 5227 is to report the financial activities of a split-interest trust to the IRS.

Q: Are there any penalties for not filing IRS Form 5227?

A: Yes, there may be penalties for not filing IRS Form 5227 or for filing it late.

Q: Can I e-file IRS Form 5227?

A: Currently, IRS Form 5227 cannot be e-filed and must be filed by mail or hand-delivered.

Form Details:

- A 7-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 5227 through the link below or browse more documents in our library of IRS Forms.