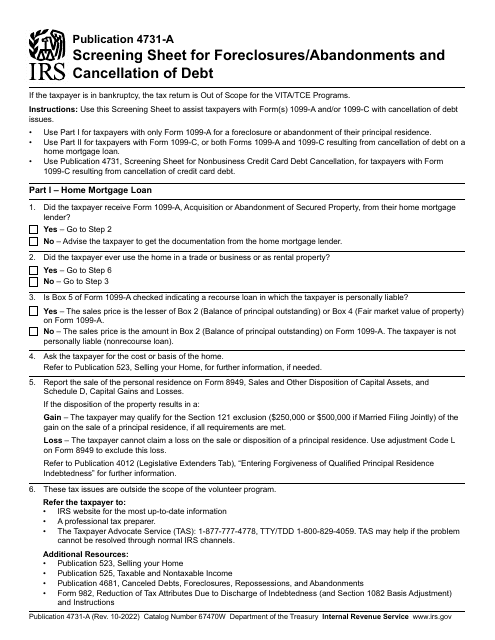

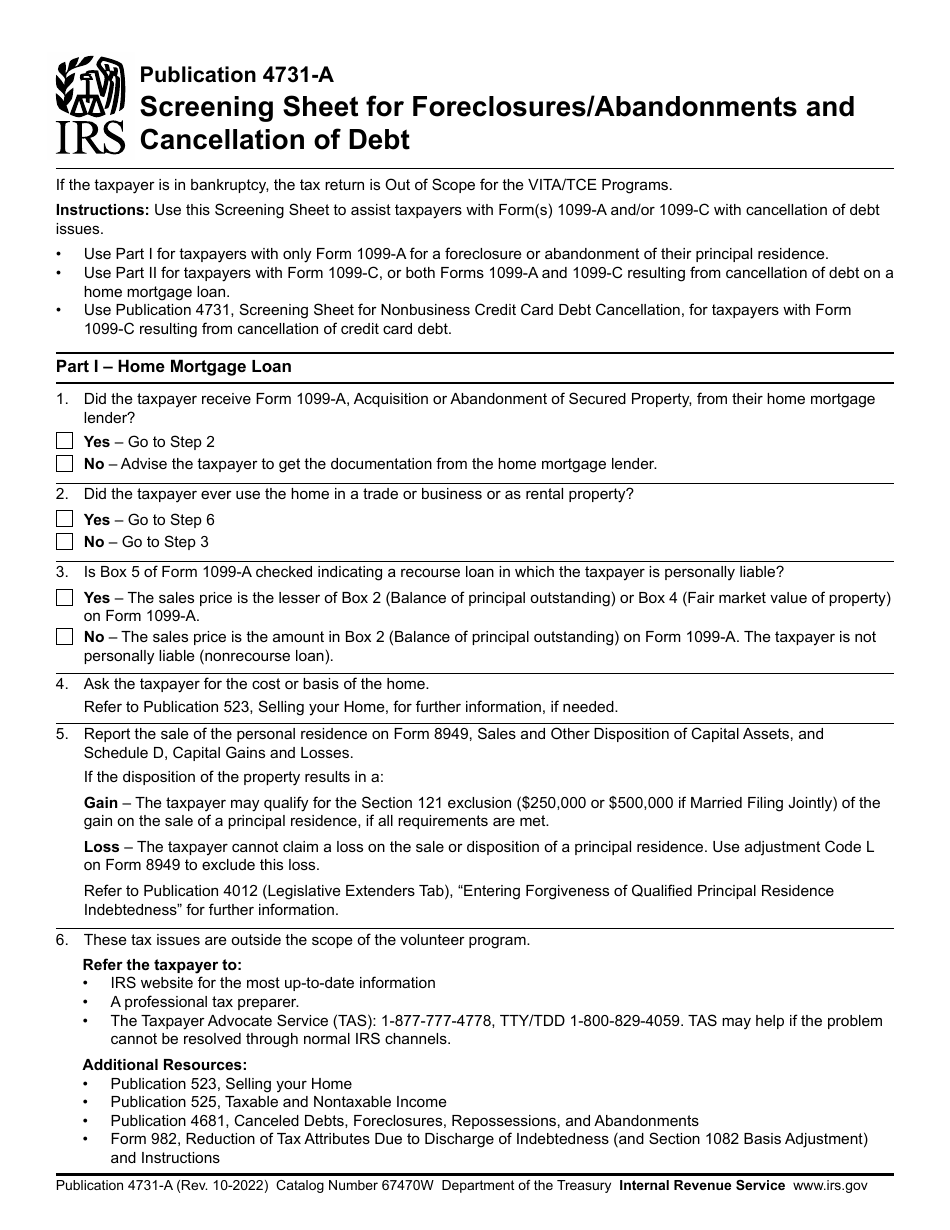

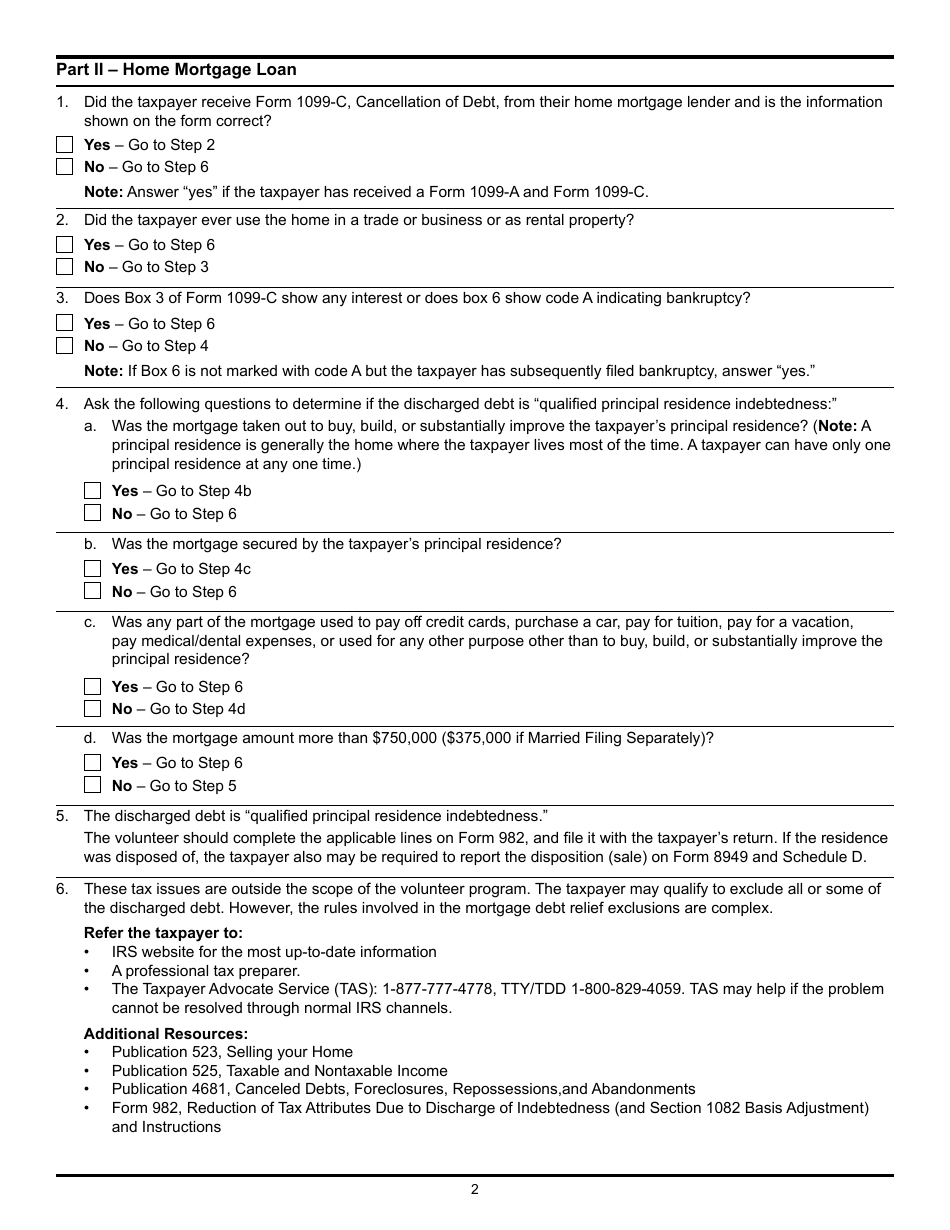

IRS Form 4731-A Screening Sheet for Foreclosures / Abandonments and Cancellation of Debt

What Is IRS Form 4731-A?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on October 1, 2022. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 4731-A used for?

A: IRS Form 4731-A is used for screening foreclosures/abandonments and cancellation of debt.

Q: What information is required on IRS Form 4731-A?

A: IRS Form 4731-A requires specific information related to foreclosures/abandonments and cancellation of debt.

Q: Do I need to file IRS Form 4731-A if I haven't foreclosed or abandoned property?

A: No, IRS Form 4731-A is only necessary if you have experienced a foreclosure or abandonment or have had debt canceled.

Q: What should I do if I have questions about filling out IRS Form 4731-A?

A: If you have questions about filling out IRS Form 4731-A, you can contact the IRS directly or seek assistance from a tax professional.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a printable version of IRS Form 4731-A through the link below or browse more documents in our library of IRS Forms.