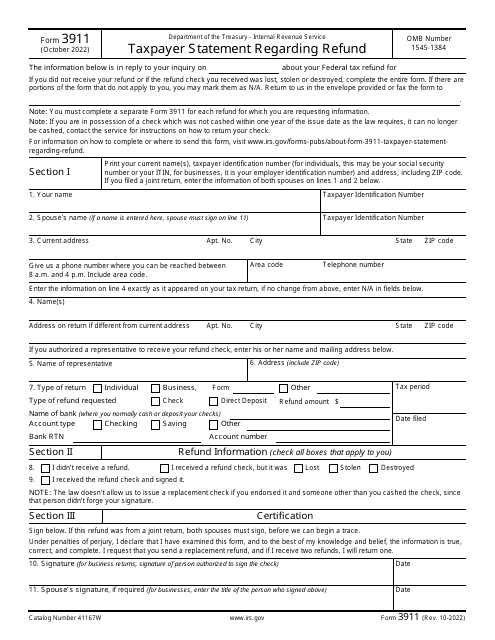

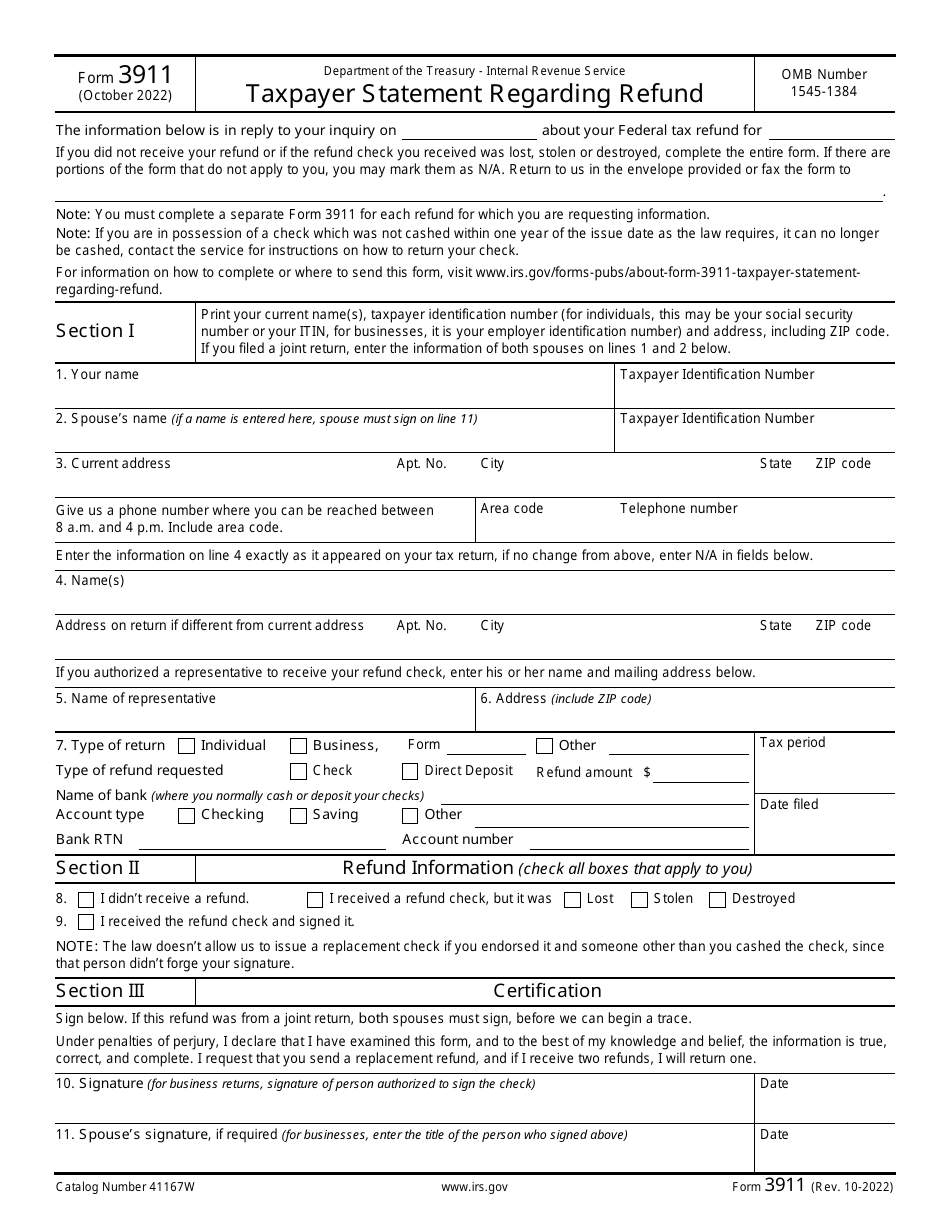

IRS Form 3911 Taxpayer Statement Regarding Refund

What Is IRS Form 3911?

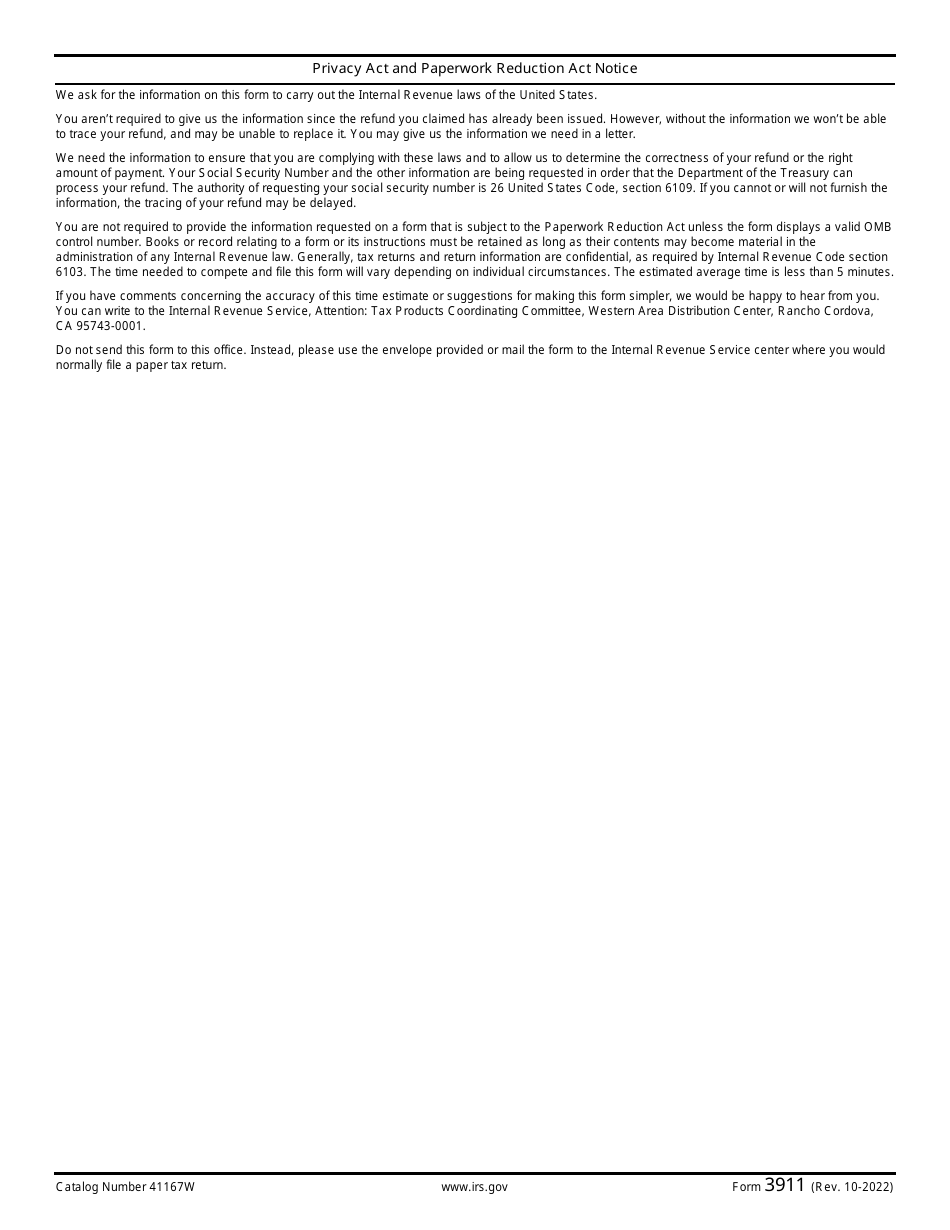

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on October 1, 2022. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 3911?

A: IRS Form 3911 is a taxpayer statement used to notify the IRS of a missing, lost, or stolen refund check.

Q: How do I fill out IRS Form 3911?

A: Fill out the required information, including your personal details, refund amount, and reason for requesting a replacement check.

Q: How long does it take to receive a replacement check after submitting IRS Form 3911?

A: It typically takes about six weeks for the IRS to process your request and issue a replacement check, but it may vary.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- A Spanish version of IRS Form 3911 is available for spanish-speaking filers;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 3911 through the link below or browse more documents in our library of IRS Forms.