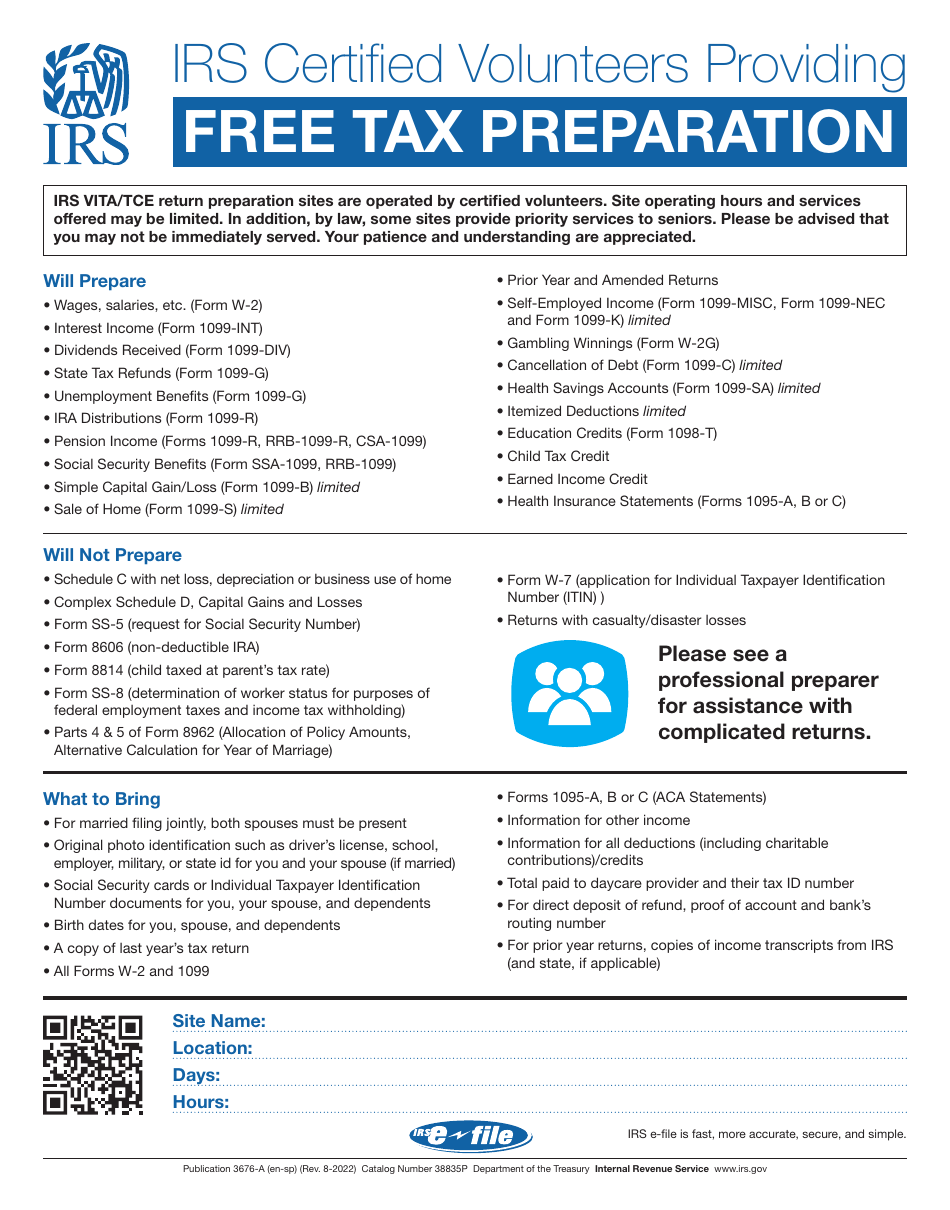

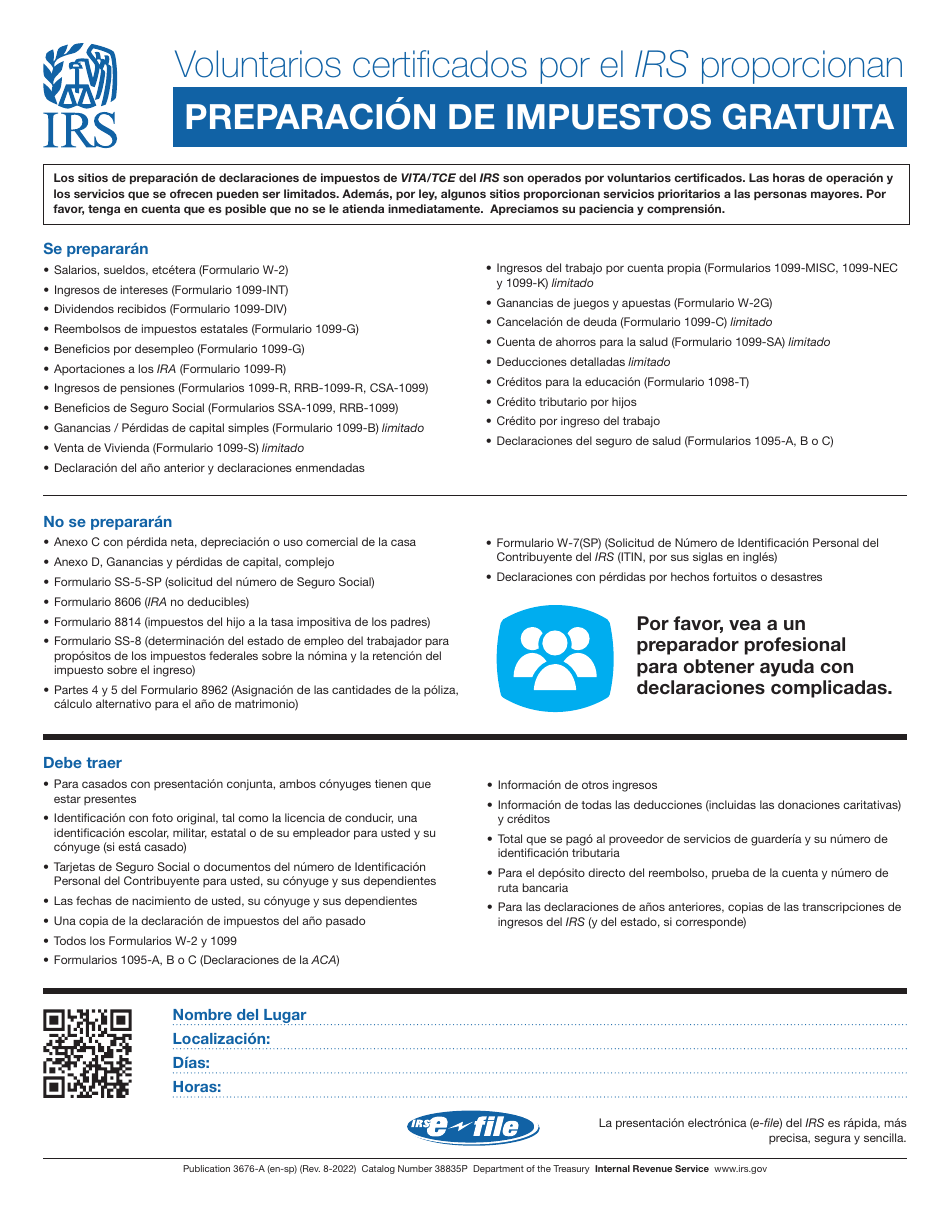

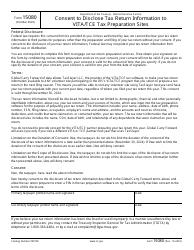

IRS Certified Volunteers Providing Free Tax Preparation (English / Spanish)

IRS Certified Volunteers Providing Free Tax Preparation is a 2-page tax-related document that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on August 1, 2022.

FAQ

Q: What is IRS certified volunteer tax preparation?

A: IRS certified volunteer tax preparation is a service provided by trained volunteers to help individuals with their tax returns, free of charge.

Q: What do IRS certified volunteers do?

A: IRS certified volunteers assist individuals in preparing their tax returns accurately and help them understand their tax obligations.

Q: Is the tax preparation service available in both English and Spanish?

A: Yes, the tax preparation service is available in both English and Spanish.

Q: Who can use the free tax preparation service?

A: The free tax preparation service is available to individuals who meet certain income requirements.

Q: How can I find an IRS certified volunteer tax preparation site?

A: You can find an IRS certified volunteer tax preparation site near you by using the IRS's free tax preparation site locator tool.

Q: Is there an age restriction for using the free tax preparation service?

A: There is no age restriction for using the free tax preparation service. It is available to individuals of all ages.

Q: How can I volunteer to become an IRS certified tax preparer?

A: You can volunteer to become an IRS certified tax preparer by contacting organizations that offer volunteer tax preparation programs.

Q: Are there any fees associated with the tax preparation service?

A: No, the tax preparation service provided by IRS certified volunteers is free of charge.

Q: Is the tax preparation service available year-round?

A: The availability of the tax preparation service may vary, but it is generally offered during the tax filing season, which is usually from January to April.

Q: What should I bring to the tax preparation appointment?

A: You should bring all necessary documents such as income statements, W-2 forms, and any relevant deductions or credits to your tax preparation appointment.

Form Details:

- Available for download in PDF;

- Actual and valid for 2023;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a printable version of the form through the link below or browse more documents in our library of IRS Forms.