This version of the form is not currently in use and is provided for reference only. Download this version of

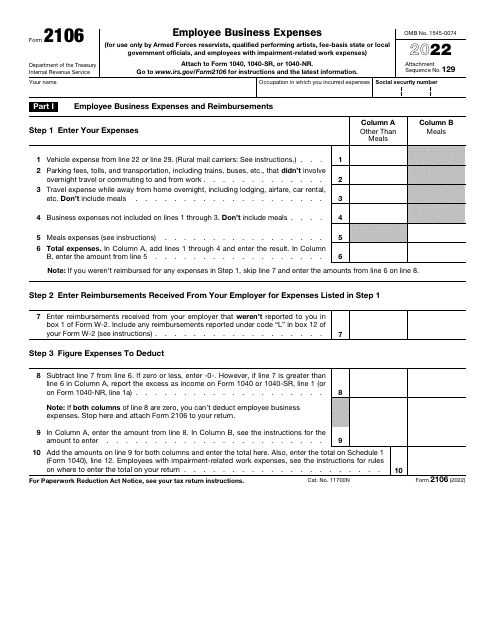

IRS Form 2106

for the current year.

IRS Form 2106 Employee Business Expenses

What Is IRS Form 2106?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 2106?

A: IRS Form 2106 is a tax form used to report employee business expenses.

Q: Who needs to fill out IRS Form 2106?

A: Employees who have unreimbursed business expenses and want to deduct them on their tax return need to fill out IRS Form 2106.

Q: What expenses can be included on IRS Form 2106?

A: Common expenses that can be included on Form 2106 are travel, meals, entertainment, home office expenses, and job-related education.

Q: Can I deduct all of my business expenses on IRS Form 2106?

A: No, there are certain limitations and restrictions on what expenses can be deducted.

Q: When is the deadline to file IRS Form 2106?

A: IRS Form 2106 is typically filed along with your annual tax return, which is due on April 15th, unless it falls on a weekend or holiday.

Q: Can I e-file IRS Form 2106?

A: Yes, you can e-file IRS Form 2106 if you are submitting your tax return electronically.

Q: What happens if I don't submit IRS Form 2106?

A: If you have eligible expenses and don't submit Form 2106, you may miss out on potential tax deductions.

Q: Is there a limit to how much I can deduct on IRS Form 2106?

A: Yes, there are certain limits and thresholds for different types of expenses.

Form Details:

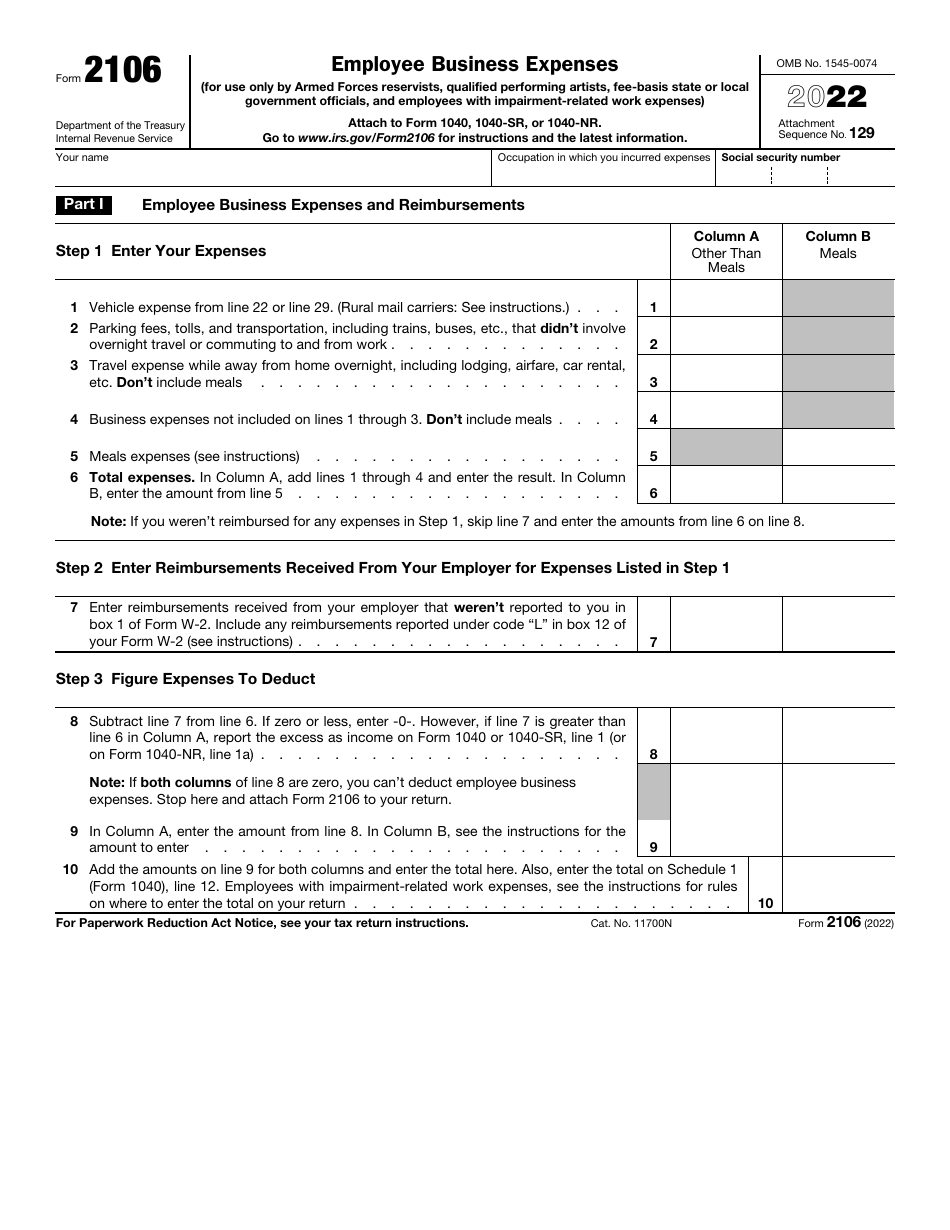

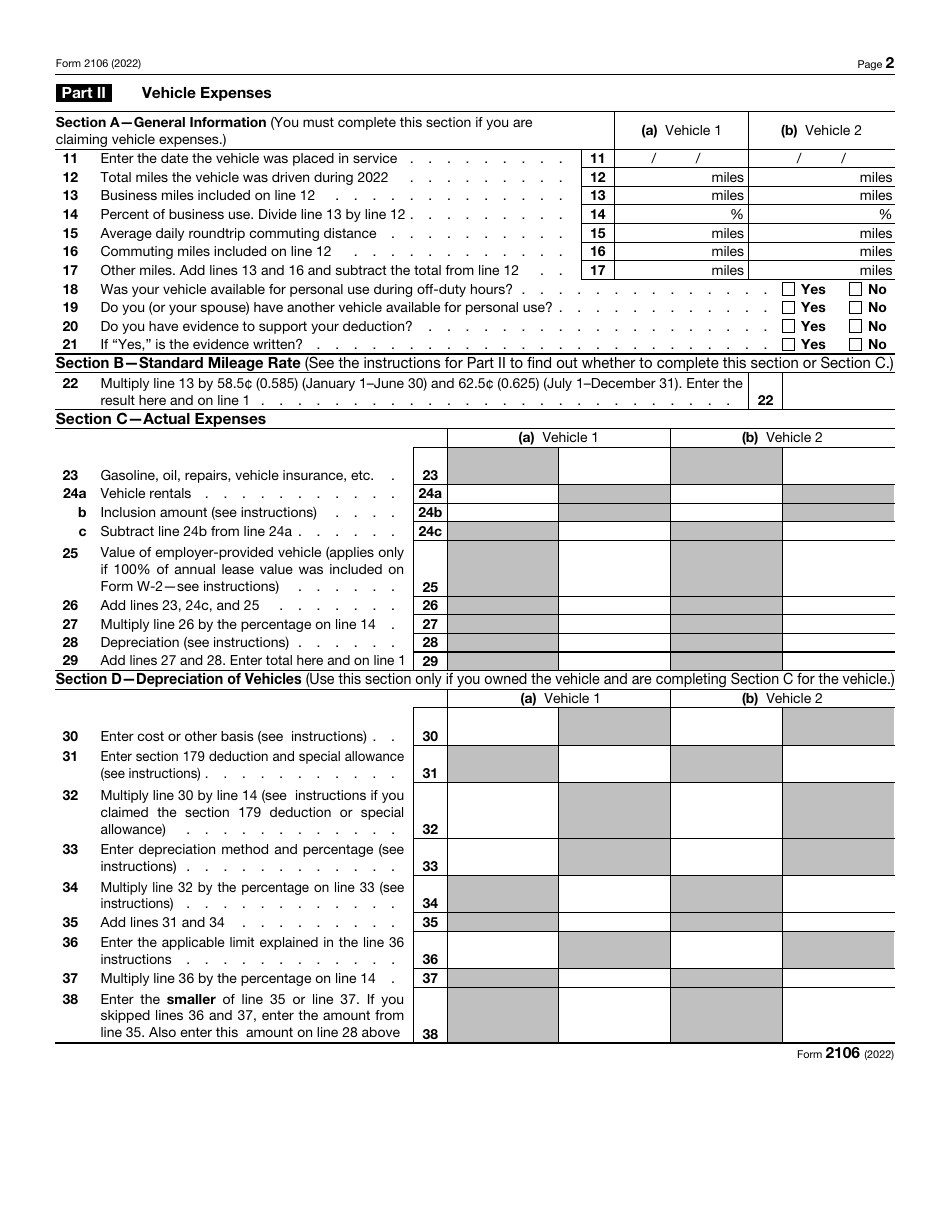

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 2106 through the link below or browse more documents in our library of IRS Forms.