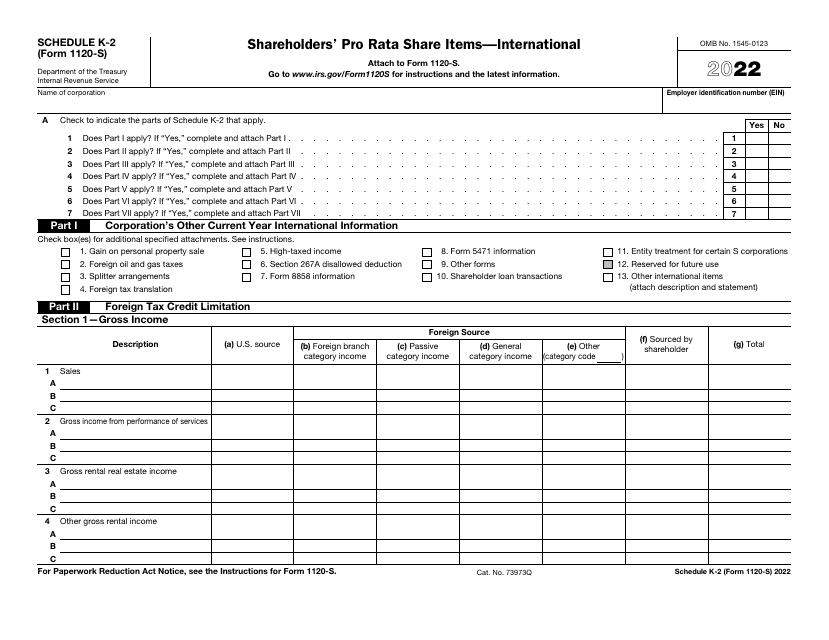

This version of the form is not currently in use and is provided for reference only. Download this version of

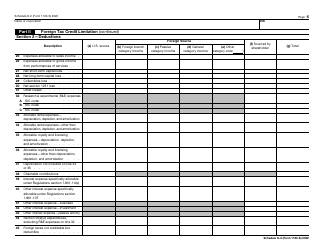

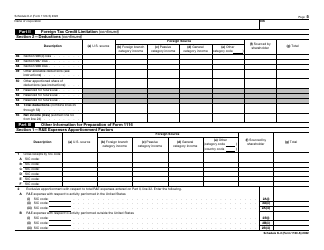

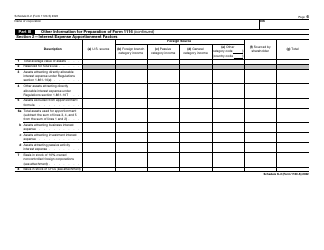

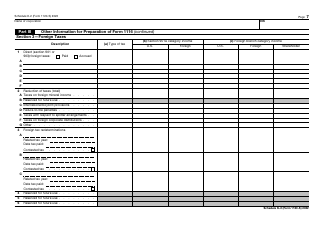

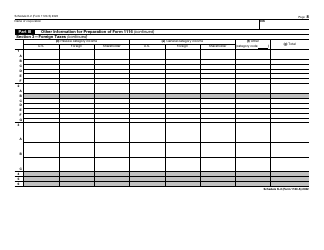

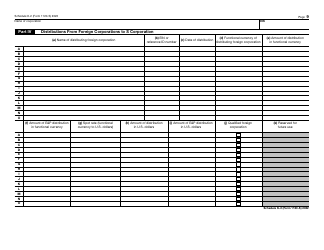

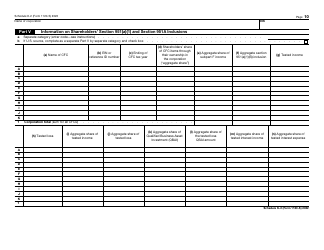

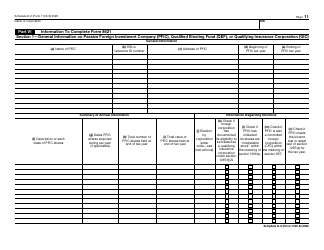

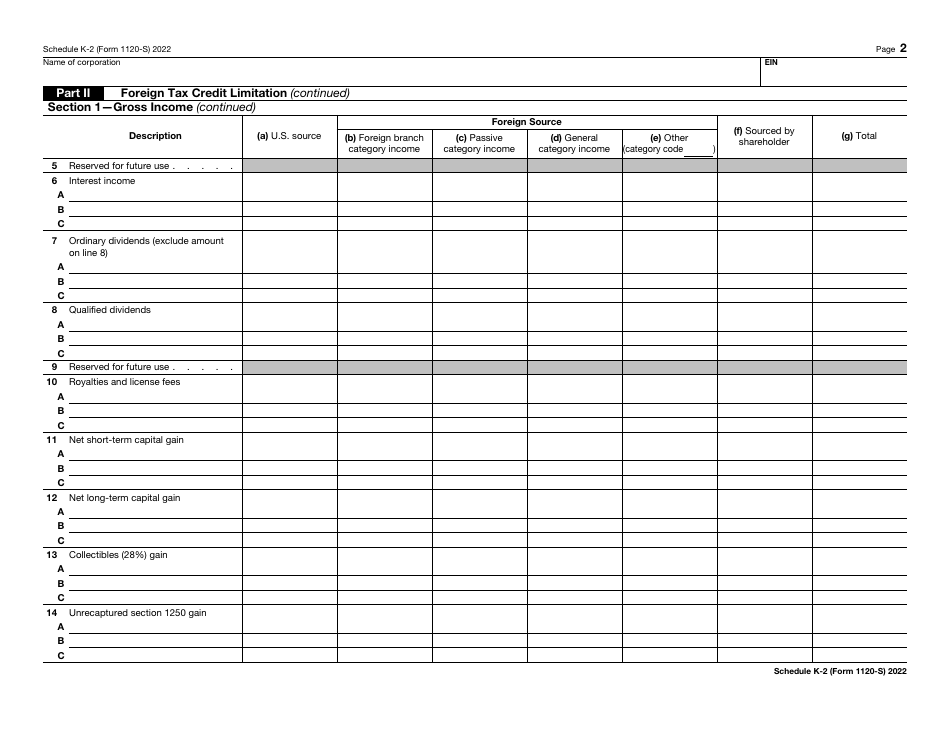

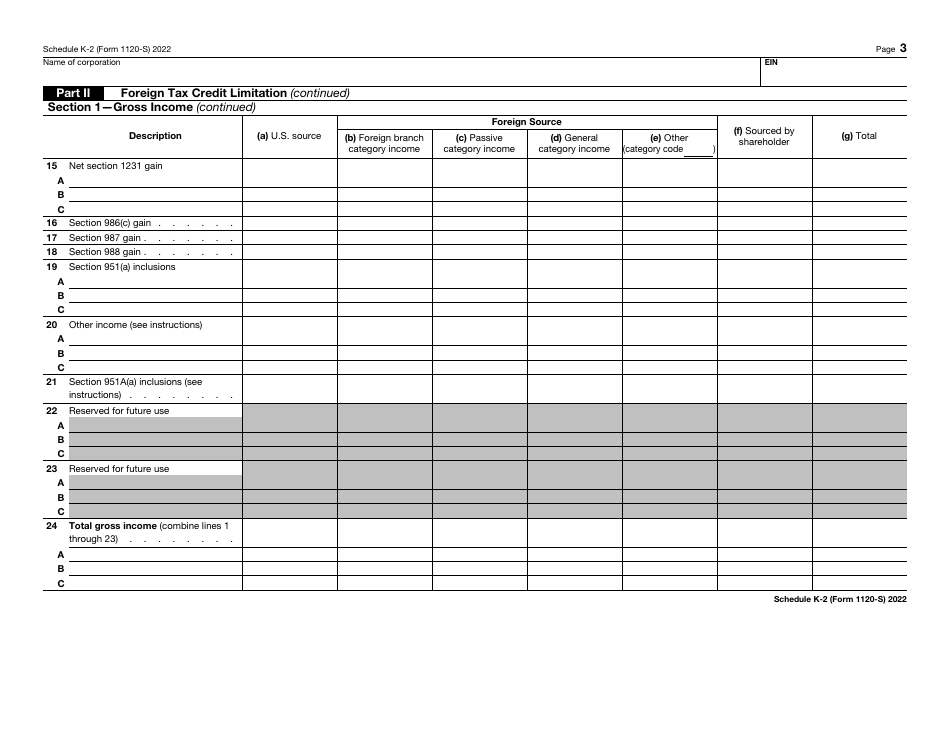

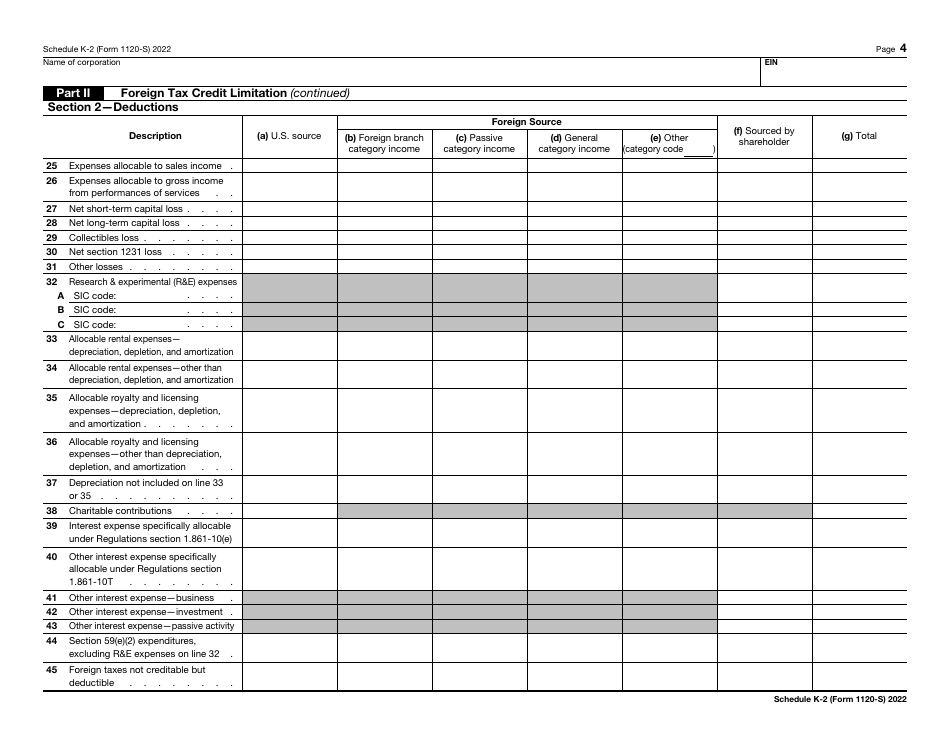

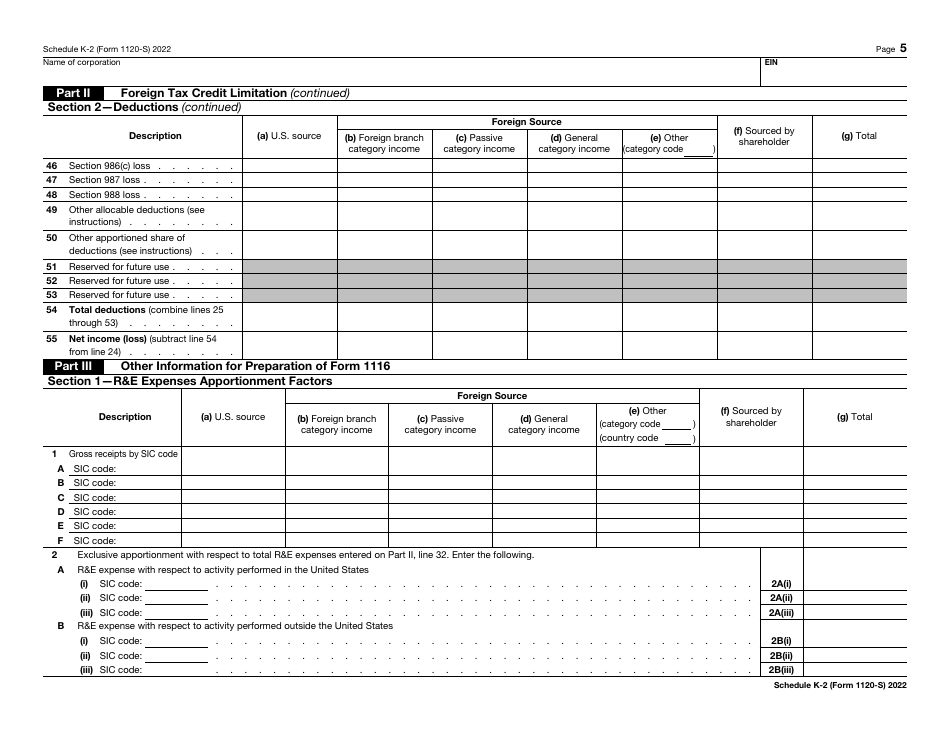

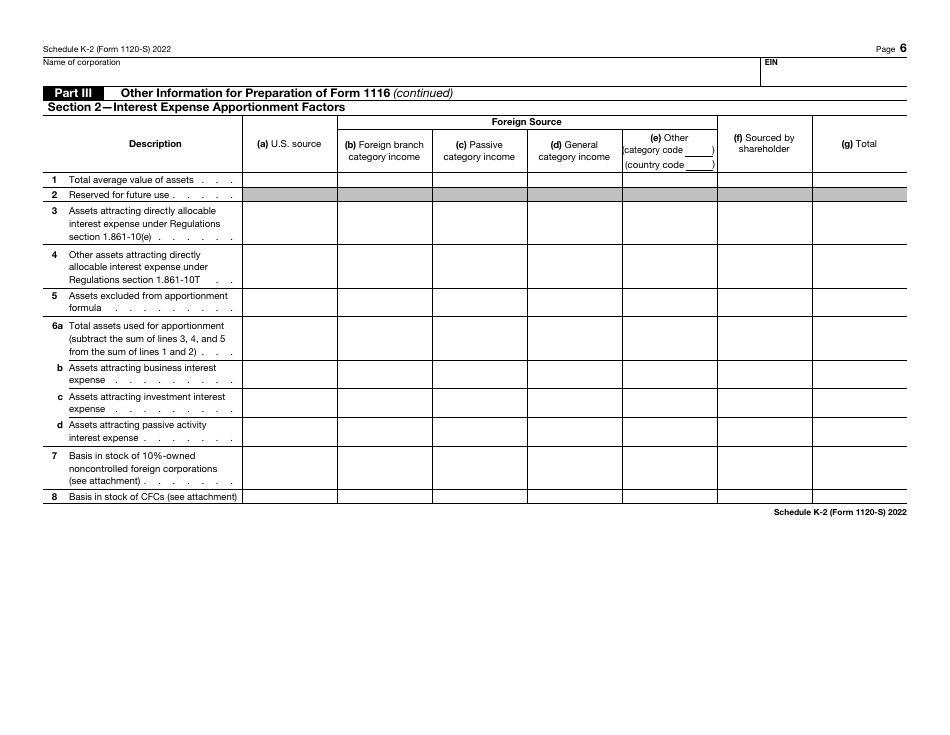

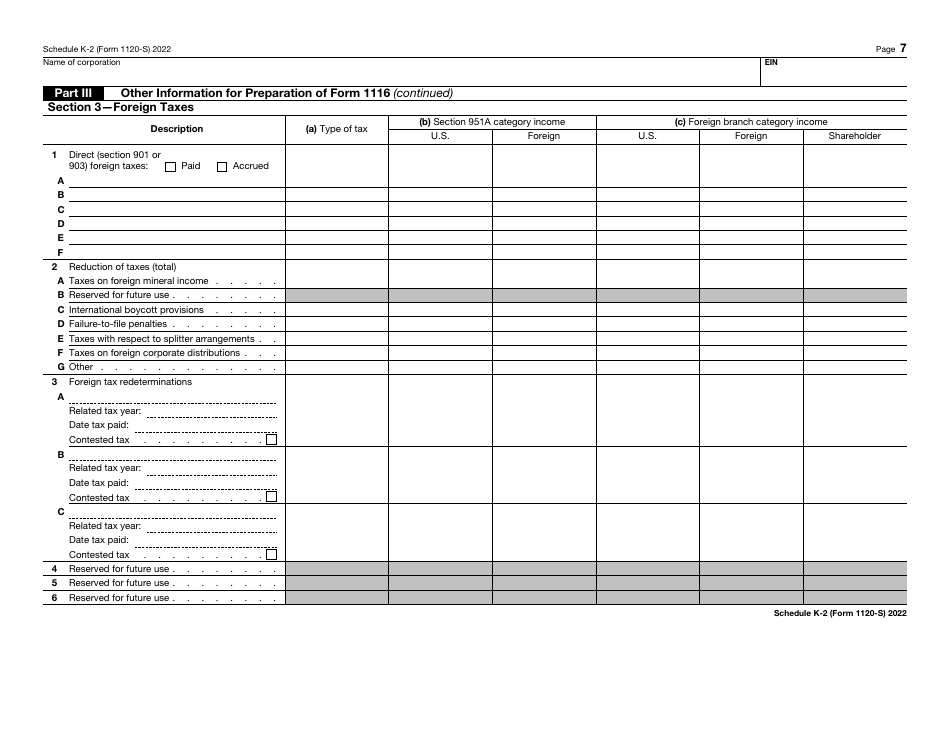

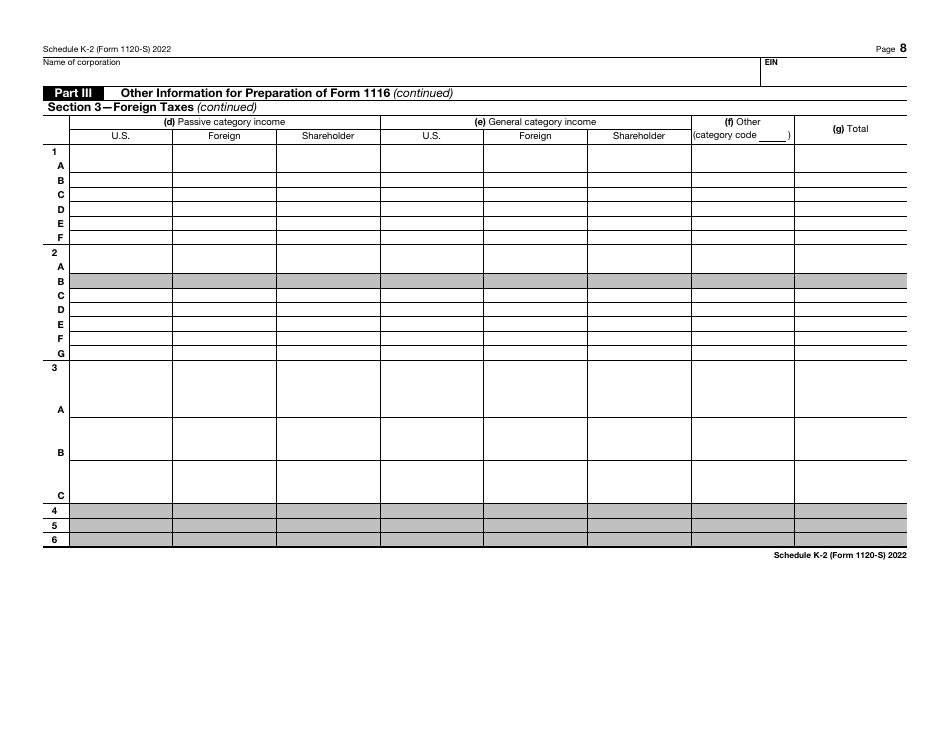

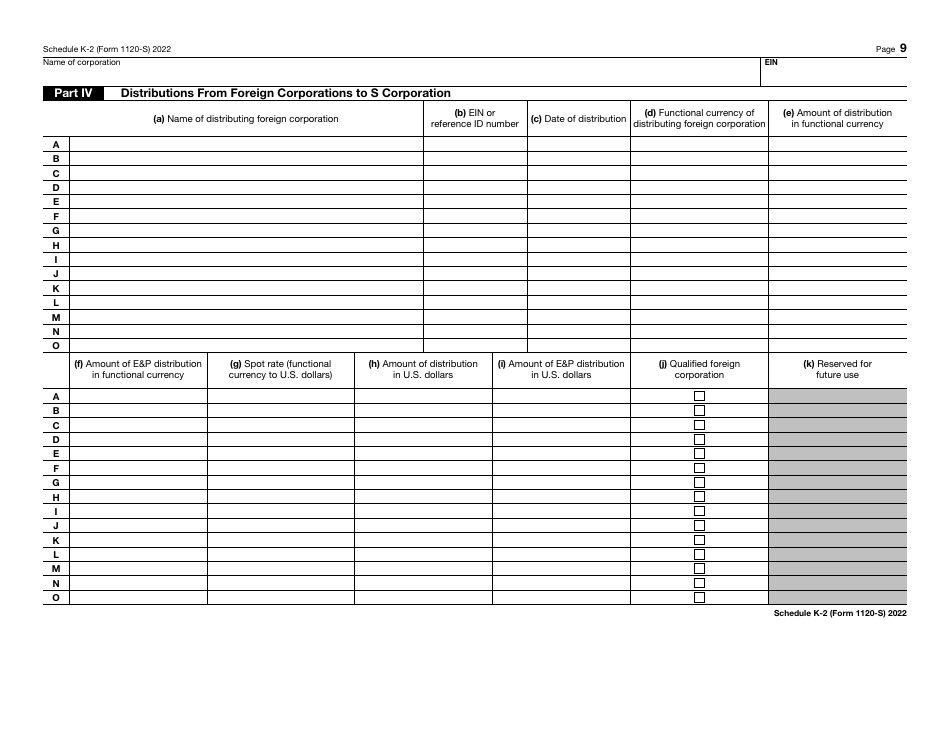

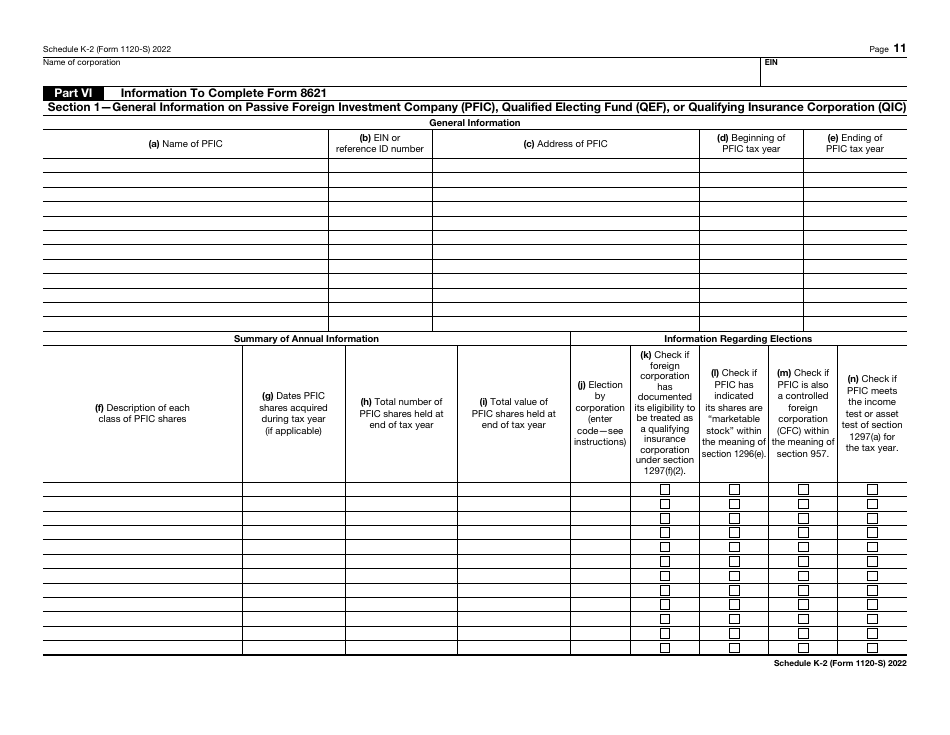

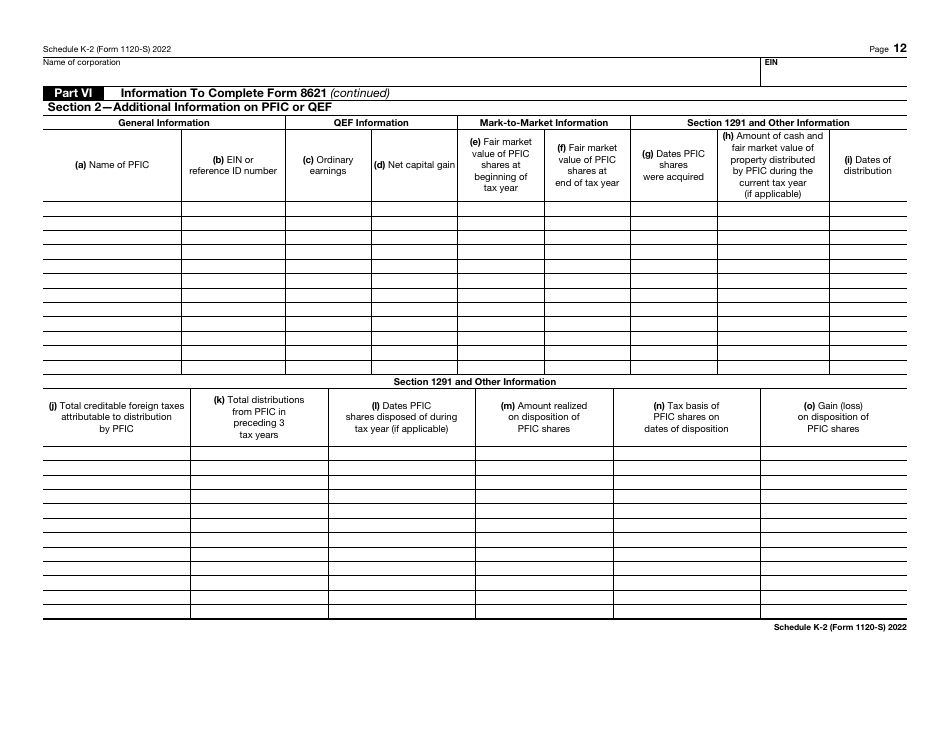

IRS Form 1120-S Schedule K-2

for the current year.

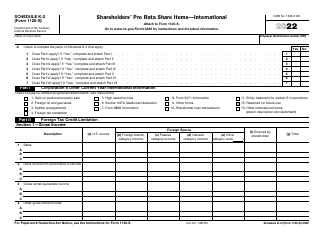

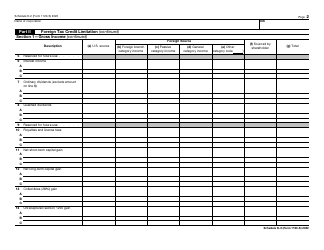

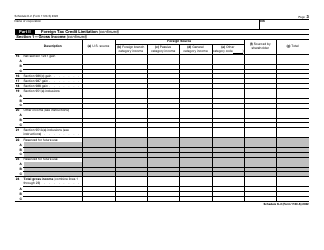

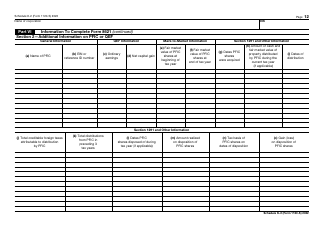

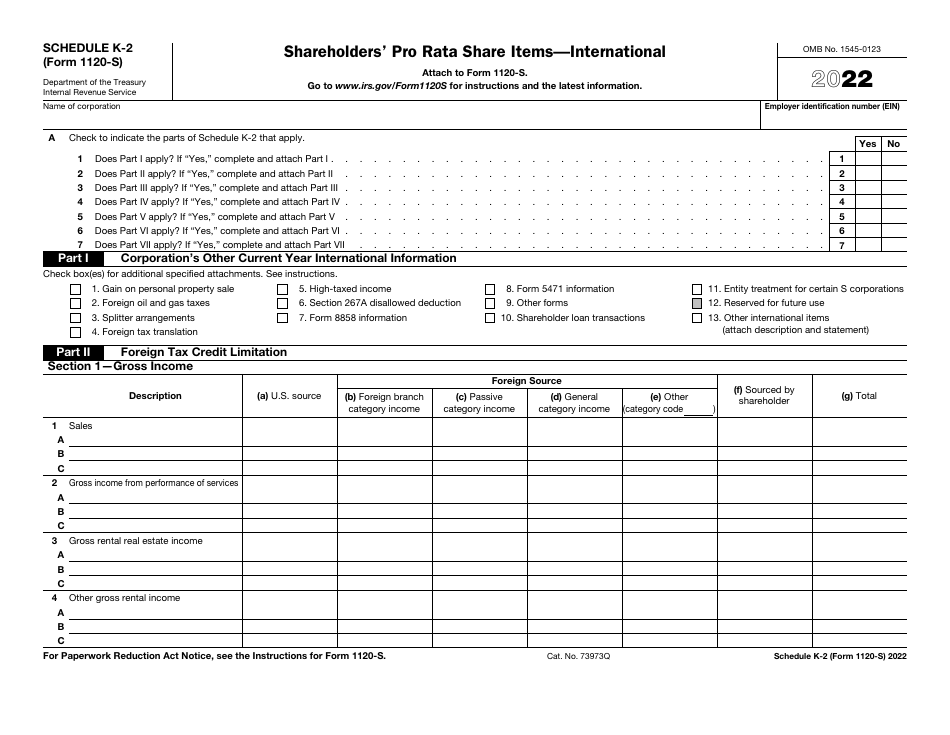

IRS Form 1120-S Schedule K-2 Shareholders' Pro Rata Share Items - International

What Is IRS Form 1120-S Schedule K-2?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1120-S, U.S. Income Tax Return for an S Corporation. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1120-S Schedule K-2?

A: IRS Form 1120-S Schedule K-2 is a tax form used by S corporations to report shareholders' pro rata share items.

Q: What are shareholders' pro rata share items?

A: Shareholders' pro rata share items are the portion of the S corporation's income, deductions, credits, and other items that are allocated to each individual shareholder.

Q: What is the purpose of Schedule K-2?

A: The purpose of Schedule K-2 is to provide information about the shareholders' pro rata share items to the IRS.

Q: Do all S corporations have to file Schedule K-2?

A: No, Schedule K-2 is only required for S corporations that have international shareholders or foreign activities.

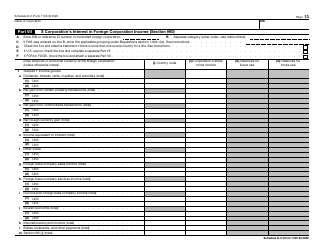

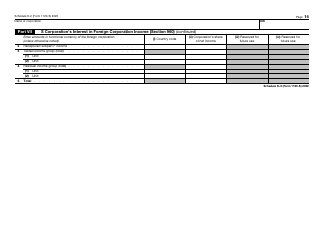

Q: What information is reported on Schedule K-2?

A: Schedule K-2 reports information such as the shareholder's name, tax identification number, and their share of the S corporation's income, deductions, and credits.

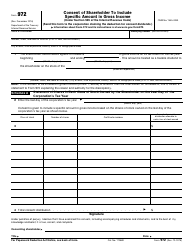

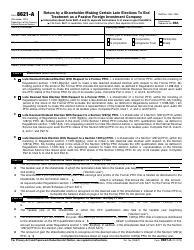

Q: Are there any other forms related to Schedule K-2?

A: Yes, S corporations may also need to file Form 5471 or Form 8865 to report certain international activities.

Form Details:

- A 14-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120-S Schedule K-2 through the link below or browse more documents in our library of IRS Forms.