This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1120-H

for the current year.

Instructions for IRS Form 1120-H U.S. Income Tax Return for Homeowners Associations

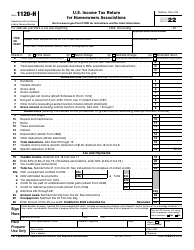

This document contains official instructions for IRS Form 1120-H , U.S. Income Tax Return for Homeowners Associations - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1120-H is available for download through this link.

FAQ

Q: What is IRS Form 1120-H?

A: IRS Form 1120-H is the U.S. Income Tax Return specifically designed for Homeowners Associations.

Q: Who should file IRS Form 1120-H?

A: Homeowners Associations should file IRS Form 1120-H to report their income and expenses for tax purposes.

Q: What information is required to file IRS Form 1120-H?

A: To file IRS Form 1120-H, you will need to provide details about your Homeowners Association's income, expenses, and any exemptions.

Q: When is the deadline for filing IRS Form 1120-H?

A: The deadline for filing IRS Form 1120-H is generally the 15th day of the 4th month following the close of the tax year, which is April 15 for most calendar year associations.

Q: What are the potential penalties for not filing IRS Form 1120-H?

A: Failure to file IRS Form 1120-H or filing it late can result in penalties and interest charges, so it's important to meet the filing deadline.

Q: Can a Homeowners Association use any other IRS form instead of Form 1120-H?

A: No, Homeowners Associations are specifically required to use IRS Form 1120-H for their income tax return.

Q: Are there any special rules or exemptions for Homeowners Associations?

A: Yes, IRS Form 1120-H includes special rules and exemptions that are specific to Homeowners Associations. It is important to understand these rules when preparing the tax return.

Instruction Details:

- This 6-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.