This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1066

for the current year.

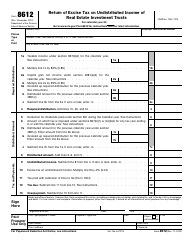

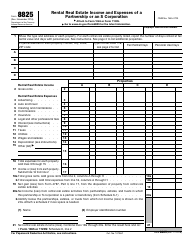

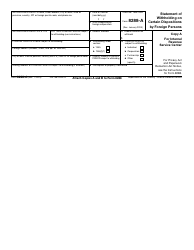

Instructions for IRS Form 1066 U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax Return

This document contains official instructions for IRS Form 1066 , U.S. Real Estate Mortgage Investment Conduit (Remic) Income Tax Return - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1066 is available for download through this link.

FAQ

Q: What is IRS Form 1066?

A: IRS Form 1066 is the U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax Return.

Q: Who needs to file IRS Form 1066?

A: Partnerships and REMICs are required to file IRS Form 1066.

Q: What is a REMIC?

A: REMIC stands for Real Estate Mortgage Investment Conduit. It is a type of entity that holds a pool of mortgages and issues mortgage-backed securities.

Q: What is the purpose of filing IRS Form 1066?

A: The purpose of filing IRS Form 1066 is to report the income, deductions, and credits of a REMIC.

Q: When is the due date for filing IRS Form 1066?

A: IRS Form 1066 is generally due on the 15th day of the 3rd month following the end of the REMIC's tax year.

Q: Are there any penalties for not filing IRS Form 1066?

A: Yes, there can be penalties for not filing IRS Form 1066 or for filing it late. It is important to meet the filing deadline to avoid any penalties.

Q: Can I e-file IRS Form 1066?

A: No, IRS Form 1066 cannot be e-filed. It must be filed on paper and mailed to the appropriate IRS address.

Q: Do I need to attach any documents to IRS Form 1066?

A: Yes, you may need to attach certain schedules and statements to IRS Form 1066, depending on your specific situation. The instructions for the form will provide more information.

Instruction Details:

- This 9-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.