This version of the form is not currently in use and is provided for reference only. Download this version of

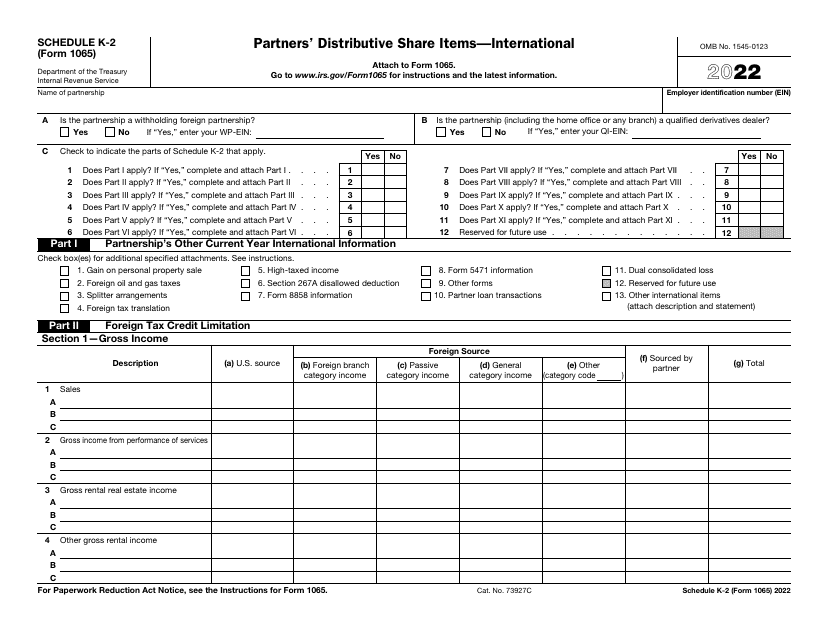

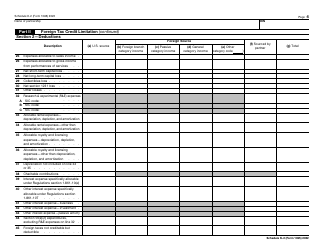

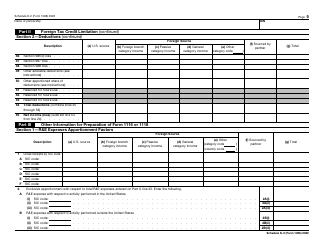

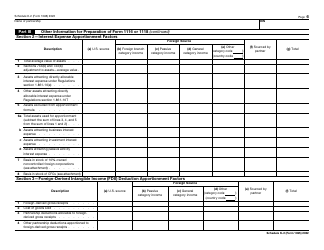

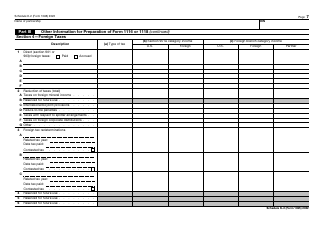

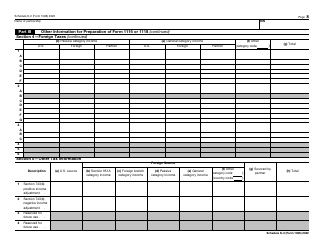

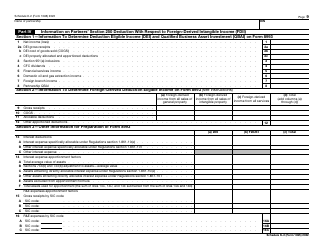

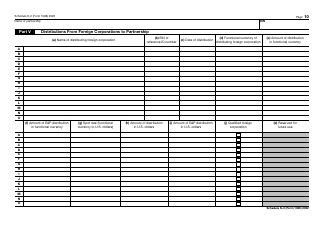

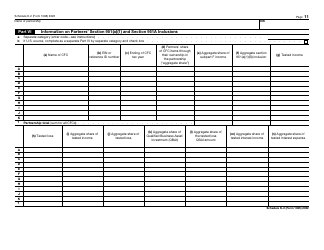

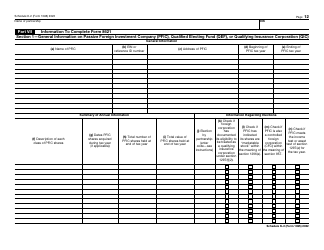

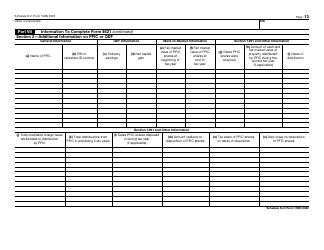

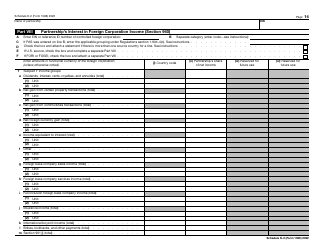

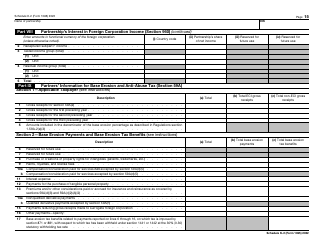

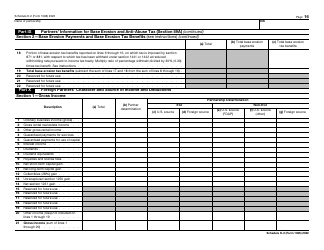

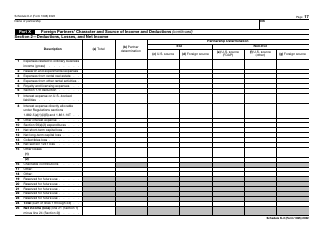

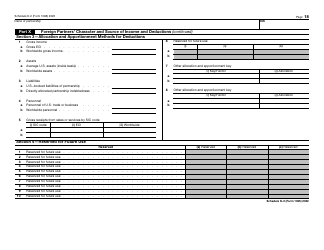

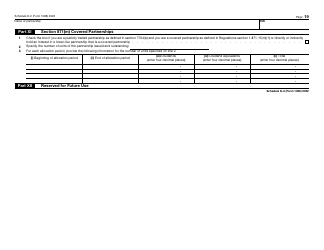

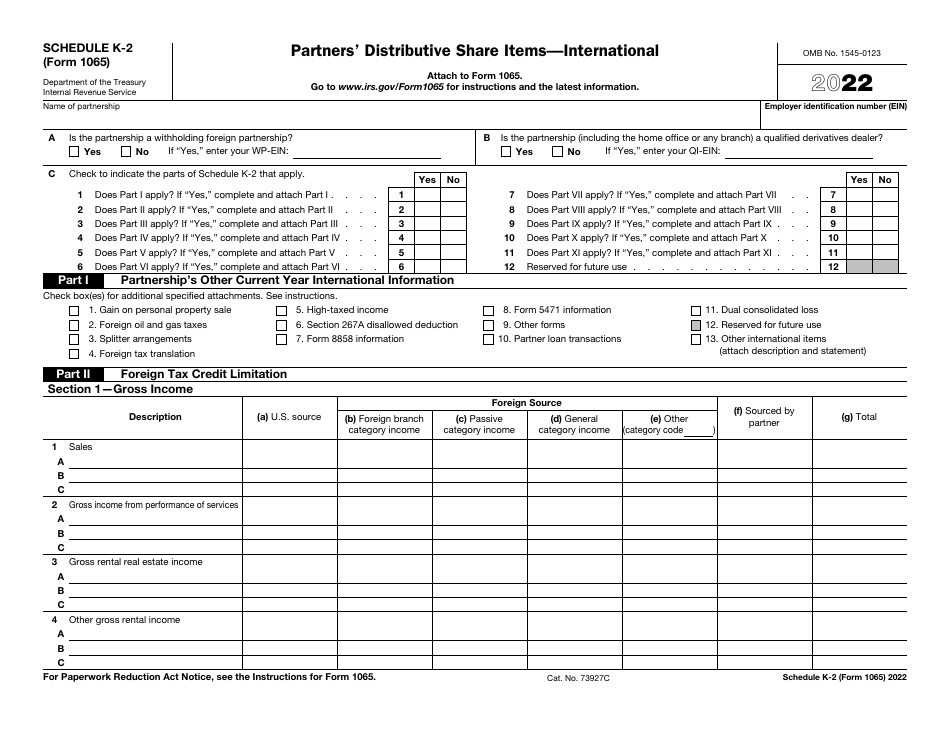

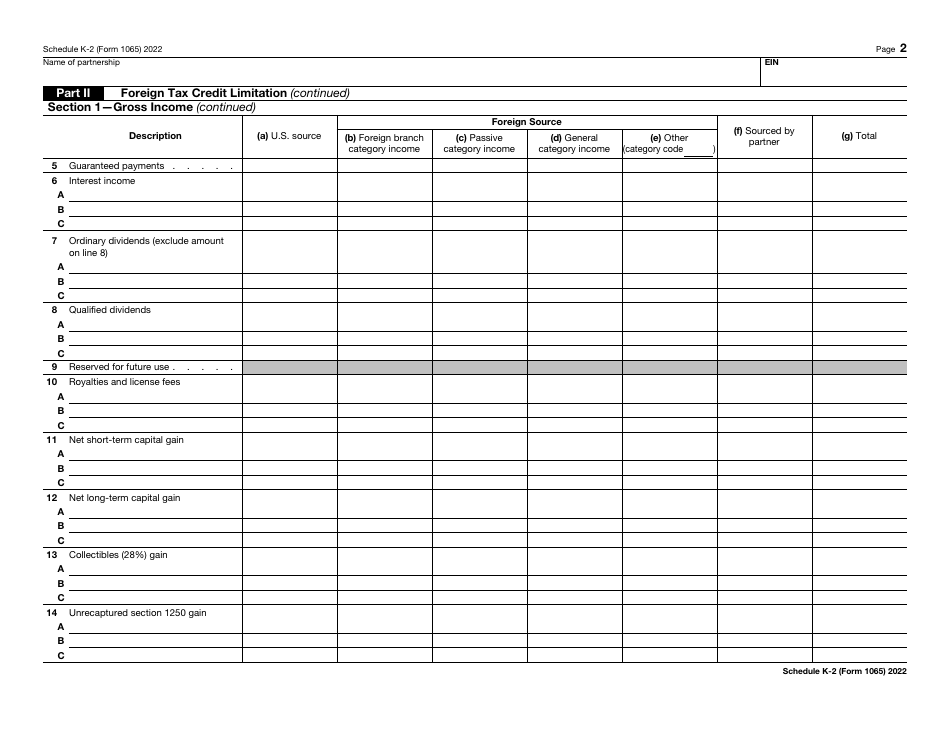

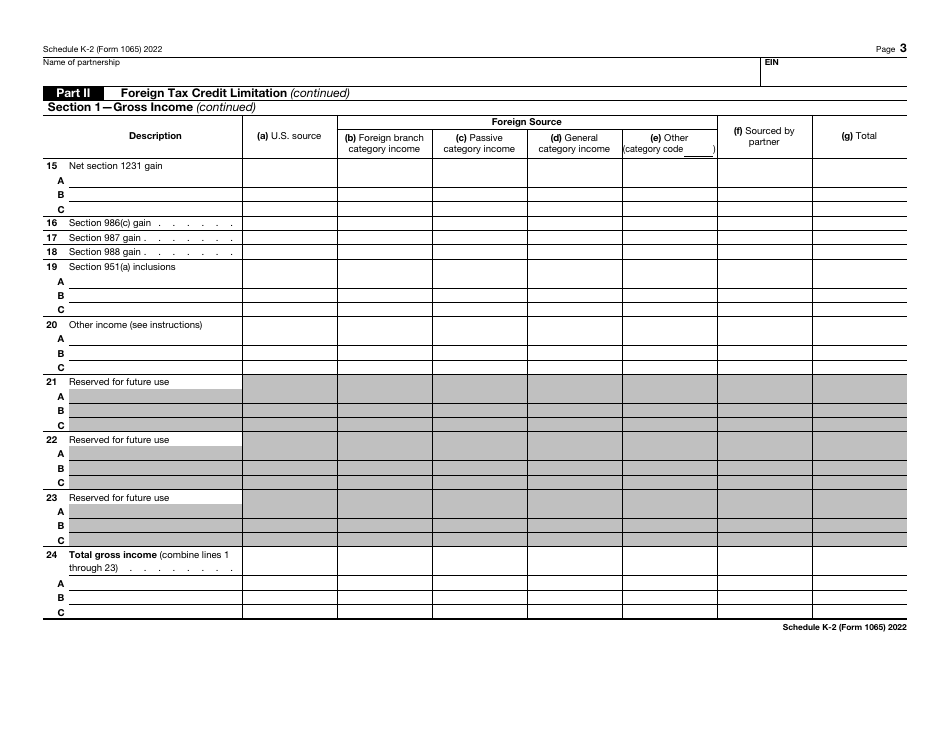

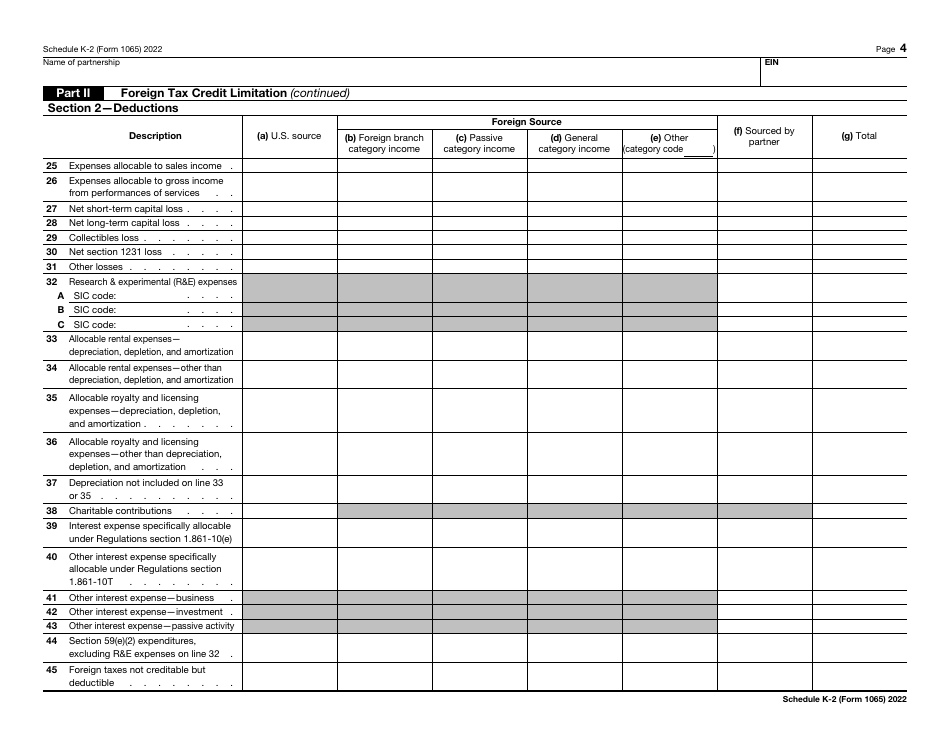

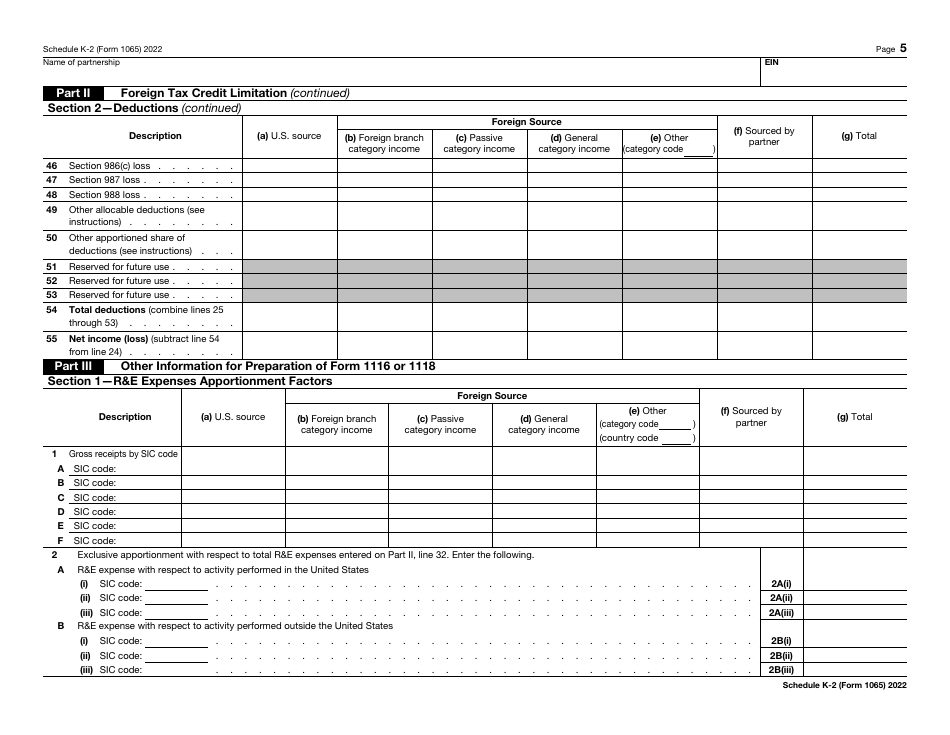

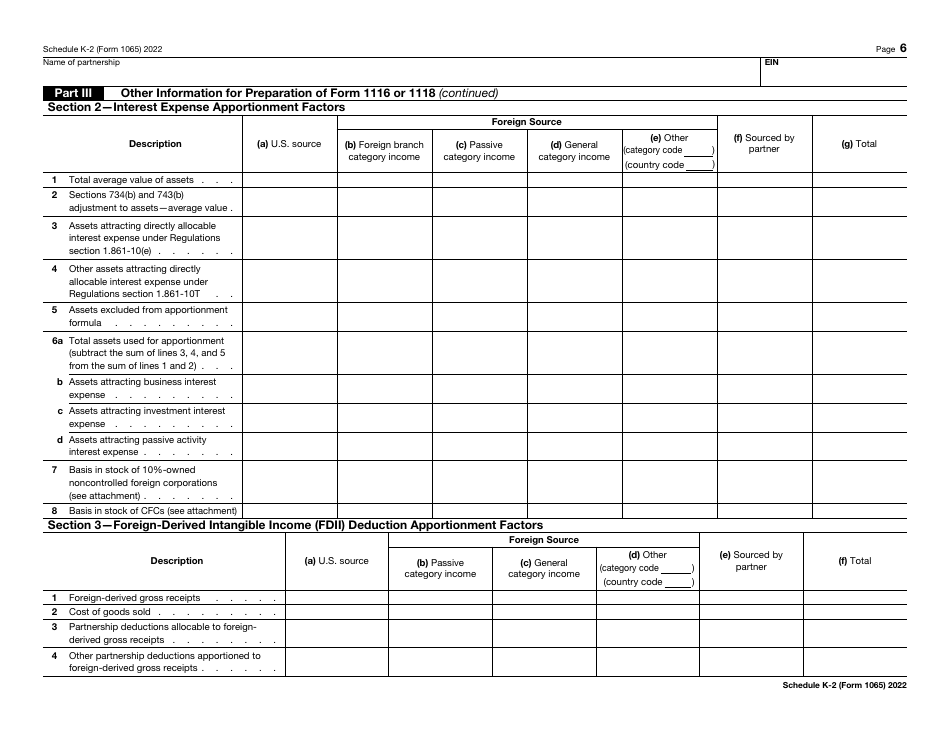

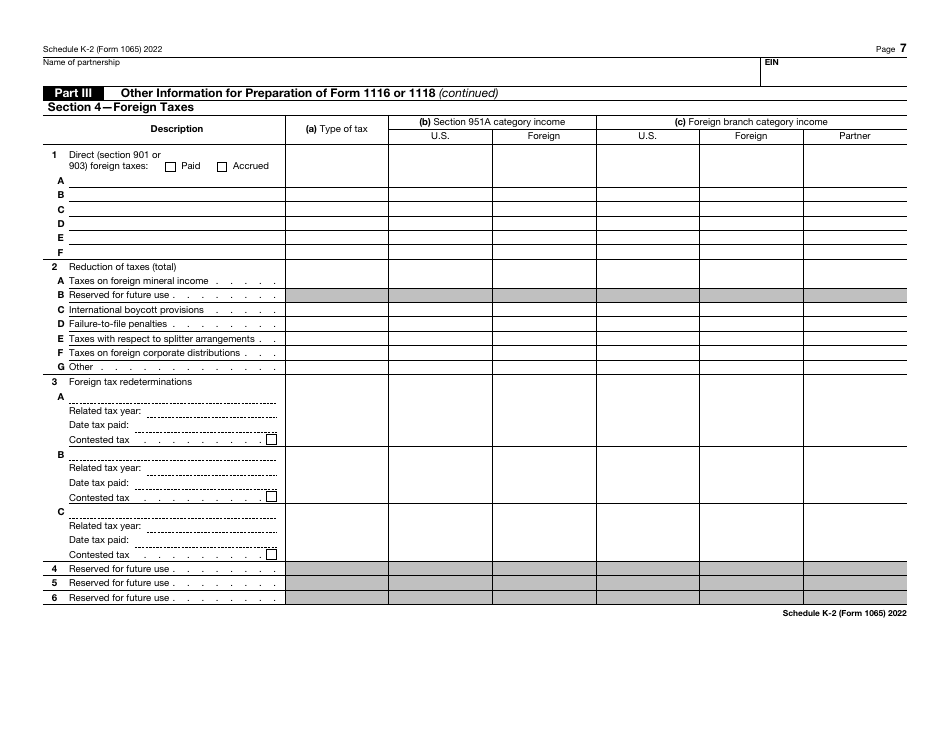

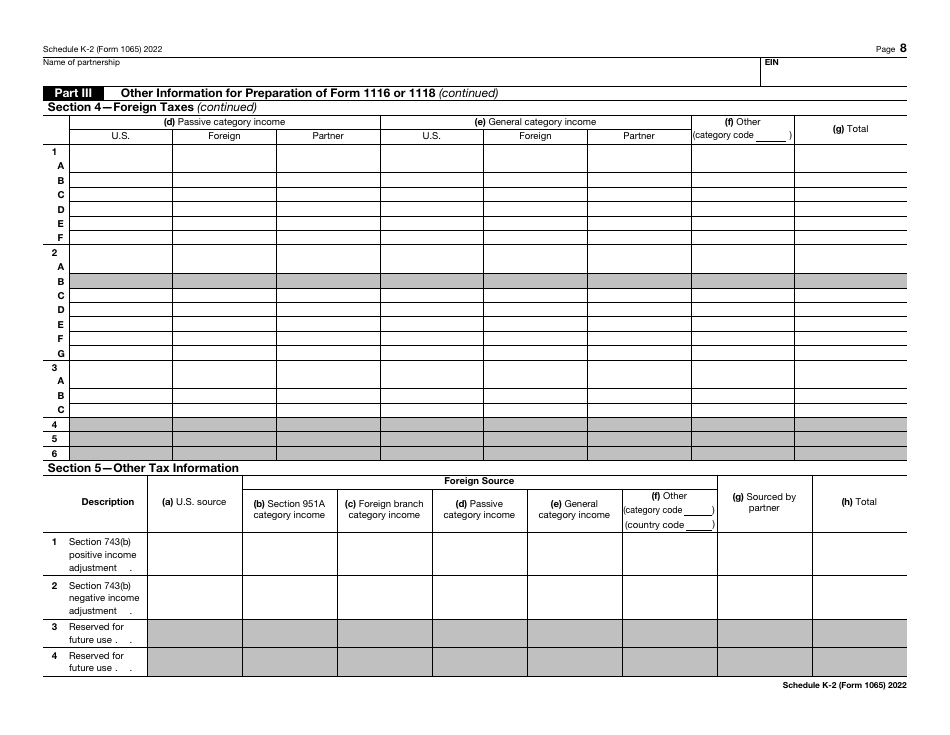

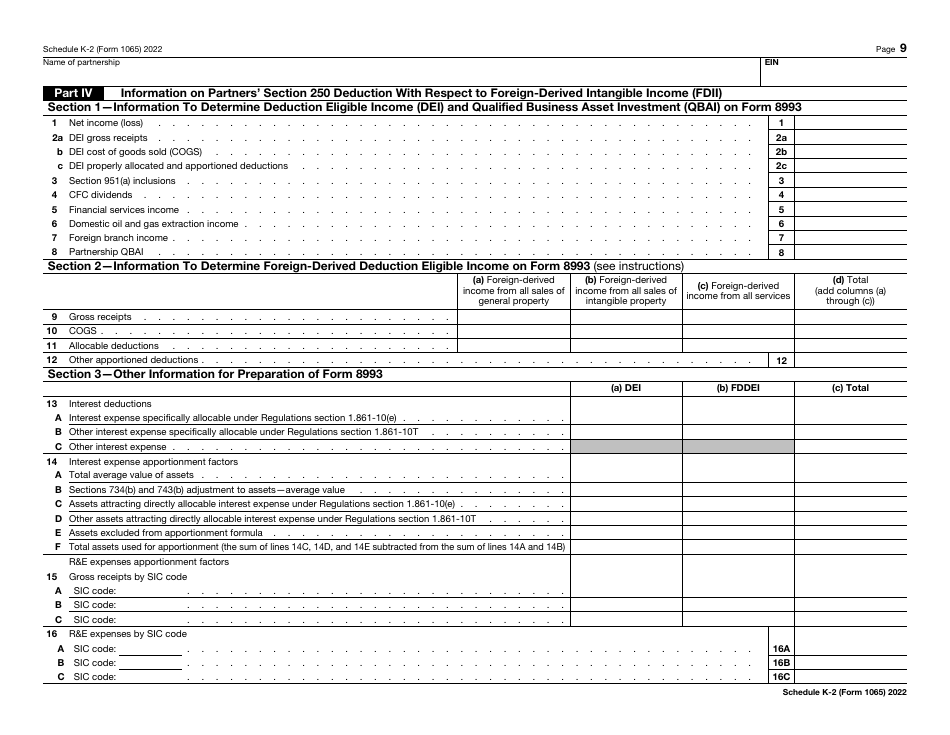

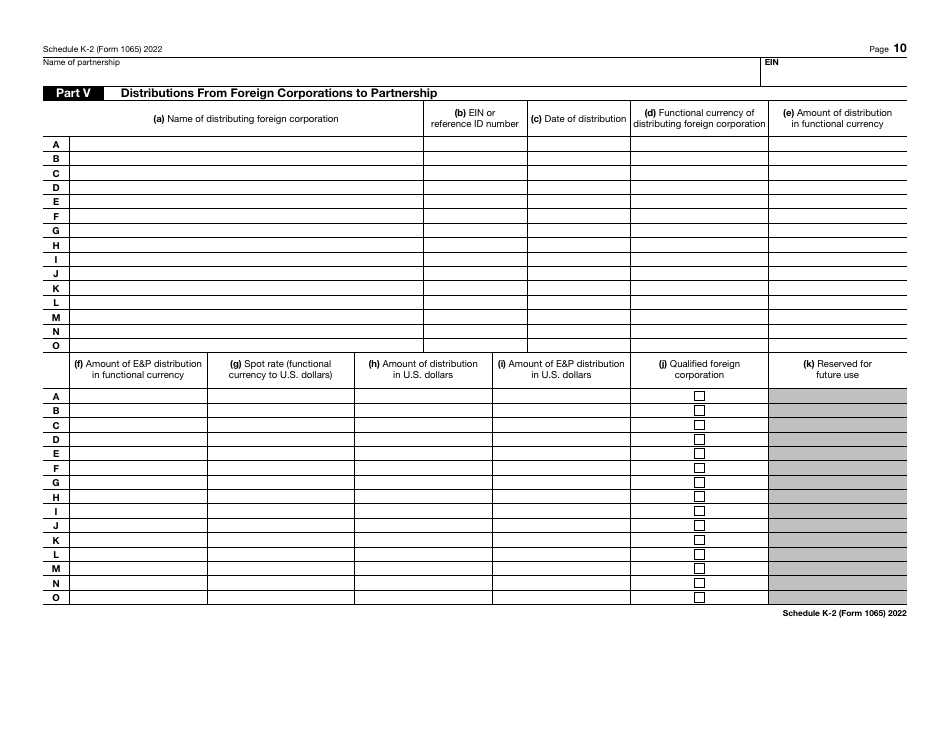

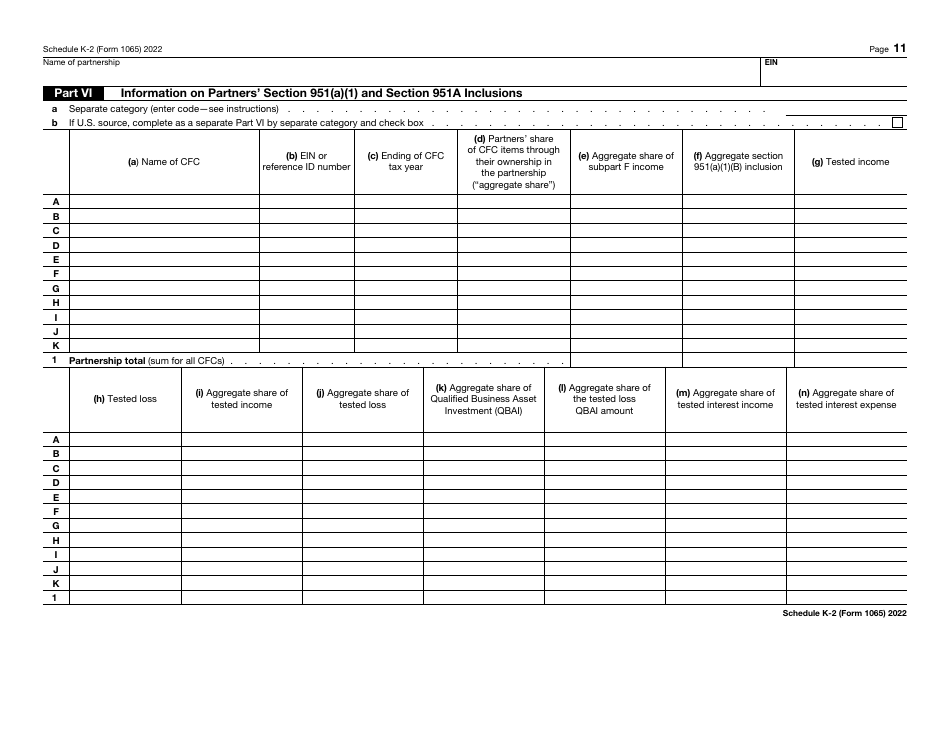

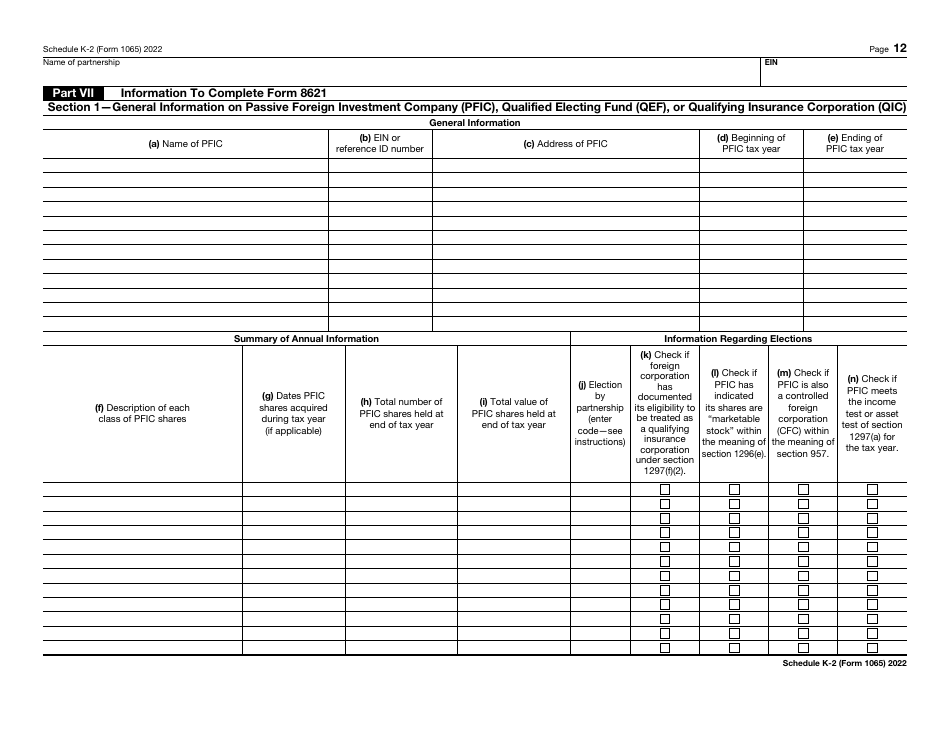

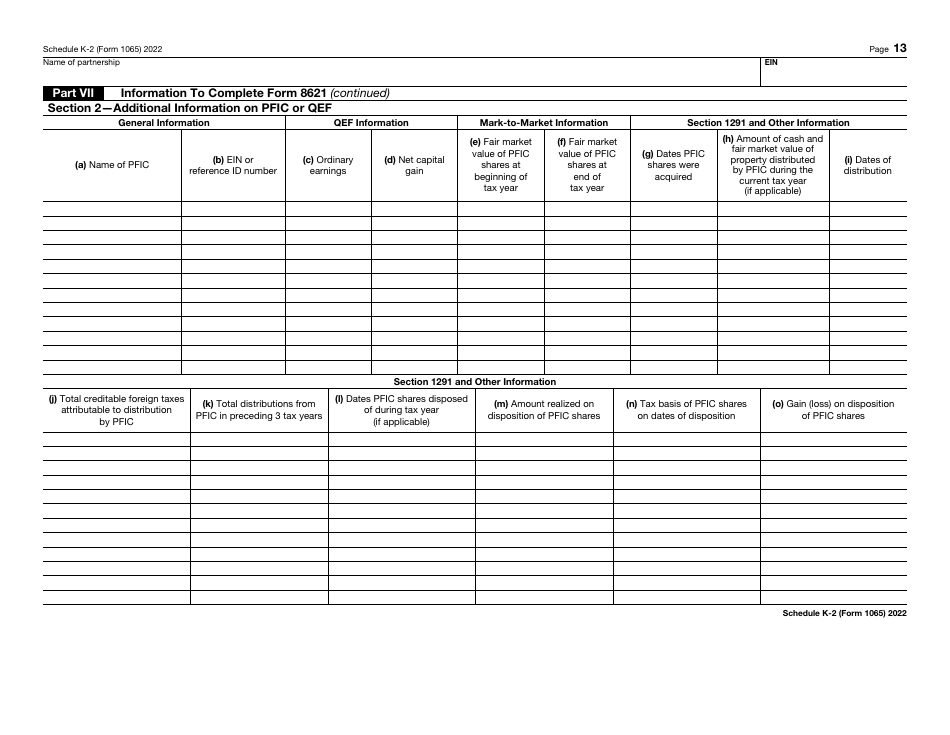

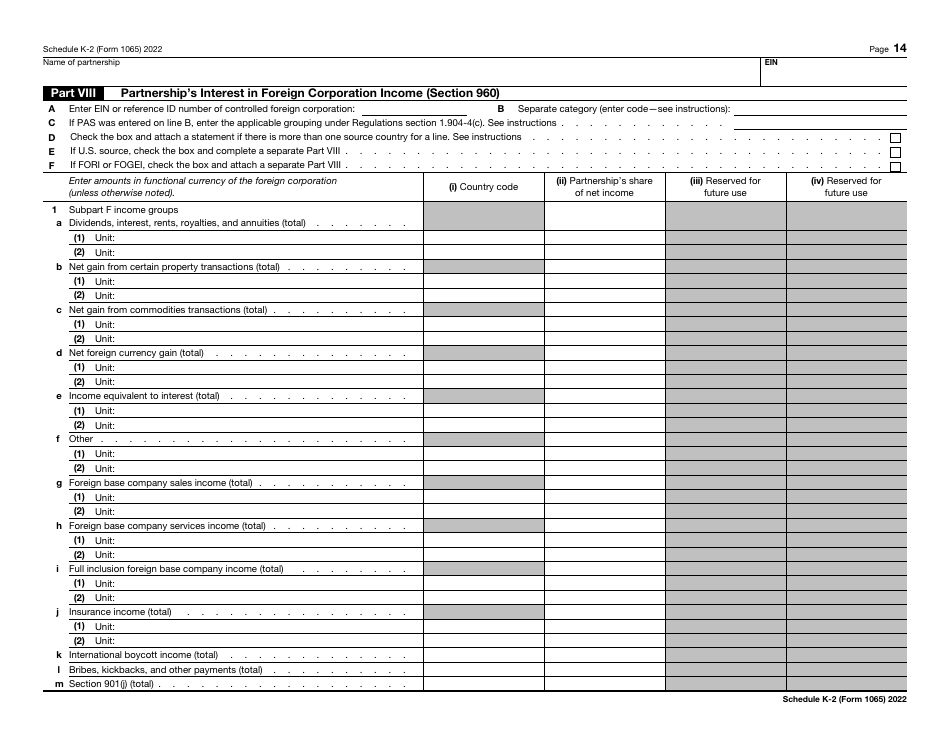

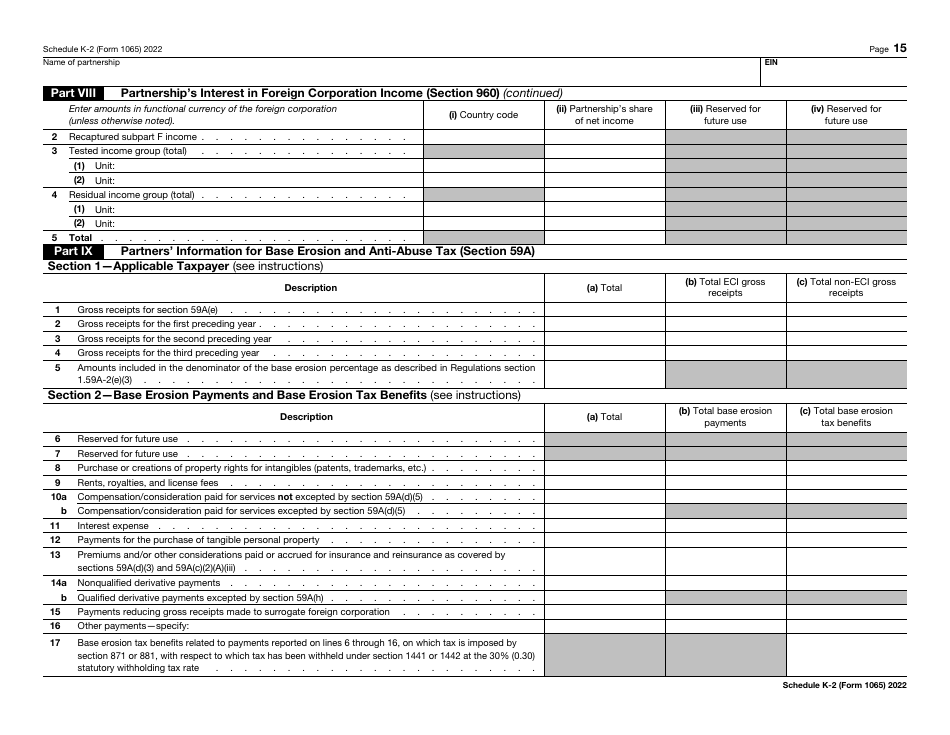

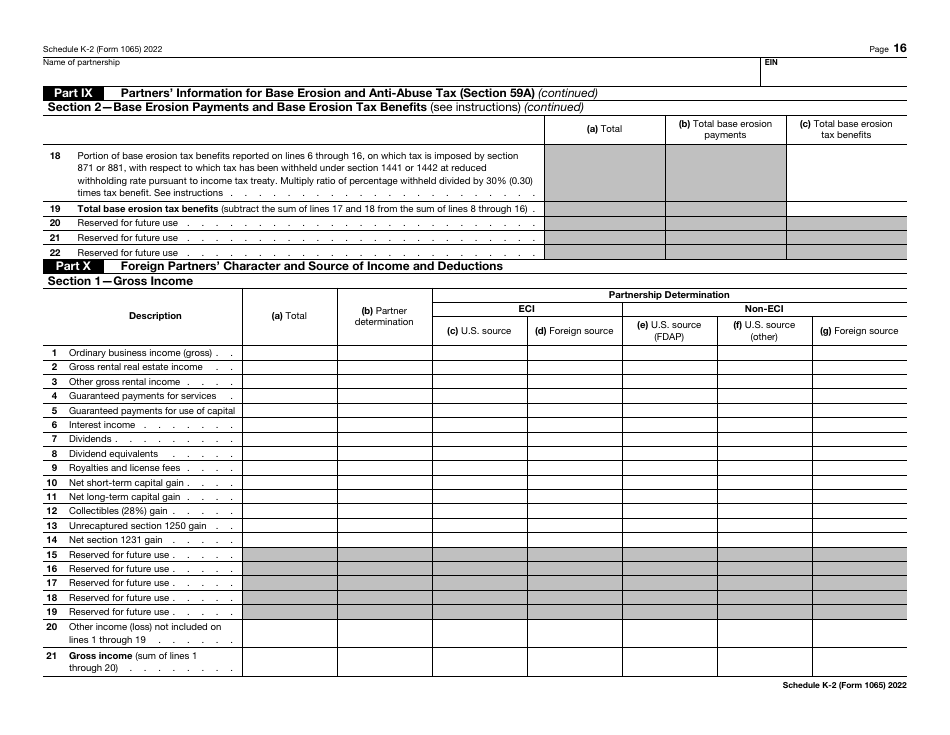

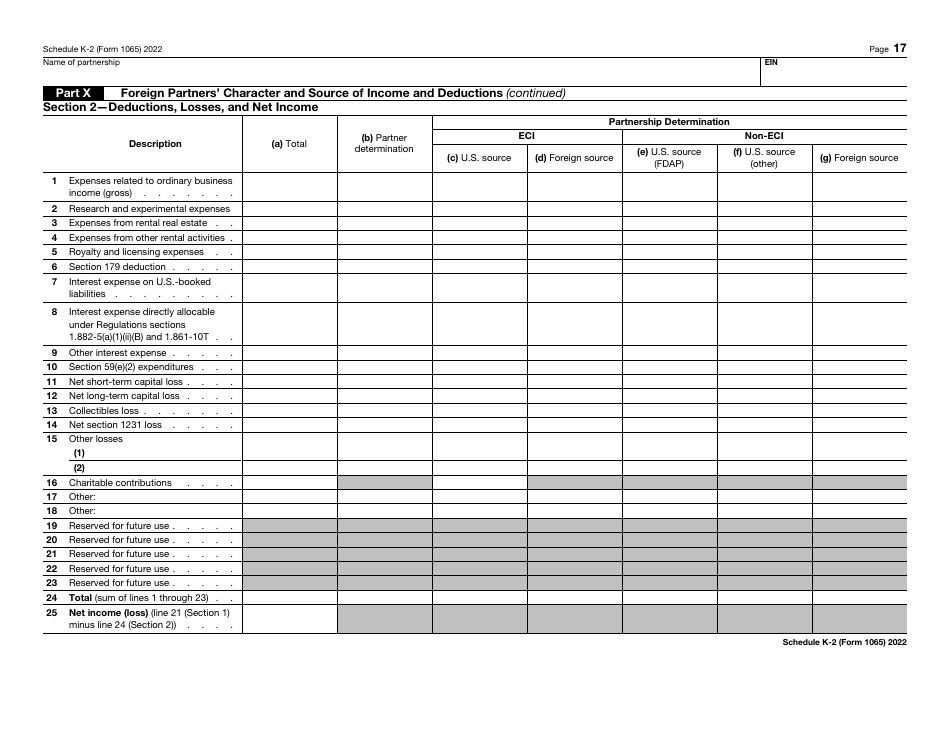

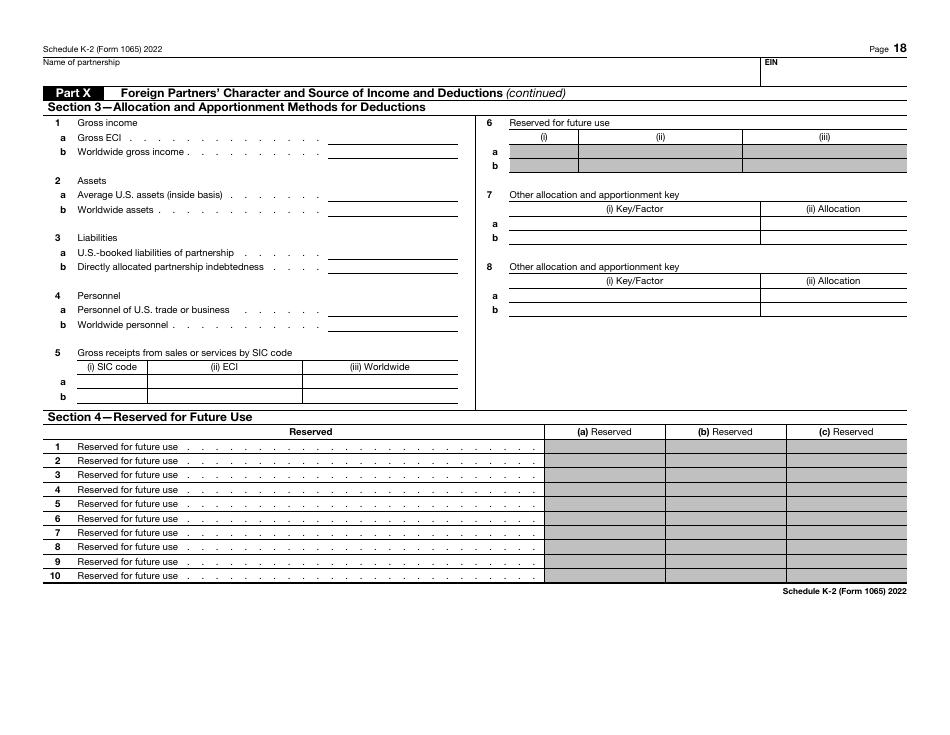

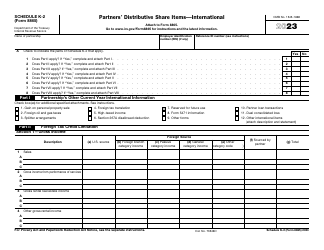

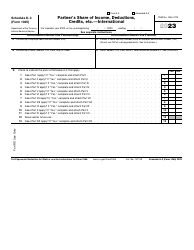

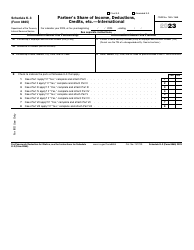

IRS Form 1065 Schedule K-2

for the current year.

IRS Form 1065 Schedule K-2 Partners' Distributive Share Items - International

What Is IRS Form 1065 Schedule K-2?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1065, U.S. Return of Partnership Income. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1065 Schedule K-2?

A: It is a tax form used to report partners' distributive share items.

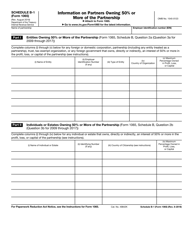

Q: What are partners' distributive share items?

A: They are the partnership's income, deductions, credits, and other items that are allocated to each partner.

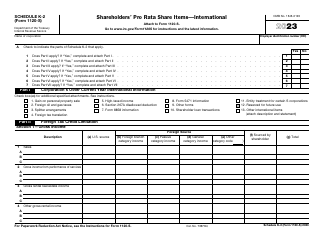

Q: What does 'International' refer to in this form?

A: 'International' refers to items relevant to partnerships with international transactions or activities.

Q: Who needs to file IRS Form 1065 Schedule K-2?

A: Partnerships with partners who have distributive share items and international transactions or activities.

Q: What is the purpose of filing this form?

A: The form is used to provide information about partners' distributive share items related to international transactions or activities.

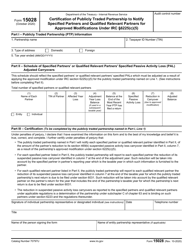

Q: Are there any specific requirements or instructions for filling out this form?

A: Yes, there are specific instructions provided by the IRS that should be followed while filling out this form.

Q: Is this form required for all partnerships?

A: No, only partnerships with partners who have distributive share items and international transactions or activities need to file this form.

Q: Are there any penalties for not filing this form?

A: Yes, there can be penalties for not filing or inaccurately filling out this form. It's important to comply with IRS requirements.

Q: Can I get help or guidance in filling out this form?

A: Yes, you can seek assistance from tax professionals or refer to the instructions provided by the IRS for detailed guidance.

Form Details:

- A 19-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1065 Schedule K-2 through the link below or browse more documents in our library of IRS Forms.