This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1041 Schedule J

for the current year.

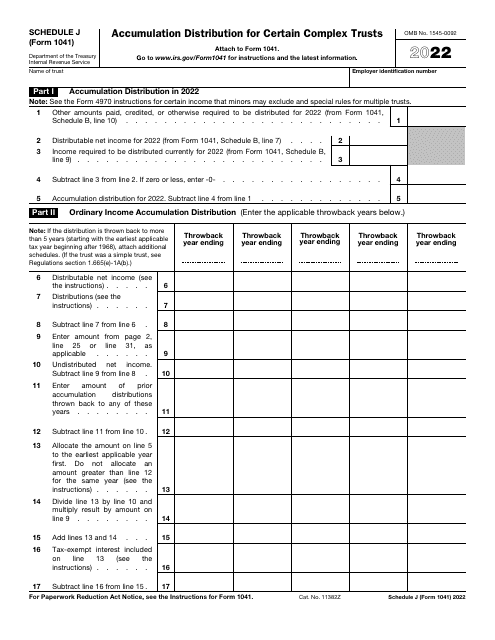

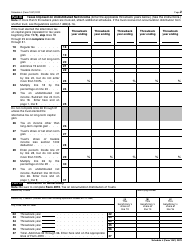

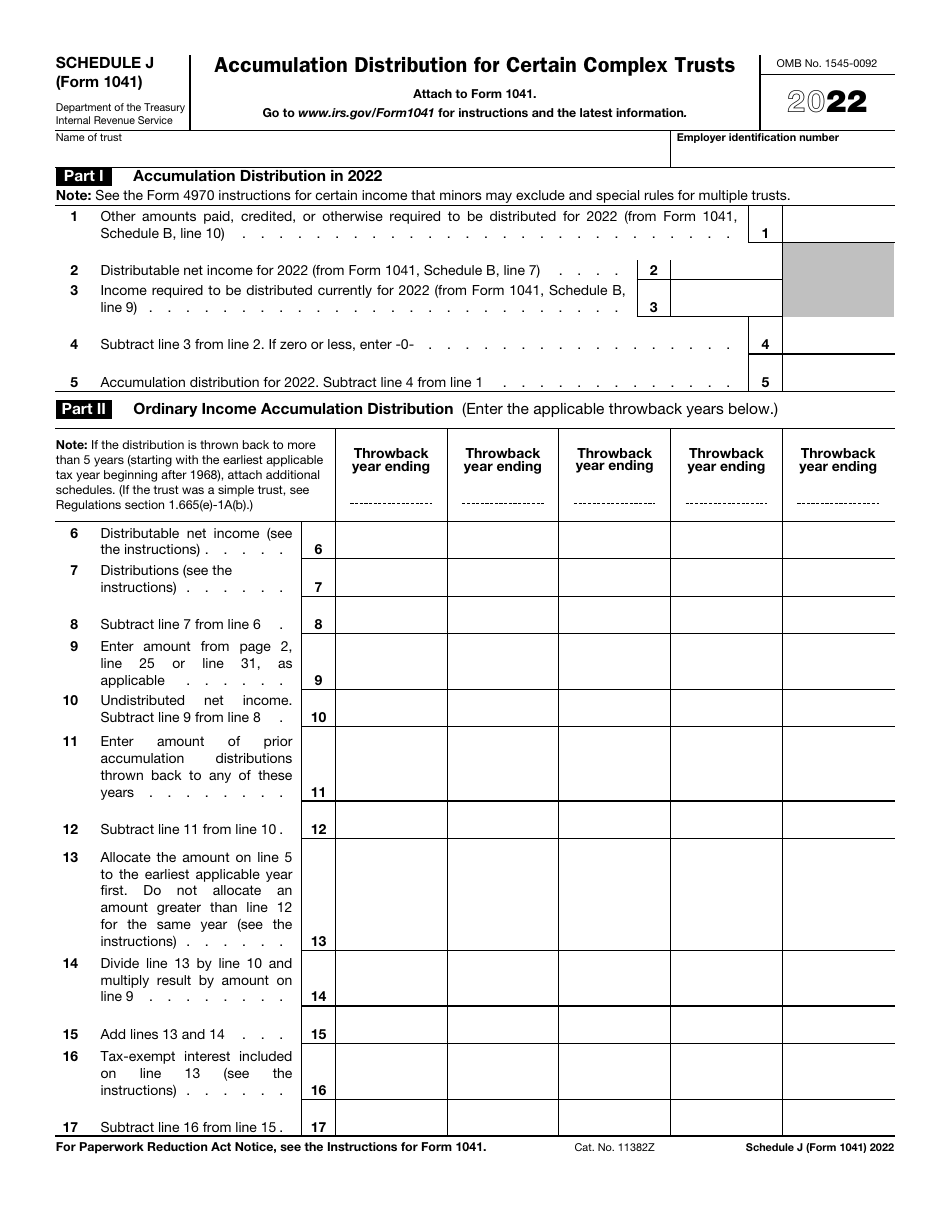

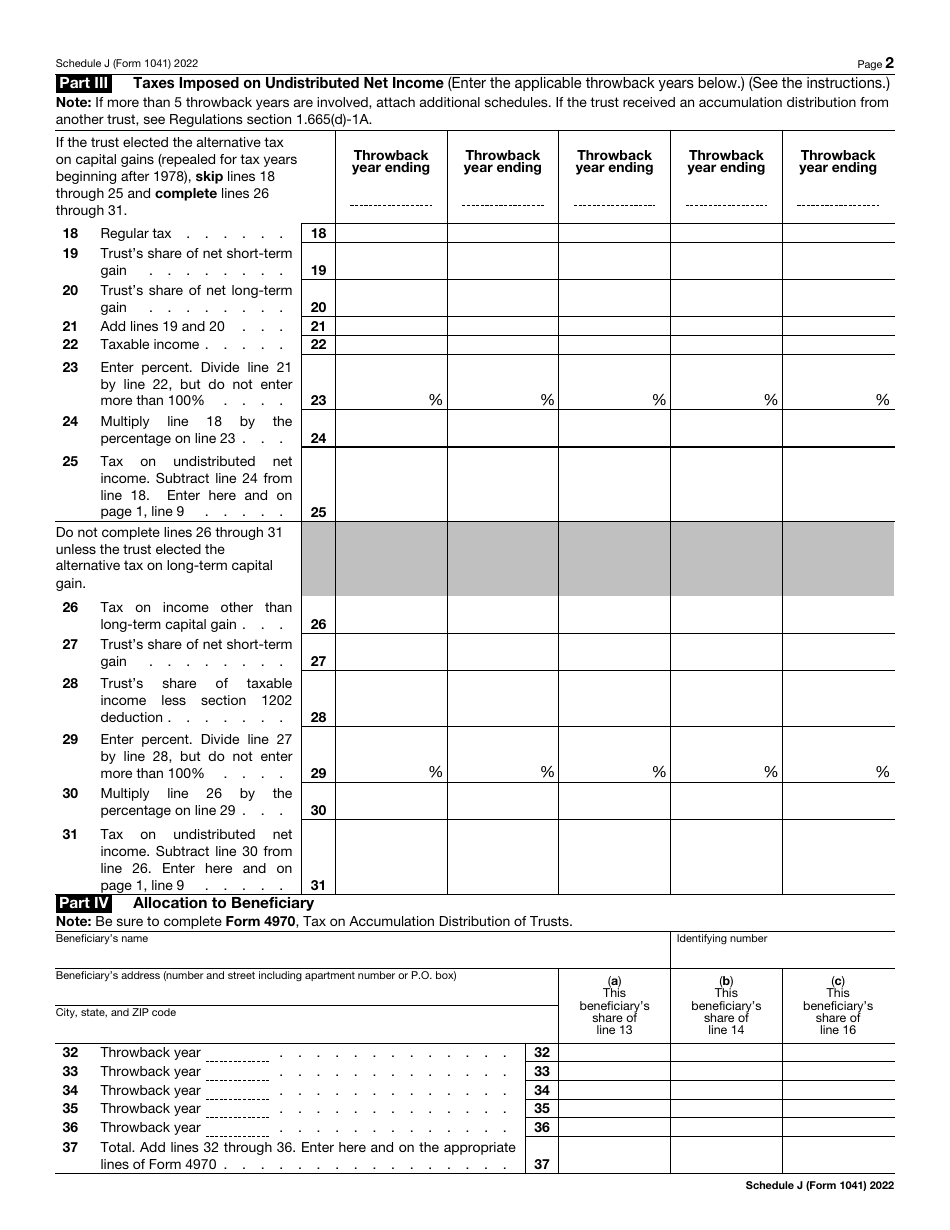

IRS Form 1041 Schedule J Accumulation Distribution for Certain Complex Trusts

What Is IRS Form 1041 Schedule J?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1041, U.S. Income Tax Return for Estates and Trusts. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 1041 Schedule J?

A: IRS Form 1041 Schedule J is a form used to report the accumulation distribution of certain complex trusts.

Q: What does Schedule J of Form 1041 report?

A: Schedule J of Form 1041 reports the accumulation distribution for certain complex trusts.

Q: Who needs to file Form 1041 Schedule J?

A: Taxpayers who have certain complex trusts that have made an accumulation distribution need to file Form 1041 Schedule J.

Q: What is an accumulation distribution?

A: An accumulation distribution is a distribution of income earned by a complex trust that has been accumulated rather than distributed to beneficiaries.

Q: Are all complex trusts required to file Schedule J?

A: No, only complex trusts that have made an accumulation distribution need to file Schedule J.

Q: Is there a deadline for filing Form 1041 Schedule J?

A: Yes, Form 1041 Schedule J should be filed by the same deadline as the annual income tax return for the trust, which is usually April 15th.

Q: What happens if I don't file Form 1041 Schedule J?

A: If you are required to file Form 1041 Schedule J and fail to do so, you may face penalties and interest on any unpaid tax liabilities.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1041 Schedule J through the link below or browse more documents in our library of IRS Forms.