This version of the form is not currently in use and is provided for reference only. Download this version of

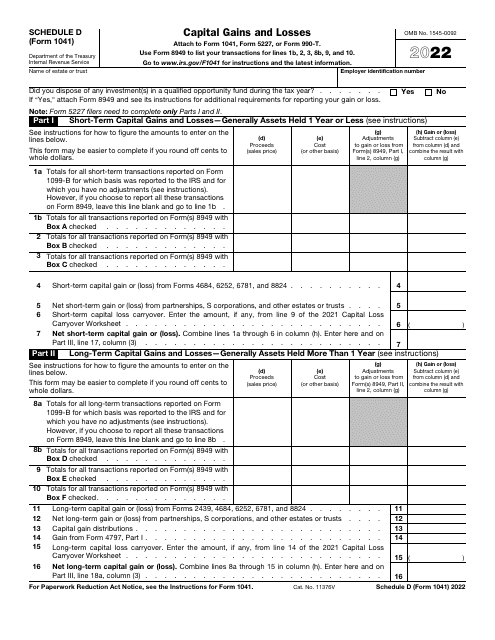

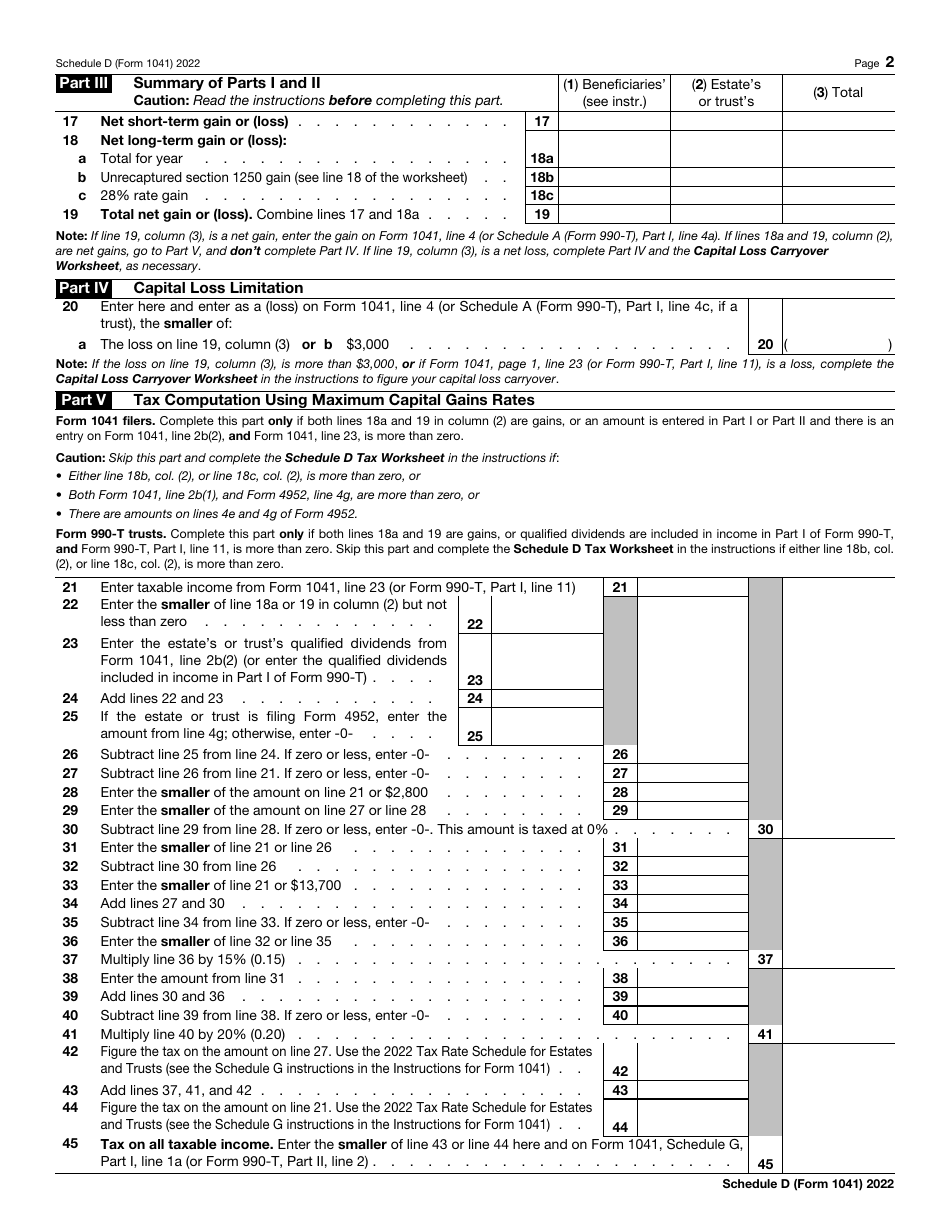

IRS Form 1041 Schedule D

for the current year.

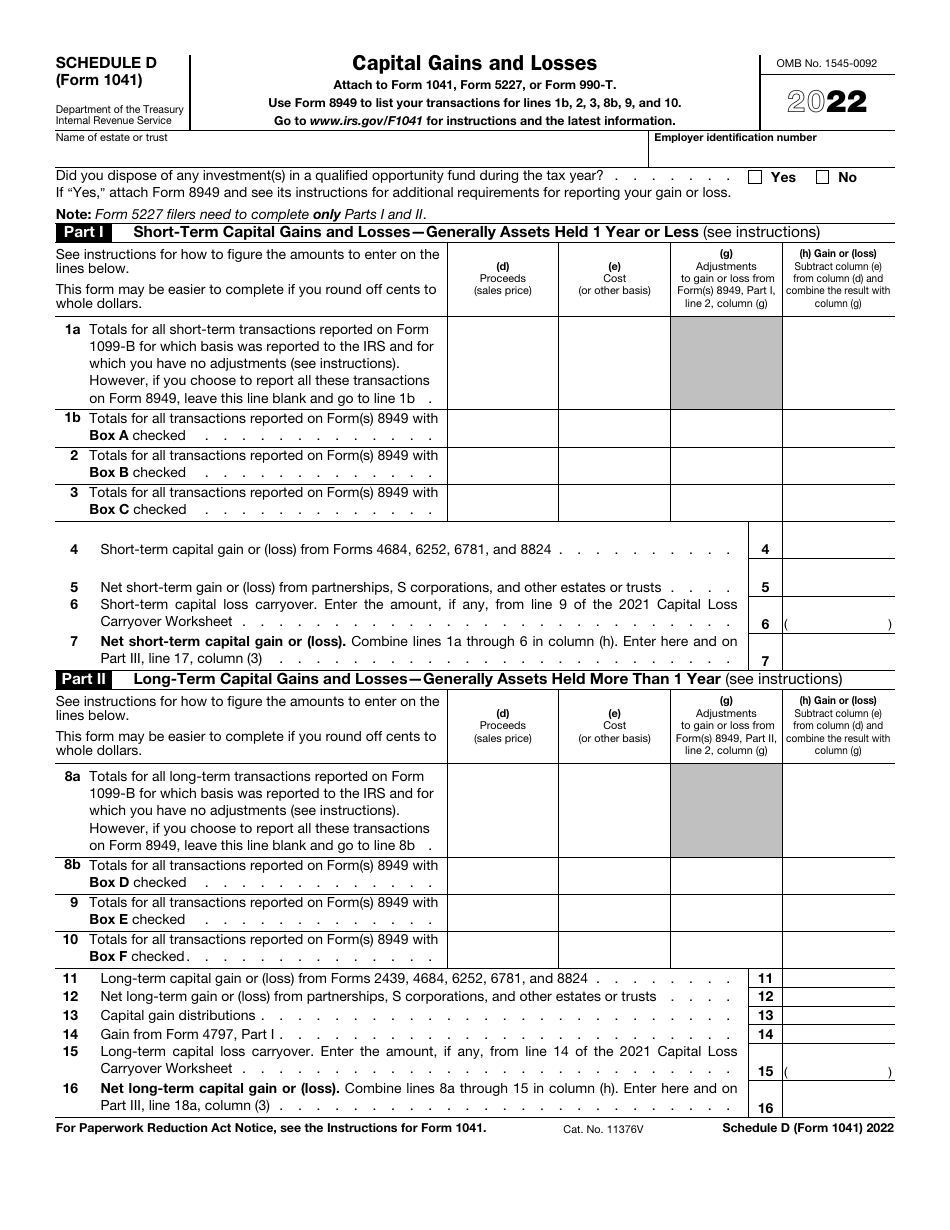

IRS Form 1041 Schedule D Capital Gains and Losses

What Is IRS Form 1041 Schedule D?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1041, U.S. Income Tax Return for Estates and Trusts. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1041?

A: IRS Form 1041 is a tax form used to report income, deductions, and other tax information for estates and trusts.

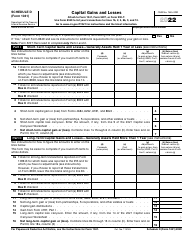

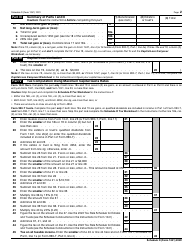

Q: What is Schedule D?

A: Schedule D is a part of IRS Form 1041 that is used to report capital gains and losses.

Q: What are capital gains and losses?

A: Capital gains are profits made from the sale of assets, while capital losses are losses incurred from the sale of assets.

Q: What types of assets are included in Schedule D?

A: Schedule D includes assets such as stocks, bonds, real estate, and other investment properties.

Q: How do I calculate capital gains or losses?

A: To calculate capital gains or losses, you subtract the cost basis (purchase price) of the asset from the sale price.

Q: What are the tax implications of capital gains?

A: Capital gains are generally subject to taxation, and the rate of tax depends on factors such as the holding period of the asset and the individual's income.

Q: Do I need to file Schedule D if I had no capital gains or losses?

A: If you did not have any capital gains or losses during the tax year, you may not need to file Schedule D. However, it is advisable to review the form's instructions or consult a tax professional.

Q: Can I e-file Schedule D?

A: Yes, you can e-file Schedule D along with IRS Form 1041 if you are using tax preparation software or if you are using the services of a tax professional.

Q: When is the deadline to file IRS Form 1041 Schedule D?

A: The deadline to file IRS Form 1041 Schedule D is generally the same as the deadline for filing IRS Form 1041, which is April 15th for most taxpayers.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1041 Schedule D through the link below or browse more documents in our library of IRS Forms.