This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1040 Schedule R

for the current year.

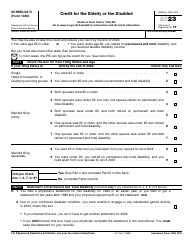

Instructions for IRS Form 1040 Schedule R Credit for the Elderly or the Disabled

This document contains official instructions for IRS Form 1040 Schedule R, Credit for the Elderly or the Disabled - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040 Schedule R is available for download through this link.

FAQ

Q: What is IRS Form 1040 Schedule R?

A: IRS Form 1040 Schedule R is a form used to claim the Credit for the Elderly or the Disabled.

Q: Who can claim the Credit for the Elderly or the Disabled?

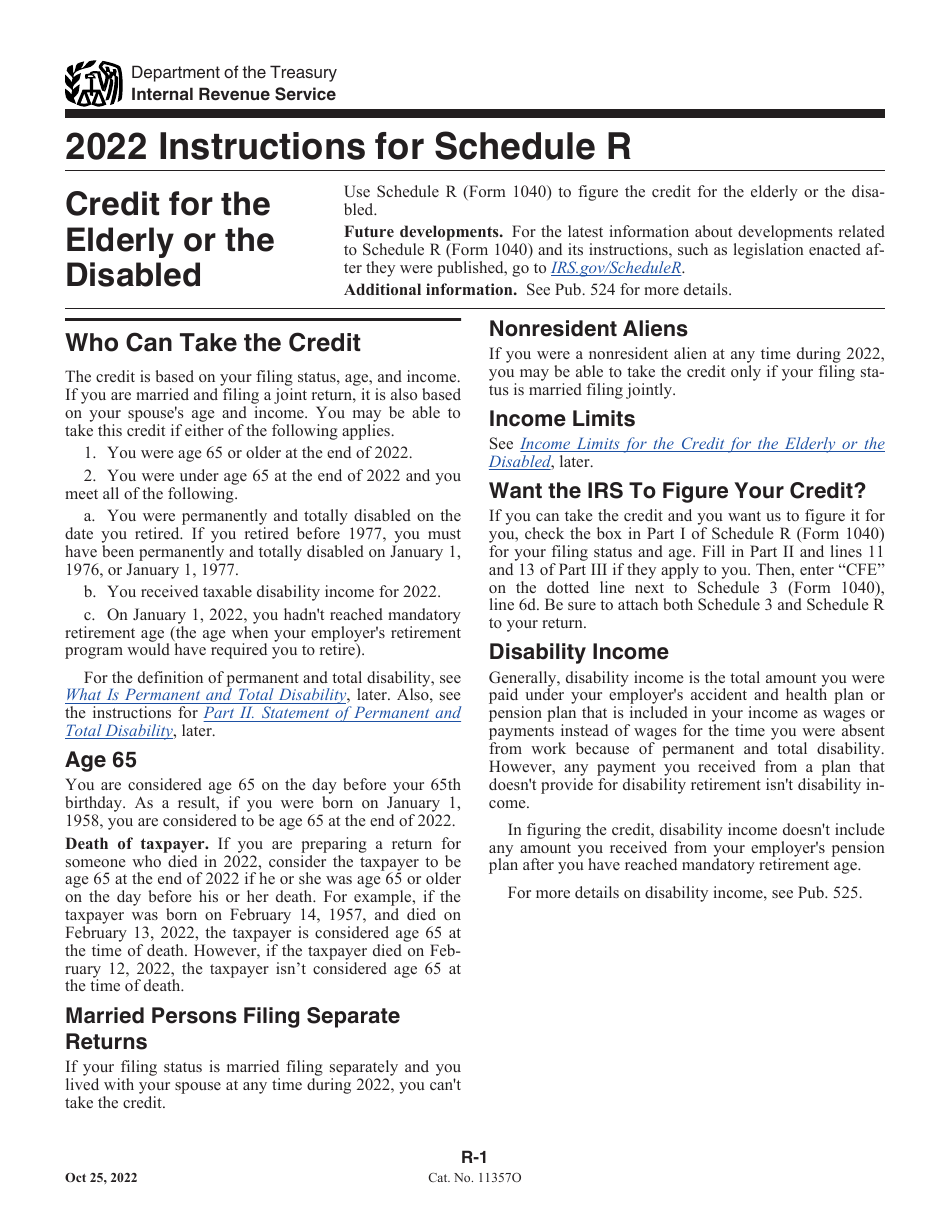

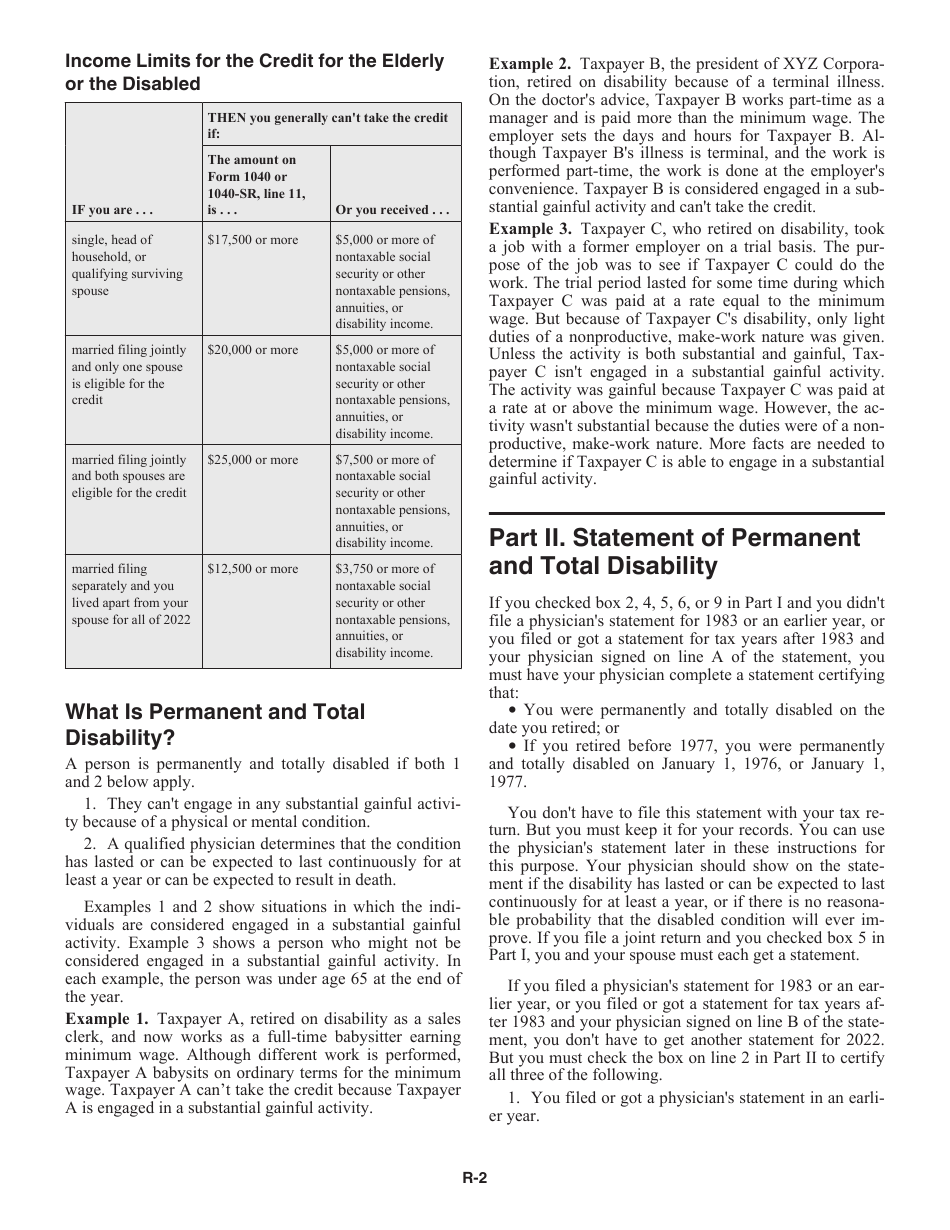

A: Individuals who are age 65 or older, or those who are permanently and totally disabled, may be eligible to claim the Credit for the Elderly or the Disabled.

Q: What is the purpose of the Credit for the Elderly or the Disabled?

A: The purpose of the Credit for the Elderly or the Disabled is to provide tax relief for eligible individuals based on their age or disability status.

Q: What expenses are eligible for the credit?

A: Certain expenses related to health insurance premiums and long-term care services may be eligible for the credit.

Q: How do I claim the Credit for the Elderly or the Disabled?

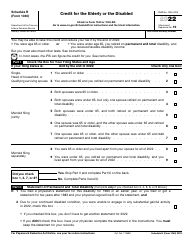

A: To claim the credit, individuals must complete and attach Schedule R to their Form 1040 when filing their federal income tax return.

Q: Are there income limits for claiming the credit?

A: Yes, there are income limits that determine eligibility for the credit. These limits change each year, so it's important to check the latest guidelines.

Q: Is the Credit for the Elderly or the Disabled refundable?

A: No, the Credit for the Elderly or the Disabled is not refundable. It can only reduce the amount of taxes owed to the IRS.

Q: Can I claim the credit if I am claimed as a dependent on someone else's tax return?

A: No, individuals who are claimed as dependents on someone else's tax return are not eligible to claim the Credit for the Elderly or the Disabled.

Q: Are there any other requirements to claim the credit?

A: Yes, there are additional requirements related to residency, filing status, and the amount of taxable income. These requirements can be found in the instructions for Schedule R.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.