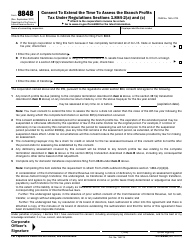

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1040 Schedule J

for the current year.

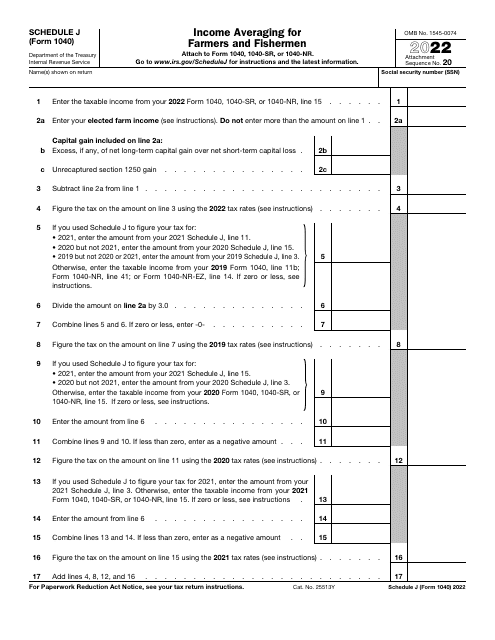

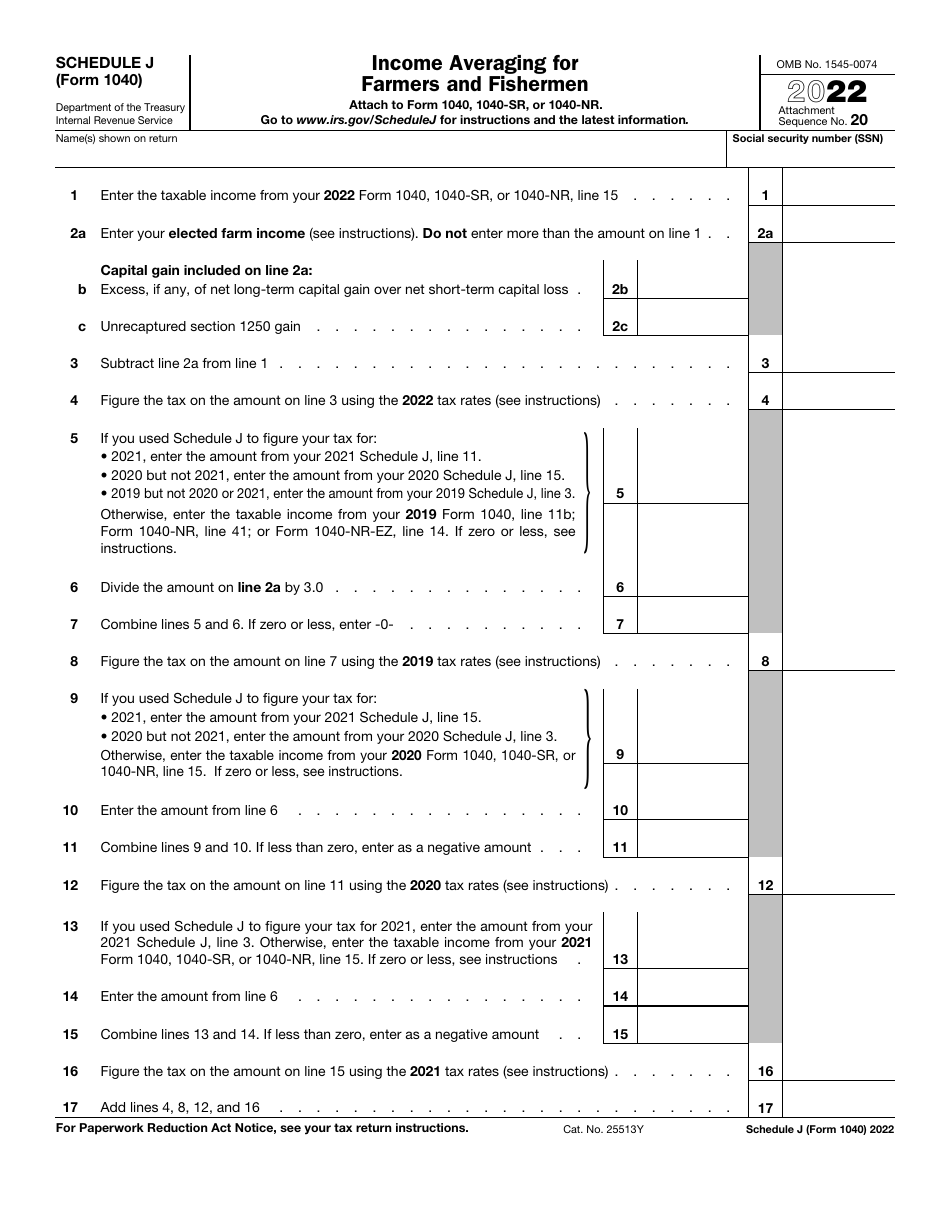

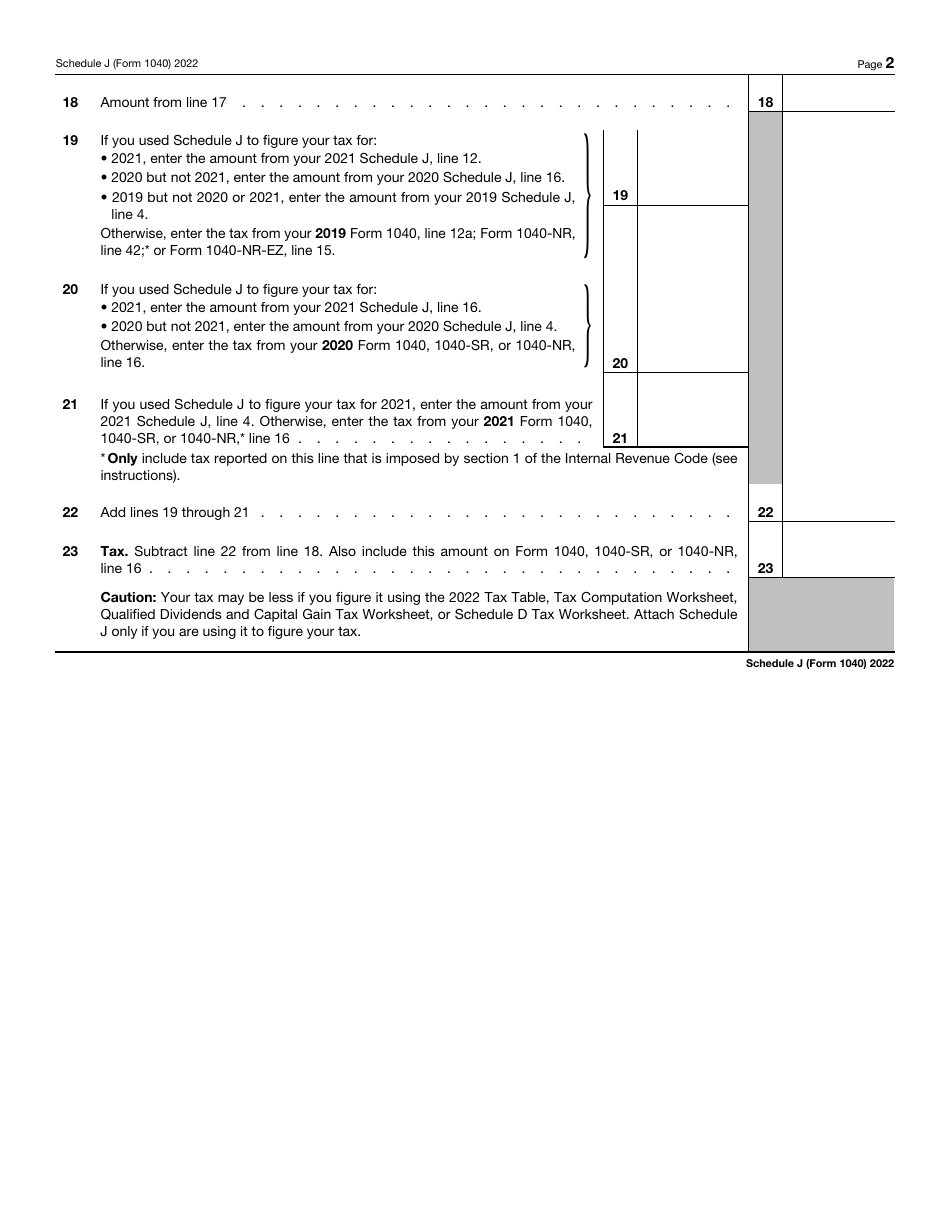

IRS Form 1040 Schedule J Income Averaging for Farmers and Fishermen

What Is IRS Form 1040 Schedule J?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1040, U.S. Individual Income Tax Return. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1040 Schedule J?

A: IRS Form 1040 Schedule J is a tax form specifically designed for farmers and fishermen to calculate their income averaging.

Q: Who is eligible to use IRS Form 1040 Schedule J?

A: Farmers and fishermen who meet certain requirements are eligible to use IRS Form 1040 Schedule J.

Q: What is income averaging?

A: Income averaging is a tax strategy that allows farmers and fishermen to average their income over a number of years, which can help reduce their tax liability.

Q: How does IRS Form 1040 Schedule J work?

A: IRS Form 1040 Schedule J calculates the income averaging for farmers and fishermen by taking into account the previous three years' taxable income and applying a specific formula.

Q: What are the benefits of using IRS Form 1040 Schedule J?

A: Using IRS Form 1040 Schedule J can help farmers and fishermen reduce their tax liability by averaging their income over several years.

Q: Do I need to include IRS Form 1040 Schedule J with my tax return?

A: If you are a farmer or fisherman and choose to use income averaging, you will need to include IRS Form 1040 Schedule J with your tax return.

Q: Can I use IRS Form 1040 Schedule J if I am not a farmer or fisherman?

A: No, IRS Form 1040 Schedule J is specifically designed for farmers and fishermen and cannot be used by others.

Q: Is income averaging mandatory for farmers and fishermen?

A: No, income averaging is optional for farmers and fishermen. They can choose whether or not to use IRS Form 1040 Schedule J.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040 Schedule J through the link below or browse more documents in our library of IRS Forms.