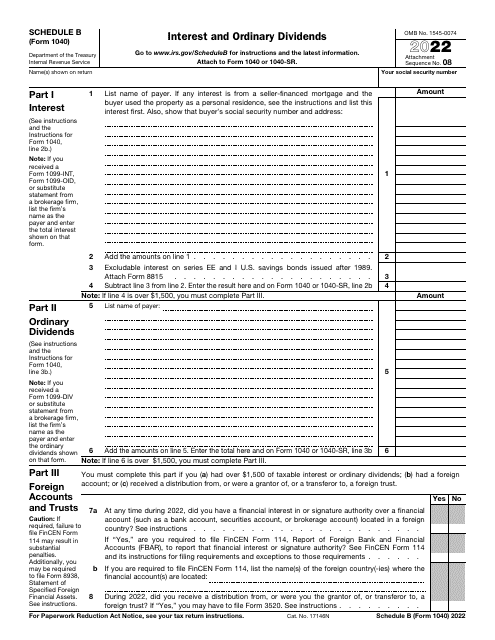

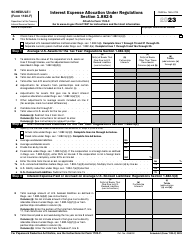

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1040 Schedule B

for the current year.

IRS Form 1040 Schedule B Interest and Ordinary Dividends

What Is IRS Form 1040 Schedule B?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1040, U.S. Individual Income Tax Return. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1040 Schedule B?

A: IRS Form 1040 Schedule B is a form used to report interest and ordinary dividends received during the tax year.

Q: What are interest and ordinary dividends?

A: Interest refers to the money you earn from lending or investing. Ordinary dividends are the distributions of earnings made by corporations to their shareholders.

Q: Why do I need to use Schedule B?

A: You need to use Schedule B if you received more than $1,500 of taxable interest or ordinary dividends or if you had a foreign account.

Q: What information do I need to complete Schedule B?

A: You will need to know the amounts of taxable interest and ordinary dividends you received during the year, as well as any information related to foreign accounts.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040 Schedule B through the link below or browse more documents in our library of IRS Forms.