This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1040 Schedule 8812

for the current year.

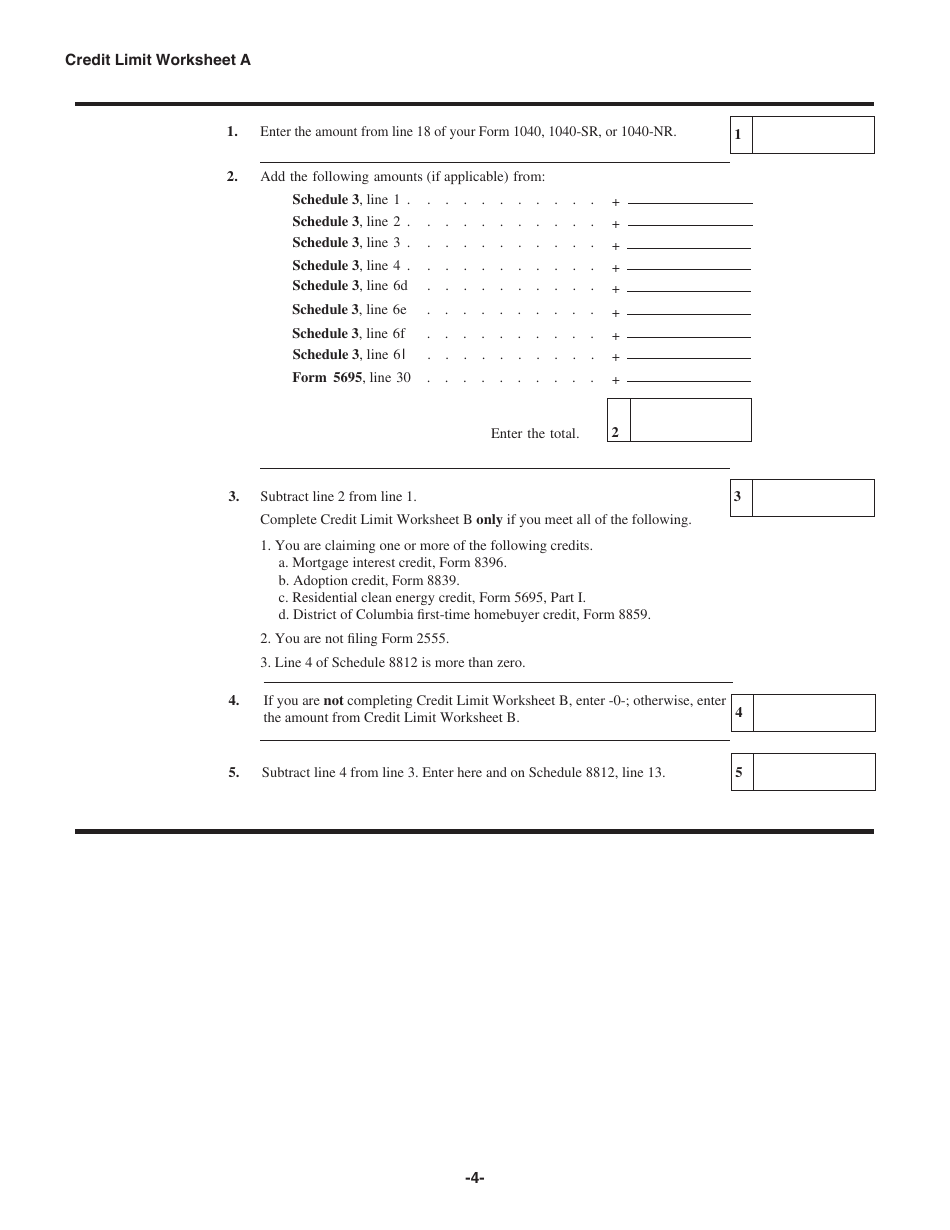

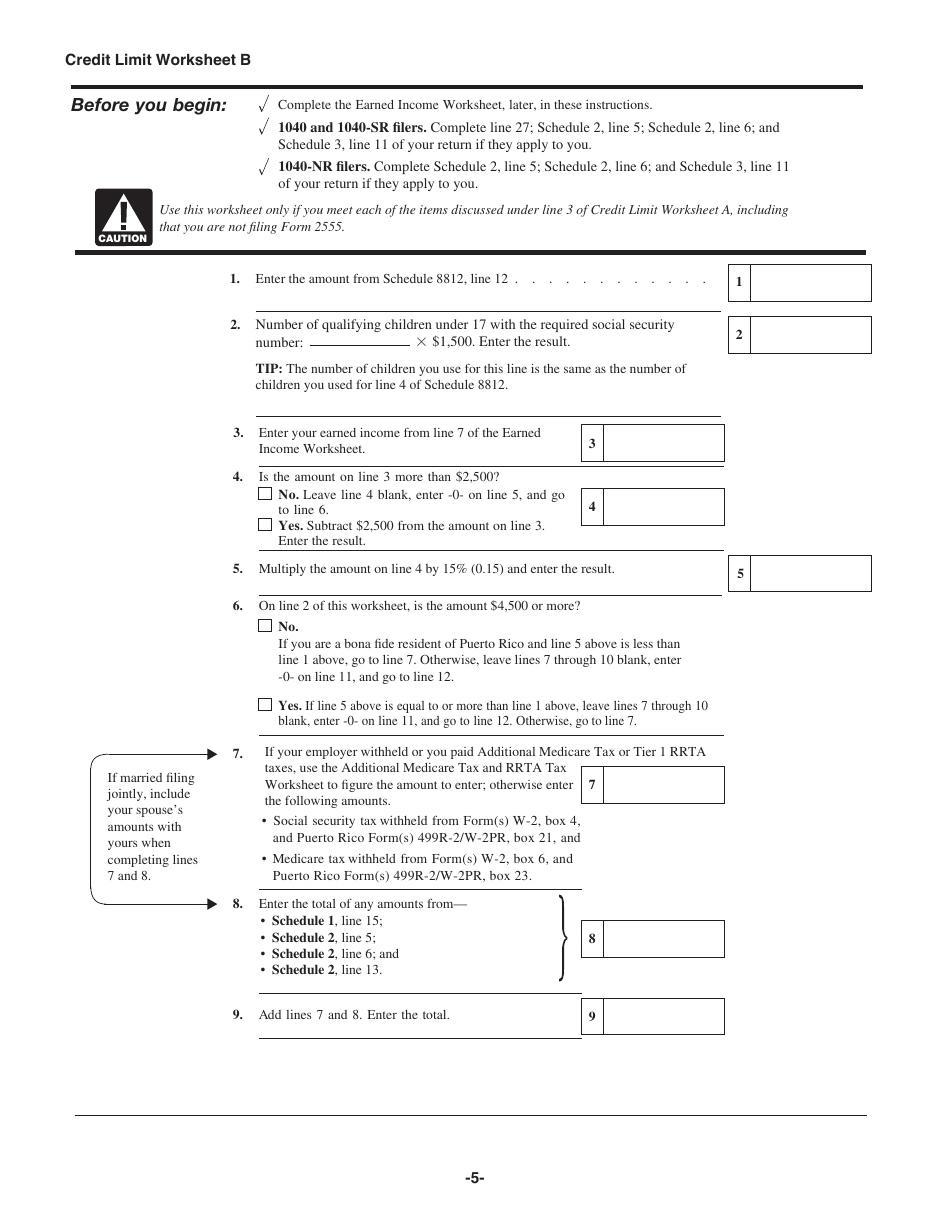

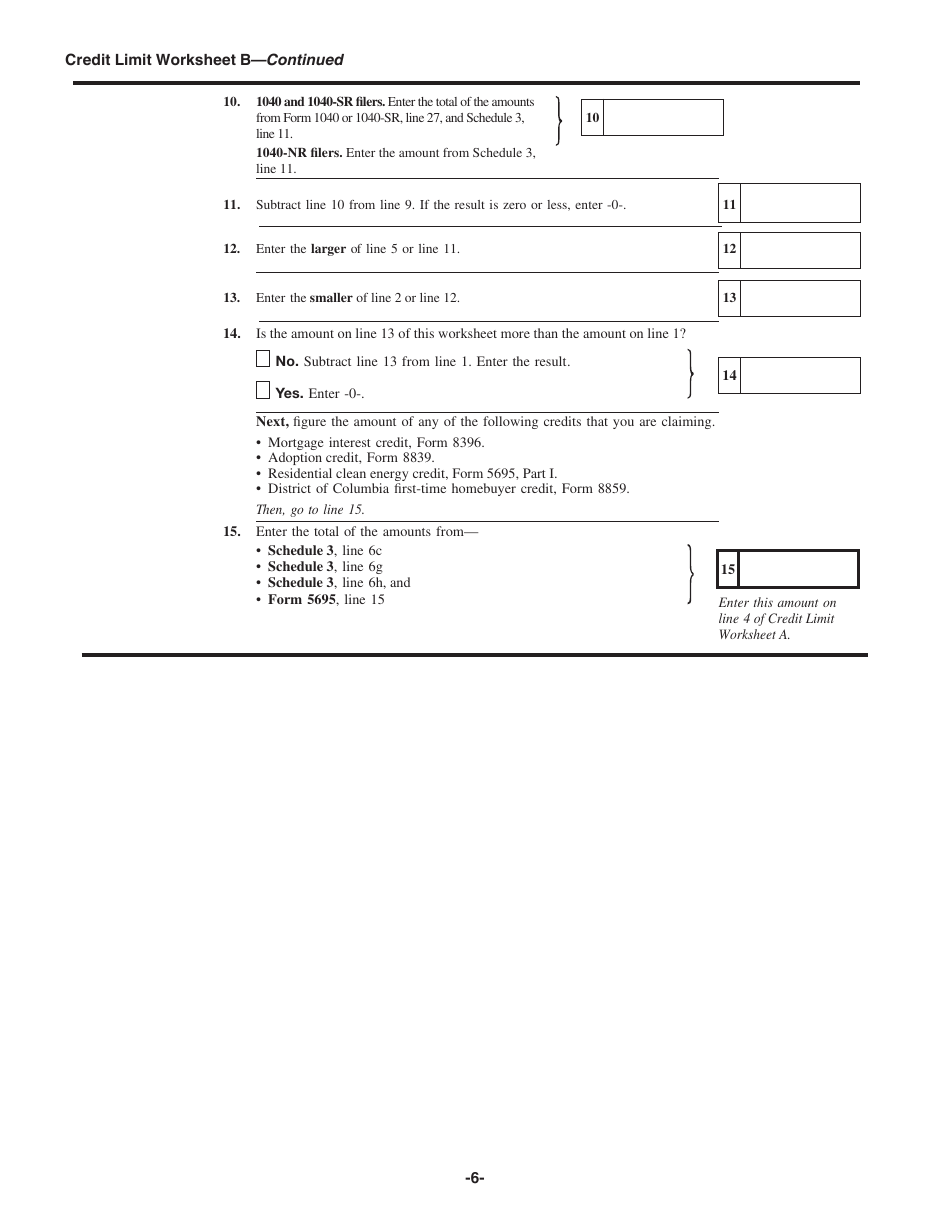

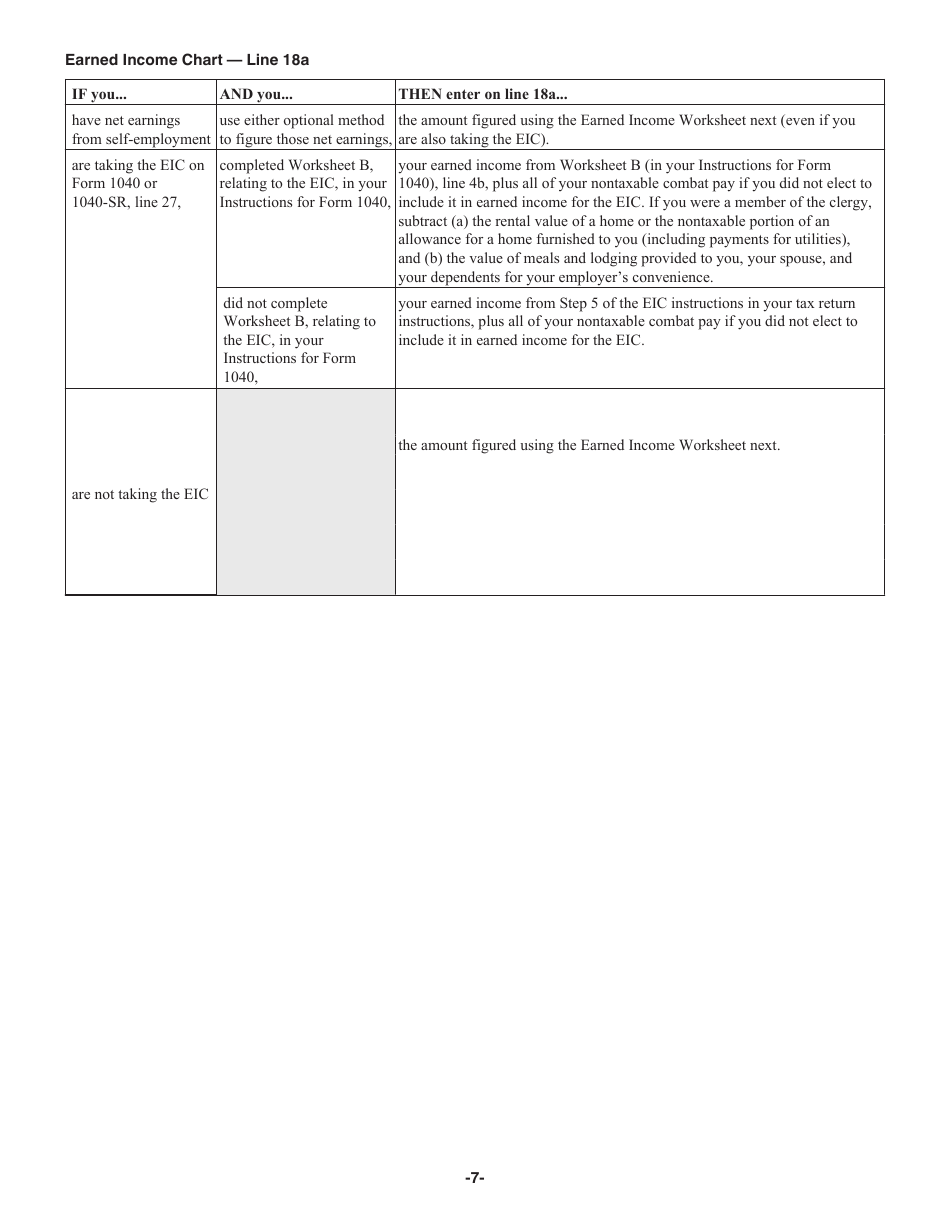

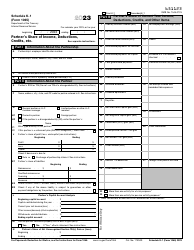

Instructions for IRS Form 1040 Schedule 8812 Credits for Qualifying Children and Other Dependents

This document contains official instructions for IRS Form 1040 Schedule 8812, Credits for Qualifying Children and Other Dependents - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040 Schedule 8812 is available for download through this link.

FAQ

Q: What is IRS Form 1040 Schedule 8812?

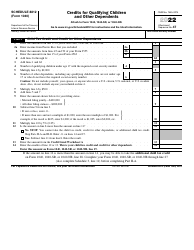

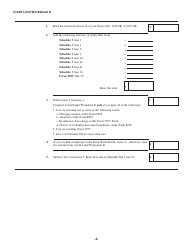

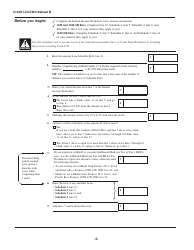

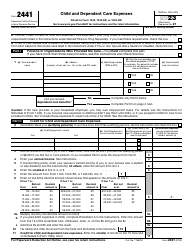

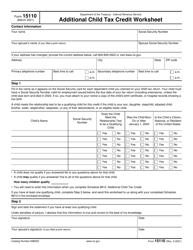

A: IRS Form 1040 Schedule 8812 is a tax form used to claim the Child Tax Credit and the Additional Child Tax Credit.

Q: Who should file IRS Form 1040 Schedule 8812?

A: Families who have qualifying children or other dependents may need to file IRS Form 1040 Schedule 8812 to claim certain tax credits.

Q: What tax credits can I claim with IRS Form 1040 Schedule 8812?

A: You can claim the Child Tax Credit and the Additional Child Tax Credit using IRS Form 1040 Schedule 8812.

Q: What is the Child Tax Credit?

A: The Child Tax Credit is a tax credit designed to help families with the cost of raising children. It can reduce your tax liability by up to $2,000 per qualifying child.

Q: What is the Additional Child Tax Credit?

A: The Additional Child Tax Credit is a refundable tax credit that you may be eligible for if the amount of the Child Tax Credit exceeds the amount of taxes you owe.

Q: Who is considered a qualifying child?

A: A qualifying child must be under the age of 17, have a certain relationship to you (such as a son, daughter, stepchild, or foster child), and meet other criteria set by the IRS.

Q: How do I calculate the Child Tax Credit?

A: The Child Tax Credit is calculated based on your modified adjusted gross income (MAGI) and the number of qualifying children you have.

Q: Can I claim the Child Tax Credit for more than one child?

A: Yes, you can claim the Child Tax Credit for each qualifying child you have.

Q: How do I claim the Child Tax Credit?

A: To claim the Child Tax Credit, you need to complete IRS Form 1040 Schedule 8812 and include it with your tax return.

Instruction Details:

- This 9-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.