This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 990 Schedule D

for the current year.

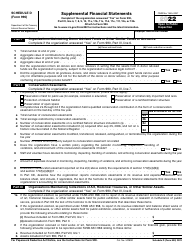

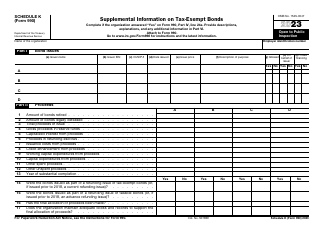

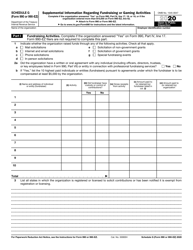

Instructions for IRS Form 990 Schedule D Supplemental Financial Statements

This document contains official instructions for IRS Form 990 Schedule D, Supplemental Financial Statements - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 990 Schedule D is available for download through this link.

FAQ

Q: What is IRS Form 990 Schedule D?

A: IRS Form 990 Schedule D is a supplemental form used to provide additional financial information for certain organizations.

Q: When is IRS Form 990 Schedule D used?

A: IRS Form 990 Schedule D is used when an organization has financial transactions or positions that require reporting beyond what is included on the main Form 990.

Q: What type of financial information is reported on IRS Form 990 Schedule D?

A: IRS Form 990 Schedule D typically includes reporting of investments, grants, contributions, and other financial activity.

Q: Who is required to file IRS Form 990 Schedule D?

A: Organizations that meet certain criteria and file Form 990 or 990-EZ are typically required to file Schedule D if they have relevant financial transactions or positions.

Q: Are there any filing deadlines for IRS Form 990 Schedule D?

A: The filing deadline for IRS Form 990 Schedule D is generally the same as the deadline for the main Form 990, which is the 15th day of the 5th month after the end of the organization's fiscal year.

Instruction Details:

- This 6-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.