This version of the form is not currently in use and is provided for reference only. Download this version of

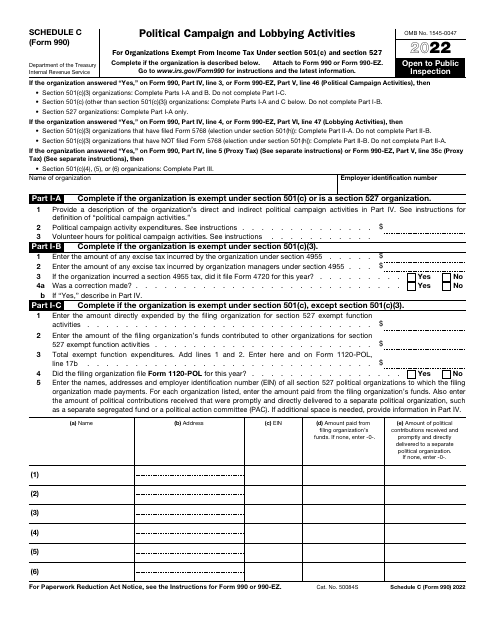

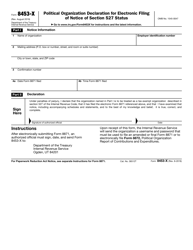

IRS Form 990 Schedule C

for the current year.

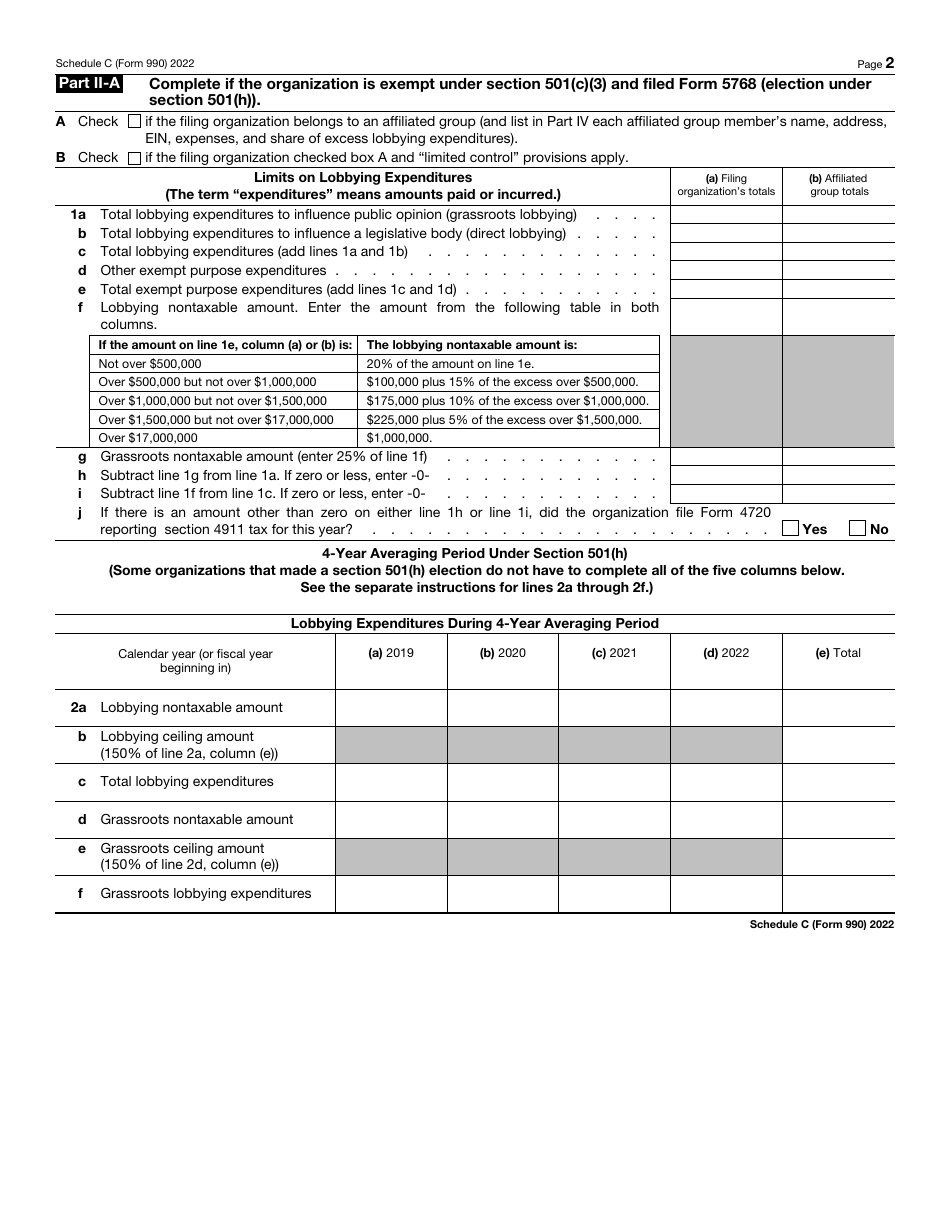

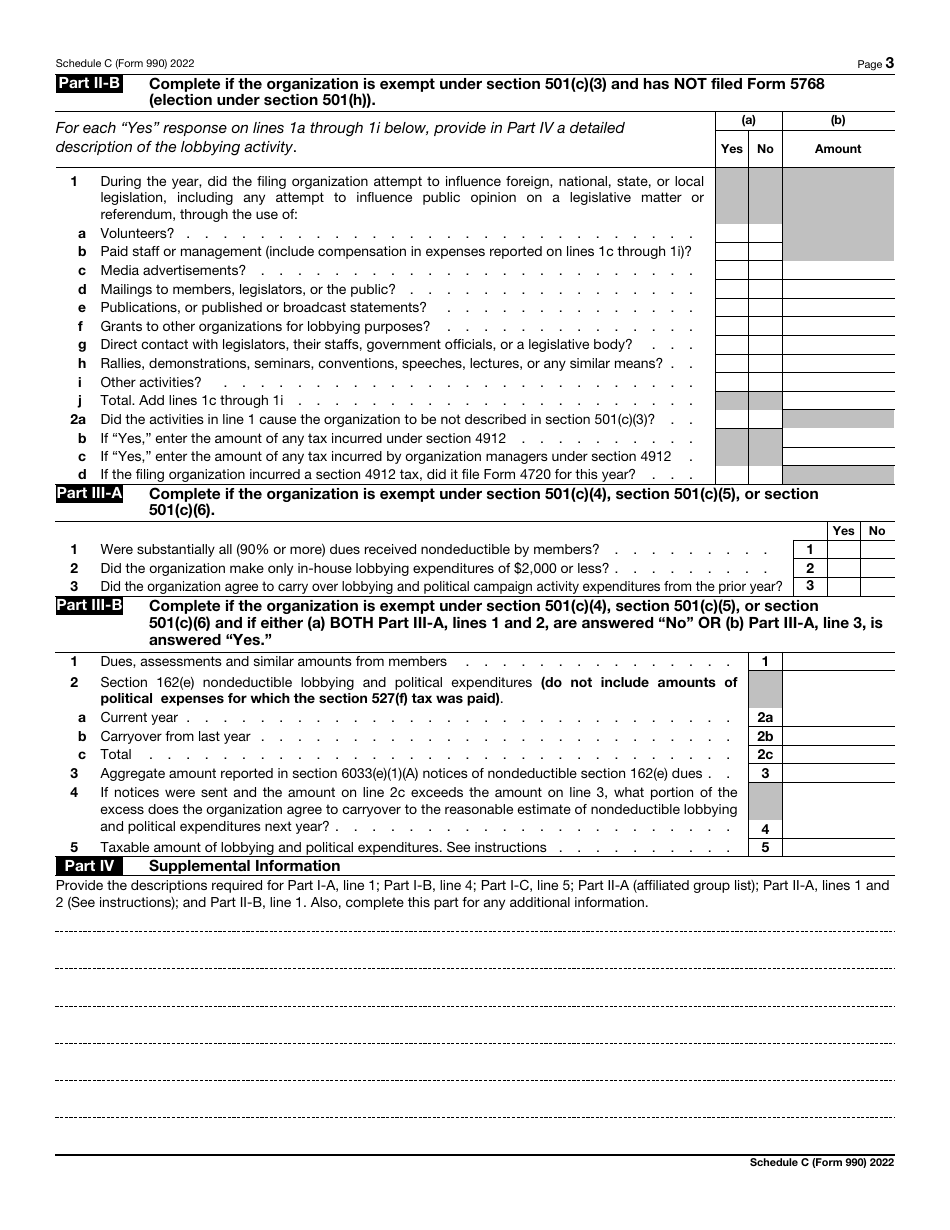

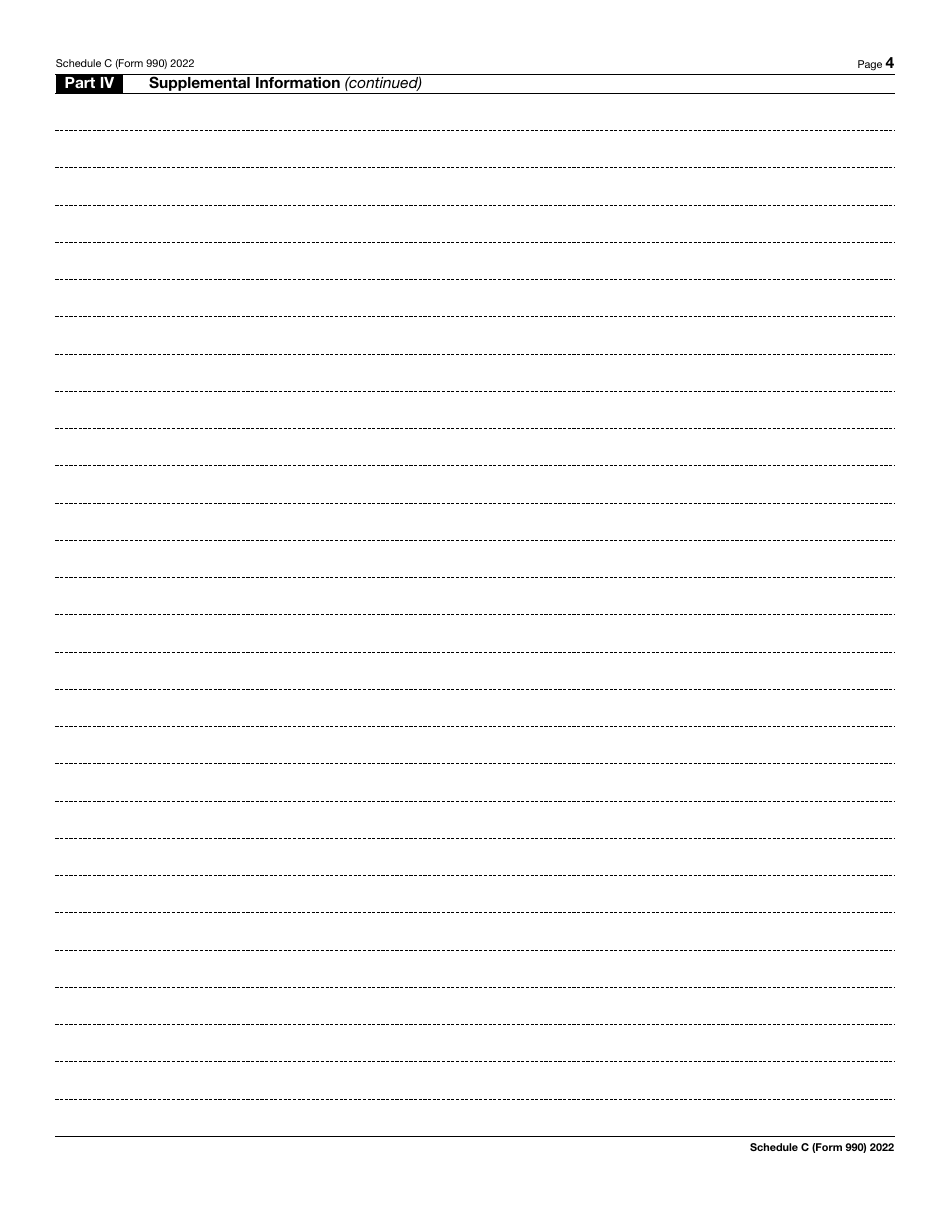

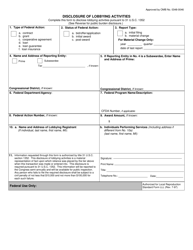

IRS Form 990 Schedule C Political Campaign and Lobbying Activities

What Is IRS Form 990 Schedule C?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 990, Return of Organization Exempt From Income Tax. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

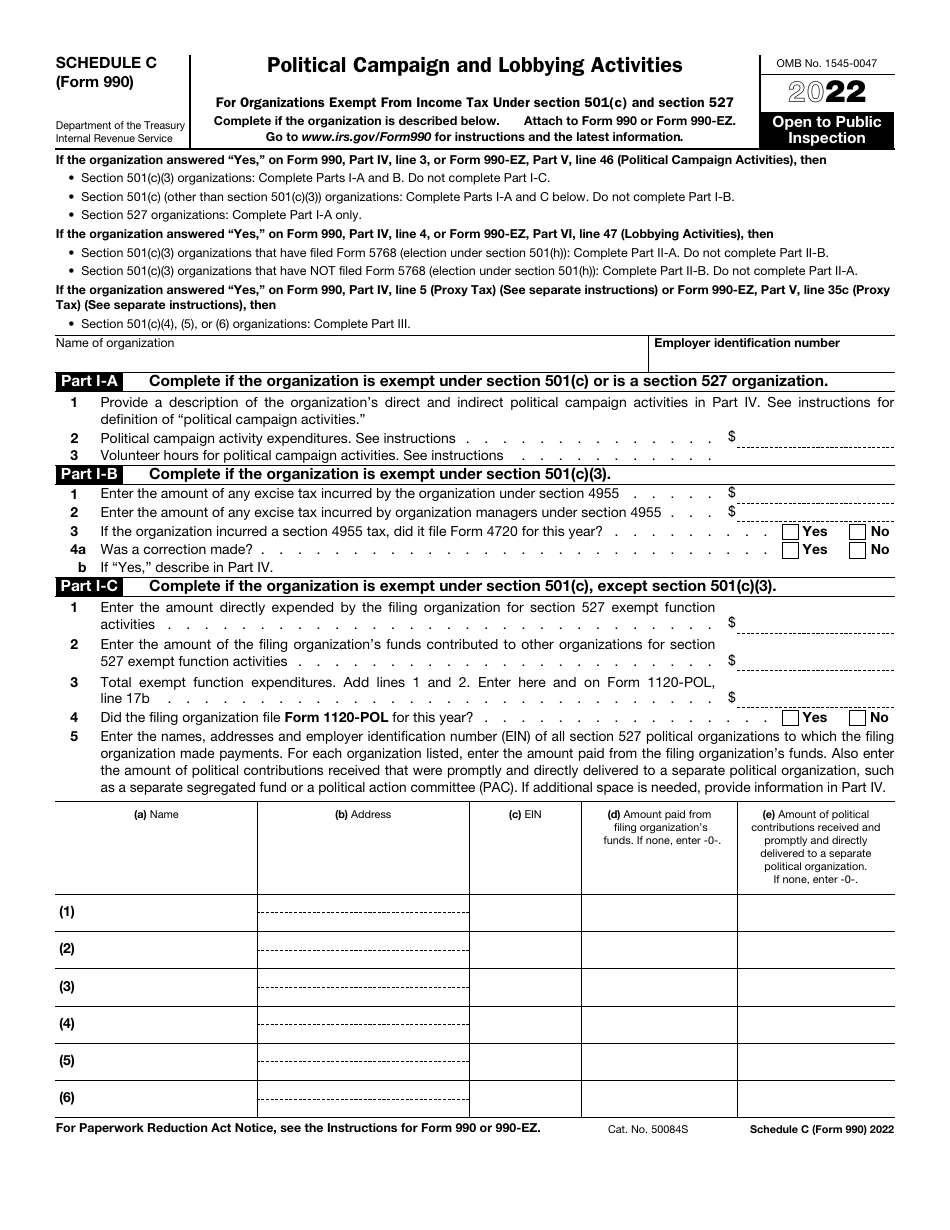

Q: What is IRS Form 990 Schedule C?

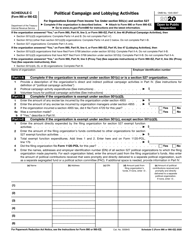

A: IRS Form 990 Schedule C is a form used by tax-exempt organizations to report their political campaign and lobbying activities.

Q: Who needs to file IRS Form 990 Schedule C?

A: Tax-exempt organizations that engage in political campaign and lobbying activities need to file IRS Form 990 Schedule C.

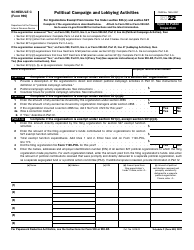

Q: What information is reported on IRS Form 990 Schedule C?

A: IRS Form 990 Schedule C requires organizations to disclose details about their political campaign and lobbying activities, including the amounts spent and the nature of the activities.

Q: Are there any restrictions on political campaign and lobbying activities for tax-exempt organizations?

A: Yes, tax-exempt organizations are subject to certain restrictions and limitations when it comes to engaging in political campaign and lobbying activities.

Form Details:

- A 4-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 990 Schedule C through the link below or browse more documents in our library of IRS Forms.